Global Healthcare Payer Solutions Market

Market Size in USD Billion

CAGR :

%

USD

72.19 Billion

USD

133.63 Billion

2024

2032

USD

72.19 Billion

USD

133.63 Billion

2024

2032

| 2025 –2032 | |

| USD 72.19 Billion | |

| USD 133.63 Billion | |

|

|

|

|

Healthcare Payer Solutions Market Size

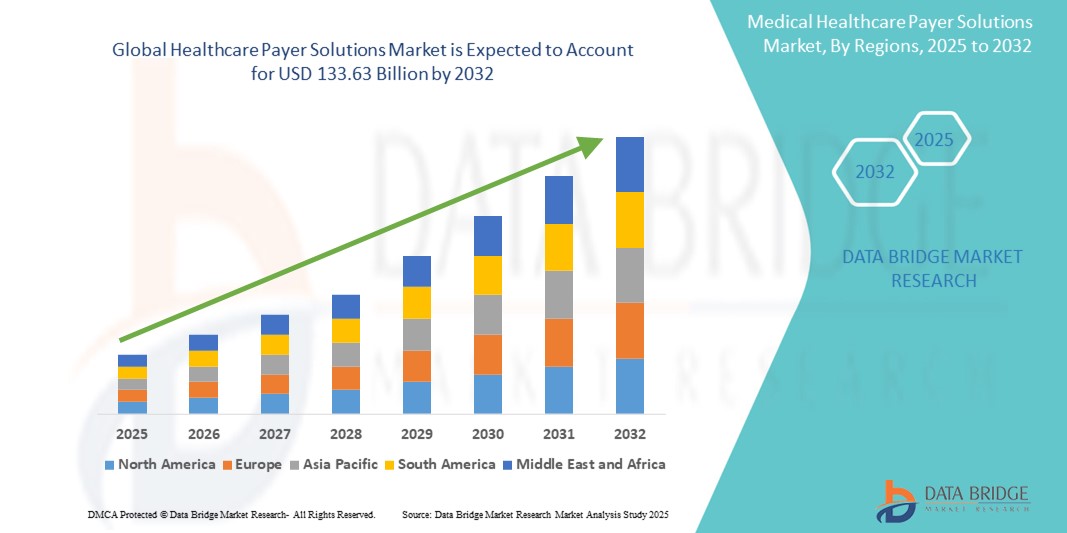

- The global healthcare payer solutions market size was valued at USD 72.19 billion in 2024 and is expected to reach USD 133.63 billion by 2032, at a CAGR of 8.00% during the forecast period

- The market expansion is primarily driven by the increasing complexity of healthcare systems and the growing need for cost containment, claims management, and enhanced patient engagement, especially among insurance providers and government payers

- In addition, the adoption of advanced analytics, cloud-based platforms, and AI-driven tools is streamlining operations and improving decision-making. These innovations are transforming traditional payer models, significantly propelling the demand for efficient, scalable healthcare payer solutions

Healthcare Payer Solutions Market Analysis

- Healthcare payer solutions, encompassing services and platforms for claims management, member engagement, and risk assessment, are becoming critical for optimizing operations and improving cost-efficiency across public and private insurance organizations globally

- The surge in demand for payer solutions is largely driven by the increasing pressure to reduce administrative costs, enhance patient outcomes, and comply with evolving regulatory frameworks and value-based care models

- North America dominated the healthcare payer solutions market with the largest revenue share of 46.8% in 2024, owing to a highly digitized healthcare infrastructure, strong regulatory oversight, and early adoption of advanced analytics and cloud technologies by insurers and government programs such as Medicare and Medicaid

- Asia-Pacific is projected to be the fastest-growing region in the healthcare payer solutions market during the forecast period due to expanding health insurance coverage, digital transformation initiatives, and rising healthcare expenditure in countries such as India and China

- Business process outsourcing segment dominated the healthcare payer solutions market with a market share of 50.1% in 2024, driven by its cost-efficiency, scalability, and ability to streamline non-core administrative functions such as claims processing and customer support

Report Scope and Healthcare Payer Solutions Market Segmentation

|

Attributes |

Healthcare Payer Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Healthcare Payer Solutions Market Trends

“AI-Powered Automation and Predictive Analytics in Claims and Member Management”

- A major trend transforming the global healthcare payer solutions market is the integration of artificial intelligence (AI), machine learning (ML), and predictive analytics into payer systems to streamline operations and enhance decision-making accuracy. These technologies are increasingly used for automating claims processing, detecting fraudulent activities, and improving member engagement strategies

- For instance, companies such as Optum and Cognizant are leveraging AI to automate repetitive administrative tasks, reducing processing time and operational costs. AI-powered tools also analyze vast datasets to forecast healthcare utilization patterns, allowing payers to proactively manage risks and care outcomes

- Predictive analytics helps payers in identifying high-risk members, optimizing care coordination, and enabling early interventions that improve health outcomes while reducing costs. For instance Anthem, Inc. uses data analytics to stratify member populations and guide resource allocation efficiently

- Chatbots and virtual assistants are also becoming common in member service functions, offering 24/7 support, reducing call center load, and improving user satisfaction through real-time query resolution

- This shift toward digital automation and intelligence not only enhances operational efficiency but also aligns payer systems with the broader goals of value-based care, accountability, and personalized member experience, fueling ongoing innovation and investment in next-generation payer platforms.

Healthcare Payer Solutions Market Dynamics

Driver

“Rising Demand for Cost Containment and Regulatory Compliance”

- The global healthcare payer solutions market is significantly driven by the increasing demand from payers to reduce administrative costs, ensure timely claims processing, and remain compliant with evolving healthcare regulations

- For instance, in 2024, CVS Health announced the expansion of its payer solutions portfolio to include AI-driven claim adjudication and compliance tools aimed at reducing administrative burden and improving claim accuracy

- Escalating healthcare expenditures and the push toward value-based care are prompting both public and private payers to adopt digital platforms that improve workflow efficiency, reduce fraud, and enhance care coordination

- In addition, growing government mandates and regulatory requirements such as HIPAA, ICD-11 adoption, and ACA compliance further necessitate advanced payer technologies that support accurate data reporting and real-time auditing, fueling market demand across developed and emerging regions

Restraint/Challenge

“Data Privacy Concerns and Integration Complexities”

- One of the major challenges facing the healthcare payer solutions market is ensuring data privacy and security in the face of increasing cyber threats and stringent data protection regulations such as GDPR and HIPAA

- High-profile breaches in health data systems have raised alarm among stakeholders, necessitating robust cybersecurity frameworks, secure cloud infrastructure, and comprehensive access control measures

- In addition, integrating payer solutions with legacy IT systems, disparate data sources, and provider networks often proves complex and resource-intensive. In many cases, organizations face technical and operational hurdles in migrating to modern platforms or consolidating fragmented infrastructures

- These integration difficulties, combined with concerns around system downtime, interoperability, and vendor lock-in, may slow adoption among traditional payers

- Overcoming these challenges through scalable, interoperable solutions and clear compliance protocols is essential for the market’s long-term success

Healthcare Payer Solutions Market Scope

The market is segmented on the basis of service type, application, and end-user.

- By Service Type

On the basis of service type, the healthcare payer solutions market is segmented into business process outsourcing (BPO), information technology outsourcing (ITO), and knowledge process outsourcing (KPO). The business process outsourcing (BPO) segment dominated the market with the largest revenue share of 50.1% in 2024, driven by the need to reduce administrative costs and improve operational efficiency through outsourcing services such as claims processing, member services, and billing. Payers are increasingly adopting BPO to streamline non-core processes, gain scalability, and focus on core strategic functions.

The knowledge process outsourcing (KPO) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for advanced analytics, actuarial services, and risk management solutions. As the market matures, payers are investing in higher-value outsourcing services that provide data-driven insights and support for strategic decision-making.

- By Application

On the basis of application, the healthcare payer solutions market is segmented into claims management services, integrated front office service and back office operations, member management services, provider management services, billing and accounts management services, analytics and fraud management services, HR services, payment management services, and audit and analysis systems. The claims management services segment held the highest market share of 28.3% in 2024, owing to increasing claims volume and the need for automation, accuracy, and compliance in processing. Efficient claims handling significantly reduces delays and administrative costs, making this a core focus for both private and public payers.

The analytics and fraud management services segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the growing emphasis on detecting fraudulent claims, managing risk, and improving cost containment through predictive analytics and AI-based tools. The rising complexity of healthcare data is also pushing payers to adopt intelligent, scalable solutions in this area.

- By End User

On the basis of end-user, the healthcare payer solutions market is segmented into private payers and public payers. The private payers segment dominated the market with a revenue share of 57.1% in 2024, driven by higher investment capacity, early adoption of digital technologies, and increasing partnerships with third-party service providers. Private insurers are more agile in implementing AI, automation, and cloud-based solutions to enhance efficiency and member engagement.

The public payers segment is projected to grow steadily during the forecast period, supported by government healthcare reforms, the expansion of public insurance programs, and initiatives to modernize legacy systems with integrated digital platforms.

Healthcare Payer Solutions Market Regional Analysis

- North America dominated the healthcare payer solutions market with the largest revenue share of 46.8% in 2024, owing to a highly digitized healthcare infrastructure, strong regulatory oversight, and early adoption of advanced analytics and cloud technologies by insurers and government programs such as Medicare and Medicaid

- The region's emphasis on reducing healthcare costs, improving administrative efficiency, and complying with evolving regulatory requirements is accelerating the adoption of digital payer solutions such as claims automation, fraud detection, and member engagement tools

- In addition, the availability of skilled professionals, favorable government policies, and high healthcare expenditure further support the expansion of payer solutions in both private and public sectors, making North America a leading hub for innovation and implementation in this market

U.S. Healthcare Payer Solutions Market Insight

The U.S. healthcare payer solutions market held the largest revenue share of 78.6% in North America in 2024, driven by high healthcare spending, complex insurance structures, and strong regulatory oversight. The demand for advanced payer platforms is supported by the growing shift toward value-based care, rising administrative costs, and an emphasis on improving member outcomes. Integration of AI, cloud-based systems, and interoperability tools is accelerating digital transformation across both public and private payers, fostering market expansion.

Europe Healthcare Payer Solutions Market Insight

The Europe healthcare payer solutions market is projected to grow at a steady CAGR over the forecast period, driven by national healthcare reforms, increasing adoption of digital health solutions, and pressure to control public healthcare spending. Countries such as Germany, France, and the U.K. are investing in electronic claims management, risk adjustment systems, and population health analytics to modernize payer infrastructure. The implementation of GDPR has also prompted the development of secure, compliant payer platforms across the region.

U.K. Healthcare Payer Solutions Market Insight

The U.K. healthcare payer solutions market is expected to grow steadily, fueled by the National Health Service’s (NHS) digital transformation initiatives and the need to reduce operational inefficiencies. The adoption of payer solutions is being supported by policy-driven demand for integrated care systems and value-based reimbursement models. In addition, increased focus on fraud detection and predictive analytics is driving uptake among government and private health schemes.

Germany Healthcare Payer Solutions Market Insight

The Germany healthcare payer solutions market is expanding due to the country’s emphasis on efficient statutory health insurance operations and compliance with stringent regulatory frameworks. Payer organizations are increasingly adopting automation and AI-powered tools to streamline claims, enhance fraud detection, and support population health management. Germany’s strong public-private payer mix and advanced healthcare infrastructure make it a key contributor to Europe’s overall market growth.

Asia-Pacific Healthcare Payer Solutions Market Insight

The Asia-Pacific healthcare payer solutions market is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by rising healthcare expenditures, growing insurance penetration, and government initiatives aimed at healthcare digitalization. Countries such as China, India, and Japan are adopting payer solutions to support expanding national insurance schemes, improve claims efficiency, and reduce fraud. Regional market growth is also bolstered by an increasing focus on cloud-based and mobile-enabled platforms.

Japan Healthcare Payer Solutions Market Insight

The Japan’s healthcare payer solutions market is witnessing robust growth due to the country's universal healthcare system modernization and a high demand for efficient claims processing and analytics. As Japan faces rising costs due to its aging population, payer organizations are adopting intelligent solutions to optimize resource allocation, detect fraud, and ensure sustainable service delivery. Integration with electronic medical records and digital health platforms is also gaining momentum.

India Healthcare Payer Solutions Market Insight

The India accounted for the largest revenue share in Asia Pacific in 2024, driven by its rapidly growing health insurance sector, digital health mission initiatives, and expanding public-private partnerships. Government programs such as Ayushman Bharat are driving demand for scalable, cloud-based payer solutions to manage claims, member data, and performance analytics. The proliferation of health-tech startups and affordable IT services further boosts India’s position as a dynamic and high-potential market for payer solutions.

Healthcare Payer Solutions Market Share

The healthcare payer solutions industry is primarily led by well-established companies, including:

- Optum, Inc. (U.S.)

- Cognizant (U.S.)

- Change Healthcare (U.S.)

- ExlService Holdings, Inc. (U.S.)

- Infosys Limited (India)

- Tata Consultancy Services Limited (India)

- Wipro (India)

- Accenture (Ireland)

- IBM (U.S.)

- Conduent Incorporated (U.S.)

- HCL Technologies Limited (India)

- NTT DATA Group Corporation (Japan)

- Atos SE (France)

- DXC Technology Company (U.S.)

- Genpact Limited (U.S.)

- Oracle Corporation (U.S.)

- Epic Systems Corporation (U.S.)

- HealthEdge Software, Inc. (U.S.)

- Inovalon Holdings, Inc. (U.S.)

- MCKESSON CORPORATION (U.S.)

What are the Recent Developments in Global Healthcare Payer Solutions Market?

- In April 2024, Optum, a leading health services provider under UnitedHealth Group, launched a next-generation AI-powered claims adjudication engine aimed at accelerating processing times and reducing errors. The solution integrates predictive analytics to flag anomalies, enhancing fraud detection and improving reimbursement accuracy. This development reflects Optum’s commitment to advancing automation and data intelligence in healthcare payer operations

- In March 2024, Cognizant Technology Solutions expanded its healthcare payer platform with new features focused on regulatory compliance and value-based reimbursement models. The upgrade includes enhanced interoperability capabilities, allowing better integration with electronic health records and health information exchanges. This move strengthens Cognizant’s position in providing scalable, compliant solutions for both private and public payers

- In February 2024, Change Healthcare, now part of Optum, introduced an advanced payment accuracy platform to help payers identify and prevent overpayments before claims are settled. The platform utilizes real-time analytics and AI algorithms, demonstrating the growing demand for intelligent cost containment tools in payer ecosystems

- In January 2024, Infosys Ltd. announced a strategic partnership with a leading U.S. health insurer to modernize its core payer systems using cloud-native architecture. The collaboration focuses on delivering enhanced member experiences, real-time claims tracking, and operational agility through a fully integrated digital solution

- In December 2023, EXL Service Holdings Inc. launched a dedicated healthcare payer analytics suite designed to support population health management and risk stratification. By enabling payers to derive actionable insights from vast healthcare datasets, the solution supports improved care coordination and outcome-based planning, highlighting the industry's pivot toward data-driven strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 KEY PRICING STRATEGIES

6.2 DATA-DRIVEN DECISION MAKING

6.3 ADOPTION OF OUTSOURCING

6.4 INTERVIEWS WITH SPECIALIST

6.5 OTHER KOL SNAPSHOTS

6.6 PAYER VALUE CHAIN ANALYSIS

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 REGULATORY FRAMEWORK

8.1 REGULATORY PROCESS

8.2 REGULATORY APPROVAL PATHWAYS

8.3 LICENSING AND REGISTRATION

9 MARKET ACCESS

9.1 10-YEAR MARKET FORECAST

9.2 TECHNOLOGICAL ENABLEMENT

9.3 EXPANDING HEALTH INSURANCE COVERAGE

9.4 FOCUS ON CUSTOMER ENGAGEMENT

9.5 NAVIGATING REIMBURSEMENT MODELS

10 MARKET OVERVIEW

10.1 DRIVERS

10.2 RESTRAINTS

10.3 OPPORTUNITIES

10.4 CHALLENGES

11 GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET , BY SERVICE TYPE

11.1 OVERVIEW

11.2 BUSINESS PROCESS OUTSOURCING

11.2.1 CLAIMS PROCESSING

11.2.2 CUSTOMER SERVICE

11.2.3 ENROLLMENT & BILLING SERVICES

11.2.4 PROVIDER MANAGEMENT

11.2.5 MEDICAL CODING & BILLING

11.2.6 OTHER ADMINISTRATIVE SERVICES

11.3 KPO (KNOWLEDGE PROCESS OUTSOURCING)

11.3.1 DATA ANALYTICS & ACTUARIAL SERVICES

11.3.2 COMPLIANCE & RISK MANAGEMENT

11.3.3 FRAUD DETECTION & PREVENTION

11.3.4 HEALTHCARE CONSULTING & MARKET RESEARCH

11.3.5 HEALTH PLAN DESIGN & CONSULTING

11.3.6 PREDICTIVE MODELING

11.4 ITO (INFORMATION TECHNOLOGY OUTSOURCING)

11.4.1 IT INFRASTRUCTURE MANAGEMENT

11.4.2 APPLICATION MANAGEMENT SERVICES

11.4.3 CYBERSECURITY & DATA PRIVACY

11.4.4 CLOUD SERVICES & HOSTING

11.4.5 SYSTEM INTEGRATION & IMPLEMENTATION

11.4.6 DATA WAREHOUSING & BUSINESS INTELLIGENCE

12 GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET , BY APPLICATION

12.1 OVERVIEW

12.2 CLAIMS MANAGEMENT

12.3 PROVIDER NETWORK MANAGEMENT

12.4 CUSTOMER RELATIONSHIP MANAGEMENT

12.5 BILLING & ACCOUNTS MANAGEMENT

12.6 COMPLIANCE MANAGEMENT

12.7 FRAUD DETECTION & PREVENTION

12.8 DATA ANALYTICS & HEALTH INFORMATICS

13 GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET , BY DEPLOYMENT MODE

13.1 OVERVIEW

13.2 ON-PREMISE

13.3 CLOUD-BASED

14 GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET , BY END USER

14.1 OVERVIEW

14.2 PRIVATE PAYERS

14.2.1 INSURANCE COMPANIES

14.2.2 HEALTH MAINTENANCE ORGANIZATIONS (HMOS)

14.2.3 PREFERRED PROVIDER ORGANIZATIONS (PPOS)

14.3 PUBLIC PAYERS

14.3.1 GOVERNMENT HEALTH INSURANCE PROGRAMS

14.3.2 MEDICARE & MEDICAID

15 GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET , BY CONTRACT TYPE

15.1 OVERVIEW

15.2 LONG-TERM CONTRACTS

15.3 SHORT-TERM CONTRACTS

16 GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET , BY SIZE OF ORGANIZATION (PAYER)

16.1 OVERVIEW

16.2 LARGE ENTERPRISES

16.3 SMALL & MEDIUM ENTERPRISES (SMES)

17 GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET , SWOT AND DBMR ANALYSIS

18 GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET , COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT & APPROVALS

18.7 EXPANSIONS

18.8 REGULATORY CHANGES

18.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET , BY REGION

GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

19.2 EUROPE

19.2.1 GERMANY

19.2.2 U.K.

19.2.3 ITALY

19.2.4 FRANCE

19.2.5 SPAIN

19.2.6 RUSSIA

19.2.7 SWITZERLAND

19.2.8 TURKEY

19.2.9 BELGIUM

19.2.10 NETHERLANDS

19.2.11 DENMARK

19.2.12 SWEDEN

19.2.13 POLAND

19.2.14 NORWAY

19.2.15 FINLAND

19.2.16 REST OF EUROPE

19.3 ASIA-PACIFIC

19.3.1 JAPAN

19.3.2 CHINA

19.3.3 SOUTH KOREA

19.3.4 INDIA

19.3.5 SINGAPORE

19.3.6 THAILAND

19.3.7 INDONESIA

19.3.8 MALAYSIA

19.3.9 PHILIPPINES

19.3.10 AUSTRALIA

19.3.11 NEW ZEALAND

19.3.12 VIETNAM

19.3.13 TAIWAN

19.3.14 REST OF ASIA-PACIFIC

19.4 SOUTH AMERICA

19.4.1 BRAZIL

19.4.2 ARGENTINA

19.4.3 REST OF SOUTH AMERICA

19.5 MIDDLE EAST AND AFRICA

19.5.1 SOUTH AFRICA

19.5.2 EGYPT

19.5.3 BAHRAIN

19.5.4 UNITED ARAB EMIRATES

19.5.5 KUWAIT

19.5.6 OMAN

19.5.7 QATAR

19.5.8 SAUDI ARABIA

19.5.9 REST OF MEA

19.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

20 GLOBAL HEALTHCARE PAYER SOLUTIONS MARKET , COMPANY PROFILE

20.1 COGNIZANT

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 GEOGRAPHIC PRESENCE

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 ACCENTURE

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 GEOGRAPHIC PRESENCE

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 XEROX (CONDUENT)

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 GEOGRAPHIC PRESENCE

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENTS

20.4 TATA CONSULTANCY SERVICES (TCS)

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 GEOGRAPHIC PRESENCE

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 WIPRO

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHIC PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 INFOSYS

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHIC PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT DEVELOPMENTS

20.7 UNITEDHEALTH GROUP (OPTUM)

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 GEOGRAPHIC PRESENCE

20.7.4 PRODUCT PORTFOLIO

20.7.5 RECENT DEVELOPMENTS

20.8 HCL TECHNOLOGIES

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 GEOGRAPHIC PRESENCE

20.8.4 PRODUCT PORTFOLIO

20.8.5 RECENT DEVELOPMENTS

20.9 EXL SERVICE HOLDINGS, INC.

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 GEOGRAPHIC PRESENCE

20.9.4 PRODUCT PORTFOLIO

20.9.5 RECENT DEVELOPMENTS

20.1 IBM CORPORATION

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 GEOGRAPHIC PRESENCE

20.10.4 PRODUCT PORTFOLIO

20.10.5 RECENT DEVELOPMENTS

20.11 GENPACT

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 GEOGRAPHIC PRESENCE

20.11.4 PRODUCT PORTFOLIO

20.11.5 RECENT DEVELOPMENTS

20.12 NTT DATA CORPORATION

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 GEOGRAPHIC PRESENCE

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPMENTS

20.13 MPHASIS

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 GEOGRAPHIC PRESENCE

20.13.4 PRODUCT PORTFOLIO

20.13.5 RECENT DEVELOPMENTS

20.14 CAPGEMINI

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 GEOGRAPHIC PRESENCE

20.14.4 PRODUCT PORTFOLIO

20.14.5 RECENT DEVELOPMENTS

20.15 WNS GLOBAL SERVICES

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 GEOGRAPHIC PRESENCE

20.15.4 PRODUCT PORTFOLIO

20.15.5 RECENT DEVELOPMENTS

20.16 HGS (HINDUJA GLOBAL SOLUTIONS)

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 GEOGRAPHIC PRESENCE

20.16.4 PRODUCT PORTFOLIO

20.16.5 RECENT DEVELOPMENTS

20.17 SUTHERLAND GLOBAL SERVICES

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 GEOGRAPHIC PRESENCE

20.17.4 PRODUCT PORTFOLIO

20.17.5 RECENT DEVELOPMENTS

20.18 SUTHERLAND GLOBAL SERVICES

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 GEOGRAPHIC PRESENCE

20.18.4 PRODUCT PORTFOLIO

20.18.5 RECENT DEVELOPMENTS

20.19 HEXAWARE TECHNOLOGIES

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 GEOGRAPHIC PRESENCE

20.19.4 PRODUCT PORTFOLIO

20.19.5 RECENT DEVELOPMENTS

20.2 CONCENTRIX

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 GEOGRAPHIC PRESENCE

20.20.4 PRODUCT PORTFOLIO

20.20.5 RECENT DEVELOPMENTS

20.21 ALORICA

20.21.1 COMPANY OVERVIEW

20.21.2 REVENUE ANALYSIS

20.21.3 GEOGRAPHIC PRESENCE

20.21.4 PRODUCT PORTFOLIO

20.21.5 RECENT DEVELOPMENTS

20.22 FIRSTSOURCE SOLUTIONS

20.22.1 COMPANY OVERVIEW

20.22.2 REVENUE ANALYSIS

20.22.3 GEOGRAPHIC PRESENCE

20.22.4 PRODUCT PORTFOLIO

20.22.5 RECENT DEVELOPMENTS

20.23 DXC TECHNOLOGY

20.23.1 COMPANY OVERVIEW

20.23.2 REVENUE ANALYSIS

20.23.3 GEOGRAPHIC PRESENCE

20.23.4 PRODUCT PORTFOLIO

20.23.5 RECENT DEVELOPMENTS

21 RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.