Global Hemodynamic Monitoring Equipment Market

Market Size in USD Billion

CAGR :

%

USD

1.36 Billion

USD

2.25 Billion

2024

2032

USD

1.36 Billion

USD

2.25 Billion

2024

2032

| 2025 –2032 | |

| USD 1.36 Billion | |

| USD 2.25 Billion | |

|

|

|

|

Hemodynamic Monitoring Equipment Market Size

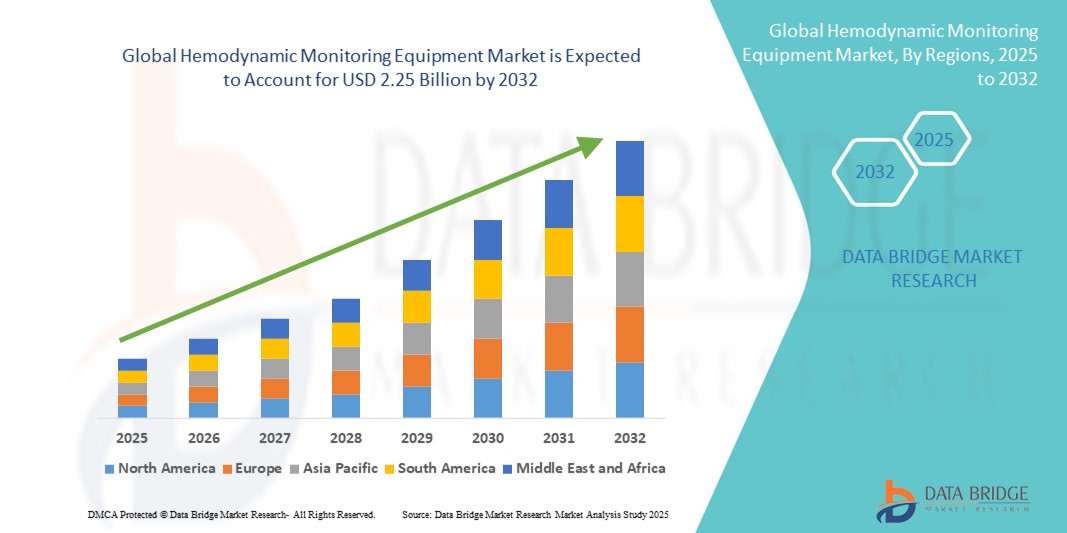

- The global hemodynamic monitoring equipment market size was valued at USD 1.36 billion in 2024 and is expected to reach USD 2.25 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, rising demand for real-time patient monitoring in critical care settings, and technological advancements in minimally invasive and non-invasive monitoring devices

- Furthermore, the aging global population and increasing healthcare expenditures are driving the adoption of reliable diagnostic tools. These converging factors are accelerating the uptake of hemodynamic monitoring systems, thereby significantly boosting the industry's growth

Hemodynamic Monitoring Equipment Market Analysis

- Hemodynamic monitoring equipment, providing real-time assessment of cardiovascular function, is becoming increasingly essential in modern healthcare settings, including hospitals, intensive care units, and surgical centers, due to its ability to guide treatment decisions, improve patient outcomes, and integrate with advanced hospital information systems

- The growing demand for hemodynamic monitoring devices is primarily driven by the rising prevalence of cardiovascular diseases, increasing critical care requirements, and technological advancements in minimally invasive and non-invasive monitoring systems

- North America dominated the hemodynamic monitoring equipment market with the largest revenue share of 39.2% in 2024, supported by advanced healthcare infrastructure, high adoption of sophisticated monitoring systems, and a strong presence of leading industry players. The U.S. witnessed significant growth in device installations, particularly in ICUs and cardiac care units, fueled by innovations in wireless, AI-enabled, and wearable monitoring technologies

- Asia-Pacific is expected to be the fastest-growing region in the hemodynamic monitoring equipment market during the forecast period, driven by increasing healthcare investments, expanding hospital networks, and rising awareness about advanced cardiovascular care

- Minimally invasive hemodynamic monitoring systems dominated the hemodynamic monitoring equipment market with a market share of 42.4% in 2024, attributed to their accuracy, reduced patient risk, and ease of integration into existing clinical workflows

Report Scope and Hemodynamic Monitoring Equipment Market Segmentation

|

Attributes |

Hemodynamic Monitoring Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hemodynamic Monitoring Equipment Market Trends

Advancements Through AI, Wireless, and Wearable Technologies

- A key and accelerating trend in the global hemodynamic monitoring equipment market is the integration of artificial intelligence (AI), wireless connectivity, and wearable monitoring devices. These technologies are improving real-time patient assessment, predictive analytics, and remote monitoring capabilities, significantly enhancing clinical decision-making

- For instance, wireless hemodynamic monitors such as Edwards Lifesciences’ FloTrac system allow clinicians to continuously track cardiac output and other vital parameters without invasive catheters. Similarly, non-invasive devices such as CNSystems’ NICCI monitor enable continuous blood pressure monitoring through wearable sensors

- AI integration enables features such as predictive alerts for cardiovascular instability, automated trend analysis, and personalized patient care recommendations. Some advanced systems can learn patient-specific patterns, alerting healthcare staff to deviations that may indicate deterioration. Wireless and wearable capabilities also allow ICU staff to monitor multiple patients remotely, improving workflow efficiency and response times

- The seamless integration of hemodynamic monitors with electronic health record (EHR) systems and hospital information platforms facilitates centralized monitoring and data analysis, supporting coordinated care and improved outcomes

- This trend toward smarter, connected, and patient-centric monitoring systems is reshaping expectations for critical care management. Companies such as Philips Healthcare and GE HealthCare are developing AI-enabled and wireless hemodynamic monitoring devices that provide continuous, real-time data and predictive analytics

- The demand for intelligent, minimally invasive, and connected hemodynamic monitoring solutions is growing rapidly across hospitals and critical care units as healthcare providers prioritize patient safety, efficiency, and proactive cardiovascular management

Hemodynamic Monitoring Equipment Market Dynamics

Driver

Increasing Prevalence of Cardiovascular Diseases and Critical Care Needs

- The rising incidence of cardiovascular diseases and the growing need for real-time monitoring in ICUs and surgical settings are key drivers for the expanding demand for hemodynamic monitoring devices

- For instance, in March 2024, Edwards Lifesciences introduced enhancements to its FloTrac system, integrating AI-based predictive analytics for improved perioperative and ICU monitoring. Such innovations by key players are expected to drive market growth during the forecast period

- Hemodynamic monitors offer advanced features including continuous cardiac output monitoring, trend analysis, and early detection of patient deterioration, providing significant advantages over traditional intermittent measurement methods

- Furthermore, increasing adoption of minimally invasive and non-invasive monitoring systems supports enhanced patient safety, shorter hospital stays, and reduced procedure-related complications, boosting market uptake

- The growing implementation of remote patient monitoring and centralized ICU management solutions, combined with hospital digitalization initiatives, is further propelling the adoption of hemodynamic monitoring equipment globally

Restraint/Challenge

High Cost and Integration Complexities

- The relatively high cost of advanced hemodynamic monitoring systems poses a significant challenge, particularly for smaller hospitals and healthcare facilities in developing regions. Devices incorporating AI, wireless connectivity, and minimally invasive technology often require substantial capital investment

- Integration of these systems with existing hospital IT infrastructure and electronic health record platforms can be complex and resource-intensive, creating potential adoption barriers

- In addition, ensuring accuracy and reliability in minimally invasive and non-invasive devices remains a concern for some clinicians. For instance, in 2023, a pilot study on non-invasive cardiac output monitors reported inconsistent readings under certain clinical conditions, prompting clinicians to rely on invasive methods in critical cases

- Addressing these challenges through cost-effective device options, simplified integration solutions, and clinician training programs will be crucial for expanding market penetration and sustaining long-term growth

- Overcoming these financial, technical, and operational hurdles will be vital for healthcare providers to fully leverage the benefits of advanced hemodynamic monitoring solutions in critical care and perioperative management

Hemodynamic Monitoring Equipment Market Scope

The market is segmented on the basis of product, system, technique type, application, modality, and end-user.

- By Product

On the basis of product, the hemodynamic monitoring equipment market is segmented into monitors and disposables. The monitors segment dominated the market in 2024 due to its critical role in providing real-time cardiovascular assessments in hospitals and ICUs. These monitors offer multi-parameter tracking such as cardiac output, blood pressure, and oxygen saturation, helping clinicians make timely decisions. Integration with hospital IT systems and AI-enabled predictive analytics further enhances their utility. Monitors support continuous monitoring for multiple patients, improving workflow efficiency and critical care outcomes. Their durability, reliability, and ability to integrate with other devices make them indispensable in high-acuity settings. Hospitals often prefer advanced monitors to reduce complications and optimize perioperative and ICU care.

The disposables segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing need for single-use consumables such as catheters, sensors, and tubing in both invasive and minimally invasive procedures. Rising cardiovascular surgeries, ICU admissions, and patient safety requirements are fueling this demand. Disposables reduce the risk of infections, maintain clinical hygiene, and are convenient for high-turnover healthcare settings. Technological innovations in disposable sensors and materials are improving accuracy and ease of use. Their cost-effectiveness in the long term, along with regulatory compliance for single-use equipment, is encouraging hospitals to adopt them. Emerging markets with growing hospital infrastructure present additional opportunities for disposables.

- By Systems

On the basis of systems, the hemodynamic monitoring equipment market is segmented into vital sign monitors, pulse oximeters, non-invasive blood pressure monitors, central venous catheters, and pulmonary artery catheters. The vital sign monitors segment dominated in 2024 due to their capability to measure multiple physiological parameters simultaneously, including heart rate, respiratory rate, oxygen saturation, and blood pressure. Hospitals and ICUs rely on these systems for continuous monitoring, early detection of patient deterioration, and prompt interventions. Advanced vital sign monitors often include alarm systems and integration with hospital EHR platforms. Their versatility in various clinical settings, from perioperative monitoring to critical care, makes them highly preferred. Multi-parameter monitors reduce the need for multiple standalone devices, saving space and improving staff efficiency. Adoption is further supported by AI-based analytics and predictive alert features.

The central venous catheters segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by increasing cardiovascular disorders and complex surgical procedures. Innovations in catheter design, materials, and minimally invasive insertion techniques are enhancing safety, accuracy, and patient comfort. Catheters are essential for monitoring central venous pressure, drug administration, and fluid management. Rising awareness of patient safety and infection control protocols drives their adoption in hospitals and catheterization labs. The growing number of cardiac surgeries and ICU admissions globally contributes to this segment’s expansion. Demand is particularly high in emerging markets with increasing investments in healthcare infrastructure.

- By Technique Type

On the basis of technique type, the hemodynamic monitoring equipment market is segmented into invasive, non-invasive, and minimally invasive hemodynamic monitoring. The minimally invasive monitoring segment dominated the market in 2024 with a 42.4% market share, driven by its balance of accuracy, patient safety, and ease of use. These systems reduce procedural risks compared to fully invasive methods while providing continuous real-time hemodynamic data, making them suitable for ICUs, step-down units, and perioperative monitoring. Hospitals and critical care centers increasingly prefer minimally invasive devices for their ability to shorten hospital stays, lower infection risk, and improve workflow efficiency. Integration with hospital IT systems, EHRs, and AI-enabled predictive analytics further enhances clinical decision-making. In addition, growing adoption in emerging markets, where invasive procedures may be resource-intensive, supports the dominance of this segment.

The invasive monitoring segment is expected to witness the fastest growth from 2025 to 2032, owing to its high accuracy and comprehensive monitoring capabilities. Invasive techniques, including pulmonary artery catheterization, provide precise measurements of cardiac output, systemic vascular resistance, and other vital hemodynamic parameters, making them indispensable in high-acuity and complex cardiac cases. Hospitals rely on invasive systems for critical care, perioperative monitoring, and surgical procedures where patient stability must be closely tracked. Although more costly and requiring trained personnel, invasive monitoring remains the gold standard for certain clinical scenarios. Rising cardiovascular surgeries, ICU admissions, and technological innovations improving safety and ease of use are fueling the growth of this segment globally.

- By Application

On the basis of application, the hemodynamic monitoring equipment market is segmented into laboratory-based monitoring systems, home-based monitoring systems, and hospital-based monitoring systems. The hospital-based monitoring systems segment dominated in 2024 due to high patient volumes and the critical nature of care in ICUs, surgical wards, and cardiac units. Hospitals rely on these systems for real-time monitoring, early warning alerts, and integration with centralized monitoring stations. Their deployment improves workflow efficiency and patient safety, while AI-enabled analytics allow predictive interventions. Hospitals prefer hospital-based systems for both invasive and minimally invasive monitoring across multiple patient profiles. Investment in advanced infrastructure, regulatory approvals, and trained staff further strengthen this segment.

The home-based monitoring systems segment is expected to witness the fastest growth from 2025 to 2032, driven by telemedicine adoption, chronic disease management needs, and the proliferation of wearable monitoring devices. Patients can track vitals such as heart rate and blood pressure remotely, reducing hospital visits and enabling proactive healthcare. Home-based systems are increasingly integrated with mobile apps for real-time alerts and physician notifications. Rising awareness about cardiovascular health and government initiatives for remote care are fueling adoption. The convenience of self-monitoring and integration with AI-enabled predictive analytics enhances patient adherence. This trend is particularly strong in developed markets with high smartphone penetration and internet connectivity.

- By Modality

On the basis of modality, the hemodynamic monitoring equipment market is segmented into laboratory-based, home-based, and hospital-based systems. The hospital-based modality dominated in 2024, due to extensive adoption across ICUs, cardiac care units, and surgical centers. These systems provide continuous monitoring, alarm notifications, and integration with hospital information systems for real-time data management. Hospital-based modalities ensure accuracy, reliability, and seamless workflow across departments. Adoption is driven by the need for patient safety, perioperative monitoring, and compliance with healthcare standards. Advanced hospital-based devices often incorporate AI for predictive insights, further strengthening their market position.

The home-based modality is projected to grow the fastest during forecast period, supported by the rise of wearable devices, remote patient monitoring, and AI-driven solutions. Patients can monitor vital parameters outside traditional healthcare facilities, enabling early detection of anomalies and chronic disease management. Integration with mobile apps allows physicians to track patient data in real-time. Convenience, reduced hospital readmissions, and increasing telehealth adoption contribute to rapid growth. Rising consumer awareness about health monitoring and cardiovascular care in developed and emerging markets further accelerates adoption.

- By End-User

On the basis of end-user, the hemodynamic monitoring equipment market is segmented into hospitals, clinics, ambulatory surgery centers, home care settings, and independent catheterization laboratories. The hospitals segment dominated in 2024, as hospitals manage the highest volume of critical care patients requiring continuous hemodynamic monitoring. Hospitals have the infrastructure, trained staff, and IT integration needed for advanced monitoring devices. ICU, surgical, and cardiac units drive sustained demand for both invasive and minimally invasive systems. Hospitals also invest in AI-enabled and multi-parameter devices to improve workflow efficiency and patient outcomes. Regulatory compliance, quality standards, and integration with hospital information systems further strengthen hospital dominance.

The home care settings segment is anticipated to witness the fastest growth during forecast period, driven by the increasing prevalence of chronic cardiovascular diseases, patient preference for home-based care, and growth of telemedicine services. Remote monitoring devices allow patients to track vital signs in real-time, reducing the need for hospital visits. Wearable sensors and AI-enabled predictive tools enhance patient safety and adherence to treatment plans. Growing awareness of proactive healthcare and government initiatives promoting home-based care contribute to rapid adoption. This segment offers opportunities for cost-effective, scalable solutions in both developed and emerging markets.

Hemodynamic Monitoring Equipment Market Regional Analysis

- North America dominated the hemodynamic monitoring equipment market with the largest revenue share of 39.2% in 2024, supported by advanced healthcare infrastructure, high adoption of sophisticated monitoring systems, and a strong presence of leading industry players

- Hospitals and ICUs in the region prioritize real-time patient monitoring, predictive analytics, and AI-enabled systems to improve patient outcomes and optimize workflow efficiency

- This widespread adoption is further supported by high healthcare spending, a well-trained medical workforce, and the presence of key industry players developing innovative monitoring solutions, establishing hemodynamic monitoring systems as essential in both perioperative and intensive care settings

U.S. Hemodynamic Monitoring Equipment Market Insight

The U.S. hemodynamic monitoring equipment market captured the largest revenue share of 36% in 2024 within North America, driven by advanced healthcare infrastructure and high adoption of ICU and perioperative monitoring technologies. Hospitals and critical care units prioritize real-time patient monitoring, predictive analytics, and AI-enabled systems to improve clinical outcomes. The growing prevalence of cardiovascular diseases, coupled with rising ICU admissions, fuels demand for both invasive and minimally invasive monitoring solutions. In addition, the integration of wireless and wearable devices with hospital IT systems is further expanding market adoption. The presence of major players such as Edwards Lifesciences, Philips Healthcare, and GE HealthCare supports continuous innovation and product availability.

Europe Hemodynamic Monitoring Equipment Market Insight

The Europe hemodynamic monitoring equipment market is projected to expand at a significant CAGR during the forecast period, driven by increasing geriatric populations, rising cardiovascular disease incidence, and growing hospital modernization initiatives. The adoption of minimally invasive and non-invasive monitoring systems is accelerating due to their safety, ease of use, and ability to integrate with electronic health records. European hospitals are increasingly implementing centralized monitoring solutions to improve patient care and reduce ICU complications. Government policies and healthcare regulations promoting advanced patient monitoring further support market growth across residential, clinical, and hospital settings.

U.K. Hemodynamic Monitoring Equipment Market Insight

The U.K. hemodynamic monitoring equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the rising prevalence of cardiovascular disorders and an increasing focus on ICU and surgical care. Hospitals and specialized cardiac centers are adopting advanced monitors and disposable systems to enhance patient safety, clinical accuracy, and operational efficiency. The country’s robust healthcare infrastructure, coupled with strong R&D investment in monitoring technologies, is expected to drive adoption. The integration of AI-enabled predictive monitoring tools and remote patient management solutions is further boosting the market.

Germany Hemodynamic Monitoring Equipment Market Insight

The Germany hemodynamic monitoring equipment market is expected to expand at a considerable CAGR during the forecast period, driven by high awareness of cardiovascular health and advanced hospital infrastructure. Germany emphasizes innovation and technological advancement, resulting in strong adoption of minimally invasive and AI-enabled monitoring systems. Hospitals are integrating these systems with electronic health records and centralized ICU management platforms to improve workflow efficiency. Rising demand for precise, real-time cardiovascular monitoring in surgical and critical care settings further fuels growth. In addition, government initiatives promoting digital health solutions and patient safety contribute to market expansion.

Asia-Pacific Hemodynamic Monitoring Equipment Market Insight

The Asia-Pacific hemodynamic monitoring equipment market is poised to grow at the fastest CAGR of 9.8% during the forecast period of 2025 to 2032, driven by increasing healthcare infrastructure, rising ICU admissions, and growing awareness of cardiovascular diseases in countries such as China, Japan, and India. The region’s focus on hospital modernization, telemedicine, and remote patient monitoring supports the adoption of minimally invasive and wearable monitoring devices. Increasing government initiatives for digital health and cardiovascular care, along with rising disposable incomes, are accelerating market growth. Moreover, APAC is emerging as a hub for manufacturing monitoring components, improving affordability and accessibility of devices.

Japan Hemodynamic Monitoring Equipment Market Insight

The Japan hemodynamic monitoring equipment market is gaining momentum due to the country’s technologically advanced healthcare system, aging population, and rising demand for continuous patient monitoring. Hospitals and ICUs emphasize high-precision monitoring, particularly in cardiac and surgical care. Integration of AI-driven predictive analytics, wearable monitoring devices, and centralized patient monitoring platforms is fueling market adoption. Japan’s focus on telehealth and home-based care solutions is further supporting the use of non-invasive and minimally invasive monitoring systems. In addition, strong government support for advanced healthcare infrastructure drives continuous investment in monitoring technologies.

India Hemodynamic Monitoring Equipment Market Insight

The India hemodynamic monitoring equipment market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid healthcare infrastructure development, increasing cardiovascular disease prevalence, and growing ICU capacity. Hospitals, clinics, and home healthcare providers are adopting minimally invasive and wearable monitoring systems to enhance patient care. Rising awareness of cardiovascular health, government initiatives for telemedicine, and the push towards smart hospital solutions further propel market growth. Affordable device options and domestic manufacturing capabilities support widespread adoption in both urban and semi-urban regions.

Hemodynamic Monitoring Equipment Market Share

The Hemodynamic Monitoring Equipment industry is primarily led by well-established companies, including:

- Edwards Lifesciences LLC (U.S.)

- Koninklijke Philips N.V., (Netherlands)

- GE HealthCare (U.S.)

- Masimo U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- Drägerwerk AG & Co. KGaA (Germany)

- Mindray Bio-Medical Electronics Co., Ltd. (China)

- Fukuda Denshi Co., Ltd. (Japan)

- Spacelabs Healthcare (U.S.)

- Schiller AG (Switzerland)

- Biolight Medical Technology Co., Ltd. (China)

- SunTech Medical, Inc. (U.S.)

- BD (U.S.)

- Nonin Medical, Inc. (U.S.)

- ICU Medical, Inc. (U.S.)

- Deltex Medical Group PLC (U.K.)

- LiDCO Group (U.K.)

- Getinge AB (Sweden)

- Tensys Medical, Inc. (U.S.)

- CNSystems Medizintechnik GmbH (Austria)

What are the Recent Developments in Global Hemodynamic Monitoring Equipment Market?

- In May 2025, BD announced the launch of its next-generation hemodynamic monitoring platform, HemoSphere Alta. This platform offers advanced monitoring capabilities, supporting clinicians in making informed decisions during critical care scenarios

- In October 2023, Masimo received the EU MDR CE mark for the LiDCO module, a board-in-cable solution designed to provide a more complete picture of oxygen delivery. This module connects to multi-patient monitoring platforms, offering advanced hemodynamic monitoring capabilities to clinicians

- In October 2022, Nihon Kohden released the Life Scope G7 patient monitor into the U.S. market. This advanced bedside monitor features a 19” screen and is designed for high-acuity settings, providing quick access to multiple configurations and trend analysis, thereby enhancing patient monitoring capabilities

- In April 2022, Caretaker Medical received U.S. FDA 510(k) clearance for four new continuous hemodynamic parameters for its VitalStream wireless patient monitoring platform. The clearance added cardiac output, stroke volume, heart rate variability, and left ventricular ejection time, expanding the platform's ability to provide ICU-grade, beat-by-beat data without the need for invasive catheters or wires

- In May 2021, Philips announced the integration of its Interventional Hemodynamic System with the IntelliVue X3 portable patient monitor. This development allows for advanced hemodynamic measurements to be taken at the tableside during image-guided procedures on the Philips Azurion system, creating a more seamless workflow and providing comprehensive patient records to support timely clinical decision-making

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.