Global Hog Production And Pork Market

Market Size in USD Million

CAGR :

%

USD

512.24 Million

USD

600.17 Million

2025

2033

USD

512.24 Million

USD

600.17 Million

2025

2033

| 2026 –2033 | |

| USD 512.24 Million | |

| USD 600.17 Million | |

|

|

|

|

Hog Production and Pork Market Size

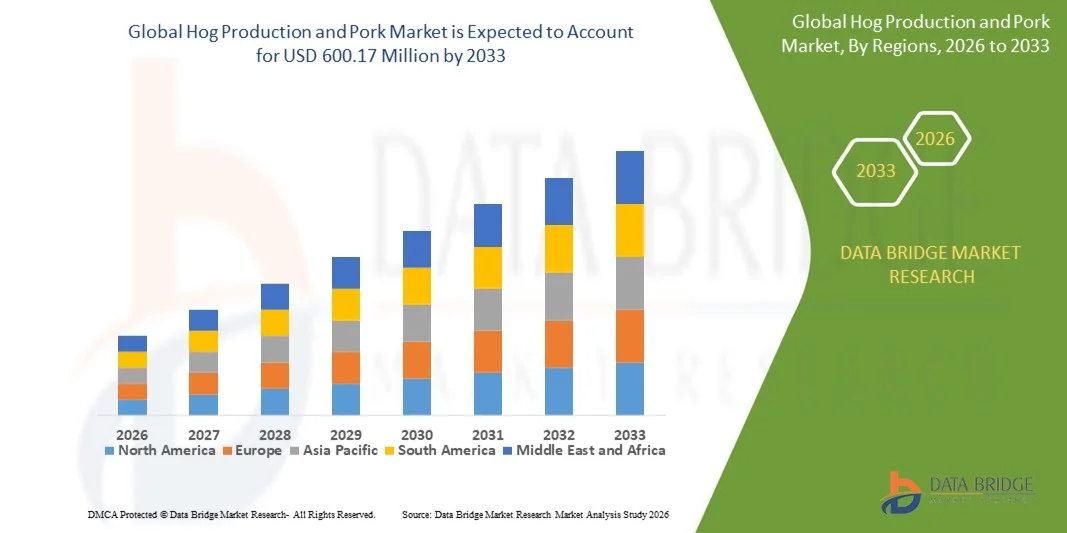

- The global hog production and pork market size was valued at USD 512.24 million in 2025 and is expected to reach USD 600.17 million by 2033, at a CAGR of 2.0% during the forecast period

- The market growth is largely fueled by rising global pork consumption, expanding commercial hog farming operations, and increasing investments in modern livestock management practices, which are improving productivity and supply consistency across both developed and emerging economies

- Furthermore, growing demand for protein-rich diets, rapid expansion of food processing and food service industries, and improved cold-chain and distribution infrastructure are strengthening pork availability across fresh, frozen, and processed formats. These converging factors are accelerating hog production scalability and market penetration, thereby significantly supporting overall market growth

Hog Production and Pork Market Analysis

- Hog production and pork, encompassing fresh, frozen, and processed pork products, remain a critical component of the global meat industry due to pork’s versatility, affordability, and widespread consumption across household, retail, and food service channels

- The increasing demand for pork is primarily driven by population growth, urbanization, and changing dietary patterns, along with advancements in breeding, feed efficiency, and biosecurity measures that are enhancing production efficiency and supply reliability

- Asia-Pacific dominated the hog production and pork market with a share of over 40% in 2025, due to high pork consumption, large-scale hog farming, and strong integration of traditional wet markets with modern processing facilities

- North America is expected to be the fastest growing region in the hog production and pork market during the forecast period due to strong export demand, large-scale commercial hog farming, and advanced meat processing capabilities

- Fresh segment dominated the market with a market share of 46.5% in 2025, due to strong consumer preference for freshly cut meat in household cooking and traditional food preparation, particularly in Asia-Pacific and Latin America. Fresh pork is widely perceived as superior in taste, texture, and nutritional value, which supports its high demand across wet markets and butcher shops. Its extensive use in daily meals, local cuisines, and food service establishments further strengthens its market leadership. The availability of established cold-chain logistics in urban regions has also supported the consistent supply of fresh pork products

Report Scope and Hog Production and Pork Market Segmentation

|

Attributes |

Hog Production and Pork Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hog Production and Pork Market Trends

Growth in Demand for Processed and Value-Added Pork Products

- A key trend in the hog production and pork market is the rising demand for processed and value-added pork products, driven by changing consumer lifestyles, urbanization, and increasing preference for convenient meal solutions. Processed pork products such as bacon, sausages, ham, and ready-to-cook cuts are gaining traction across retail and food service channels due to their longer shelf life and ease of preparation

- For instance, companies such as Smithfield Foods and BRF Global have expanded their portfolios of packaged and processed pork products to cater to growing demand from supermarkets and quick-service restaurants. These offerings support consistent quality, portion control, and wide distribution, strengthening processed pork consumption globally

- The expansion of modern retail formats and cold-chain infrastructure is further supporting this trend by improving product availability and reducing spoilage. This enables processors to reach urban and semi-urban consumers more efficiently with chilled and frozen pork products

- Rising demand from food service providers, including fast-food chains and hospitality operators, is reinforcing the importance of standardized, value-added pork cuts that ensure operational efficiency. This trend is particularly evident in North America and Asia-Pacific

- Consumers are also showing increasing interest in premium, flavored, and ready-to-cook pork options that align with evolving taste preferences. As a result, the market is witnessing continuous innovation in product formulation and packaging

- Overall, the shift toward processed and value-added pork is reshaping production strategies and strengthening the role of downstream processing in driving market growth

Hog Production and Pork Market Dynamics

Driver

Rising Global Consumption of Protein-Rich Diets

- The hog production and pork market is strongly driven by rising global consumption of protein-rich diets, supported by population growth, income expansion, and increasing awareness of nutritional intake. Pork remains one of the most widely consumed animal proteins globally due to its affordability, versatility, and high protein content

- For instance, WH Group Limited, through its subsidiaries including Smithfield Foods, continues to scale hog production and processing capacity to meet sustained protein demand across domestic and export markets. This reflects strong consumption trends across Asia, North America, and Europe

- Increasing urbanization and dietary shifts toward higher meat consumption are boosting pork demand across household and food service applications. Pork’s adaptability across fresh, frozen, and processed forms further supports its role as a staple protein source

- Advancements in breeding, feed optimization, and farm management are also improving production efficiency, enabling producers to meet growing demand more effectively. These factors collectively reinforce protein-driven growth across the pork value chain

- Sustained reliance on pork as a primary protein source continues to anchor long-term market expansion and production investments

Restraint/Challenge

Increasing Exposure to Animal Disease Outbreaks

- The hog production and pork market faces significant challenges from recurring animal disease outbreaks that disrupt supply chains, increase costs, and impact production stability. Diseases such as African Swine Fever have demonstrated the vulnerability of hog populations to widespread losses

- For instance, outbreaks of African Swine Fever have affected large producers in regions such as China, impacting companies including China Yurun Food Group Ltd. through reduced hog availability and increased biosecurity expenditure. These disruptions often lead to supply shortages and price volatility

- Disease outbreaks increase operational costs due to heightened biosecurity requirements, herd management adjustments, and regulatory compliance. Producers must invest heavily in prevention, monitoring, and containment measures

- Restrictions on animal movement and trade during outbreak periods further limit market access and export potential, affecting revenue streams. This creates uncertainty for both producers and processors across the value chain

- Overall, the persistent risk of disease outbreaks remains a key constraint, influencing production planning, investment decisions, and long-term market stability

Hog Production and Pork Market Scope

The market is segmented on the basis of form, type, application, distribution channel, and end user.

- By Form

On the basis of form, the hog production and pork market is segmented into fresh, frozen, and processed pork. The fresh pork segment dominated the market with the largest share of 46.5% in 2025, driven by strong consumer preference for freshly cut meat in household cooking and traditional food preparation, particularly in Asia-Pacific and Latin America. Fresh pork is widely perceived as superior in taste, texture, and nutritional value, which supports its high demand across wet markets and butcher shops. Its extensive use in daily meals, local cuisines, and food service establishments further strengthens its market leadership. The availability of established cold-chain logistics in urban regions has also supported the consistent supply of fresh pork products.

The processed pork segment is anticipated to witness the fastest growth from 2026 to 2033, supported by rising consumption of ready-to-eat and value-added meat products such as sausages, ham, and bacon. Increasing urbanization, changing dietary habits, and growing preference for convenience foods are driving demand for processed pork. Longer shelf life, ease of storage, and expanding presence in modern retail formats further accelerate the growth of this segment.

- By Type

On the basis of type, the hog production and pork market is segmented into leg/ham, loin of pork, belly/side of pork/bacon, ribs, shoulder/Boston butt, picnic shoulder/hand, and others. The belly/side of pork/bacon segment held the largest market share in 2025, driven by its extensive use in bacon production and high demand across fast-food chains and food service providers. Pork belly is valued for its rich flavor and high fat content, making it a preferred cut for both processed and fresh applications. Its strong demand in Western diets and growing popularity in Asian cuisines further supports segment dominance.

The loin of pork segment is expected to grow at the fastest rate during the forecast period, supported by increasing consumer focus on lean meat consumption. Pork loin is widely preferred for its lower fat content and versatility in home cooking and restaurant menus. Rising health awareness and growing adoption of protein-rich diets are key factors driving this segment’s rapid expansion.

- By Application

On the basis of application, the hog production and pork market is segmented into food, medicine, and clothing. The food segment dominated the market in 2025, driven by the widespread consumption of pork as a primary protein source across residential, commercial, and institutional settings. Pork’s versatility across fresh, frozen, and processed formats supports its extensive use in global cuisines. High demand from food processing companies and food service providers further reinforces the dominance of this segment.

The medicine segment is projected to witness the fastest growth from 2026 to 2033, supported by the increasing use of porcine-derived products in pharmaceuticals and medical applications. Hog-derived gelatin, insulin substitutes, and surgical materials are gaining importance due to their biological compatibility. Growing healthcare expenditure and expanding pharmaceutical manufacturing are key drivers supporting this segment’s accelerated growth.

- By Distribution Channel

On the basis of distribution channel, the hog production and pork market is segmented into B2B/direct, hypermarkets/supermarkets, convenience stores, specialty stores, butcher shop/wet markets, and online retailing. The butcher shop/wet markets segment accounted for the largest market share in 2025, driven by strong consumer trust in freshly cut pork and traditional purchasing habits in emerging economies. These channels offer product customization, perceived freshness, and competitive pricing, which sustain their dominance. High footfall and local sourcing further strengthen their position in the market.

The online retailing segment is anticipated to register the fastest growth over the forecast period, supported by increasing digital adoption and expansion of cold-chain-enabled e-commerce platforms. Consumers are increasingly preferring online channels for doorstep delivery, product transparency, and flexible purchasing options. Improved logistics and growing penetration of meat-focused online platforms are accelerating this segment’s growth.

- By End User

On the basis of end user, the hog production and pork market is segmented into food processing industry, food service providers, and others. The food processing industry segment dominated the market in 2025, driven by high utilization of pork in the production of processed meat products such as sausages, bacon, and cured meats. Large-scale procurement, consistent demand, and established supply contracts support the strong market position of this segment. Rising global consumption of packaged meat products further reinforces its dominance.

The food service providers segment is expected to witness the fastest growth from 2026 to 2033, supported by the expansion of quick-service restaurants, hotels, and catering services. Increasing dining-out trends and growing demand for pork-based menu offerings are key factors driving this segment. The recovery and expansion of the hospitality sector further contribute to its accelerated growth trajectory.

Hog Production and Pork Market Regional Analysis

- Asia-Pacific dominated the hog production and pork market with the largest revenue share of over 40% in 2025, driven by high pork consumption, large-scale hog farming, and strong integration of traditional wet markets with modern processing facilities

- The region’s growing population, rising disposable income, and strong cultural preference for pork-based diets are accelerating demand across fresh, frozen, and processed pork segments

- Expanding cold-chain infrastructure, increasing investments in commercial hog farming, and government support for livestock productivity are contributing to sustained market growth

China Hog Production and Pork Market Insight

China held the largest share in the Asia-Pacific hog production and pork market in 2025, owing to its position as the world’s largest producer and consumer of pork. Strong domestic demand, large-scale industrial farming, and continuous modernization of slaughtering and processing facilities are key growth drivers. Government initiatives to stabilize pork supply and improve biosecurity standards are further supporting market expansion.

India Hog Production and Pork Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by rising pork consumption in select regions, increasing organized meat processing, and growing demand from food service providers. Expansion of cold storage facilities and improving distribution networks are supporting market development. In addition, increasing acceptance of pork-based processed foods is contributing to higher growth momentum.

Europe Hog Production and Pork Market Insight

The Europe hog production and pork market is growing steadily, supported by advanced livestock management practices, strict animal welfare regulations, and strong demand for high-quality pork products. The region emphasizes traceability, food safety, and premium meat processing, which supports consistent consumption across retail and food service channels. Increasing exports of processed pork products are further strengthening regional growth.

Germany Hog Production and Pork Market Insight

Germany’s market is driven by its well-established meat processing industry, strong domestic consumption, and export-oriented pork production. Advanced farming technologies, efficient supply chains, and high standards for quality and sustainability support stable demand. The country remains a key hub for processed pork products within Europe.

U.K. Hog Production and Pork Market Insight

The U.K. market is supported by steady pork consumption, growing preference for locally sourced meat, and increasing demand for premium and processed pork products. Investments in sustainable farming practices and modern slaughtering facilities are improving production efficiency. Retail demand for packaged and value-added pork products continues to support market growth.

North America Hog Production and Pork Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong export demand, large-scale commercial hog farming, and advanced meat processing capabilities. Rising consumption of processed pork products and expansion of food service chains are boosting regional demand. Technological advancements in breeding, feed efficiency, and cold-chain logistics further support growth.

U.S. Hog Production and Pork Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by its highly industrialized hog farming sector and strong presence of integrated pork producers. High productivity, advanced processing infrastructure, and strong export relationships are key growth factors. Increasing demand for bacon, ham, and value-added pork products continues to reinforce the U.S.’s leading position.

Hog Production and Pork Market Share

The hog production and pork industry is primarily led by well-established companies, including:

- JBS (Brazil)

- Triumph Foods, LLC. (U.S.)

- Seaboard Corporation (U.S.)

- The Maschhoffs, LLC (U.S.)

- Iowa Select Farms (U.S.)

- China Yurun Food Group Ltd. (China)

- Charoen Pokphand Group (Thailand)

- BRF Global (Brazil)

- Smithfield Foods, Inc. (U.S.)

- WH Group Limited (Hong Kong)

- Arthur's Food Company Private Limited (India)

- MeisterWurst (Australia)

Latest Developments in Global Hog Production and Pork Market

- In December 2025, Danish Crown announced the expansion of its pork processing operations in Europe through the installation of advanced automation and packaging technologies at selected facilities. This development enhances processing efficiency, improves labor productivity, and strengthens the company’s ability to supply consistent, high-quality pork products to both domestic and export markets, reinforcing its competitive position in global pork trade

- In September 2025, Seaboard Foods completed the acquisition of three hog farms in Texas and Oklahoma, adding approximately 57,000 market hog spaces dedicated to supplying its Guymon, Oklahoma processing plant. This strategic investment deepens vertical integration, stabilizes live hog supply, and improves cost efficiency, enabling the company to better respond to fluctuations in market demand

- In June 2025, Hamlet Protein launched HP 270 at the World Pork Expo, introducing a specialized swine nutrition solution designed to support gut health and feed efficiency. This product development enhances on-farm productivity and supports higher-quality hog output, contributing to improved performance across the pork value chain

- In April 2025, Olymel introduced a new line of innovative pork products across grocery stores in Quebec, focusing on premium taste and ease of preparation for home cooking consumers. This launch strengthens Olymel’s value-added portfolio, increases retail penetration, and supports higher-margin product growth amid changing consumer cooking habits

- In October 2024, SunPork unveiled its patented maternity ring system to replace traditional farrowing crates, representing a major advancement in animal welfare practices. This company-led innovation improves sow comfort and piglet outcomes, supports compliance with evolving welfare standards, and enhances SunPork’s reputation as a sustainability-focused pork producer

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hog Production And Pork Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hog Production And Pork Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hog Production And Pork Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.