Global Healthcare Biometrics Market

Market Size in USD Billion

CAGR :

%

USD

10.50 Billion

USD

45.48 Billion

2024

2032

USD

10.50 Billion

USD

45.48 Billion

2024

2032

| 2025 –2032 | |

| USD 10.50 Billion | |

| USD 45.48 Billion | |

|

|

|

|

Healthcare Biometrics Market Size

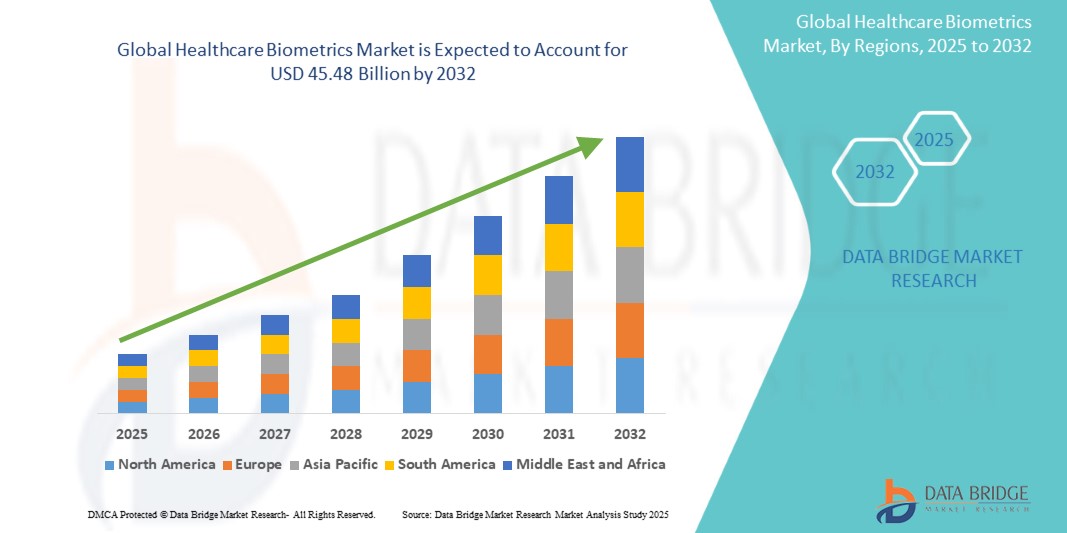

- The global healthcare biometrics market size was valued at USD 10.50 billion in 2024 and is expected to reach USD 45.48 billion by 2032, at a CAGR of 20.10% during the forecast period

- This growth is driven by factors such as the increasing need for secure patient identification, rising adoption of biometric technologies for healthcare applications, and the growing focus on reducing fraud and enhancing data security in healthcare systems

Healthcare Biometrics Market Analysis

- The healthcare biometrics market is experiencing steady growth with increasing applications in patient identification, access control, and data security, ensuring a higher level of protection for sensitive health information

- The market is expanding as healthcare providers increasingly adopt biometric technologies for improving the accuracy and efficiency of medical record management, reducing errors and enhancing operational performance

- North America is expected to dominate the healthcare biometrics market due to the presence of advanced healthcare infrastructure, high adoption of biometric technologies, and government initiatives promoting secure patient data management.

- Asia-Pacific is expected to be the fastest growing region in the healthcare biometrics market during the forecast period due to increasing healthcare digitization, rising healthcare needs, and rapid adoption of biometric technologies in countries such as India and China.

- The fingerprint recognition segment is expected to dominate the healthcare biometrics market with the largest share of 39.68% in 2025 due to its cost-effectiveness, ease of use, and high reliability in patient identification

Report Scope and Healthcare Biometrics Market Segmentation

|

Attributes |

Healthcare Biometrics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Healthcare Biometrics Market Trends

“Integration of Artificial Intelligences with Healthcare Biometrics”

- Artificial intelligence is increasingly being integrated with healthcare biometrics to enhance accuracy and functionality in identification and security systems

- AI-powered biometric systems are capable of analyzing large volumes of data in real-time, improving the speed and precision of patient recognition during consultations or hospital admissions

- Facial recognition systems combined with AI are gaining popularity in hospitals, enabling touchless identification and seamless patient experience while reducing the risk of errors associated with manual input

- A notable instance is the use of AI-driven fingerprint biometrics in clinics to streamline check-in processes, ensuring faster patient flow and reducing waiting times for appointments

- For instance, in the case of a major hospital chain in the U.S. adopting fingerprint scanning technology for its patient registration process

- AI's role in predictive analytics is also growing, with biometric systems identifying trends in patient health data, helping healthcare providers to intervene proactively in patient care and reduce the risk of medical errors, as seen with a hospital in India using AI-enabled biometrics to monitor vital signs and predict patient needs in real time

Healthcare Biometrics Market Dynamics

Driver

“Increasing Need for Enhanced Data Security in Healthcare”

- The increasing need for enhanced data security and patient privacy in healthcare is driving the growth of the healthcare biometrics market, particularly due to rising cyber threats, identity theft, and fraudulent activities

- As healthcare organizations digitize patient records, the amount of sensitive health data stored online becomes vulnerable to security breaches, necessitating the adoption of more secure identification methods

- Biometric technologies such as fingerprint scanning, facial recognition, and iris scanning provide secure identification solutions, offering a higher level of protection than traditional methods such as passwords or PIN codes

- To reduce unauthorized access and improve overall data security, hospitals and clinics are adopting biometric authentication systems for staff access to sensitive patient data

- For instance, a large hospital group in the U.S. has implemented fingerprint biometrics for staff authentication, while a healthcare provider in the U.K. uses biometric access control to protect patient data in its IT systems

- Biometric patient identification systems are helping improve the accuracy of patient records and ensuring correct treatment

- For instance, a leading hospital network in Europe uses facial recognition for patient check-in, and a medical center in Australia has integrated iris scanning for secure patient identification during surgeries

Opportunity

“Expansion in Remote Patient Monitoring and Telemedicine”

- The rapid growth of telemedicine and remote patient monitoring presents a significant opportunity for the healthcare biometrics market, driven by the increasing adoption of virtual care models in the healthcare industry

- As virtual care expands, there is a growing need for secure and efficient ways to verify patient identities remotely, ensuring patients can access medical records, consult with providers, and receive prescriptions without physical interaction

- Biometrics plays a crucial role in this process, enabling secure patient identification during remote consultations

- For instance, telemedicine platforms can integrate biometric authentication technologies such as facial recognition or voice recognition to verify patient identities, reducing the risk of fraud

- Biometrics can also be integrated into wearable health devices, securely monitoring vital signs and other health metrics. These devices ensure that only authorized individuals have access to sensitive health information, further securing patient data in real-time

- For instance, the integration of biometric features in mobile health applications. These apps enable patients to securely manage their health data and connect with healthcare professionals remotely, with biometric authentication ensuring the security of patient interactions and data

Restraint/Challenge

“High Implementation and Maintenance Costs”

- Despite the advantages offered by healthcare biometrics, the high initial costs of implementation and ongoing maintenance remain a significant challenge for the market

- The integration of biometric technologies into existing healthcare infrastructures requires substantial investment in hardware, software, and training, which can be difficult for many healthcare organizations, particularly small and medium-sized ones, to afford

- Ongoing expenses related to maintaining biometric systems, such as regular software updates, hardware maintenance, and support services, further strain healthcare budgets, especially for smaller providers with limited resources

- For instance, large hospitals or healthcare systems may have the capital to implement and maintain biometric systems, while smaller clinics or independent practitioners may find it financially challenging to adopt such technologies, creating a gap in access to advanced solutions

- Concerns about return on investment due to the high initial costs can also prevent some healthcare organizations from fully embracing biometrics, ultimately slowing down the growth and widespread adoption of these technologies in the healthcare sector

Healthcare Biometrics Market Scope

The market is segmented on the basis of technology, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Application |

|

|

By End User |

|

In 2025, the fingerprint recognition is projected to dominate the market with a largest share in Technology segment

The fingerprint recognition segment is expected to dominate the healthcare biometrics market with the largest share of 39.68% in 2025 due to its cost-effectiveness, ease of use, and high reliability in patient identification.

The patient tracking is expected to account for the largest share during the forecast period in Application market

In 2025, the patient tracking segment is expected to dominate the market with the largest market share of 34.5% due to its ability to enhance patient safety, prevent misidentification, and improve care coordination across healthcare facilities.

Healthcare Biometrics Market Regional Analysis

“North America Holds the Largest Share in the Healthcare Biometrics Market”

- North America is the dominating region in the healthcare biometrics market, holding a significant market share of approximately 40%. This dominance is due to the high adoption of biometric technologies in healthcare facilities

- The U.S. healthcare sector is heavily investing in biometrics to secure patient data and improve operational efficiency, driving market growth in the region

- A well-established infrastructure, including the use of electronic health records (EHR), supports the integration of biometric solutions

- The region has strong regulatory frameworks that promote the use of secure identification systems in healthcare, contributing to market dominance

- Major healthcare providers in North America are adopting biometric systems for patient identification, workforce management, and access control, further boosting the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Healthcare Biometrics Market”

- Asia-Pacific is the fastest-growing region in the healthcare biometrics market, experiencing rapid adoption of biometric technologies in healthcare applications

- The increasing demand for digital healthcare solutions in countries such as India and China is fuelling the growth of biometric systems in healthcare

- Rising investments in healthcare infrastructure and government initiatives to improve healthcare delivery are contributing to the fast growth

- The growing healthcare needs of the large and diverse population in the region are pushing for secure and efficient patient identification methods

- The rise of telemedicine and remote patient monitoring in Asia-Pacific is further boosting the demand for biometric authentication solutions

Healthcare Biometrics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Zkteco, Inc (China)

- Thales Group (France)

- Bio-Key International Inc (U.S.)

- Crossmatch Technologies Inc (U.S.)

- Fujitsu Limited (Japan)

- Imprivata Inc (U.S.)

- Lumidigm (U.S.)

- Morpho (France)

- NEC Corporation (Japan)

- Suprema Inc (South Korea)

- Integrated Biometrics (U.S.)

- Facetec Inc. (U.S.)

Latest Developments in Global Healthcare Biometrics Market

- In February 2024, Imprivata, a digital identity company, launched the Imprivata Biometric Patient Identity solution, a HIPAA-compliant facial recognition technology designed to address patient misidentification in healthcare settings. Integrated with Epic Systems, this solution enables healthcare providers to accurately identify patients by capturing facial images during enrollment and utilizing standard webcams during check-in, accommodating attributes such as medical masks and glasses. By replacing manual identification methods, it aims to reduce duplicate records, minimize medical errors, and enhance patient privacy and satisfaction. This development is expected to improve clinical efficiency and patient experiences, contributing to the broader adoption of biometric solutions in the healthcare industry

- In November 2022, NEC Corporation launched its multimodal biometric authentication solution under the "Bio-IDiom" brand, integrating world-leading face and iris recognition technologies, each recognized as the world's No. 1 by the U.S. National Institute of Standards and Technology (NIST). This solution offers high-speed, high-precision touchless authentication with a false acceptance rate of one in 10 billion, even under conditions where individuals wear masks, goggles, and gloves. It is designed for a wide range of applications, including strict access control in critical facilities and high-security areas, as well as payments that require the use of passwords and other authentication factors. The solution's implementation is smooth, requiring no complicated design, and supports REST API for easy integration with various systems, reducing both cost and time required for deployment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.