Global High Performance Computing for Automotive Market, By Offering (Solution, Software, and Services), Deployment Model (On Premises, and Cloud), Organization Size (Large Enterprises, Small and Medium Size Enterprises (SMES)), Computation Type (Parallel Computing, Distributed Computing, and Exascale Computing), Platform (Safety & Motion HPC, Autonomous Driving HPC, Body HPC, Cockpit HPC, and Cross-Domain HPC), Vehicle Type (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle) - Industry Trends and Forecast to 2030.

High Performance Computing for Automotive Market Analysis and Size

The increase in demand for HPC research across the globe acts as one of the major factors driving the growth of high performance computing market. The increase in the need for efficient computing, enhanced scalability, and reliable storage, and the growing need for continued diversification, expansion of the IT industry, high-efficiency computing, and advances in virtualization, accelerate the market growth. The rise in the adoption of high performance computing owing to its ability of HPC systems to process large volumes of data at higher speeds and high usage in various sectors further influence the market.

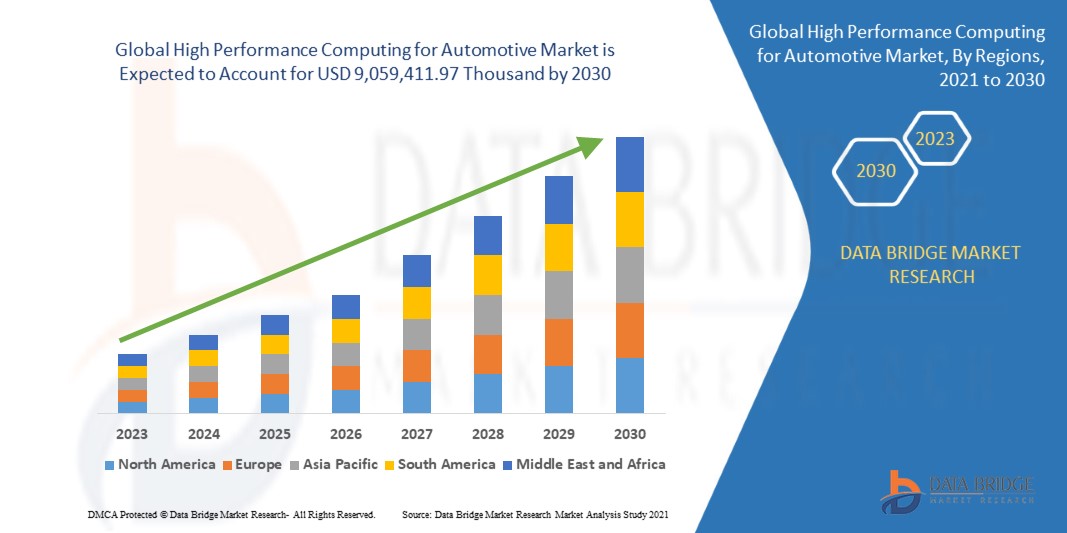

Data Bridge Market Research analyses that the global high performance computing for automotive market is expected to reach a value of USD 9,059,411.97 thousand by 2030, at a CAGR of 12.1% during the forecast period. The global high performance computing for automotive market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customisable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Thousand, Pricing in USD

|

|

Segments Covered

|

Offering (Solution, Software, and Services), Deployment Model (On Premises, and Cloud), Organization Size (Large Enterprises, Small and Medium Size Enterprises (SMES)), Computation Type (Parallel Computing, Distributed Computing, and Exascale Computing), Platform (Safety & Motion HPC, Autonomous Driving HPC, Body HPC, Cockpit HPC, and Cross-Domain HPC), Vehicle Type (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle)

|

|

Regions Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, U.K., Russia, Italy, Spain, Netherlands, Poland, Switzerland, Belgium, Sweden, Turkey, Denmark, Rest of Europe, Japan, China, India, South Korea, Vietnam, Taiwan, Australia & New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Kuwait, Qatar, Rest of Middle East and Africa

|

|

Market Players Covered

|

Hewlett Packard Enterprise Development LP, IBM, Lenovo., NVIDIA Corporation, Advanced Micro Devices, Inc., Microsoft, Taiwan Semiconductor Manufacturing Company Limited, Dell Inc., Fujitsu, Elektrobit., NEC Corporation, Beijing Jingwei Hirain Technologies Co., Inc., NXP Semiconductors., ANSYS, Inc, ESI Group, Super Micro Computer, Inc., Altair Engineering Inc., TotalCAE., Vector Informatik GmbH, MiTAC Computing Technology Corporation, Rescale, Inc.

|

Market Definition

High-performance computing (HPC) refers to the use of powerful and specialized computer systems that are capable of processing and analyzing vast amounts of data at incredibly high speeds. These systems employ advanced parallel processing techniques and often utilize multiple processors or nodes working together to solve complex problems in scientific research, engineering simulations, financial modeling, weather forecasting, and other computationally intensive tasks. HPC enables researchers and professionals to tackle challenges that would be infeasible or impractical using conventional computers, leading to accelerated discoveries, better insights, and more efficient problem-solving across various domains.

Global High Performance Computing For Automotive Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

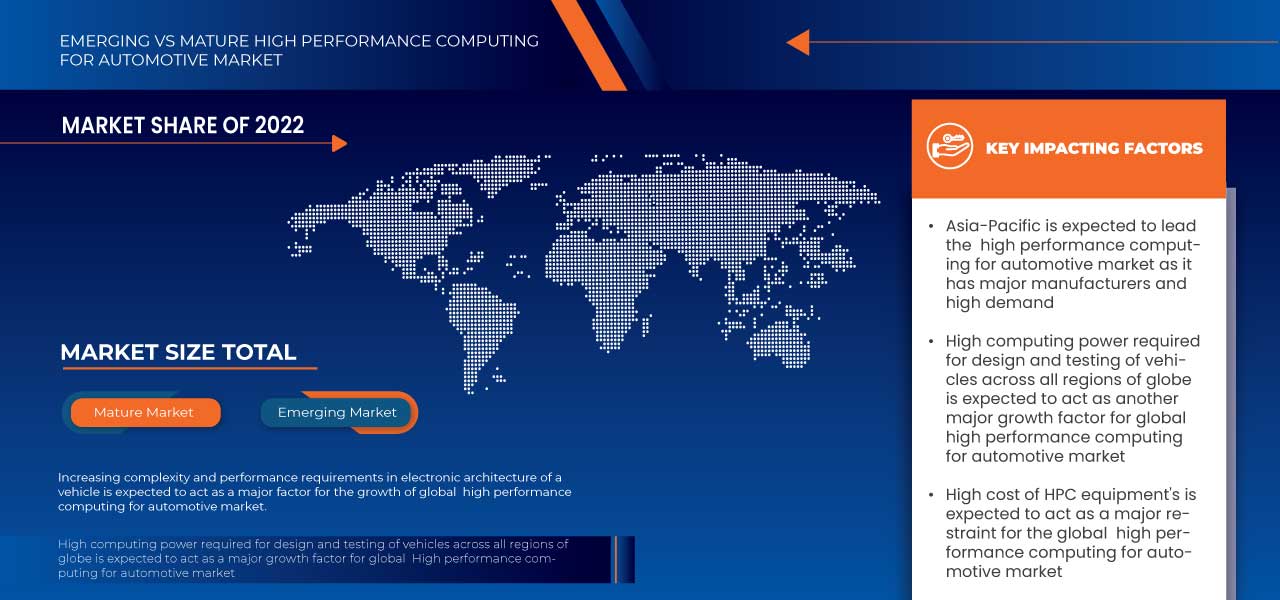

- Increasing complexity and performance requirements in electronic architecture of a vehicle

Future mobility will have access to a variety of new features and services thanks to digitalization. However, this is also causing an exponential rise in the volume of data and information that needs to be processed. The current electrical/electronics (E/E) architecture is already past its breaking point. Megatrends in the automotive industry including automated driving, software defined vehicles, and linked mobility call for an increasing amount of intelligence and computer capacity. The complexity and performance of today's automobile electrical/electronic architectures are at their maximum. It takes a lot of processing power to support connectivity, over-the-air updates, automated and autonomous driving, and advanced driver assistance systems (ADAS).

- High computing power is required for the design and testing of vehicles

High-performance computing (HPC) for automotive is an improved kind of HPC created to meet the demands of the automobile manufacturing industry in terms of computing power and software compatibility. Modern vehicles are produced using software-enabled precision engineering, which calls for a significant degree of computational performance. HPC can provide the necessary processing capacity at any level of the design process, including feature testing and safety simulation. Software-delivered features within cars themselves are also receiving more attention. With a CASE (connected, autonomous, shared, electric) vision, cars are evolving into Software-Defined Vehicles (SDVs), where the characteristics made possible by code link together the mechanical capabilities.

Opportunity

- The adoption of cloud-based hpc solutions

With technological developments driving innovations in electric mobility, driverless vehicles, and connected cars, the automotive industry is going through a drastic shift. Automotive firms are looking for ways to speed up product development, enhance vehicle performance, and optimize production processes to stay competitive in this quickly changing environment. The adoption of cloud-based High-Performance Computing (HPC) technologies is one strategy that has gained traction lately. Automotive businesses are opening new doors for quicker, more productive, and less expensive research, design, and testing processes by leveraging the power of cloud computing and cutting-edge computer capabilities.

Restraint/Challenge

- High cost of HPC equipments

One of the primary obstacles to HPC technologies' acceptance in autos is their cost. The high cost of purchasing and maintaining HPC systems can be a significant obstacle for automotive companies, particularly small and medium-sized ones. HPC systems typically have a large number of processors, which can drive up the cost. HPC systems typically use high-speed processors, which can also drive up the cost. HPC systems typically need a lot of memory, which can also drive up the cost. HPC systems generate a lot of heat, which requires specialized cooling systems. This can also drive up the cost.

- Handling sensitive automotive data

Automotive manufacturers and mobility providers now place a high priority on connected car security and data privacy. Personal identifying information (PII), customer location, behavior, and financial data, as well as intellectual property associated with the car and the services offered, can all be included in the sensitive data collected via connected automobiles. Employees and contractors throughout the world have access to this sensitive data as it moves through many settings and platforms, both on-premises and in the cloud. Manufacturers are greatly in danger of cyberattacks due to this honeypot of information.

Recent Developments

- In January 2023, NVIDIA Corporation and Hon Hai Technology Group (Foxconn), today announced a strategic partnership to develop automated and autonomous vehicle platforms. As part of the deal, Foxconn will produce electronic control units (ECUs) based on NVIDIA DRIVE Orin for the worldwide automotive market as a tier-one manufacturer

- In November 2022, Dell Inc. announced an extension of its high-performance computing (HPC) portfolio, with new hardware, services, and a hybrid quantum computing solution. The Dell Quantum Computing Solution enables businesses to benefit from quantum technology's enhanced computing. Customers can utilize this to accelerate machine learning, natural language processing, and chemistry and materials simulation

Global High-Performance Computing for Automotive Market Scope

Global high performance computing for automotive market is segmented on the basis of offering, deployment model, organization size, computation type, platform, and vehicle type. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Solution

- Software

- Services

On the basis of offering, global high performance computing for automotive market has been segmented into solution, software, and services.

Deployment Model

- On Premises

- Cloud

On the basis of deployment model, global high performance computing for automotive market has been segmented into on premises and cloud.

Organization Size

- Large Enterprises

- Small and Medium Size Enterprises (SMES)

On the basis of organization size, global high performance computing for automotive market has been segmented into large enterprises and small and medium size enterprises (SMES).

Computation Type

- Parallel Computing

- Distributed Computing

- Exascale Computing

On the basis of computation type, global high performance computing for automotive market has been segmented into parallel computing, distributed computing, and exascale computing.

Platform

- Safety & Motion HPC

- Autonomous Driving HPC

- Body HPC

- Cockpit HPC

- Cross-Domain HPC

On the basis of platform, global high performance computing for automotive market has been segmented into safety & motion HPC, autonomous driving HPC, body HPC, cockpit HPC, and cross-domain HPC.

Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

On the basis of vehicle type, global high performance computing for automotive market has been segmented into passenger car, light commercial vehicle, and heavy commercial vehicle.

Global High Performance Computing For Automotive Market Regional Analysis/Insights

Global high performance computing for automotive Market is analysed, and market size insights and trends are provided by region, type, deployment mode, application, and end-user as referenced above.

The regions covered in the global high performance computing for automotive market report are North America, South America, Europe, Asia-Pacific, Middle East and Africa. Asia-Pacific region is expected to dominate in the global high performance computing for automotive market fuelled by various factors, including strong government support, substantial investment in research and development, and collaborations between academia, industry, and research institutions. China dominates in the Asia-Pacific region as China has been investing heavily in HPC infrastructure and research to enhance its technological capabilities and scientific advancements. Moreover, U.S. dominates the North America region owing to factors such as high adoption of HPC technologies in automotive sectors which rely on HPC to accelerate product development, enhance scientific discoveries, and optimize operations.

Europe high performance computing for automotive market has witnessed the highest growth rate among all regions in high performance computing for the automotive market. Owing to factors such as the growing adoption of electric vehicle (EVs) and autonomous driving technology. Germany is dominating the region due to collaborative efforts between automotive manufacturers and HPC providers to develop eco-friendly, lightweight materials and streamline manufacturing processes, promoting sustainability and reducing environmental impact.

The region section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Global High Performance Computing For Automotive Market Share Analysis

Global high performance computing for automotive market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global high performance computing for automotive market.

Some of the major players operating in the global high performance computing for automotive market are, Hewlett Packard Enterprise Development LP, IBM, Lenovo., NVIDIA Corporation, Advanced Micro Devices, Inc., Microsoft, Taiwan Semiconductor Manufacturing Company Limited, Dell Inc., Fujitsu, Elektrobit., NEC Corporation, Beijing Jingwei Hirain Technologies Co., Inc., NXP Semiconductors., ANSYS, Inc, ESI Group, Super Micro Computer, Inc., Altair Engineering Inc., TotalCAE., Vector Informatik GmbH, MiTAC Computing Technology Corporation, Rescale, Inc. and among others.

SKU-