Global Healthcare It Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

519.49 Billion

USD

1,799.39 Billion

2024

2032

USD

519.49 Billion

USD

1,799.39 Billion

2024

2032

| 2025 –2032 | |

| USD 519.49 Billion | |

| USD 1,799.39 Billion | |

|

|

|

|

Healthcare Information Technology (IT) Outsourcing Market Size

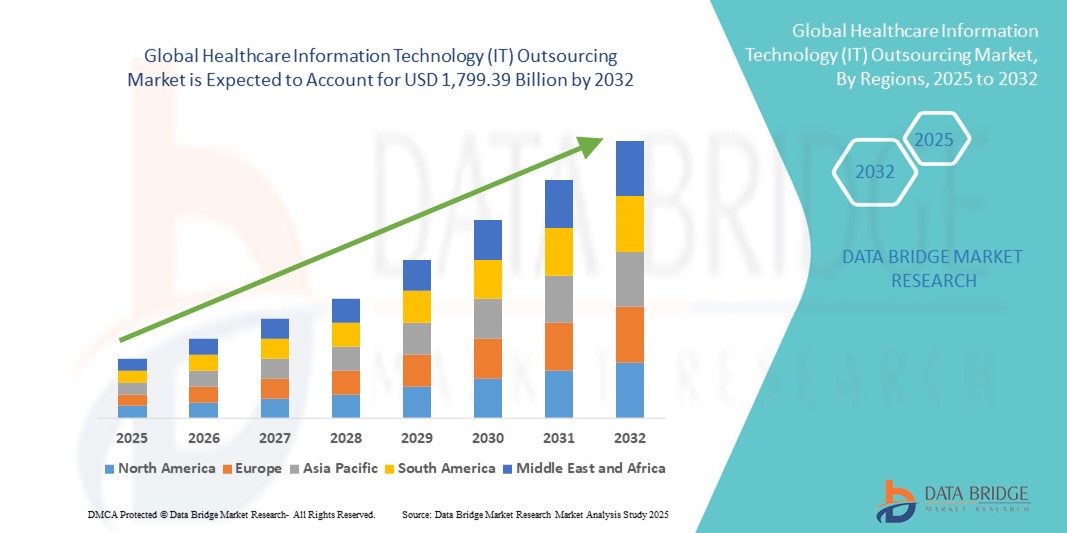

- The global healthcare information technology (IT) outsourcing market size was valued at USD 519.49 billion in 2024 and is expected to reach USD 1,799.39 billion by 2032, at a CAGR of 16.80% during the forecast period

- The market growth is largely fueled by the increasing need to reduce operational costs, improve efficiency, and manage the rising complexity of healthcare IT infrastructure, driving greater adoption of outsourcing models by hospitals, clinics, and payers

- Furthermore, the rising demand for advanced digital health solutions, electronic health records (EHR), and data security, along with the integration of AI, cloud computing, and analytics in healthcare operations, is positioning outsourcing as a strategic necessity. These converging factors are accelerating the uptake of healthcare IT outsourcing, thereby significantly boosting the industry’s growth

Healthcare Information Technology (IT) Outsourcing Market Analysis

- Healthcare IT outsourcing, involving the delegation of IT services such as infrastructure management, application development, and data processing to third-party vendors, is becoming an essential strategy for healthcare providers and payers seeking cost optimization, scalability, and improved service delivery

- The escalating demand for healthcare IT outsourcing is primarily fueled by the growing complexity of healthcare operations, the rising need to manage electronic health records (EHR), and the increasing focus on data security and regulatory compliance, alongside the global push for digital transformation in healthcare

- North America dominated the healthcare information technology (IT) outsourcing market with a revenue share of 40% in 2024, characterized by advanced healthcare infrastructure, early adoption of digital health solutions, and the strong presence of outsourcing service providers, with the U.S. leading in large-scale adoption driven by cloud-based solutions, AI-enabled analytics, and stringent HIPAA compliance requirements

- Asia-Pacific is expected to be the fastest growing region in the healt healthcare information technology (IT) outsourcing market during the forecast period, fueled by increasing healthcare expenditure, rapid digitalization of hospital systems, and the expansion of IT service capabilities in countries such as India and the Philippines

- The provider HCIT outsourcing segment dominated the healthcare information technology (IT) outsourcing market with a market share of 45.2% in 2024, driven by the need for efficient management of clinical, non-clinical, and administrative functions, enabling healthcare organizations to focus more on patient care while ensuring reduced operational costs and improved efficiency

Report Scope and Healthcare Information Technology (IT) Outsourcing Market Segmentation

|

Attributes |

Healthcare Information Technology (IT) Outsourcing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Healthcare Information Technology (IT) Outsourcing Market Trends

Growing Integration of Cloud, AI, and Analytics in Outsourcing Models

- A significant and accelerating trend in the global healthcare IT outsourcing market is the increasing integration of cloud-based services, artificial intelligence (AI), and advanced analytics within outsourcing contracts. This convergence is enhancing operational efficiency, scalability, and real-time data utilization for healthcare providers and payers

- For instance, IBM and Oracle provide AI-driven outsourcing solutions that help healthcare systems automate administrative workflows and support predictive analytics for population health management. Similarly, Cognizant and Accenture deliver cloud-enabled outsourcing services that allow hospitals to manage electronic health records (EHR) securely while improving interoperability

- AI adoption in outsourcing agreements enables predictive maintenance of IT systems, automated claims management, and advanced fraud detection. Companies such as Wipro and Infosys are embedding AI and machine learning capabilities into healthcare outsourcing solutions to optimize patient data processing and improve clinical decision support

- The rising demand for value-based care models is also accelerating outsourcing of analytics and cloud-driven IT services, enabling providers to focus on patient outcomes while delegating IT-intensive tasks to specialized vendors

- This trend toward intelligent, cloud-enabled, and data-driven outsourcing solutions is reshaping healthcare IT operations, with providers and payers increasingly expecting vendors to deliver not only cost savings but also strategic insights for digital health transformation

- Consequently, global outsourcing companies are expanding their healthcare IT portfolios to include AI-enabled platforms, cybersecurity-as-a-service, and cloud-native solutions, driving a more advanced and integrated outsourcing landscape

Healthcare Information Technology (IT) Outsourcing Market Dynamics

Driver

Cost Optimization and Focus on Core Healthcare Delivery

- The growing need among healthcare providers and payers to reduce operational costs while concentrating on core patient care functions is a key driver of healthcare IT outsourcing adoption

- For instance, in March 2024, Cognizant expanded its healthcare IT outsourcing partnership with a U.S.-based hospital network to include cloud migration and data security, aimed at reducing overhead costs while enhancing compliance with HIPAA standards

- Outsourcing helps healthcare organizations address the challenges of rising IT maintenance costs, increasing digital complexity, and labor shortages in IT departments, enabling better allocation of resources toward clinical innovation

- Furthermore, outsourcing enables healthcare systems to adopt advanced technologies such as cloud computing, AI, and blockchain more rapidly, offering improved scalability and compliance with stringent healthcare regulations

- The ability to manage electronic health records (EHR), claims processing, and revenue cycle management through outsourcing partners also drives efficiency, making outsourcing an attractive solution for both providers and payers

Restraint/Challenge

Data Security Concerns and Regulatory Compliance Hurdles

- Despite its advantages, healthcare IT outsourcing faces challenges around cybersecurity risks and strict regulatory compliance requirements. Patient data handled by third-party vendors is vulnerable to breaches and unauthorized access, creating concerns among providers and patients asuch as

- For instance, high-profile data breaches in healthcare IT systems have raised questions about the security of outsourcing vendors, making healthcare organizations cautious in selecting partners

- Addressing these concerns requires robust encryption, secure authentication, and adherence to regulations such as HIPAA in the U.S. and GDPR in Europe. Vendors such as Accenture and TCS emphasize compliance frameworks and advanced cybersecurity in their outsourcing contracts to build trust with clients

- In addition, integration complexity and data migration risks when transitioning from legacy systems to outsourced cloud platforms can delay adoption. The relatively high initial investment in outsourcing arrangements also deters smaller healthcare providers

- Overcoming these challenges through stronger compliance frameworks, vendor transparency, and improved cybersecurity will be critical to achieving wider acceptance and sustained growth of healthcare IT outsourcing worldwide

Healthcare Information Technology (IT) Outsourcing Market Scope

The market is segmented on the basis of type, application, and end use.

- By Type

On the basis of type, the healthcare information technology (IT) outsourcing market is segmented into Provider HCIT Outsourcing, Electronic Health Record (EHR), Payer HCIT Outsourcing, Operational HCIT Outsourcing, Life Sciences HCIT Outsourcing, and IT Infrastructure Outsourcing. Provider HCIT Outsourcing dominated the market with the largest revenue share of 45.2% in 2024, driven by the growing need among hospitals, clinics, and healthcare systems to manage complex IT operations efficiently. Providers increasingly outsource clinical data management, revenue cycle management, and patient information systems to focus on improving patient care. This segment benefits from the surge in electronic medical records and the rising pressure to reduce operational costs while meeting compliance requirements such as HIPAA. In addition, outsourcing enables healthcare providers to adopt advanced solutions such as cloud storage, AI-driven analytics, and cybersecurity protection more quickly, making this the most established segment in the industry.

Electronic Health Record (EHR) Outsourcing is anticipated to witness the fastest growth rate during the forecast period, driven by global regulatory pushes for EHR adoption and the rising demand for interoperability across healthcare systems. As EHR platforms require continuous updates, system integration, and strong data security measures, outsourcing becomes an attractive choice for providers lacking in-house IT resources. Vendors offer scalable EHR outsourcing services, supporting digital health expansion and reducing the risks of compliance violations. The growing volume of patient data, combined with government initiatives to standardize EHR adoption across developing markets, is accelerating outsourcing growth in this subsegment.

- By Application

On the basis of application, the healthcare information technology (IT) outsourcing market is segmented into care management, administration, and IT infrastructure management. IT Infrastructure Management held the largest market revenue share in 2024, supported by the need for healthcare organizations to manage increasingly complex digital ecosystems. Hospitals and payers rely heavily on third-party vendors to handle servers, cloud platforms, cybersecurity, and data storage systems. The dominance of this subsegment is also driven by the high upfront costs and technical expertise required to manage IT infrastructure in-house, which outsourcing vendors can deliver more efficiently at scale. Growing cyber threats, coupled with the necessity for real-time interoperability across healthcare networks, ensure the continued reliance on outsourcing for infrastructure management.

Care Management is projected to grow at the fastest rate from 2025 to 2032, driven by rising demand for personalized healthcare delivery and value-based care models. Outsourcing partners provide advanced analytics, patient engagement platforms, and AI-enabled monitoring solutions that support chronic disease management and population health programs. The integration of outsourced care management solutions helps healthcare providers reduce readmissions, improve patient outcomes, and meet government reimbursement benchmarks. Increasing digital health adoption, particularly in telehealth and remote monitoring, is also fueling the rapid expansion of this subsegment.

- By End Use

On the basis of end use, the healthcare information technology (IT) outsourcing market is segmented into healthcare provider systems, pharmaceutical, biotechnology, clinical research organizations (CROs), and Health Insurance. healthcare provider Systems dominated the market with the largest revenue share in 2024, attributed to their massive reliance on outsourcing partners for IT infrastructure, EHR management, and revenue cycle optimization. Hospitals, clinics, and integrated health systems face ongoing pressure to cut costs while improving patient care, making outsourcing a key enabler for digital transformation. Providers also face heightened compliance and cybersecurity demands, further pushing them to partner with specialized IT vendors. With the growing adoption of AI and cloud platforms in hospitals, outsourcing continues to serve as a cost-effective solution to meet operational and clinical IT needs.

Clinical Research Organizations (CROs) are expected to be the fastest-growing end-use segment during the forecast period, fueled by the surge in global clinical trials and the increasing complexity of data management requirements. CROs often rely on outsourcing for functions such as clinical data processing, regulatory submissions, pharmacovigilance, and advanced analytics. The adoption of decentralized trials and digital platforms is further boosting demand for IT outsourcing to streamline trial operations and reduce costs. As pharmaceutical and biotech firms continue to expand R&D pipelines, outsourcing to CROs with IT expertise will grow significantly, positioning this segment as the fastest expanding in the industry.

Healthcare Information Technology (IT) Outsourcing Market Regional Analysis

- North America dominated the healthcare information technology (IT) outsourcing market with a revenue share of 40% in 2024, characterized by advanced healthcare infrastructure, early adoption of digital health solutions, and the strong presence of outsourcing service providers

- Healthcare providers and payers in the region prioritize outsourcing to manage the rising complexity of electronic health records (EHR), cybersecurity requirements, and cloud-based operations while focusing resources on improving patient outcomes

- This widespread adoption is further supported by stringent regulatory compliance frameworks such as HIPAA, growing healthcare expenditure, and a strong demand for cost reduction and operational efficiency, establishing outsourcing as a strategic necessity for both healthcare providers and payers in the region

U.S. Healthcare Information Technology (IT) Outsourcing Market Insight

The U.S. healthcare information technology (IT) outsourcing market captured the largest revenue share of 82% in 2024 within North America, fueled by the rapid adoption of electronic health records (EHR), cloud platforms, and AI-driven analytics. Hospitals and payers are increasingly outsourcing IT functions to reduce costs and address labor shortages while complying with HIPAA and other regulatory frameworks. The rising popularity of remote care solutions, combined with the need for robust cybersecurity and scalable IT infrastructure, is propelling demand. Moreover, partnerships between leading IT service providers and healthcare systems are significantly contributing to the market’s expansion.

Europe Healthcare Information Technology (IT) Outsourcing Market Insight

The Europe healthcare information technology (IT) outsourcing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent GDPR compliance requirements and the increasing demand for secure, interoperable healthcare systems. Growing investments in digital health and cloud-based solutions are fostering outsourcing adoption among hospitals and research institutions. European healthcare providers are also leveraging outsourcing to support EHR management, revenue cycle optimization, and advanced analytics. The market is experiencing significant growth across both public and private healthcare systems, with IT outsourcing being integrated into modernization and digital transformation initiatives.

U.K. Healthcare Information Technology (IT) Outsourcing Market Insight

The U.K. healthcare information technology (IT) outsourcing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the NHS’s continued push for digital transformation and budget optimization. Rising demand for secure patient data management, telehealth platforms, and interoperable systems is encouraging healthcare organizations to partner with outsourcing providers. The U.K.’s strong regulatory environment, coupled with a high level of digital literacy, supports outsourcing adoption. In addition, a growing focus on AI-enabled healthcare solutions and cloud adoption is expected to further stimulate market growth.

Germany Healthcare Information Technology (IT) Outsourcing Market Insight

The Germany healthcare information technology (IT) outsourcing market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong focus on healthcare digitization and strict data security standards. German healthcare providers are increasingly outsourcing IT services for EHR management, cybersecurity, and infrastructure modernization. The government’s initiatives to enhance interoperability and expand digital health records adoption are further accelerating market growth. In addition, Germany’s emphasis on sustainable and efficient IT operations aligns with outsourcing strategies that optimize costs and support long-term scalability.

Asia-Pacific Healthcare Information Technology (IT) Outsourcing Market Insight

The Asia-Pacific healthcare information technology (IT) outsourcing market is poised to grow at the fastest CAGR of 24% during 2025 to 2032, driven by rising healthcare expenditure, rapid hospital digitalization, and strong IT service capabilities in countries such as India, China, and the Philippines. Increasing urbanization and government-backed digital health initiatives are supporting outsourcing adoption across both providers and payers. Furthermore, the region’s role as a hub for IT services enhances affordability and accessibility, enabling wider adoption of outsourcing in healthcare operations.

Japan Healthcare Information Technology (IT) Outsourcing Market Insight

The Japan healthcare information technology (IT) outsourcing market is gaining momentum due to the country’s advanced healthcare infrastructure, high-tech culture, and emphasis on precision healthcare. Japanese hospitals and insurers are outsourcing EHR management, cybersecurity, and analytics to address rising patient volumes and improve efficiency. Integration of outsourced IT services with IoT-enabled healthcare devices and telemedicine platforms is further fueling growth. Moreover, Japan’s aging population is such asly to drive demand for outsourced digital health solutions that improve patient monitoring and long-term care management.

India Healthcare Information Technology (IT) Outsourcing Market Insight

The India healthcare information technology (IT) outsourcing market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to its strong domestic IT services ecosystem and growing demand for affordable healthcare technology solutions. India serves as both a leading provider and consumer of outsourcing services, with hospitals and insurers increasingly relying on third-party vendors for EHR, claims management, and telehealth support. Government initiatives such as the Ayushman Bharat Digital Mission are accelerating digital health adoption, while the availability of skilled IT talent and cost advantages make India a central hub for healthcare IT outsourcing growth.

Healthcare Information Technology (IT) Outsourcing Market Share

The Healthcare Information Technology (IT) Outsourcing industry is primarily led by well-established companies, including:

- Accenture (Ireland)

- Cognizant (U.S.)

- IBM (U.S.)

- Wipro (India)

- Tata Consultancy Services Limited (India)

- Infosys Limited (India)

- HCLTech (India)

- Tech Mahindra Limited (India)

- NTT DATA, Inc. (Japan)

- DXC Technology (U.S.)

- Capgemini (France)

- Atos (France)

- Fujitsu (Japan)

- CGI Inc. (Canada)

- EPAM Systems, Inc. (U.S.)

- LTIMindtree Limited (India)

- UST (U.S.)

- Persistent Systems (India)

- Genpact (U.S.)

- EXL (U.S.)

What are the Recent Developments in Global Healthcare Information Technology (IT) Outsourcing Market?

- In July 2025, AGS Health was named the Top Mid-Cycle RCM (Revenue Cycle Management) Outsourcing Vendor for 2025 by Black Book Research, recognized for excellence in coding accuracy, clinical documentation improvement, automation readiness, and service scalability

- In June 2025, Simplify Healthcare entered a strategic partnership with Atento to launch a pilot-first customer experience (CX) program using the Xperience1 platform—enabling U.S. healthcare payers to boost member and provider satisfaction, reduce call handling times, and accelerate operational transformation with no upfront capital investment

- In January 2025, the World Economic Forum and Apollo Hospitals, along with other global healthcare and technology organizations, launched the Digital Healthcare Transformation (DHT) Initiative. This public-private partnership is focused on leveraging digital health to improve healthcare access and outcomes, particularly in countries such as India

- In September 2022, Honeywell announced a commitment to developing technology-led solutions for healthcare by signing Memorandums of Understanding (MoUs) with two major healthcare companies, the University Hospital Brno in the Czech Republic and Narayana Health in India. These partnerships provide a framework to co-innovate and digitalize healthcare processes, such as improving patient monitoring and operational agility

- In March 2022, Epic Systems launched "Garden Plot," a new software-as-a-service (SaaS) solution for independent medical groups with more than 40 providers. This model allows smaller practices to access Epic's comprehensive electronic health record (EHR) system without the need for a full-scale, on-premise implementation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.