Global High Barrier Packaging Films Market

Market Size in USD Billion

CAGR :

%

USD

27.32 Billion

USD

49.83 Billion

2024

2032

USD

27.32 Billion

USD

49.83 Billion

2024

2032

| 2025 –2032 | |

| USD 27.32 Billion | |

| USD 49.83 Billion | |

|

|

|

|

High Barrier Packaging Films Market Size

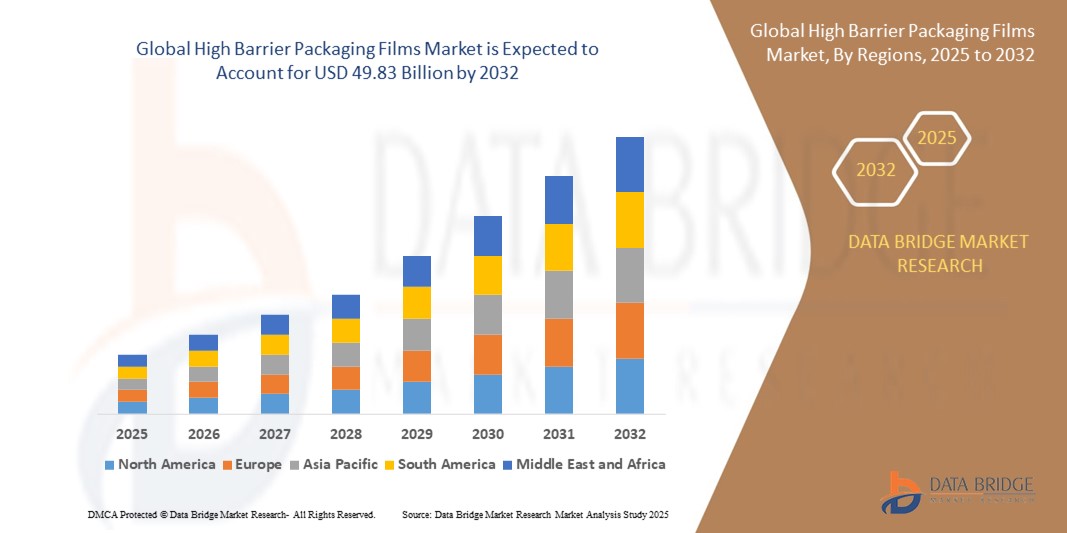

- The global high barrier packaging films market size was valued at USD 27.32 billion in 2024 and is expected to reach USD 49.83 billion by 2032, at a CAGR of 7.8% during the forecast period

- Market growth is primarily driven by the rising demand for extended shelf life and product protection in food, beverage, and pharmaceutical packaging, where high barrier films offer superior resistance to oxygen, moisture, and other environmental factors

- In addition, the increasing shift toward sustainable and lightweight packaging solutions, especially in developing economies, is further fueling the adoption of high barrier packaging films. Technological advancements in multi-layer co-extrusion and bio-based films are also supporting market expansion across diverse industrial applications

High Barrier Packaging Films Market Analysis

- High barrier packaging films play a critical role across multiple industries—particularly in food & beverage, pharmaceuticals, and personal care—due to their superior resistance to moisture, oxygen, UV rays, and contaminants, effectively extending shelf life and maintaining product quality

- Rising demand for convenience foods, pharmaceutical stability, and lightweight, sustainable packaging is accelerating the adoption of high barrier films. Technological innovations, including bio-based multilayer structures and recyclable films, are driving a shift toward more sustainable solutions across the value chain

- North America dominates the global high barrier packaging films market with the largest revenue share of approximately 41.5% in 2025, driven by high consumption of packaged goods, strict regulatory standards for food and drug safety, and a mature packaging industry. The United States leads the region with advanced R&D capabilities and growing investments in sustainable barrier technologies by major players like Amcor, Sealed Air, and Berry Global

- Asia-Pacific is projected to be the fastest-growing region, supported by rapid industrialization, increasing demand for packaged and processed foods, and government initiatives promoting local manufacturing. Key countries such as China, India, and Indonesia are witnessing significant growth in consumer product packaging, driving the need for cost-effective and durable barrier films

- The food and beverage segment is expected to hold the largest market share of around 45.8% in 2025, as manufacturers prioritize packaging that prevents oxidation, spoilage, and aroma loss. Formats such as vacuum pouches, retort bags, and MAP (Modified Atmosphere Packaging) continue to see high demand in both developed and emerging markets.

Report Scope and High Barrier Packaging Films Market Segmentation

|

Attributes |

High Barrier Packaging Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

High Barrier Packaging Films Market Trends

“Strategic Technological Advancements and Supply Chain Integration”

- A key and accelerating trend in the global high barrier packaging films market is the integration of advanced multilayer film manufacturing technologies, including nano-coating, co-extrusion, and vacuum metallization, to improve barrier performance while maintaining film flexibility, transparency, and recyclability. These technologies enhance shelf life and product safety in food, pharmaceutical, and electronic packaging

- For instance, in April 2024, Amcor introduced a recyclable high-barrier film using its proprietary AmLite technology, combining high oxygen and moisture resistance with recyclability under existing infrastructure, supporting both sustainability and performance goals for global FMCG clients

- Leading packaging companies are pursuing vertical integration strategies—from raw polymer processing to finished film conversion. In January 2024, Constantia Flexibles acquired a specialty PET film facility in Eastern Europe, allowing greater control over resin sourcing, coating, and lamination, while reducing supply chain disruptions and lead times for European customers

- The demand for eco-friendly and compliant packaging is driving the adoption of bio-based and mono-material barrier films. In March 2024, Toray Plastics (America) launched a new line of compostable high-barrier films targeting organic food packaging and personal care products, aligning with growing regulatory frameworks like the EU Packaging and Packaging Waste Regulation (PPWR)

- Digital supply chain technologies such as IoT-enabled packaging lines and AI-based quality control systems are being widely implemented. In June 2023, MULTIVAC deployed smart packaging equipment with predictive maintenance and defect detection capabilities, improving production efficiency and traceability across global operations

- Recycling and circular economy initiatives are emerging as strategic pillars. In 2024, Sonoco Products Company began scaling a chemical recycling pilot to recover high-barrier film components—such as EVOH and nylon—from multilayer structures, aiming to reduce landfill waste and improve material recovery for high-performance reuse

- These trends underscore a broader transformation in the high barrier packaging films market, where technological innovation, environmental stewardship, and integrated operations are critical to competitiveness. Industry leaders are investing in closed-loop systems, sustainable material innovation, and digital automation to future-proof their packaging strategies and meet rising global demand for safe, efficient, and eco-friendly solutions

High Barrier Packaging Films Market Dynamics

Driver

“Growing Demand for Product Protection, Shelf Life Extension, and Sustainable Packaging”

- The increasing need to protect perishable products—especially in the food & beverage, pharmaceutical, and electronics sectors—is a major driver for high barrier packaging films. These films offer superior resistance to oxygen, moisture, UV light, and contaminants, extending shelf life and reducing spoilage

- For instance, in February 2024, Sealed Air Corporation expanded its portfolio of multilayer vacuum barrier films for fresh meat and cheese packaging, citing rising consumer demand for longer shelf life and food safety assurance in both retail and e-commerce distribution

- The global push for sustainable packaging, particularly recyclable and lightweight alternatives to rigid containers, has led to accelerated adoption of high barrier flexible films. These films reduce packaging weight, lower carbon footprint, and support circular economy goals

- Emerging applications in nutraceuticals, dairy, and healthcare packaging are further driving market demand, especially in fast-growing regions such as Asia-Pacific and Latin America, where urbanization and packaged food consumption are rising

- In addition, advancements in film engineering, including mono-material and bio-based structures, are enabling manufacturers to meet both barrier performance and recyclability targets. Companies like Amcor and Constantia Flexibles are at the forefront of this innovation trend

- Overall, the dual need for performance and sustainability, along with stricter global packaging regulations (e.g., EU Packaging and Packaging Waste Regulation, FDA guidelines), continues to propel the high barrier packaging films market forward

Restraint/Challenge

“Material Complexity, Cost Pressures, and Recycling Limitations”

- A primary challenge in the high barrier packaging films market is the complexity of multilayer material structures, often combining polymers like EVOH, PA, PET, and aluminum. While these combinations enhance barrier properties, they significantly complicate recyclability and waste management

- For instances, multi-material flexible films are difficult to separate and reprocess, and many recycling systems lack the capability to handle them, leading to increased landfill waste and regulatory scrutiny

- Raw material price volatility, especially for specialty polymers and metalized components, poses cost pressure on manufacturers. In 2023–2024, supply chain disruptions and inflationary trends led to rising prices of PET, PA, and aluminum, affecting profit margins

- Regulatory challenges are intensifying, with the EU’s Green Deal, EPR (Extended Producer Responsibility) frameworks, and plastic taxation policies placing pressure on manufacturers to redesign packaging formats while managing costs and compliance.

- The capital expenditure required for high-tech barrier film production lines, including multilayer co-extrusion and vacuum metallization systems, is substantial. This limits entry for smaller players and makes capacity expansion expensive in developing regions

- In addition, supply chain integration remains uneven, with limited transparency across raw material sourcing, film conversion, and end-of-life disposal. The lack of closed-loop systems further undermines circularity goals

- To address these restraints, industry leaders are investing in design-for-recycling initiatives, AI-based sorting technologies, and mono-material barrier films that maintain performance while enabling recovery within standard recycling streams

High Barrier Packaging Films Market Scope

The market is segmented on the basis of type, material, packaging type, and end user.

By Type

On the basis of type, the High Barrier Packaging Films market is segmented into Metalized Films, Clear Films, Organic Coating Films, Inorganic Oxide Coating Films, and Others. The Metalized Films segment dominates the largest market revenue share in 2025, driven by its excellent barrier properties against oxygen, moisture, and light, making it highly suitable for food and pharmaceutical packaging applications

Metalized films are preferred for their cost-effectiveness and ability to provide extended shelf life, especially in snack foods, confectionery, and medical products. The market also witnesses strong demand for Clear Films due to their transparency and printability, which enhance product visibility and branding on retail shelves

• By Material

On the basis of material, the High Barrier Packaging Films market is segmented into Plastic, Aluminum, Oxides, and Others. The Plastic segment holds the largest revenue share in 2025, owing to its versatility, lightweight nature, and compatibility with various coating technologies. Plastics such as PET and PE provide excellent mechanical strength and flexibility, making them ideal for flexible packaging solution

Aluminum films are widely utilized for their superior barrier against moisture and oxygen, especially in pharmaceutical and electronic device packaging, where maximum protection is critical

• By Packaging Type

On the basis of packaging type, the market is segmented into Pouches, Bags, Lids, Shrink Films, Laminated Tubes, and Others. The Pouches segment commands the largest market revenue share in 2025, propelled by their convenience, resealability, and ability to preserve product freshness. Pouches are extensively used across food, beverage, and pharmaceutical industries, driven by rising consumer preference for portable and sustainable packaging formats

Lids and Shrink Films are also witnessing rapid adoption, supported by innovations in sealing technologies and enhanced barrier performance for perishable goods

• By End User

On the basis of end user, the High Barrier Packaging Films market is segmented into Food and Beverages, Pharmaceuticals, Electronic Devices, Medical Devices, Agriculture, Chemicals, and Others. The Food segment leads the market with the largest revenue share in 2025, fueled by the growing demand for packaged convenience foods, snacks, and ready-to-eat meals requiring extended shelf life and protection from spoilage

The Pharmaceuticals segment is also growing steadily, driven by stringent regulatory requirements for moisture and oxygen barrier properties to ensure drug safety and efficacy. Emerging sectors such as Electronic Devices and Medical Devices are increasingly adopting high barrier films for component protection and sterilization packaging

High Barrier Packaging Films Market Regional Analysis

- North America dominates the global High Barrier Packaging Films market, holding the largest revenue share of approximately 41.5% in 2025, driven by the presence of major packaging manufacturers and strong demand across the food & beverage, pharmaceuticals, and medical devices sectors. The region benefits from advanced manufacturing infrastructure, high consumer awareness around product safety, and stringent regulatory standards requiring superior barrier properties

- Growing demand for sustainable and recyclable packaging solutions in North America is pushing manufacturers to develop mono-material high barrier films and bio-based coatings, aligning with federal and state-level policies on plastic waste reduction and extended producer responsibility

- In addition, expanding e-commerce and changing consumer preferences for convenience and freshness in packaged goods are propelling the adoption of flexible high barrier films. The region’s well-established logistics network and supply chain integration further support efficient production and distribution

Japan High Barrier Packaging Films Market Insight

The Japan High Barrier Packaging Films market is driven by the country’s advanced packaging technologies, stringent quality standards, and high demand for premium food, pharmaceutical, and electronics packaging. Japanese manufacturers focus on innovation in multilayer film structures, organic and inorganic coatings, and sustainable solutions to meet niche applications requiring superior barrier performance, moisture resistance, and durability. Additionally, Japan’s emphasis on eco-friendly packaging and circular economy principles is pushing demand for recyclable and biodegradable high barrier films

China High Barrier Packaging Films Market Insight

The China High Barrier Packaging Films market is expected to dominate the Asia-Pacific region, fueled by the country’s vast packaging industry, increasing food and pharmaceutical production, and rapid growth in e-commerce packaging demand. China’s large-scale manufacturing capabilities and investments in metalized and coated film technologies are driving adoption across multiple sectors including consumer goods, healthcare, and electronics. Leading domestic producers are upgrading production lines with automation and advanced quality control to meet rising requirements for high-performance, cost-effective packaging films both domestically and for export

North America High Barrier Packaging Films Market Insight

The North America High Barrier Packaging Films market is witnessing strong growth due to high consumer demand for convenience packaging, medical devices, and sustainable packaging solutions. The U.S. leads the region with technological advancements in multilayer co-extrusion, organic and inorganic oxide coatings, and the development of recyclable mono-material barrier films. Major industry players such as Sealed Air, Sonoco, and Amcor are investing heavily in R&D and capacity expansions to address evolving regulatory requirements and consumer preferences for eco-friendly packaging

U.S. High Barrier Packaging Films Market Insight

The U.S. High Barrier Packaging Films market holds the largest share in North America in 2025, supported by a mature packaging industry and strong demand from the food, pharmaceutical, and medical sectors. Increasing regulations on product safety and environmental sustainability are propelling innovations in barrier films with superior oxygen, moisture, and aroma protection. The country’s leadership in film extrusion technology and coating processes, coupled with rising investments in circular packaging solutions, is enhancing supply chain resilience and product differentiation

Europe High Barrier Packaging Films Market Insight

The Europe High Barrier Packaging Films market is projected to grow steadily, driven by strict regulatory frameworks such as the EU’s Green Deal and packaging waste directives. Countries including Germany, France, and the Netherlands are spearheading adoption of recyclable multilayer films, bio-based coatings, and metalized films to reduce environmental impact while maintaining high barrier properties. Collaboration between chemical companies, packaging converters, and brand owners is fostering innovation in sustainable packaging solutions, especially for food and pharmaceuticals

U.K. High Barrier Packaging Films Market Insight

The U.K. High Barrier Packaging Films market is gaining momentum due to rising demand in the food service, pharmaceutical, and cosmetic packaging sectors. Manufacturers are increasingly adopting organic coating films and clear barrier films for their superior aesthetics and performance. Government policies aimed at reducing plastic waste and promoting reusable packaging systems are encouraging investment in recyclable barrier film technologies. Industry initiatives on green chemistry and packaging eco-design are also driving growth in high-performance, low-impact films

Germany High Barrier Packaging Films Market Insight

The Germany High Barrier Packaging Films market is expanding significantly, supported by the country’s robust automotive, food, and pharmaceutical industries. German manufacturers emphasize development of inorganic oxide coating films and metalized films that offer exceptional barrier efficiency and durability under strict EU regulatory standards. Investment in sustainable packaging solutions and advanced film processing technologies is rising to meet the demand for recyclable and lightweight packaging. Germany’s focus on precision engineering and quality assurance continues to position it as a key player in the European market

High Barrier Packaging Films Market Share

The high barrier packaging films industry is primarily led by well-established companies, including:

- Advanced Converting Works (U.S.)

- Constantia Flexibles (Austria)

- HPM GLOBAL INC. (U.S.)

- FLAIR Flexible Packaging Corporation (U.S.)

- ClearBags (U.S.)

- Perlen Packaging (Switzerland)

- OLIVER (U.S.)

- Celplast Metallized Products (Canada)

- Toray Plastics (America), Inc. (U.S.)

- ISOFlex Packaging (U.S.)

- KREHALON (Netherlands)

- MULTIVAC (Germany)

- BERNHARDT Packaging & Process (U.S.)

- Sonoco Products Company (U.S.)

- Sealed Air (U.S.)

- WINPAL LTD. (Taiwan)

- Schur Flexibles Holding GesmbH (Austria)

- Amcor Ltd. (Australia)

Latest Developments in Global High Barrier Packaging Films Market

- In April 2024, UFlex launched a series of new high barrier packaging films, designed to provide superior product protection and extended shelf life while enhancing sustainability. These advanced packaging solutions cater to the growing demand for high-performance, eco-friendly materials in the flexible packaging industry

- In April 2024, Inteplast BOPP Films partnered with VerdaFresh to create flexible high barrier films that will enhance food shelf life while minimizing package waste. Inteplast's high-moisture barrier biaxially oriented polypropylene (BOPP) films will be blended with oxygen protective coating technology from VerdaFresh

- In March 2024, Toppan announced the launch of a new high barrier packaging film that combines recyclability with superior barrier performance, enhancing sustainability in the packaging industry

- In December 2023, Amcor introduced a new recyclable high barrier packaging film, designed to deliver exceptional product protection while supporting sustainability efforts

- In October 2022, Toppan expanded its GL Barrier range with a mono-material PE barrier designed to package liquid products in a durable, sterile, and easy-to-recycle material. Aiming to meet "growing demand" in the European and North American markets, the company claims that vapor deposition has previously posed a challenge with PE packaging and that its new barrier supersedes existing designs of its kind

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global High Barrier Packaging Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global High Barrier Packaging Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global High Barrier Packaging Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.