Global Heart Beat Sensor Market

Market Size in USD Million

CAGR :

%

USD

842.40 Million

USD

2,271.40 Million

2025

2033

USD

842.40 Million

USD

2,271.40 Million

2025

2033

| 2026 –2033 | |

| USD 842.40 Million | |

| USD 2,271.40 Million | |

|

|

|

|

Heart Beat Sensor Market Size

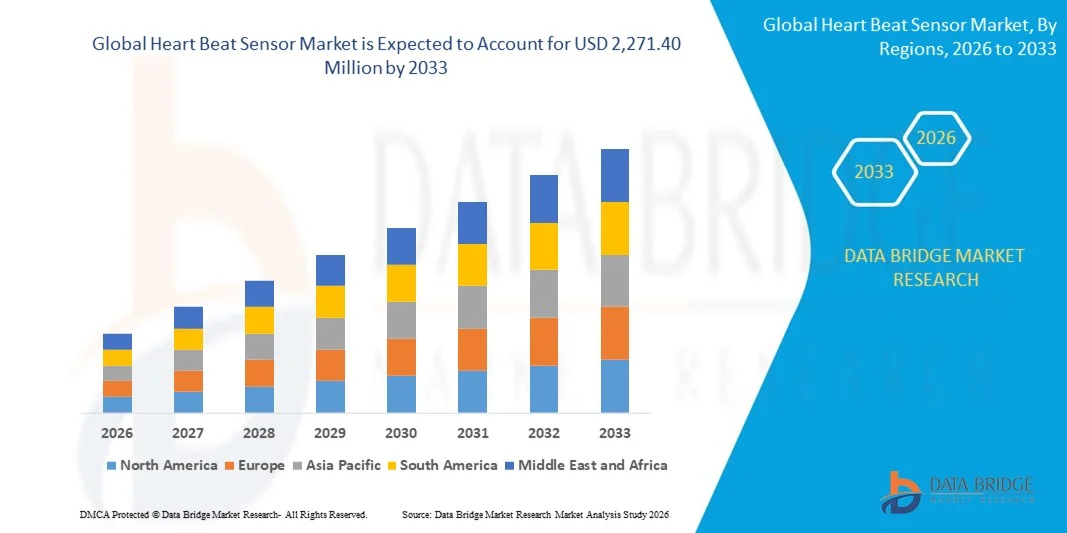

- The global heart beat sensor market size was valued at USD 842.40 million in 2025 and is expected to reach USD 2,271.40 million by 2033, at a CAGR of 13.20% during the forecast period

- The market growth is largely fuelled by the rising prevalence of cardiovascular diseases and growing focus on continuous health monitoring and early diagnosis

- Increasing adoption of wearable devices and remote patient monitoring solutions is supporting sustained demand for compact and energy-efficient heart beat sensors

Heart Beat Sensor Market Analysis

- The heart beat sensor market is experiencing robust growth driven by the convergence of medical devices, consumer electronics, and digital health ecosystems, enabling real-time monitoring and data-driven healthcare decisions

- Continuous innovation in optical, electrical, and MEMS-based sensing technologies, along with increasing acceptance of preventive healthcare and fitness tracking, is strengthening long-term market potential

- North America dominated the global heart beat sensor market with the largest revenue share in 2025 driven by advanced healthcare infrastructure, high adoption of wearable health devices, and strong awareness of preventive healthcare

- Asia-Pacific region is expected to witness the highest growth rate in the global heart beat sensor market, driven by rapid urbanization, expanding middle-class population, improving healthcare access, and increasing penetration of smart health and fitness devices

- The vital sign monitoring segment held the largest market revenue share in 2025 driven by the widespread adoption of heart beat sensors for continuous monitoring of core physiological parameters such as heart rate and pulse rhythm. These sensors are extensively used in hospitals, homecare devices, and consumer wearables for real-time health tracking. Their ability to support early detection of cardiovascular irregularities and enable preventive healthcare significantly supports segment growth. In addition, integration with digital health platforms enhances data accessibility and patient engagement

Report Scope and Heart Beat Sensor Market Segmentation

|

Attributes |

Heart Beat Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Heart Beat Sensor Market Trends

Rising Demand for Continuous and Real-Time Health Monitoring

- Growing prevalence of cardiovascular disorders and lifestyle-related health conditions is significantly shaping the heart beat sensor market. Healthcare providers and consumers are increasingly adopting heart beat sensors to enable continuous monitoring, early detection of abnormalities, and timely medical intervention

- Increasing consumer awareness regarding preventive healthcare and fitness tracking has accelerated the adoption of heart beat sensors across wearable devices, home healthcare equipment, and mobile health applications. Users are emphasising real-time data access, accuracy, and ease of integration with digital health platforms

- Regulatory support for remote patient monitoring and digital health solutions is influencing purchasing decisions, with medical device manufacturers prioritising reliable, clinically validated, and interoperable heart beat sensing technologies. Compliance with healthcare and medical device standards is supporting wider adoption

- For instance, in 2024, companies such as Apple in the U.S. and Philips in the Netherlands expanded the integration of advanced optical and electrical heart beat sensors across smartwatches and remote monitoring devices to improve health tracking and clinical insights

- While demand for heart beat sensors is increasing, sustained market growth depends on sensor accuracy, power efficiency, data security, and affordability. Manufacturers are focusing on miniaturisation, AI-enabled analytics, and scalable production to enhance performance and adoption

Heart Beat Sensor Market Dynamics

Driver

Rising Focus on Preventive Healthcare and Remote Patient Monitoring

- Increasing awareness of the importance of early diagnosis and continuous monitoring of heart health is a major driver for the heart beat sensor market. Hospitals, clinics, and consumers are investing in sensor-based solutions to improve patient outcomes and reduce healthcare costs

- Expanding applications across wearables, medical devices, and home healthcare systems are driving market growth. Heart beat sensors enable real-time monitoring, long-term health tracking, and data-driven clinical decision-making

- Medical device manufacturers and technology companies are actively adopting advanced sensing technologies such as optical sensors, ECG-based sensors, and MEMS components to enhance measurement accuracy and reliability. These initiatives are supported by growing demand for connected healthcare solutions

- For instance, in 2023, companies such as Garmin in the U.S. and Omron in Japan reported increased deployment of advanced heart beat sensors in fitness wearables and medical-grade monitoring devices to meet rising consumer and clinical demand

- Although preventive healthcare trends are supporting growth, wider adoption depends on cost optimisation, sensor durability, and seamless integration with healthcare IT systems. Investment in R&D and digital health infrastructure will be critical for sustaining market competitiveness

Restraint/Challenge

Accuracy Limitations and Regulatory Compliance Requirements

- Variability in sensor accuracy due to motion, skin tone, and environmental factors remains a key challenge, particularly for consumer-grade heart beat sensors. Ensuring consistent and reliable measurements requires advanced algorithms and calibration

- Stringent regulatory requirements for medical-grade heart beat sensors increase development time and compliance costs for manufacturers. Meeting validation, certification, and data privacy standards can slow product launches

- Data security and privacy concerns related to continuous health monitoring also impact market growth. Protecting sensitive health information requires robust cybersecurity measures and compliance with data protection regulations

- For instance, in 2024, smaller wearable device manufacturers faced delays in product approvals across Europe and Asia due to evolving medical device regulations and data protection requirements. Compliance with stricter clinical validation, cybersecurity, and data privacy standards increased development timelines and certification costs.

- Addressing these challenges will require improvements in sensor accuracy, standardised testing protocols, and enhanced data security frameworks. Collaboration between technology providers, healthcare institutions, and regulators will be essential to support large-scale adoption of heart beat sensor solutions globally

Heart Beat Sensor Market Scope

The market is segmented on the basis of monitoring type, product, indication, application, and end users.

- By Monitoring Type

On the basis of monitoring type, the global heart beat sensor market is segmented into Vital Sign Monitoring, Diagnostic Monitoring, and Specialized Monitoring. The vital sign monitoring segment held the largest market revenue share in 2025 driven by the widespread adoption of heart beat sensors for continuous monitoring of core physiological parameters such as heart rate and pulse rhythm. These sensors are extensively used in hospitals, homecare devices, and consumer wearables for real-time health tracking. Their ability to support early detection of cardiovascular irregularities and enable preventive healthcare significantly supports segment growth. In addition, integration with digital health platforms enhances data accessibility and patient engagement.

The diagnostic monitoring segment is expected to witness the fastest growth rate from 2026 to 2033 driven by the rising global burden of cardiovascular diseases and the growing need for precise diagnostic solutions. Diagnostic heart beat sensors are increasingly used for long-term monitoring, clinical assessments, and treatment evaluation. Their high accuracy and compatibility with advanced diagnostic systems support their adoption in specialized healthcare settings. Growing investments in healthcare infrastructure further contribute to market expansion.

- By Product

On the basis of product, the global heart beat sensor market is segmented into Wearable and Non-Wearable. The wearable segment dominated the market in 2025 supported by the increasing penetration of smartwatches, fitness bands, and health trackers integrated with heart beat sensors. These products offer continuous monitoring, user convenience, and seamless connectivity with smartphones. Rising consumer focus on fitness, wellness, and preventive health management drives sustained demand. Technological advancements such as compact sensor design and improved battery efficiency further strengthen this segment.

The non-wearable segment is expected to grow rapidly from 2026 to 2033 driven by its strong presence in hospitals and diagnostic centers. These sensors are widely used in patient monitoring systems, intensive care units, and diagnostic equipment due to their superior accuracy and reliability. Their ability to deliver consistent performance in critical clinical environments supports adoption. Increasing hospital admissions and demand for advanced monitoring solutions contribute to segment growth.

- By Indication

On the basis of indication, the market is segmented into Sports and Medical. The medical segment accounted for the largest market share in 2025 due to the extensive use of heart beat sensors in disease diagnosis, patient monitoring, and chronic condition management. These sensors play a vital role in monitoring cardiovascular health and supporting timely clinical interventions. Growing aging population and increasing prevalence of lifestyle-related diseases boost demand. In addition, regulatory approvals and clinical validation enhance trust in medical applications.

The sports segment is expected to register significant growth from 2026 to 2033 driven by rising awareness of fitness tracking and performance optimization. Athletes and fitness enthusiasts increasingly rely on heart beat sensors to monitor training intensity, endurance, and recovery levels. These sensors help prevent overexertion and sports-related injuries. Growing adoption of wearable technology in professional and recreational sports supports segment expansion.

- By Application

On the basis of application, the global heart beat sensor market is segmented into Self-Care, Telehealth, and Medical. The medical segment led the market in 2025 supported by widespread deployment of heart beat sensors in hospitals and clinical environments. These sensors are essential for continuous patient monitoring, emergency care, and post-operative management. High accuracy and integration with hospital information systems enhance clinical efficiency. Rising healthcare expenditure further strengthens this segment.

The telehealth segment is expected to grow rapidly from 2026 to 2033 driven by the rapid expansion of remote healthcare services. Heart beat sensors enable continuous monitoring and real-time data transmission between patients and healthcare providers. This supports early intervention and reduces the need for frequent hospital visits. Increasing adoption of digital health platforms and favorable regulatory support accelerate segment growth.

- By End Users

On the basis of end users, the market is segmented into Hospital & Clinics, Sport Medicine Centers, Professionals, and Individuals. Hospitals and clinics held the largest revenue share in 2025 owing to high demand for reliable and accurate heart beat monitoring systems. These end users rely on advanced sensors for diagnosis, treatment monitoring, and critical care management. Availability of skilled professionals and advanced infrastructure supports adoption. Growing patient inflow further drives market demand.

The individuals segment is expected to grow rapidly from 2026 to 2033 driven by increasing health consciousness and self-monitoring trends. Easy availability of wearable heart beat sensors encourages individuals to track daily health metrics and manage wellness proactively. Integration with mobile applications enhances user engagement and data insights. Rising disposable income and awareness of preventive healthcare contribute to sustained growth.

Heart Beat Sensor Market Regional Analysis

- North America dominated the global heart beat sensor market with the largest revenue share in 2025 driven by advanced healthcare infrastructure, high adoption of wearable health devices, and strong awareness of preventive healthcare

- Consumers in the region increasingly value continuous health monitoring, accuracy, and seamless integration of heart beat sensors with smartphones, fitness platforms, and digital health ecosystems

- This widespread adoption is further supported by high healthcare spending, a technologically advanced population, and growing demand for remote patient monitoring solutions across medical and self-care applications

U.S. Heart Beat Sensor Market Insight

The U.S. heart beat sensor market captured the largest revenue share in 2025 within North America supported by the rapid uptake of wearable devices and digital health technologies. Consumers and healthcare providers are increasingly prioritizing continuous heart rate monitoring for early diagnosis and chronic disease management. The strong presence of leading medical device manufacturers, coupled with rising adoption of telehealth and remote monitoring solutions, continues to drive market growth. In addition, increasing integration with mobile health applications and AI-based analytics is strengthening adoption across both medical and consumer segments.

Europe Heart Beat Sensor Market Insight

The Europe heart beat sensor market is expected to witness the fastest growth rate from 2026 to 2033 driven by rising healthcare digitization and a strong focus on preventive and remote healthcare. Increasing prevalence of cardiovascular diseases and an aging population are accelerating demand for continuous monitoring solutions. European consumers are also increasingly adopting wearable health devices for fitness and wellness tracking. Growth is observed across hospitals, homecare, and sports applications, supported by favorable regulatory frameworks and healthcare investments.

U.K. Heart Beat Sensor Market Insight

The U.K. heart beat sensor market is expected to witness the fastest growth rate from 2026 to 2033 driven by the expansion of telehealth services and growing awareness of cardiovascular health. Rising adoption of wearable technology and remote patient monitoring devices is supporting market growth. In addition, government initiatives promoting digital healthcare and early disease detection are encouraging the use of heart beat sensors across both medical and self-care applications.

Germany Heart Beat Sensor Market Insight

The Germany heart beat sensor market is expected to witness the fastest growth rate from 2026 to 2033 fueled by strong demand for advanced, reliable medical monitoring solutions. Germany’s well-established healthcare system and emphasis on medical technology innovation support widespread adoption. Increasing use of heart beat sensors in hospitals, diagnostics, and homecare settings is driving growth. The preference for high-precision, data-secure health devices aligns well with local consumer and clinical expectations.

Asia-Pacific Heart Beat Sensor Market Insight

The Asia-Pacific heart beat sensor market is expected to witness the fastest growth rate from 2026 to 2033 driven by rapid urbanization, rising disposable incomes, and expanding access to healthcare technologies. Growing awareness of fitness and preventive health, along with increasing adoption of wearable devices in countries such as China, Japan, and India, is fueling demand. Government initiatives supporting digital healthcare and telemedicine further contribute to market expansion.

Japan Heart Beat Sensor Market Insight

The Japan heart beat sensor market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s advanced healthcare ecosystem and strong focus on health monitoring. High adoption of wearable technology and connected health devices supports market growth. Japan’s aging population is significantly increasing demand for continuous and easy-to-use heart beat monitoring solutions. Integration of sensors with IoT-based healthcare systems is further accelerating adoption across residential and medical settings.

China Heart Beat Sensor Market Insight

The China heart beat sensor market accounted for the largest market revenue share in Asia Pacific in 2025 attributed to rapid urbanization, a growing middle-class population, and increasing health awareness. The country’s expanding wearable device market and strong domestic manufacturing base support large-scale adoption. Heart beat sensors are widely used across fitness, self-care, and medical applications. The push toward smart healthcare systems and digital health platforms continues to propel market growth in China.

Heart Beat Sensor Market Share

The Heart Beat Sensor industry is primarily led by well-established companies, including:

- Apple Inc. (U.S.)

- Garmin Ltd (U.S.)

- Visiomed Group (France)

- SAMSUNG (South Korea)

- Nike, Inc. (U.S.)

- Fitbit, Inc. (U.S.)

- Beurer GmbH (Germany)

- Omron Healthcare, Inc. (Japan)

- LG Electronics (South Korea)

- u-beca & maxcellent co. (South Korea)

- Polar (Finland)

- TomTom International BV (Netherlands)

- Motorola Solutions, Inc. (U.S.)

- SONY INDIA (Japan)

- SUUNTO (Finland)

- Myzone (U.S.)

- Wahoo Fitness (U.S.)

- Moov Inc. (U.S.)

- Nokia (Finland)

- Bragi (Germany)

- Jabra (Denmark)

- Decathlon Sports India Pvt Ltd. (France)

- Scosche Industries (U.S.)

Latest Developments in Global Heart Beat Sensor Market

- In January 2024, Masimo, regulatory approval, secured FDA clearance for its MightySat Fingertip Pulse Oximeter to improve the accuracy of pulse rate and blood oxygen saturation measurements under challenging conditions, strengthening reliability in clinical and homecare settings and reinforcing trust in non-invasive monitoring devices

- In January 2024, Masimo, strategic partnership, partnered with Medable Inc. to integrate pulse oximeters into decentralized clinical trial platforms, enabling efficient remote patient monitoring, reducing dependency on in-person trials, and accelerating the adoption of digital and virtual healthcare models

- In April 2024, Medtronic, product launch, introduced a new handheld pulse oximeter with enhanced accuracy and connectivity for home and ambulatory care, supporting continuous monitoring outside hospital environments and expanding access to patient-centric healthcare solutions

- In April 2024, Medtronic, acquisition, acquired HealthData Solutions to strengthen its remote patient monitoring ecosystem, enhancing integration of heart rate and pulse sensors, improving data-driven care delivery, and increasing competition and innovation within the connected medical device market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Heart Beat Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Heart Beat Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Heart Beat Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.