Global High Speed Camera Market

Market Size in USD Billion

CAGR :

%

USD

614.51 Billion

USD

1,260.86 Billion

2024

2032

USD

614.51 Billion

USD

1,260.86 Billion

2024

2032

| 2025 –2032 | |

| USD 614.51 Billion | |

| USD 1,260.86 Billion | |

|

|

|

|

High Speed Camera Market Size

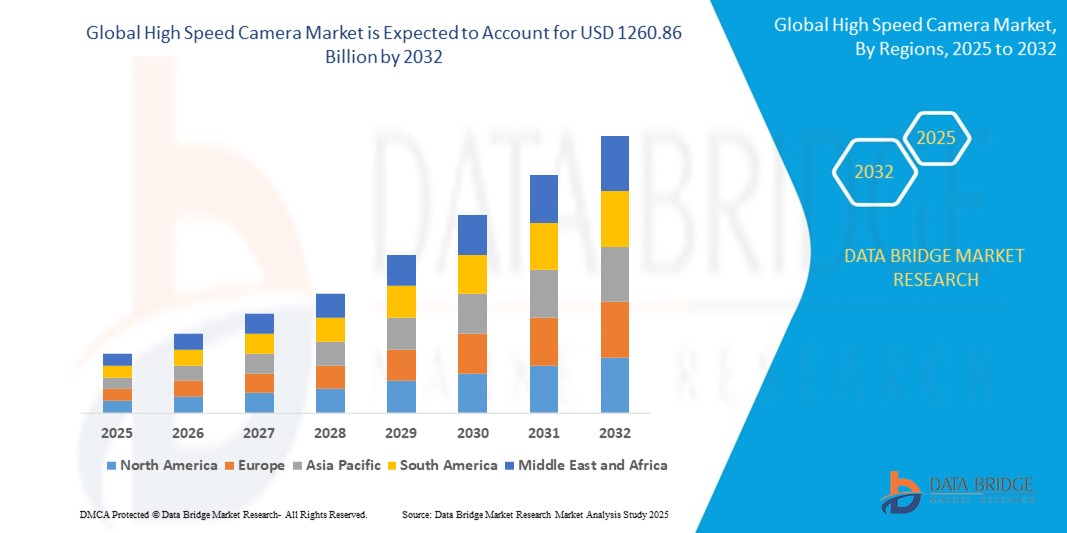

- The global high speed camera market size was valued at USD 614.51 billion in 2024 and is expected to reach USD 1260.86 billion by 2032, at a CAGR of 9.40% during the forecast period

- The market growth is primarily driven by increasing demand for high speed cameras in research, development, and testing across industries such as automotive, aerospace, and media, coupled with advancements in imaging technologies

- In addition, growing applications in scientific research, sports analysis, and industrial automation are boosting the adoption of high speed cameras, further propelling market expansion

High Speed Camera Market Analysis

- High speed cameras, capable of capturing fast-moving objects with high frame rates, are critical tools in industries requiring precise motion analysis, such as automotive crash testing, aerospace research, and media production, due to their superior resolution, sensitivity, and real-time processing capabilities

- The rising demand for high speed cameras is fueled by advancements in sensor technology, increasing automation in manufacturing, and the growing need for detailed visual data in scientific and entertainment applications

- North America dominated the high speed camera market with the largest revenue share of 38.5% in 2024, driven by robust R&D activities, a strong presence of key manufacturers, and widespread adoption in automotive and defense sectors

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid industrialization, increasing investments in automotive and electronics manufacturing, and rising disposable incomes

- The Visible RGB segment held the largest market revenue share of 60.4% in 2024, driven by its widespread application in industries such as media production, sports broadcasting, and scientific research, where accurate color reproduction is essential

Report Scope and High Speed Camera Market Segmentation

|

Attributes |

High Speed Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

High Speed Camera Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global high-speed camera market is experiencing a notable trend of integrating Artificial Intelligence (AI) and Big Data analytics to enhance imaging capabilities

- These technologies facilitate advanced image processing and analysis, providing deeper insights into motion capture, material behavior, and dynamic event analysis across various applications

- AI-powered high-speed camera systems enable proactive analysis, identifying critical patterns or anomalies in high-frame-rate footage, such as defects in manufacturing or biomechanical irregularities in sports analytics

- For instances, companies are developing AI-driven platforms that analyze high-speed footage to optimize automotive crash testing or improve real-time quality control in production lines by detecting minute flaws

- This trend is increasing the value of high-speed cameras, making them indispensable for industries such as automotive, aerospace, and scientific research, appealing to both commercial and academic users

- AI algorithms can process vast datasets from high-speed captures, analyzing parameters such as motion blur, vibration, or fluid dynamics to deliver precise, actionable insights

High Speed Camera Market Dynamics

Driver

“Rising Demand for Advanced Motion Analysis and Safety Testing”

- The growing need for precise motion analysis in industries such as automotive, aerospace, and media is a key driver for the global high-speed camera market

- High-speed cameras enable critical applications such as crash testing, ballistic analysis, and slow-motion capture for entertainment, enhancing safety and performance evaluation

- Government regulations, particularly in North America and Europe, mandating stringent safety standards in automotive and aerospace industries, are boosting the adoption of high-speed cameras

- The advancement of IoT and 5G technologies supports faster data transfer and real-time analysis, enabling sophisticated applications such as intelligent transport systems and advanced manufacturing

- Manufacturers are increasingly integrating high-speed cameras as standard tools in R&D and quality control to meet industry demands and enhance product reliability

Restraint/Challenge

“High Cost of Implementation and Data Management Concerns”

- The significant initial investment required for high-speed camera hardware, software, and integration can be a barrier, particularly for small enterprises or emerging markets

- Integrating high-speed cameras into existing systems, such as industrial automation or research setups, can be complex and costly due to compatibility issues

- Data management and storage pose major challenges, as high-speed cameras generate massive volumes of data, raising concerns about processing, storage capacity, and compliance with data regulations

- The lack of standardized protocols for data handling across regions complicates operations for global manufacturers and users

- These factors may deter adoption in cost-sensitive markets or regions with limited infrastructure, potentially slowing market growth

High Speed Camera market Scope

The market is segmented on the basis of spectrum type, frame rate, component, pixels, lens mount, light sensitivity, and application.

- By Spectrum Type

On the basis of spectrum type, the global high-speed camera market is segmented into X-Ray, Infrared, and Visible RGB. The Visible RGB segment held the largest market revenue share of 60.4% in 2024, driven by its widespread application in industries such as media production, sports broadcasting, and scientific research, where accurate color reproduction is essential. These cameras provide high-quality color representation, making them ideal for product quality control and visual inspection.

The X-Ray segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing applications in healthcare, security, and industrial inspection. X-Ray high-speed cameras enable non-destructive testing, medical imaging, and security screening, with advancements in sensor sensitivity and AI-driven processing accelerating adoption.

- By Frame Rate

On the basis of frame rate, the global high-speed camera market is segmented into 250-1,000 FPS, 1,001-10,000 FPS, 10,001-30,000 FPS, 30,001-50,000 FPS, and Above 50,000 FPS. The 1,001-10,000 FPS segment dominated the market with a revenue share of 33.1% in 2024, owing to its versatility in capturing fast-moving objects in applications such as automotive testing, manufacturing, and biomechanics research. This segment balances speed, resolution, and cost effectively.

The 30,001-50,000 FPS segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by rising demand in scientific research, industrial automation, and sports analysis. These cameras are critical for capturing ultra-rapid phenomena in high-stakes scenarios such as ballistics testing and high-speed manufacturing.

- By Component

On the basis of component, the global high-speed camera market is segmented into Processors, Image Sensors, Memory, Fan and Cooling, Lens, and Others. The Image Sensors segment held the largest market revenue share of 37.0% in 2024, driven by their critical role in enhancing camera performance through advancements in resolution, low-light performance, and frame rates. The demand for high-quality imaging in industrial automation and scientific research further supports this segment.

The Memory segment is expected to witness the fastest growth from 2025 to 2032, propelled by the need for high-speed data storage solutions to handle large volumes of high-resolution imaging data. Innovations in DRAM, NAND flash, and edge computing are accelerating adoption in automotive, aerospace, and commercial imaging applications.

- By Pixels

On the basis of pixels, the global high-speed camera market is segmented into Up to 2 Megapixels, 2 to 3 Megapixels, and Above 3 Megapixels. The Above 3 Megapixels segment is expected to hold the largest market revenue share of 45.2% in 2024, driven by the demand for high-resolution imaging in scientific research, such as spray analysis, combustion research, and vibration analysis, where crisper images provide more detailed pixel information.

The 2 to 3 Megapixels segment is anticipated to witness the fastest growth rate from 2025 to 2032, as it offers a balance between resolution and affordability, making it suitable for applications in automotive testing, sports science, and industrial automation.

- By Lens Mount

On the basis of lens mount, the global high-speed camera market is segmented into F-Mount, C-Mount, and EF-Mount. The EF-Mount segment is expected to hold the largest market revenue share of 38.7% in 2024, owing to its widespread adoption for its dependability, performance, and compatibility with a broad range of high-quality lenses, particularly in professional photography and videography.

The C-Mount segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its compact design and versatility in industrial and scientific applications, where smaller lenses and precise imaging are required.

- By Light Sensitivity

On the basis of light sensitivity, the global high-speed camera market is segmented into Color and Monochrome. The Color segment held the largest market revenue share of 62.3% in 2024, driven by its ability to provide accurate color representation for applications such as media production, quality control, and consumer electronics, where visual aesthetics are critical.

The Monochrome segment is anticipated to witness significant growth from 2025 to 2032, as it offers superior sensitivity in low-light conditions, making it ideal for scientific research, aerospace, and defense applications where high contrast and detail are prioritized over color.

- By Application

On the basis of application, the global high-speed camera market is segmented into Consumer Electronics, Automotive and Transportation, Healthcare, Media and Entertainment, Aerospace and Defense, and Others. The Aerospace and Defense segment dominated the market with a revenue share of 35.0% in 2024, driven by its critical role in missile testing, ballistics, and aircraft performance analysis. High-speed cameras provide precise data for defense research and space exploration.

The Healthcare segment is expected to witness the fastest growth rate of 12.8% from 2025 to 2032, fueled by increasing adoption in medical imaging, biomechanics, and diagnostics. High-speed cameras enable detailed analysis of rapid biological processes, supporting advancements in healthcare research and patient care.

High Speed Camera Market Regional Analysis

- North America dominated the high speed camera market with the largest revenue share of 38.5% in 2024, driven by robust R&D activities, a strong presence of key manufacturers, and widespread adoption in automotive and defense sectors

- Consumers prioritize high speed cameras for precise motion analysis, enhanced safety testing, and high-quality slow-motion capture, particularly in regions with advanced technological infrastructure

- Growth is supported by innovations in sensor technology, such as CMOS and CCD sensors, and increasing adoption in both OEM and aftermarket applications across various industries

U.S. High Speed Camera Market Insight

The U.S. high speed camera market captured the largest revenue share of 73.5% in 2024 within North America, fueled by strong demand in automotive crash testing, aerospace research, and media production. Growing awareness of the benefits of high frame rate imaging for safety and quality control, coupled with stringent industry standards, drives market expansion. The integration of high speed cameras in scientific research and entertainment further complements market growth.

Europe High Speed Camera Market Insight

The Europe high speed camera market is expected to witness significant growth, supported by regulatory emphasis on vehicle safety and industrial automation. Consumers seek cameras that offer high-resolution imaging and precise motion capture for applications in automotive testing and scientific research. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing notable adoption due to technological advancements and environmental considerations.

U.K. High Speed Camera Market Insight

The U.K. market for high speed cameras is expected to experience rapid growth, driven by demand for advanced imaging in media, sports analytics, and scientific research. Increased interest in high-quality slow-motion capture and precise motion analysis encourages adoption. Evolving regulations on safety and performance testing influence consumer choices, balancing frame rate capabilities with compliance.

Germany High Speed Camera Market Insight

Germany is expected to witness rapid growth in the high speed camera market, attributed to its advanced automotive manufacturing sector and strong focus on research and development. German consumers prefer technologically advanced cameras with high frame rates and resolutions to enhance safety testing and industrial efficiency. The integration of these cameras in premium vehicles and research applications supports sustained market growth.

Asia-Pacific High Speed Camera Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding automotive production, rapid industrialization, and increasing investments in research and development in countries such as China, Japan, and India. Growing awareness of high speed cameras for motion analysis, quality control, and media applications boosts demand. Government initiatives promoting technological innovation and safety standards further encourage adoption.

Japan High Speed Camera Market Insight

Japan’s high speed camera market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced cameras that enhance safety testing and media production. The presence of major manufacturers and the integration of high speed cameras in OEM applications accelerate market penetration. Rising interest in aftermarket customization and research applications also contributes to growth.

China High Speed Camera Market Insight

China holds the largest share of the Asia-Pacific high speed camera market, propelled by rapid industrialization, rising vehicle production, and increasing demand for advanced imaging solutions. The country’s growing technological infrastructure and focus on innovation support the adoption of high speed cameras. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

High Speed Camera Market Share

The high speed camera industry is primarily led by well-established companies, including:

- Photron (Japan)

- DEL Imaging (U.S.)

- Mikrotron GmbH (Germany)

- iX Cameras (U.S.)

- nac Image Technology (Japan)

- Vision Research Inc. (U.S.)

- Fastec Imaging (U.S.)

- Olympus Corporation (Japan)

- Motion Capture Technologies (U.S.)

- Optronis GMBH (Germany)

- SVS-Vistek GmbH (Germany)

- Panasonic Corporation (Japan)

- Keyence Corporation (Japan)

- Teledyne FLIR (U.S.)

- Basler AG (Germany)

What are the Recent Developments in Global High Speed Camera Market?

- In December 2024, Lumotive and NAMUGA Co., Ltd. announced the launch of the Stella series, a new line of 3D sensing solutions that merges Lumotive’s Light Control Metasurface (LCM™) beam-steering technology with NAMUGA’s high-speed camera systems. Designed for applications in automotive testing and industrial automation, the Stella series delivers solid-state reliability, dynamic scanning, and rapid deployment. With models optimized for both indoor and outdoor environments, this collaboration accelerates innovation in high-speed imaging and reinforces both companies’ leadership in next-generation sensing technologies

- In September 2024, SVS-Vistek GmbH launched the hr455xXGE-T, a high-resolution industrial camera featuring a 61-megapixel Sony IMX455AQK sensor and delivering 9568 × 6380 resolution at 18 fps. Engineered for precision-critical applications such as display inspection, semiconductor production, and electronics testing, the camera integrates thermoelectric cooling (TEC) via a Peltier element to maintain consistent sensor temperature—ensuring reproducible image quality even under fluctuating environmental conditions. Additional highlights include a 10GigE interface, up to 32 GB memory, and features such as Defect Pixel Correction, Lens Shading Correction, and Power over Ethernet (PoE), making it a robust solution for high-end machine vision systems

- In May 2024, Excelitas Technologies Corp. introduced the pco.flim X Camera System, a next-generation high-speed imaging solution tailored for fluorescence lifetime imaging microscopy (FLIM). As the successor to the original pco.flim, this system delivers enhanced frame rates, image quality, and sensor cooling, enabling researchers to capture fluorescence lifetimes from 1 ns to 100 µs with exceptional precision. With a resolution of 1008 × 1008 pixels and a maximum of 45 double images per second, it’s designed for demanding biomedical and scientific applications, including lightsheet microscopy and FRET biosensing

- In November 2023, Kron Technologies Inc. introduced the Chronos 4K12 and Chronos Q12 high-speed cameras, delivering professional-grade performance at a fraction of the cost of traditional systems. The Chronos 4K12 captures 4K video at over 1,397 fps and up to 29,000 fps at reduced resolutions, while the Chronos Q12 reaches 2,782 fps at 2K resolution. Both models feature USB-C connectivity, HDMI output, focus peaking, color temperature controls, and a universal lens mount system supporting C, E, F, EF, and MFT lenses. With internal 1TB SSDs and dynamic range of 11.3 stops, these cameras are ideal for scientific research, industrial inspection, and creative cinematography

- In March 2023, Mikrotron GmbH introduced the EoSens 10CCX12-FM CXP-12, a high-speed industrial camera equipped with a 10-megapixel Gpixel Gsprint 4510 CMOS sensor. It captures full-resolution color images at up to 478 frames per second (fps) with a resolution of 4608 × 2176 pixels, making it ideal for automotive crash testing, motion analysis, and other precision-driven applications. The camera supports CoaXPress 2.0 with four lanes for data transmission up to 50 Gbit/s, and features such as thermoelectric cooling, defect pixel correction, and shading correction ensure consistent image quality in demanding environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global High Speed Camera Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global High Speed Camera Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global High Speed Camera Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.