Global Horizontal Directional Drilling Market

Market Size in USD Billion

CAGR :

%

USD

16.36 Billion

USD

46.67 Billion

2025

2033

USD

16.36 Billion

USD

46.67 Billion

2025

2033

| 2026 –2033 | |

| USD 16.36 Billion | |

| USD 46.67 Billion | |

|

|

|

|

Horizontal Directional Drilling Market Size

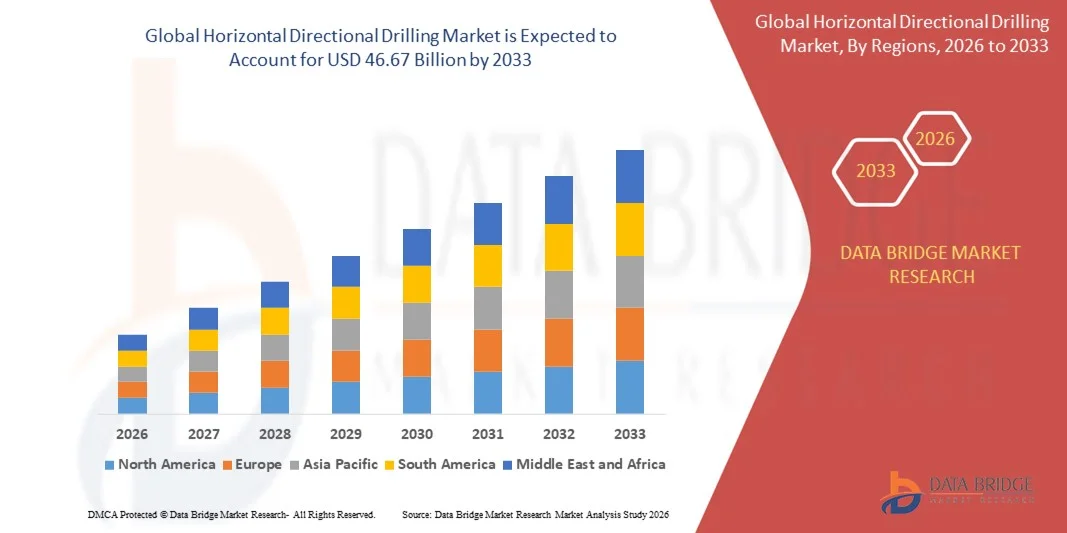

- The global horizontal directional drilling market size was valued at USD 16.36 billion in 2025 and is expected to reach USD 46.67 billion by 2033, at a CAGR of 14.00% during the forecast period

- The market growth is largely fuelled by increasing investments in underground infrastructure projects across energy, water, telecommunications, and transportation sectors

- Rising demand for trenchless construction methods to minimize surface disruption and environmental impact is supporting widespread adoption of horizontal directional drilling solutions

Horizontal Directional Drilling Market Analysis

- The market is witnessing strong momentum due to technological advancements in drilling equipment, improved accuracy, and enhanced operational efficiency, enabling complex installations in challenging terrains

- Increasing preference for cost-effective and environmentally friendly drilling techniques, along with supportive government initiatives for infrastructure modernization, is strengthening the long-term outlook of the global horizontal directional drilling market

- North America dominated the horizontal directional drilling market with the largest revenue share of 38.5% in 2025, driven by extensive infrastructure development, energy pipeline projects, and increasing investments in utility and telecommunication networks

- Asia-Pacific region is expected to witness the highest growth rate in the global horizontal directional drilling market, driven by rising infrastructure development, rapid urbanization, expanding energy and utility projects, and increasing adoption of cost-effective and advanced drilling solutions

- The Rotary Steerable System segment held the largest market revenue share in 2025, driven by its ability to provide higher drilling accuracy, better steering capabilities, and reduced operational time. This technique is increasingly preferred in complex and deep drilling projects across oil & gas, telecommunication, and utility sectors.

Report Scope and Horizontal Directional Drilling Market Segmentation

|

Attributes |

Horizontal Directional Drilling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Horizontal Directional Drilling Market Trends

Rising Adoption Of Trenchless Construction Techniques

- The increasing preference for trenchless construction methods is significantly shaping the horizontal directional drilling market, as governments and private developers seek solutions that minimize surface disruption and environmental impact. Horizontal directional drilling is gaining traction due to its ability to install pipelines and utilities beneath roads, rivers, and urban infrastructure without extensive excavation. This trend strengthens its adoption across oil & gas, water management, telecommunications, and power transmission projects, encouraging contractors to invest in advanced drilling technologies and equipment

- Rapid urbanization and infrastructure modernization have accelerated the demand for horizontal directional drilling in densely populated cities. Municipal authorities and utility providers are increasingly using HDD for underground installation of water pipelines, sewer lines, and fiber optic cables to reduce traffic disruption and restoration costs. This has also led to collaborations between infrastructure developers and drilling service providers to improve project efficiency and execution timelines

- Sustainability and regulatory compliance trends are influencing project planning decisions, with developers emphasizing reduced land disturbance, lower emissions, and improved safety standards. These factors are helping HDD gain preference over conventional open-cut methods, while also supporting compliance with environmental regulations. Companies are increasingly highlighting these advantages in project bids and infrastructure planning strategies to strengthen market positioning

- For instance, in 2024, major infrastructure projects in the U.S. and Germany adopted horizontal directional drilling for pipeline and utility installations in urban and environmentally sensitive areas. These projects were executed to minimize surface damage and project delays, with deployment across transportation corridors, water networks, and renewable energy infrastructure. The use of HDD also improved public acceptance and reduced restoration costs for local authorities

- While demand for horizontal directional drilling is rising, sustained market expansion depends on continuous technological advancement, skilled workforce availability, and cost-effective project execution. Contractors are focusing on improving drilling accuracy, equipment reliability, and digital monitoring

Horizontal Directional Drilling Market Dynamics

Driver

Growing Infrastructure Development And Utility Expansion

- Rising investments in infrastructure development and utility expansion are major drivers for the horizontal directional drilling market. Governments and private players are increasingly adopting HDD to support large-scale projects such as pipeline installations, broadband expansion, and power transmission networks. This trend is also pushing innovation in drilling fluids, guidance systems, and high-capacity rigs to meet complex project requirements

- Expanding applications in oil & gas, water and wastewater management, telecommunications, and renewable energy projects are influencing market growth. Horizontal directional drilling enables safe and efficient installation of underground utilities while reducing environmental impact, helping project owners meet regulatory and sustainability objectives. The global push for energy transition and smart infrastructure further reinforces this trend

- Infrastructure developers and drilling service providers are actively promoting HDD-based solutions through project optimization, technological upgrades, and adherence to safety standards. These efforts are supported by growing demand for cost-efficient and minimally invasive construction methods, and they also encourage partnerships between equipment manufacturers and service companies to enhance drilling performance and project outcomes

- For instance, in 2023, energy and utility companies in Canada and Australia expanded the use of horizontal directional drilling for pipeline and power cable installations. This expansion followed increased infrastructure spending and the need to access remote or environmentally sensitive locations, driving efficiency improvements and reducing project timelines. Companies also emphasized safety, precision, and reduced surface impact to strengthen stakeholder acceptance

- Although infrastructure growth supports market expansion, wider adoption depends on skilled labor availability, project cost management, and effective risk mitigation. Investment in workforce training, advanced equipment, and digital drilling solutions will be critical for meeting rising demand and maintaining competitive advantage

Restraint/Challenge

High Initial Costs And Technical Complexity

- The high initial investment associated with horizontal directional drilling equipment and project setup remains a key challenge, particularly for small and mid-sized contractors. Advanced rigs, guidance systems, and specialized drilling fluids contribute to elevated capital and operational costs. In addition, unexpected geological conditions can increase project complexity and overall expenditure

- Technical complexity and the need for skilled operators also limit adoption in certain regions. Successful HDD projects require experienced personnel for planning, execution, and monitoring, and the lack of trained professionals can lead to project delays or failures. This challenge is more pronounced in emerging markets where training infrastructure is limited

- Operational risks such as drilling fluid loss, borehole collapse, and equipment failure can impact project timelines and profitability. Companies must invest in detailed site assessments, advanced monitoring technologies, and contingency planning to mitigate these risks. These requirements increase operational costs and planning efforts

- For instance, in 2024, infrastructure contractors in parts of Southeast Asia and Africa reported project delays and cost overruns due to complex soil conditions and limited access to skilled HDD operators. Equipment downtime and higher maintenance requirements further affected project efficiency, leading some developers to delay or reassess HDD adoption

- Addressing these challenges will require cost optimization, workforce training programs, and technological innovation. Collaboration between governments, training institutes, and industry players can help develop skilled labor pools and improve project success rates. Furthermore, advancements in automation, real-time monitoring, and predictive maintenance will be essential to reduce risks and support long-term growth of the global horizontal directional drilling market

Horizontal Directional Drilling Market Scope

The market is segmented on the basis of technique, machines parts, rigs type, application, end-use, and sales channel.

- By Technique

On the basis of technique, the global horizontal directional drilling market is segmented into Conventional and Rotary Steerable System. The Rotary Steerable System segment held the largest market revenue share in 2025, driven by its ability to provide higher drilling accuracy, better steering capabilities, and reduced operational time. This technique is increasingly preferred in complex and deep drilling projects across oil & gas, telecommunication, and utility sectors.

The Conventional segment is expected to witness the fastest growth rate from 2026 to 2033, owing to its cost-effectiveness and widespread adoption in small- to medium-scale drilling projects. Conventional horizontal directional drilling is particularly valued for its simplicity, reliability, and suitability for less challenging terrains, making it a preferred choice for utility and telecommunication installations.

- By Machines Parts

On the basis of machines parts, the market is segmented into Rigs, Pipes, Bits, Reamers, and Others. The Rigs segment held the largest market revenue share in 2025, driven by the increasing demand for high-capacity drilling rigs capable of handling long-distance and large-diameter boreholes. Rigs are essential for ensuring drilling precision, operational efficiency, and safety in horizontal directional drilling projects.

The Bits segment is expected to witness the fastest growth from 2026 to 2033, owing to technological advancements in drill bit design that enhance penetration rates, durability, and performance in challenging geological conditions.

- By Rigs Type

On the basis of rigs type, the market is segmented into Mini, Midi, and Maxi. The Maxi rigs segment held the largest market revenue share in 2025, driven by their suitability for large-scale projects requiring deep and long boreholes. Maxi rigs offer superior power, torque, and operational efficiency, making them ideal for oil & gas and large utility applications.

The Mini rigs segment is expected to witness the fastest growth rate from 2026 to 2033, due to increasing demand for compact and mobile rigs capable of operating in urban areas and restricted spaces, particularly for telecommunication and utility installations.

- By Application

On the basis of application, the market is segmented into Onshore and Offshore. The Onshore segment held the largest market revenue share in 2025, driven by extensive infrastructure development, urbanization, and expansion of utility networks. Onshore drilling is widely adopted for oil & gas pipelines, water lines, and telecommunication conduits.

The Offshore segment is expected to witness the fastest growth from 2026 to 2033, owing to rising offshore oil & gas exploration and subsea infrastructure projects that require precise and efficient horizontal directional drilling techniques.

- By End-Use

On the basis of end-use, the market is segmented into Oil & Gas Excavation, Utility, Telecommunication, and Others. The Oil & Gas Excavation segment held the largest market revenue share in 2025, driven by ongoing energy exploration projects and the demand for long-distance pipeline installations. Horizontal directional drilling enables minimal environmental disruption and efficient material transport for oil & gas pipelines.

The Telecommunication segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rapid expansion of broadband networks, fiber optic cables, and smart city initiatives, which require precise and non-disruptive drilling techniques.

- By Sales Channel

On the basis of sales channel, the market is segmented into New Sales and Aftermarket. The New Sales segment held the largest market revenue share in 2025, driven by increasing infrastructure projects, modernization of drilling equipment, and the need for high-performance rigs and accessories.

The Aftermarket segment is expected to witness the fastest growth from 2026 to 2033, owing to rising maintenance requirements, replacement of worn-out components, and upgrades of drilling rigs and machinery for enhanced efficiency and extended service life.

Horizontal Directional Drilling Market Regional Analysis

- North America dominated the horizontal directional drilling market with the largest revenue share of 38.5% in 2025, driven by extensive infrastructure development, energy pipeline projects, and increasing investments in utility and telecommunication networks

- The region benefits from advanced drilling technology adoption, well-established oil & gas and utility sectors, and skilled labor capable of operating complex drilling equipment

- High demand for precise, non-disruptive drilling methods for urban construction, combined with government initiatives for infrastructure modernization, has positioned horizontal directional drilling as a preferred solution for long-distance and large-diameter boreholes

U.S. Horizontal Directional Drilling Market Insight

The U.S. horizontal directional drilling market captured the largest revenue share in 2025 within North America, fueled by increasing oil & gas exploration, pipeline installation, and urban infrastructure projects. The demand for advanced drilling techniques that reduce environmental impact and operational downtime is growing. In addition, the adoption of rotary steerable systems and high-capacity rigs is driving market growth, supported by government incentives for pipeline modernization and the expansion of telecommunication and utility networks.

Europe Horizontal Directional Drilling Market Insight

The Europe horizontal directional drilling market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations, increasing urbanization, and the need for sustainable infrastructure development. The demand for high-precision drilling methods is rising for utility, telecommunication, and oil & gas pipeline projects. European countries are also adopting advanced drilling rigs and automation technologies, boosting efficiency and reducing operational risks.

U.K. Horizontal Directional Drilling Market Insight

The U.K. horizontal directional drilling market is expected to witness the fastest growth rate from 2026 to 2033, driven by urban expansion, government infrastructure initiatives, and the demand for minimal-disruption construction techniques. The emphasis on underground utility installation, broadband network expansion, and smart city projects is encouraging the adoption of compact and efficient drilling rigs.

Germany Horizontal Directional Drilling Market Insight

The Germany horizontal directional drilling market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for sustainable and technologically advanced drilling solutions. Germany’s focus on innovation, infrastructure development, and efficient energy pipeline installation is promoting the use of rotary steerable systems and high-precision drilling machinery. Integration with digital monitoring systems is also enhancing drilling accuracy and operational safety.

Asia-Pacific Horizontal Directional Drilling Market Insight

The Asia-Pacific horizontal directional drilling market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising energy demand, and large-scale infrastructure projects in countries such as China, Japan, and India. Government initiatives promoting smart city development, telecommunication expansion, and energy pipeline projects are accelerating adoption. The availability of cost-effective rigs and drilling equipment is also widening accessibility to horizontal directional drilling solutions.

Japan Horizontal Directional Drilling Market Insight

The Japan horizontal directional drilling market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s advanced construction technology, urban infrastructure projects, and demand for precise drilling in restricted areas. The adoption of compact and rotary steerable rigs, combined with integration of digital monitoring systems, is fueling market growth. Aging infrastructure and the need for minimal-disruption pipeline installation are also contributing to increasing demand.

China Horizontal Directional Drilling Market Insight

The China horizontal directional drilling market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, large-scale oil & gas and utility projects, and strong government support for infrastructure development. The adoption of high-capacity rigs, advanced drilling techniques, and domestic manufacturing of drilling equipment is propelling market growth. The push for smart city projects and efficient pipeline installation further strengthens the demand for horizontal directional drilling solutions.

Horizontal Directional Drilling Market Share

The Horizontal Directional Drilling industry is primarily led by well-established companies, including:

- Halliburton (U.S.)

- Schlumberger Limited (U.S.)

- Seadrill Limited (Bermuda)

- TRANSOCEAN LTD. (Switzerland)

- Weatherford (Switzerland)

- China Oilfield Services Limited (China)

- DIAMOND OFFSHORE DRILLING, INC. (U.S.)

- Baker Hughes Company (U.S.)

- DOLPHIN DRILLING (U.K.)

- MAERSK DRILLING (Denmark)

- KCA Deutag (U.K.)

- Valaris plc (U.K.)

- Nabors Industries Ltd. (U.S.)

- Paragon Offshore (U.S.)

- Scientific Drilling International (U.S.)

- Noble Corporation (U.S.)

- Superior Energy Services, Inc. (U.S.)

- Archer (Norway)

- Helmerich & Payne (U.S.)

- Patterson-UTI Energy, Inc. (U.S.)

Latest Developments in Global Horizontal Directional Drilling Market

- In October 2025, Vermeer launched an enhanced D20x22 S3 horizontal directional drill in the U.S., featuring improved hydraulic protection, redesigned components, and an upgraded hood design to increase reliability and productivity, particularly benefiting urban utility contractors and boosting efficiency in complex projects

- In January 2025, Ditch Witch introduced the JT21 directional drill in the U.S., providing 40% more downhole horsepower and 53% faster carriage speed, enhancing performance for underground utility and fiber installations while reducing operational time and costs

- In September 2024, Herrenknecht deployed a rotary steerable HDD solution with advanced downhole telemetry and gyroscopic guidance, enabling extended-reach offshore shore approaches and improving drilling accuracy and project feasibility

- In June 2024, Baker Hughes released hard-rock PDC pilot bits and reamer assemblies designed to increase penetration rates in abrasive formations, reduce tool replacement frequency, and improve overall drilling efficiency, positively impacting operational productivity and cost-effectiveness in the HDD market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Horizontal Directional Drilling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Horizontal Directional Drilling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Horizontal Directional Drilling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.