Global High Performance Coatings Market

Market Size in USD Billion

CAGR :

%

USD

113.88 Billion

USD

167.74 Billion

2024

2032

USD

113.88 Billion

USD

167.74 Billion

2024

2032

| 2025 –2032 | |

| USD 113.88 Billion | |

| USD 167.74 Billion | |

|

|

|

|

High-Performance Coatings Market Size

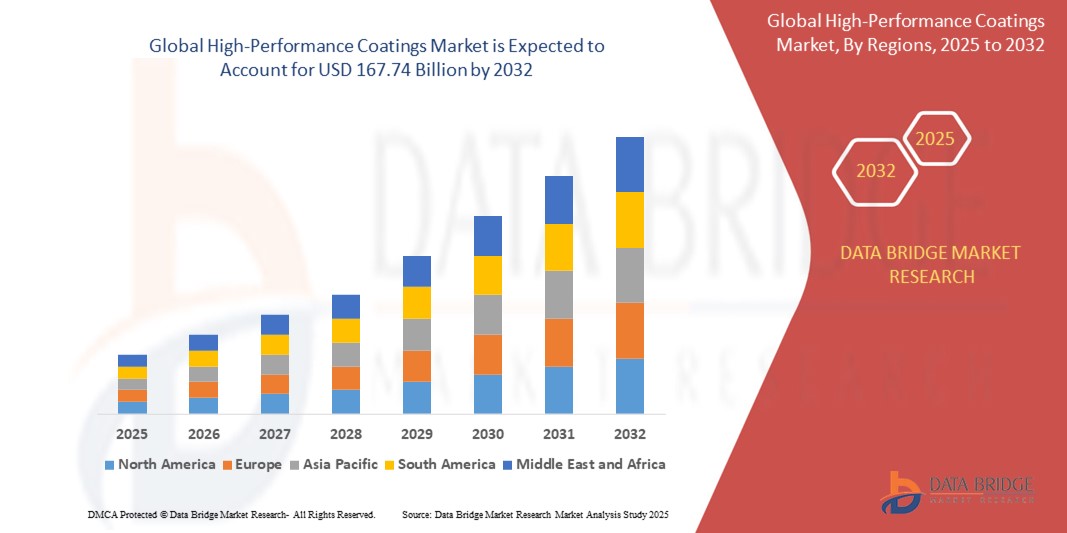

- The global high-performance coatings market size was valued at USD 113.88 billion in 2024 and is expected to reach USD 167.74 billion by 2032, at a CAGR of 4.96% during the forecast period

- The market growth is primarily driven by increasing demand for durable, corrosion-resistant, and environmentally friendly coatings across various industries, coupled with advancements in coating technologies

- Rising industrialization, infrastructure development, and stringent environmental regulations promoting eco-friendly coatings are further accelerating market expansion, positioning high-performance coatings as a preferred solution for industrial and commercial applications

High-Performance Coatings Market Analysis

- High-performance coatings, known for their superior durability, chemical resistance, and aesthetic properties, are critical in protecting surfaces in demanding environments across industries such as automotive, aerospace, marine, and construction

- The market is propelled by growing industrialization, increasing demand for sustainable and high-quality coatings, and advancements in coating technologies such as water-based and UV-cured systems

- Asia-Pacific dominated the high-performance coatings market with the largest revenue share of 45.3% in 2024, driven by rapid industrialization, infrastructure development, and a robust manufacturing base, particularly in China, India, and Japan

- North America is expected to be the fastest-growing region during the forecast period, fueled by technological advancements, increasing investments in aerospace and defense, and a shift toward eco-friendly coating solutions

- The epoxy segment held the largest market revenue share of 32% in 2024, driven by its superior durability, corrosion resistance, and versatility across industrial applications. Its widespread use in protective coatings for infrastructure and heavy machinery supports its dominance

Report Scope and High-Performance Coatings Market Segmentation

|

Attributes |

High-Performance Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

High-Performance Coatings Market Trends

“Increasing Adoption of Eco-Friendly and Sustainable Coating Solutions”

- The global high-performance coatings market is experiencing a notable trend toward the integration of eco-friendly and sustainable coating technologies

- Advanced formulations, such as water-based and UV-cured coatings, are gaining traction due to their low volatile organic compound (VOC) emissions and reduced environmental impact

- These technologies enable enhanced durability, corrosion resistance, and aesthetic appeal, meeting stringent regulatory requirements and consumer demand for sustainability

- For instance, companies are developing bio-based and recyclable coatings to cater to industries such as automotive, aerospace, and construction, where environmental compliance is critical

- This trend is enhancing the market’s appeal by aligning with global sustainability goals, making high-performance coatings more attractive to environmentally conscious industries and consumers

- Innovations in coating technologies, such as self-healing and anti-microbial coatings, are further improving performance and expanding applications across diverse end-user industries

High-Performance Coatings Market Dynamics

Driver

“Growing Demand for Durable and High-Quality Coatings across Industries”

- The rising need for coatings that offer superior protection, durability, and aesthetic qualities in industries such as automotive, aerospace, construction, and marine is a key driver for the high-performance coatings market

- High-performance coatings enhance surface resistance to corrosion, abrasion, and extreme weather conditions, extending the lifespan of components and structures

- Stringent government regulations, particularly in regions such as Europe and North America, mandating low-VOC and sustainable coatings are accelerating market growth

- The proliferation of advanced manufacturing technologies and the adoption of Industry 4.0 practices are enabling the development of high-performance coatings with improved application efficiency and performance

- Manufacturers are increasingly incorporating high-performance coatings as standard solutions to meet industry standards and enhance product value in competitive markets

Restraint/Challenge

“High Costs of Advanced Coating Technologies and Regulatory Compliance”

- The significant initial investment required for research, development, and application of high-performance coatings, such as fluoropolymer and ceramic coatings, can be a barrier, particularly for small and medium-sized enterprises in emerging markets

- The complexity of applying advanced coating technologies, such as thermal spray or chemicals vapor deposition (CVD), increases implementation costs

- In addition, stringent regulations on VOC emissions and hazardous material usage pose challenges, as manufacturers must invest in compliant formulations and processes, increasing operational costs

- The fragmented regulatory landscape across regions regarding environmental standards and safety requirements complicates operations for global manufacturers and service providers

- These factors can deter adoption in cost-sensitive markets and limit market expansion, particularly in regions with lower awareness of advanced coating benefits or high price sensitivity

High-Performance Coatings market Scope

The market is segmented on the basis of type, coating technology, spray technology, and end-user industry.

- By Type

On the basis of type, the market is segmented into epoxy, silicon, polyester, acrylic, alkyd, polyurethane, fluoropolymer, ceramic, and others. The epoxy segment held the largest market revenue share of 32% in 2024, driven by its superior durability, corrosion resistance, and versatility across industrial applications. Its widespread use in protective coatings for infrastructure and heavy machinery supports its dominance.

The polyurethane segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for high-performance coatings with excellent weatherability, flexibility, and aesthetic appeal in automotive, aerospace, and construction industries. Advancements in eco-friendly polyurethane formulations further accelerate adoption.

- By Coating Technology

On the basis of coating technology, the market is segmented into solvent-based, water-based, powder-based, and UV-cured. The solvent-based segment is expected to hold the largest market revenue share of 45% in 2024, owing to its established use in high-performance applications requiring robust adhesion and chemical resistance. Its widespread adoption in industrial and automotive sectors drives its dominance.

The water-based segment is anticipated to experience the fastest growth rate of 18.5% from 2025 to 2032, driven by stringent environmental regulations promoting low-VOC coatings and growing consumer preference for sustainable solutions. Water-based coatings offer comparable performance with reduced environmental impact, boosting their adoption across industries.

- By Spray Technology

On the basis of spray technology, the market is segmented into thermal spray coating, chemical vapor deposition (CVD), physical vapor deposition (PVD), sol-gel, and others. The thermal spray coating segment is expected to hold the largest market revenue share of 38% in 2024, driven by its ability to provide high-performance coatings with excellent wear and corrosion resistance for demanding applications in aerospace, automotive, and industrial sectors.

The sol-gel segment is projected to witness significant growth from 2025 to 2032, attributed to its ability to produce thin, high-quality coatings with enhanced durability and thermal stability. Its increasing use in advanced applications, such as electronics and aerospace, supports its growth.

- By End-User Industry

On the basis of end-user industry, the market is segmented into general industrial, protective, packaging, coil, rail, building and construction, automotive and transportation, industrial wood, aerospace and defense, marine, and others. The protective segment dominated the market revenue share of 40% in 2024, driven by the critical need for corrosion-resistant and durable coatings in infrastructure, oil and gas, and heavy machinery industries.

The automotive and transportation segment is expected to witness rapid growth of 20.1% from 2025 to 2032, fueled by increasing demand for high-performance coatings that enhance vehicle durability, aesthetics, and resistance to environmental factors. The rise in electric vehicle production and advancements in coating technologies further drive growth.

High-Performance Coatings Market Regional Analysis

- Asia-Pacific dominated the high-performance coatings market with the largest revenue share of 45.3% in 2024, driven by rapid industrialization, infrastructure development, and a robust manufacturing base, particularly in China, India, and Japan

- Consumers prioritize high-performance coatings for enhanced durability, corrosion resistance, and aesthetic appeal, particularly in harsh environmental conditions across various industries

- Growth is supported by advancements in coating technologies, such as water-based and UV-cured formulations, alongside rising adoption in OEM and aftermarket applications across multiple end-user industries

U.S. High-Performance Coatings Market Insight

The U.S. expected to be the fastest growing region in the smart high-performance coatings market, fueled by robust demand in automotive, aerospace, and general industrial applications. Increasing adoption of advanced coating types such as fluoropolymer and ceramic, coupled with a focus on energy-efficient and sustainable solutions, supports market growth. The trend toward customized coatings and regulatory compliance for environmental safety enhances both OEM and aftermarket segments.

Europe High-Performance Coatings Market Insight

The Europe high-performance coatings market is experiencing steady growth, supported by a strong emphasis on sustainability and innovation in industries such as automotive, marine, and building and construction. Consumers seek coatings that offer superior protection and energy efficiency while meeting strict regulatory standards. Countries such as Germany and the U.K. show significant uptake due to advanced manufacturing and environmental concerns.

U.K. High-Performance Coatings Market Insight

The U.K. market for high-performance coatings is expected to witness significant growth, driven by demand for durable and aesthetically appealing coatings in urban construction and automotive sectors. Increased awareness of corrosion resistance and sustainability benefits encourages adoption. Evolving regulations promoting eco-friendly coating technologies, such as water-based and UV-cured systems, influence consumer preferences and market trends.

Germany High-Performance Coatings Market Insight

Germany is expected to witness rapid growth in the high-performance coatings market, attributed to its advanced manufacturing capabilities and focus on high-quality coatings for automotive, aerospace, and industrial applications. German consumers prefer technologically advanced coatings, such as polyurethane and epoxy, that enhance durability and reduce environmental impact. Integration in premium products and aftermarket solutions supports sustained market expansion.

Asia-Pacific High-Performance Coatings Market Insight

Asia-Pacific holds the largest share of the global high-performance coatings market, driven by booming automotive, construction, and industrial sectors in countries such as China, India, and Japan. Rising disposable incomes, urbanization, and growing awareness of protective and aesthetic coating benefits fuel demand. Government initiatives promoting sustainable and energy-efficient technologies further accelerate the adoption of advanced coatings.

Japan High-Performance Coatings Market Insight

Japan’s high-performance coatings market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced coatings that enhance durability and performance. The presence of major automotive and electronics manufacturers, along with the integration of coatings in OEM applications, drives market penetration. Growing interest in sustainable aftermarket solutions also contributes to market growth.

China High-Performance Coatings Market Insight

China dominates the Asia-Pacific high-performance coatings market, propelled by rapid urbanization, increasing industrial output, and rising demand for protective and decorative coatings. The country’s expanding middle class and focus on smart manufacturing support the adoption of advanced coating technologies such as powder-based and UV-cured systems. Strong domestic production capabilities and competitive pricing enhance market accessibility.

High-Performance Coatings Market Share

The high-performance coatings industry is primarily led by well-established companies, including:

- Evonik Industries AG (Germany)

- Alnor Oil Company (U.S.)

- KRATON CORPORATION (U.S.)

- BASF (Germany)

- Cargill, Incorporated (U.S.)

- Eastman Chemical Company (U.S.)

- Procter & Gamble (U.S.)

- Godrej & Boyce Manufacturing Company Limited (India)

- PPG Industries Ohio, Inc. (U.S.)

- Emery Oleochemicals (U.S.)

- PTT Global Chemical Public Company Limited (Thailand)

- Jet-Hot, Inc. (U.S.)

- Industrial Control Development, Inc. (U.S.)

- SPI Performance Coatings (U.S.)

- EverCoat Industries Sdn Bhd (Malaysia)

What are the Recent Developments in Global High-Performance Coatings Market?

- In December 2024, Rodda Paint Company, in collaboration with the Cloverdale Group, acquired Miller Paint Company, a well-established employee-owned brand in the Pacific Northwest. This strategic acquisition unites two iconic paint manufacturers, enhancing market presence, operational efficiencies, and customer service. Rodda Paint aims to preserve Miller Paint’s legacy while leveraging combined resources to expand offerings and strengthen industry leadership. The partnership underscores a commitment to quality, innovation, and community engagement, ensuring a seamless transition for customers and employees

- In December 2024, American Industrial Partners (AIP) completed the acquisition of PPG’s architectural coatings business in the U.S. and Canada for $550 million. The newly independent company has been rebranded as The Pittsburgh Paints Company, honoring its 125-year legacy in the paint and coatings industry. The business will continue supplying interior and exterior paints, stains, caulks, adhesives, and sealants to professionals and DIY consumers. AIP aims to accelerate growth and innovation, leveraging Pittsburgh Paints Co.’s strong brand portfolio

- In October 2024, Sudarshan Chemical Industries Limited (SCIL) announced its acquisition of the Heubach Group, aiming to establish a global pigment powerhouse. This strategic move combines SCIL’s operational expertise with Heubach’s technological capabilities, expanding its product portfolio and market presence across 19 international sites. The acquisition strengthens SCIL’s foothold in Europe, the Americas, and APAC, ensuring high-quality pigment solutions for diverse industries. Led by Managing Director Rajesh Rathi, the combined entity focuses on innovation, efficiency, and customer-centric growth

- In July 2024, Axalta Coating Systems finalized the acquisition of The CoverFlexx Group from Transtar Holding Company for $285 million, with an additional earnout based on performance. This strategic move strengthens Axalta’s Refinish coatings portfolio, expanding its offerings for automotive refinish and aftermarket applications. The CoverFlexx Group, known for its primers, basecoats, clearcoats, aerosols, and detailing products, operates manufacturing sites in Michigan and Ontario. Axalta aims to enhance customer value and accelerate growth in the coatings industry

- In May 2024, AkzoNobel introduced Eclipse Gloss TUK™, an innovative touch-up kit designed to minimize paint waste while maintaining high-quality finishes. This polyurethane topcoat offers premium gloss, stain resistance, and flexibility, ensuring long-lasting durability. Engineered for efficient application, Eclipse Gloss TUK™ enhances surface protection and meets OEM standards for commercial exteriors. The kit is formulated with low VOC content, supporting environmentally responsible coatings. AkzoNobel’s commitment to sustainability and performance is reflected in this advanced touch-up solution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global High Performance Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global High Performance Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global High Performance Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.