Global Healthcare Distribution Market

Market Size in USD Billion

CAGR :

%

USD

939.27 Billion

USD

1,601.82 Billion

2022

2030

USD

939.27 Billion

USD

1,601.82 Billion

2022

2030

| 2023 –2030 | |

| USD 939.27 Billion | |

| USD 1,601.82 Billion | |

|

|

|

|

Healthcare Distribution Market Analysis and Size

Healthcare distribution is defined as the concept of providing different care services like drugs, diagnostic tests, and other facilities to patients. The healthcare system is very useful as it helps people to stay healthy. Pharmaceutical product distribution, medical device distribution service, and biopharmaceutical distribution service are some of the common types of healthcare distribution. It is using many different technologies and developments to expand and provide better facilities to patients.

An increase in the research and development investment in new drug development is a vital factor escalating the market growth, also a rise in the growth of the medical devices industry, increase in the importance of generics, high incidence and large economic burden of chronic diseases and increase in the growth of the medical devices industry are the major factors among others driving the healthcare distribution market. Moreover, a rise in the growth in the biosimilars market, an increase in specialty drug dispensing, and an increase in the uptake of biopharmaceuticals will further create new opportunities for the healthcare distribution market in the forecasted period of 2023-2030.

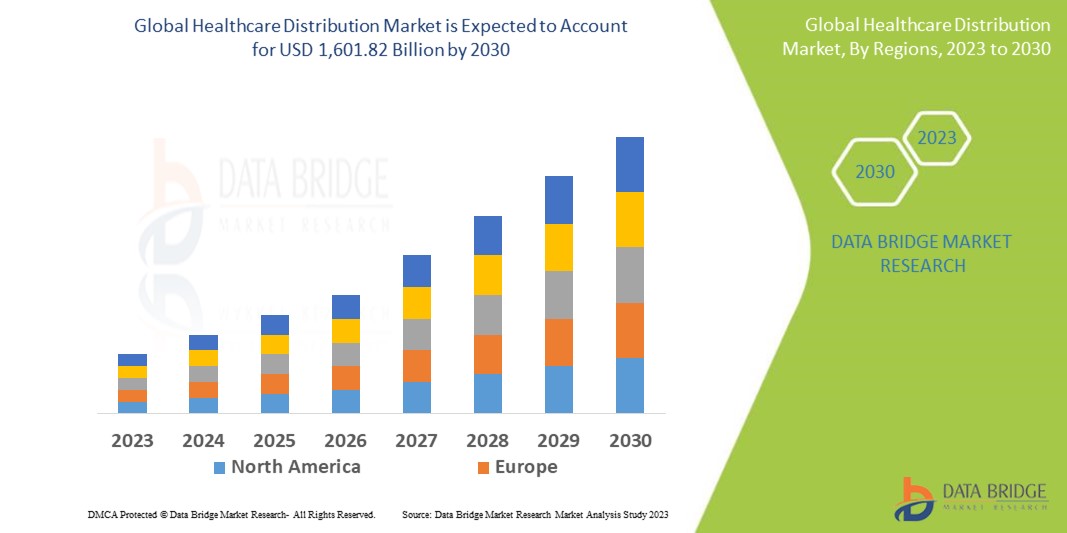

However, the high price of the drug and strict government regulations related to drug development are the major factors among others which will obstruct the market growth, and will further challenge the growth of the healthcare distribution market in the forecast period mentioned above. Data Bridge Market Research analyses that the Healthcare Distribution Market was valued at USD 939.27 billion in 2022 and is further estimated to reach USD 1,601.82 billion by 2030, and is expected to grow at a CAGR of 6.90% during the forecast period of 2023 to 2030. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Healthcare Distribution Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, and Pricing in USD |

|

Segments Covered |

By Type (Pharmaceutical Product Distribution Services, Medical Device Distribution Services, and Biopharmaceutical Product Distribution Services), End- User (Retail Pharmacies, Hospital Pharmacies, and Other End-User) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, and Rest of South America |

|

Market Players Covered |

McKesson Corporation (U.S.), Accord-UK Ltd. (U.K.), Phoenix Medical Systems Private Limited (India), Biotron Healthcare (India), OrbiMed Advisors LLC (U.S.), ALLIANCE UNICHEM IP LIMITED (Germany) and TTK (India), Cardinal Health (U.S.), AmerisourceBergen Corporation (U.S.), Owens & Minor, Inc.(U.S.), Morris & Dickson Co. L.L.C. (U.S.), Express Scripts Holding Company (U.S.), FFF Enterprises, Inc. (U.S.), Medline Industries, Inc. (U.S.), Attain Medspa (U.S.), Dakota Drug, Inc.(U.S.), Patterson Companies, Inc. (U.S.), Mutual Drug (U.S.), and Redington (India) among other. |

|

Market Opportunities |

|

Market Definition

The healthcare distribution market refers to the industry involved in the distribution and supply of healthcare products, including drugs, medical devices, equipment, and supplies. It covers the entire supply chain process from manufacturers and wholesalers to hospitals, pharmacies, clinics, and other healthcare facilities.

Healthcare distribution plays a key role in ensuring that healthcare products reach end users such as patients and healthcare professionals in a timely and efficient manner. This includes functions such as sourcing, warehousing, warehousing, transportation and logistics. The distribution process also includes ordering, packaging, labeling, and regulatory compliance to ensure product integrity and patient safety.

Healthcare Distribution Market Dynamics

Drivers

- Rise in research and development and healthcare expenditure

An increase in the research and development investment in new drug development is the vital factor escalating the market growth, also a rise in the growth of the medical devices industry, an increase in the importance of generics, high incidence and large economic burden of chronic diseases and increase in the growth of the medical devices industry are the major factors among others driving the healthcare distribution market

- Growing technological advancement

Technological advancements in healthcare distribution such as Radio-Frequency Identification (RFID) and Blockchain in logistics are boosting the healthcare distribution market. Moreover, a rise in collaborations and agreements between the key market players and an increase in government support to the healthcare sector also propel the growth of the market.

- The growing importance of generics across the globe

Growing acceptance of generic drugs in emerging regions is expected to open up new possibilities for the healthcare distribution market. A generic drug is a reproduction that is identical to a brand-name drug in strength, safety, dosage, mode of intake, performance, quality, and intended usage. These are the factor that drives the healthcare distribution market.

Opportunity

- The growing use of biosimilars and the upsurge of biopharmaceuticals

The rise in the growth in the biosimilars market, increase in specialty drug dispensing and increase in the uptake of biopharmaceuticals will further create new opportunities for the healthcare distribution market. In addition, agreements and new product launches in the healthcare market are likely to lead to a surge in opportunities in the global healthcare distribution market during the forecast period.

Restraint

- High cost associated with drug development

The high price of the drug and strict government regulations related to drug development are the major factors among others that will obstruct the market growth, and will further challenge the growth of the healthcare distribution market.

Challenge

- Rise in the use of specialty health products

The growth of specialty health products presents new challenges to the health marketing industry. Companies must design new supply chains that can serve the distribution of specialty drugs. Healthcare distribution companies are working to use information to improve existing models and provide valuable services.

This healthcare distribution market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the healthcare distribution market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In January 2023, Open Medical announces a new partnership with Tamer Group to bring its award-winning, market-leading Digital Transformation (KSA) solution to the Kingdom of Saudi Arabia. Open Medical aims to support KSA's leading innovators in their mission to redefine the effectiveness and quality of healthcare. This helped the company to expand its business.

- In April 2021, Diethelm Keller Siebel Hegner completes the acquisition of a South Korean life sciences retailer, cementing its position as a leading supplier of scientific instruments across Asia and Singapore-based medical device supplier completed the acquisition of retailer Medworks. This helped the company to expand their business.

Global Healthcare Distribution Market Scope

The healthcare distribution market is segmented based on type and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Pharmaceutical product distribution services

- Medical device distribution services

- Biopharmaceutical product distribution services

End-user.

- Retail pharmacies

- Hospital pharmacies

- Other end-user

Healthcare Distribution Market Regional Analysis/Insights

The healthcare distribution market is analyzed and market size insights and trends are provided by country, type, and end-user as referenced above.

The countries covered in the healthcare distribution market report are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America dominates the healthcare distribution market due to the rise in the growth of the medical devices industry, the increase in the importance of generics, and the large economic burden of chronic diseases in this region.

Asia-Pacific dominates the healthcare distribution market due to the rise in healthcare expenses. Furthermore, the advancing healthcare technology and huge patient population will further boost the growth of the Healthcare Distribution Market in the region during the forecast period.

North America is projected to observe a significant amount of growth in the Healthcare Distribution Market due to the rising demand for specialty drugs and generics, and the large-scale adoption of advanced technologies such as Artificial Intelligence and blockchain. Moreover, the rapid advancement of technologies and the coming of AI-based technologies have improved the supply chain efficiency of healthcare distribution services is further anticipated to propel the growth of the healthcare distribution market in the region in the coming years.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The healthcare distribution market also provides you with a detailed market analysis for every country's growth in healthcare expenditure for capital equipment, installed base of different kinds of products for the healthcare distribution market, impact of technology using lifeline curves, and changes in healthcare regulatory scenarios and their impact on the healthcare distribution market. The data is available for the historic period 2010-2020.

Competitive Landscape and Healthcare Distribution Market Share Analysis

The healthcare distribution market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the healthcare distribution market.

Some of the major players operating in the healthcare distribution market are:

- McKesson Corporation (U.S.)

- Accord-UK Ltd. (U.K.)

- Phoenix Medical Systems Private Limited (India)

- Biotron Healthcare (India)

- OrbiMed Advisors LLC (U.S.)

- ALLIANCE UNICHEM IP LIMITED (Germany) and TTK (India)

- Cardinal Health (U.S.)

- AmerisourceBergen Corporation (U.S.)

- Owens & Minor, Inc.(U.S.)

- Morris & Dickson Co. L.L.C (U.S.)

- Express Scripts Holding Company (U.S.)

- FFF Enterprises, Inc. (U.S.)

- Medline Industries, Inc. (U.S.)

- Attain Medspa (U.S.)

- Dakota Drug, Inc. (U.S.)

- Patterson Companies, Inc. (U.S.)

- Mutual Drug (U.S.)

- Redington (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.