Global Home Laundry Appliances Market

Market Size in USD Billion

CAGR :

%

USD

37.62 Billion

USD

52.26 Billion

2024

2032

USD

37.62 Billion

USD

52.26 Billion

2024

2032

| 2025 –2032 | |

| USD 37.62 Billion | |

| USD 52.26 Billion | |

|

|

|

|

Home Laundry Appliances Market Size

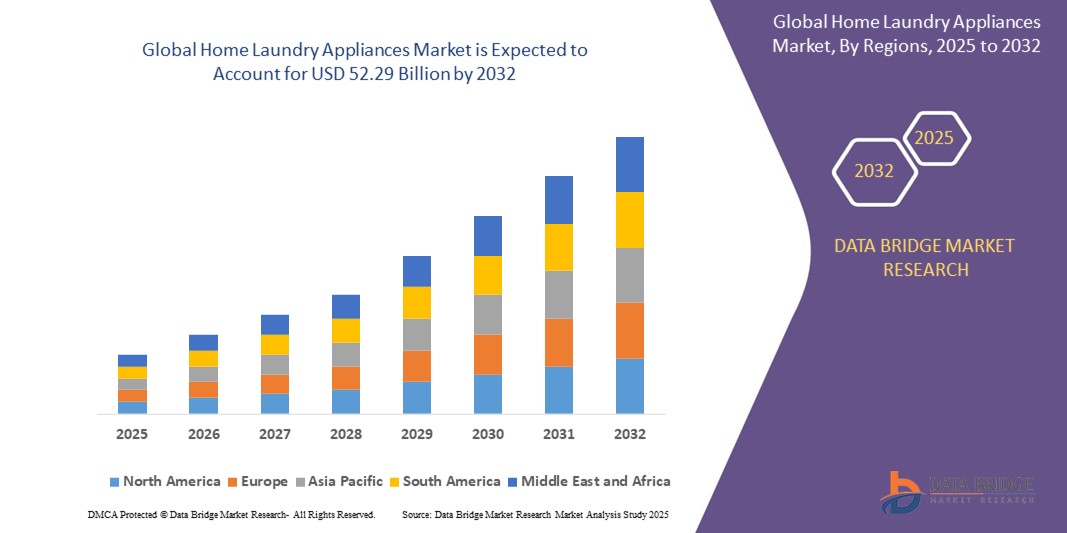

- The global home laundry appliances market size was valued at USD 37.62 billion in 2024 and is expected to reach USD 52.29 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is significantly driven by increasing consumer inclination toward energy-efficient, smart, and compact laundry solutions, in response to urban lifestyle changes and rising disposable incomes across emerging economies

- In addition, technological advancements in washer-dryer combos, the integration of IoT and AI technologies, and a growing demand for automated, low-noise, and water-efficient appliances are fueling the adoption of modern home laundry solutions worldwide

Home Laundry Appliances Market Analysis

- Home Laundry Appliances, which include washing machines, dryers, and washer-dryer combos, are becoming indispensable in modern households due to their convenience, time-saving capabilities, and growing compatibility with smart home ecosystems

- The increasing demand is mainly driven by the shift toward automated household chores, a growing awareness of sustainable living, and a rising number of nuclear families and urban dwellers who prioritize space-saving and efficient laundry appliances

- The industry is witnessing robust innovation, including AI-based washing programs, remote control features via mobile apps, and customized wash cycles, which enhance user experience and are expected to further boost market expansion throughout the forecast period

- North America dominated the home laundry appliances market with the largest revenue share of 44.21% in 2024, due to increased demand for energy-efficient and smart appliances, coupled with high awareness of advanced home technologies

- Asia-Pacific is expected to grow at the fastest CAGR of 14.44% between 2025 and 2032. Rapid urbanization, a rising middle class, and increasing disposable incomes in countries such as China, India, and Japan are key growth drivers

- The Freestanding segment dominated the market with the largest revenue share of 61.8% in 2024, attributed to its flexibility in installation, affordability, and widespread use in both residential and rental properties

Report Scope and Home Laundry Appliances Market Segmentation

|

Attributes |

Home Laundry Appliances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home Laundry Appliances Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- A significant and accelerating trend in the global home laundry appliances market is the increasing integration of artificial intelligence (AI) and popular voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. This convergence is substantially enhancing user convenience, automation, and control over household laundry tasks

- For Instance, smart washing machines and dryers from brands such as LG, Samsung, and Whirlpool now feature compatibility with all major voice assistants, enabling users to start, pause, or receive cycle updates via simple voice commands. These smart appliances offer real-time notifications, energy efficiency insights, and remote operation, contributing to a more connected and intelligent laundry experience

- AI-powered home laundry appliances are enabling advanced functionalities such as load detection, fabric recognition, and adaptive wash cycles. Some models can learn user preferences over time and suggest optimized settings for different laundry loads, thereby improving washing efficiency while minimizing water and energy use

- The integration of home laundry appliances into smart home ecosystems allows centralized control alongside lighting, HVAC, and security systems. Users can, for instance, automate laundry cycles based on energy pricing schedules or sync them with routines triggered by smart home hubs

- This trend is reshaping consumer expectations for laundry care, shifting the focus from manual operation to automated, intuitive, and personalized appliance experiences. Manufacturers are responding by embedding AI chips and IoT sensors into newer models, supporting predictive maintenance alerts, detergent level tracking, and remote troubleshooting

- The growing demand for smart, voice-compatible, and energy-efficient laundry appliances is rapidly expanding across both residential and commercial segments, as consumers increasingly seek convenience, sustainability, and seamless smart home integration

Home Laundry Appliances Market Dynamics

Driver

“Growing Demand Due to Smart Home Adoption and Lifestyle Modernization”

- The widespread adoption of smart home ecosystems, along with rising consumer preferences for connected living, is a major driver fueling growth in the Home Laundry Appliances market

- Key manufacturers are continuously enhancing product offerings with smart features. For instance, in March 2024, Samsung introduced an AI-powered washer that personalizes laundry cycles using behavioral data and optimizes energy usage based on real-time grid information signaling an industry shift toward intelligent and sustainable solutions

- Consumers are increasingly drawn to the convenience of remote operation, smartphone control, and automatic notifications, particularly in urban settings with busy lifestyles. Features such as scheduled laundry runs, maintenance alerts, and AI cycle adjustments add measurable value, especially for dual-income households

- Furthermore, as sustainability gains prominence, smart washers and dryers with energy- and water-saving modes, automatic detergent dispensing, and usage analytics are becoming essential home upgrades. Government incentives and energy efficiency regulations are further promoting adoption across developed markets

- The rise of DIY smart home installations, coupled with a broader range of affordable smart laundry appliances, is also contributing to market expansion in emerging regions

Restraint/Challenge

“High Initial Costs and Data Privacy Concerns”

- Despite its growing popularity, the home laundry appliances market faces hurdles in the form of high upfront costs and data security concerns, which may hinder adoption among cost-conscious consumers

- Smart washers and dryers typically carry a premium price tag due to embedded AI, connectivity modules, and sensor technologies. This cost differential compared to traditional appliances can deter buyers in developing economies or among consumers prioritizing basic functionality

- In addition, as these appliances collect and transmit user data, concerns regarding data privacy, cloud security, and potential misuse of behavioral information have surfaced. Instances of unauthorized data access in connected home devices have raised skepticism about the overall safety of smart appliances

- Addressing these concerns through end-to-end encryption, secure firmware updates, and transparent privacy policies is critical to earning and maintaining consumer trust. Brands such as LG and Whirlpool are emphasizing data protection features and compliance with global cybersecurity standards in their smart appliance offerings

- As technology matures and economies of scale reduce production costs, the affordability of smart Home Laundry Appliances is expected to improve. Moreover, consumer education about the benefits and safeguards of these appliances will be key to overcoming adoption barriers

Home Laundry Appliances Market Scope

The market is segmented on the basis of type, technology, product type, and distribution channel.

• By Type

On the basis of type, the home laundry appliances market is segmented into Built-in and Freestanding. The Freestanding segment dominated the market with the largest revenue share of 61.8% in 2024, attributed to its flexibility in installation, affordability, and widespread use in both residential and rental properties. Consumers prefer freestanding models for their portability, ease of relocation, and compatibility with various kitchen and laundry room layouts.

The Built-in segment is expected to witness the fastest growth from 2025 to 2032, driven by rising demand for integrated kitchen and laundry setups in urban apartments and luxury homes. The seamless aesthetic, space-saving design, and premium appeal of built-in appliances contribute to their growing popularity among high-end consumers.

• By Product Type

On the basis of product type, the home laundry appliances market is segmented into Washing Machines, Dryers, Electric Smoothing Irons, Steamers, and Other Products. The Washing Machines segment held the largest market revenue share of 47.5% in 2024, owing to their essential role in daily laundry routines and increasing demand for smart, energy-efficient washing solutions. Innovations such as load sensing, steam wash, and AI-driven cycle optimization have further boosted consumer preference for advanced washing machines.

The Dryers segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by changing weather patterns, growing dual-income households, and space-saving combo washer-dryer units. As consumer demand rises for faster drying cycles and compact solutions, manufacturers are introducing heat-pump and sensor-based technologies to improve performance and energy efficiency.

• By Distribution Channel

On the basis of distribution channel, the home laundry appliances market is segmented into Supermarket and Hypermarket, Specialty Stores, E-Commerce, and Others. The Supermarket and Hypermarket segment dominated the market with a revenue share of 38.9% in 2024, driven by high consumer footfall, immediate product availability, and the ability to compare different models in-store. These channels remain popular for buyers who prefer physical product interaction and same-day purchase.

The E-Commerce segment is projected to witness the fastest growth from 2025 to 2032, fueled by increased internet penetration, the convenience of home delivery, and access to a wide variety of brands and price points. Online platforms also offer customer reviews, price comparisons, and exclusive digital promotions, further attracting consumers.

• By Technology

On the basis of technology, the home laundry appliances market is segmented into Automatic, Semi-automatic, and Others. The Automatic segment held the largest market share of 54.3% in 2024, driven by consumer preference for convenience, time efficiency, and enhanced functionality. Fully automatic machines—both front and top-loading—are increasingly favored due to features such as smart sensors, load detection, and Wi-Fi connectivity.

The Semi-automatic segment is expected to register the fastest CAGR from 2025 to 2032, especially in emerging economies where affordability, water control, and manual oversight remain important. These machines are also appreciated for their energy efficiency and ease of use in regions with inconsistent water supply.

Home Laundry Appliances Market Regional Analysis

- North America dominated the home laundry appliances market with the largest revenue share of 44.21% in 2024, due to increased demand for energy-efficient and smart appliances, coupled with high awareness of advanced home technologies

- Consumers in this region highly appreciate features such as AI-powered wash programs, remote operability through mobile apps, and compatibility with broader smart home ecosystems.

- The region's high disposable income, combined with strong consumer interest in convenience and sustainability, is expected to sustain this leadership in the coming years

U.S. Home Laundry Appliances Market Insight

the U.S. accounted for the largest revenue share in 2024, underscoring its role as the primary growth engine of the regional market. This can be attributed to widespread adoption of large-capacity front-load and top-load washers, high penetration of smart appliances, and the growing influence of eco-conscious consumer behavior. Advanced features such as smart diagnostics, AI-driven wash cycles, and high energy efficiency ratings have made home laundry appliances highly desirable among American households, especially as sustainability trends continue to shape consumer preferences.

Europe Home Laundry Appliances Market Insight

The European home laundry appliances market is set to register steady growth over the forecast period. The region's demand is influenced by a strong preference for built-in and space-saving washer-dryer units, stringent energy efficiency regulations, and growing awareness about environmental sustainability. Many European consumers are transitioning to heat pump dryers and high-efficiency washers to minimize energy consumption. Integration of smart technologies, especially in Western Europe, and a growing renovation trend in older urban housing stock are further driving adoption of modern laundry appliances.

U.K. Home Laundry Appliances Market Insight

The U.K. market is projected to witness notable growth during the forecast period, fueled by consumer interest in compact, multifunctional appliances suited to smaller living spaces. Rising awareness of energy labeling, combined with incentives for low-energy consumption appliances, has enhanced demand for eco-efficient washing machines and dryers. The market is also benefiting from the increased availability of smart-enabled models, catering to digitally connected households seeking convenience and time-saving features in daily chores.

Germany Home Laundry Appliances Market Insight

Germany’s home laundry appliances market is poised for healthy growth, supported by the country's emphasis on sustainability and innovation. German consumers show a strong preference for appliances with advanced engineering, low noise levels, and exceptional energy performance. High adoption of front-load washers with large capacities and integration of AI and IoT features is becoming more prevalent. Demand is particularly strong in urban areas, where smart appliance ecosystems are gaining traction among tech-savvy and eco-conscious users.

Asia-Pacific Home Laundry Appliances Market Insight

Asia-Pacific is expected to grow at the fastest CAGR of 14.44% between 2025 and 2032. Rapid urbanization, a rising middle class, and increasing disposable incomes in countries such as China, India, and Japan are key growth drivers. The growing awareness of hygiene and the need for time-saving appliances are influencing consumer behavior, especially in metropolitan cities. In addition, manufacturers in this region are offering feature-rich, affordable models tailored to local preferences, further expanding the market reach.

Japan Home Laundry Appliances Market Insight

Japan is seeing a steady rise in the adoption of home laundry appliances, driven by technological innovation and compact living requirements. The country’s focus on automation, energy conservation, and multifunctional designs aligns with the demand for space-efficient washer-dryer combos. Japanese consumers also favor silent operation and AI-powered performance optimization, leading to increased uptake of smart appliances in both standalone homes and apartment complexes.

China Home Laundry Appliances Market Insight

China held the highest revenue share in the Asia-Pacific region in 2024, thanks to its expanding urban population, rising living standards, and domestic production capacity. The Chinese market is characterized by strong demand for smart and compact laundry appliances that cater to nuclear families and urban lifestyles. Local brands are heavily investing in AI, energy efficiency, and innovative drum technologies to cater to a growing base of middle-class consumers. The market continues to benefit from digital retail expansion and government support for smart home innovation.

Home Laundry Appliances Market Share

The home laundry appliances industry is primarily led by well-established companies, including:

- Godrej (India)

- Midea Group (China)

- Electrolux (Sweden)

- Haier Group (China)

- Koninklijke Philips N.V. (Netherlands)

- Hitachi, Inc. (Japan)

- Samsung (South Korea)

- Whirlpool Corporation (U.S.)

- IFB Industries Limited (India)

- LG Electronics (South Korea)

- BSH Home Appliances Group (Germany)

- Candy Group S.p.A. (Italy)

- Miele & Cie. KG (Germany)

- SHARP CORPORATION (Japan)

- Panasonic Corporation (Japan)

Latest Developments in Global Home Laundry Appliances Market

- In August 2024, Samsung Electronics Co. Ltd. launched 10 new large-capacity Bespoke AI washing machines for Indian consumers, highlighting its focus on smart and energy-efficient home appliances. These models are integrated with advanced AI technologies such as AI Wash, which optimizes water and detergent usage based on fabric type and load weight, and AI EcoBubble for enhanced cleaning with energy savings. They also support Wi-Fi connectivity, allowing users to manage wash cycles remotely using the SmartThings app. This launch reinforces Samsung’s dedication to enhancing convenience, sustainability, and personalization in Indian households

- In January 2024, Bosch upgraded its line of dishwashers with advanced features aimed at delivering a superior user experience. The innovations include modern touch controls, anti-fingerprint surfaces, and the PowerControl spray arm for better cleaning efficiency. The Home Connect app enables remote control, cycle customization, and safety notifications, catering to various user preferences and budgets. These enhancements position Bosch as a leader in delivering smart and user-friendly dishwashing solutions

- In September 2023, LG Electronics introduced the Signature Washer-Dryer, a premium appliance that integrates a high-capacity washer with an inverter heat pump dryer. With a 25 kg washing and 13 kg drying capacity, it also includes a 4 kg mini-wash option for added flexibility. This product reflects LG’s innovation in combining performance, efficiency, and user convenience in one compact unit

- In August 2023, Thomson released a new range of semi-automatic top-load washing machines in India, offering capacities of 7 kg, 7.5 kg, 8 kg, and 8.5 kg. Priced affordably between Rs 7,590 and Rs 9,999, these models are locally manufactured to provide budget-friendly solutions to a broad segment of Indian consumers. This initiative underlines Thomson’s commitment to delivering accessible and practical home appliances

- In May 2021, Samsung rolled out an AI-powered laundry range focused on achieving top-tier energy efficiency and cleaning performance. The lineup incorporates EcoBubble and QuickDrive technologies to reduce energy use and washing time while maintaining optimal fabric care. This launch marked a significant step in Samsung’s journey toward smarter, more sustainable laundry solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.