Global Healthcare Analytics Market

Market Size in USD Billion

CAGR :

%

USD

35.41 Billion

USD

205.50 Billion

2024

2032

USD

35.41 Billion

USD

205.50 Billion

2024

2032

| 2025 –2032 | |

| USD 35.41 Billion | |

| USD 205.50 Billion | |

|

|

|

|

Healthcare Analytics Market Size

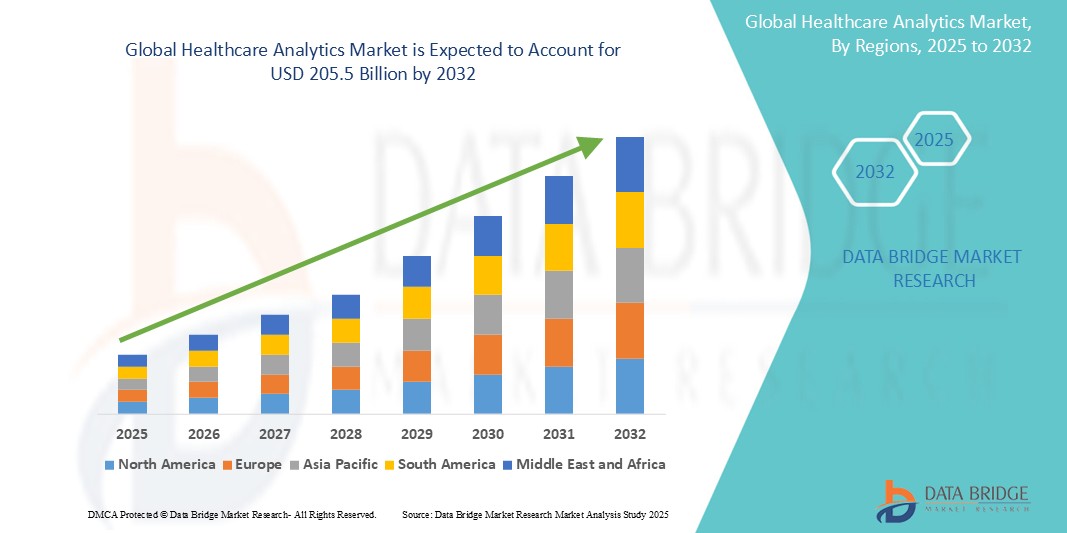

- The global healthcare analytics market size was valued at USD 35.41 billion in 2024 and is expected to reach USD 205.5 billion by 2032, at a CAGR of 24.58% during the forecast period

- The market growth is largely fuelled by the growing adoption of EHRs and the increasing demand for data-driven decision-making to enhance patient outcomes and operational efficiency across healthcare organizations

- Furthermore, the rising pressure for cost management, coupled with regulatory pushes towards value-based care, establishes healthcare analytics as a crucial tool for stakeholders. Technological advancements in AI and machine learning are also accelerating the market's growth

Healthcare Analytics Market Analysis

- Healthcare analytics, providing essential insights for optimizing patient care, operational efficiency, and financial performance, are increasingly critical components of modern healthcare settings, including hospitals, clinics, and public health agencies, due to their vital role in ensuring data-driven decision-making and improved outcomes

- The escalating demand for healthcare analytics solutions is primarily fueled by the growing volume of healthcare data, the increasing need for value-based care models, and the rising emphasis on preventive health and population health management

- North America dominates the healthcare analytics market with the largest revenue share of 37.1% in 2024, characterized by advanced healthcare infrastructure, high adoption rates of sophisticated IT solutions, and a strong presence of leading technology and analytics providers, with the U.S. experiencing substantial growth in the utilization of advanced analytical tools across various healthcare settings

- Asia-Pacific is expected to be the fastest-growing region in the healthcare analytics market during the forecast period, with an anticipated CAGR of 8.5% due to increasing healthcare expenditure, a growing burden of chronic diseases requiring data-driven interventions, and rising awareness of advanced analytics techniques in rapidly developing healthcare systems

- Descriptive analytics segment dominates the largest market revenue share, with a market share of 44.5%. This is due to its foundational role in understanding past healthcare trends and performance

Report Scope and Healthcare Analytics Market Segmentation

|

Attributes |

Healthcare Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Healthcare Analytics Market Trends

“Real-Time Decision Support Through Predictive and Prescriptive Analytics”

- A major and accelerating trend in the global healthcare analytics market is the advancement of real-time predictive and prescriptive analytics, which enable healthcare providers to proactively manage patient care and operational efficiency. These analytics tools leverage vast amounts of clinical, operational, and financial data to provide actionable insights in real time

- For instance, hospitals are increasingly adopting predictive analytics platforms that can forecast patient deterioration, readmission risks, or emergency department overcrowding. These insights allow clinicians to intervene earlier, improving patient outcomes and reducing healthcare costs

- Prescriptive analytics takes this a step further by not only forecasting future events but also recommending optimal actions. Healthcare providers are using prescriptive tools to identify the most effective treatment pathways, allocate resources more efficiently, and manage population health strategies with greater precision

- Integration with electronic health records (EHRs) and IoT-enabled medical devices ensures continuous data flow, enabling more accurate and dynamic modeling. Real-time dashboards powered by AI algorithms are becoming commonplace in clinical settings, offering personalized alerts, patient risk scores, and clinical decision support

- This trend is transforming healthcare delivery by enabling data-driven, patient-centered care. Physicians can now rely on analytical tools to supplement their clinical judgment, ensuring higher accuracy in diagnostics and more tailored treatment plans

- The surge in demand for predictive and prescriptive analytics is being driven by a growing emphasis on value-based care, where outcomes, cost efficiency, and proactive intervention are key performance metrics. As a result, healthcare organizations are investing heavily in advanced analytics platforms to meet regulatory requirements, improve care quality, and remain competitive

- Overall, the evolution of healthcare analytics from descriptive to predictive and prescriptive capabilities is reshaping the healthcare landscape, ushering in a new era of proactive and personalized medicine supported by real-time insights

Healthcare Analytics Market Dynamics

Driver

“Growing Demand for Data-Driven Decision-Making in an Evolving Healthcare Landscape”

- The escalating complexity of healthcare delivery, combined with the rising pressure to improve outcomes while controlling costs, is a major driver behind the growing adoption of healthcare analytics solutions across the globe

- For instance, in March 2024, IBM Watson Health announced a new partnership with leading hospital networks to deploy AI-powered analytics platforms capable of predicting patient deterioration and optimizing care workflows. Such strategic moves are accelerating the integration of healthcare analytics into core clinical and operational processes

- As providers shift from fee-for-service to value-based care models, the demand for real-time, actionable insights has surged. Healthcare analytics enables clinicians and administrators to track patient outcomes, monitor population health trends, and evaluate the effectiveness of treatment protocols with greater accuracy

- Moreover, the rise in chronic diseases, aging populations, and increased data availability from electronic health records (EHRs), wearable devices, and remote monitoring tools are contributing to a growing need for advanced analytics that can process vast volumes of structured and unstructured health data

- Healthcare organizations are increasingly adopting predictive modeling tools to anticipate patient readmissions, forecast disease progression, and allocate resources more efficiently. These capabilities empower providers to intervene earlier, reduce hospital stays, and lower overall costs

- The drive toward digital transformation in healthcare, supported by government initiatives and growing investments in AI and machine learning technologies, is further strengthening the market for healthcare analytics. Integration with cloud-based platforms and the expansion of interoperability standards have made it easier than ever to centralize and analyze data from disparate sources

- As patient expectations evolve toward personalized care and providers strive for operational excellence, the ability to leverage data through healthcare analytics is becoming essential. This data-driven approach is propelling growth across hospitals, clinics, and payers, transforming the way healthcare is delivered and managed globally

Restraint/Challenge

“Data Privacy Concerns and Integration Complexities Hampering Adoption”

- Growing concerns around data privacy, security breaches, and compliance with stringent healthcare regulations such as HIPAA and GDPR remain significant challenges limiting the widespread adoption of healthcare analytics platforms. The sensitive nature of patient health records makes organizations cautious about implementing analytics solutions that involve third-party platforms or cloud-based storage

- For instance, several high-profile healthcare data breaches in recent years have intensified scrutiny over how patient data is collected, stored, and analyzed. This has led many hospitals and clinics to delay or scale back their analytics deployments over fears of non-compliance and legal repercussions

- In addition to security concerns, technical integration challenges further restrain market growth. Many healthcare facilities still operate on fragmented legacy systems that are not readily compatible with modern analytics platforms. This creates data silos and hinders seamless integration, leading to incomplete or inconsistent analytics output

- Overcoming these barriers requires significant investments in IT infrastructure, data governance policies, and staff training—resources that may be out of reach for smaller clinics and facilities in emerging markets. Moreover, the steep learning curve associated with complex analytics dashboards and tools can deter frontline medical professionals from engaging fully with these systems

- Companies such as Oracle Health and Cerner are attempting to address these issues by enhancing interoperability, offering secure cloud environments, and developing user-friendly interfaces. However, ensuring end-to-end data security and ease of integration remains a substantial hurdle for the broader healthcare analytics market

- Until these privacy and integration challenges are adequately addressed through stronger regulatory compliance support, more intuitive platforms, and improved data interoperability standards, the full potential of healthcare analytics may remain underutilized in many parts of the healthcare system

Healthcare Analytics Market Scope

The market is segmented on the basis of type, component, delivery model, application, and end user.

By Type

On the basis of type, the healthcare analytics market is segmented into prescriptive analytics, predictive analytics, and descriptive analytics. The descriptive analytics segment dominates the largest market revenue share of 44.5% in 2024, driven by its foundational role in understanding past healthcare trends and performance. Healthcare organizations frequently rely on descriptive analytics for reporting and dashboards to summarize historical data, making it an essential tool for initial insights and operational monitoring.

The prescriptive analytics segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its ability to provide actionable recommendations for future decisions. As healthcare systems seek to optimize resource allocation, personalize patient care, and improve outcomes, the demand for analytics that suggest the best course of action is rapidly increasing. The integration of AI and machine learning for optimal decision-making further contributes to its accelerating adoption.

By Component

On the basis of component, the healthcare analytics market is segmented into services, software, and hardware. The services segment held the largest market revenue share in 2024, driven by the ongoing need for implementation, customization, maintenance, and consulting support for complex healthcare analytics solutions. The specialized expertise required to deploy and manage these systems ensures a continuous demand for service providers.

The software segment is from 2025 to 2032, driven by continuous innovation in analytical platforms, enhanced user expected to witness the fastest CAGR interfaces, and the proliferation of specialized software for various healthcare applications. The increasing accessibility and scalability of cloud-based software solutions also contribute to its rapid growth.

By Delivery Model

On the basis of delivery model, the healthcare analytics market is segmented into on-demand and on-premise. The on-premise segment held the largest market revenue share in 2024, driven by established healthcare organizations with existing IT infrastructure and a preference for direct control over their data for security and compliance reasons.

The on-demand segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its scalability, flexibility, cost-effectiveness, and ease of deployment. The growing trend of digital transformation in healthcare, coupled with the need for rapid data processing and accessibility across diverse locations, is accelerating the adoption of cloud-based analytics solutions.

By Application

On the basis of application, the healthcare analytics market is segmented into clinical analytics, population health analytics, operational and administrative analytics, and financial analytics. The financial analytics segment accounted for the largest market revenue share in 2024, driven by the persistent need for healthcare organizations to manage costs, optimize revenue cycles, and improve financial performance in a complex reimbursement landscape.

The population health analytics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing focus on preventive care, value-based healthcare models, and managing health outcomes for specific patient populations. The ability to identify at-risk individuals, track disease progression, and measure the effectiveness of interventions fuels the rapid growth of this segment.

By End User

On the basis of end user, the healthcare analytics market is segmented into healthcare payers, healthcare providers, Accountable Care Organizations (ACOs), Health Insurance Exchanges (HIEs), Managed Care Organizations (MCOs) and Third-Party Administrators (TPAs). The healthcare providers segment accounted for the largest market revenue share in 2024, driven by the widespread adoption of analytics in hospitals, clinics, and other care delivery settings to enhance patient care, improve operational efficiency, and support clinical decision-making.

The healthcare payers segment is projected to have the fastest CAGR from 2025 to 2032 due to the increasing demand for cost-effective care, growing adoption of digital health solutions, stricter regulatory requirements, the urgency to prevent fraud, and the expansion of value-based care models

Healthcare Analytics Market Regional Analysis

- North America dominates the healthcare analytics market with the largest revenue share of 37.1% in 2024, driven by a strong demand for value-based care and the widespread adoption of advanced digital health infrastructure. The region's leadership in healthcare analytics is supported by a robust network of electronic health record (EHR) systems, high healthcare spending, and a strong regulatory framework encouraging data interoperability and real-time decision-making

- Consumers and healthcare providers in North America highly value the ability of analytics platforms to deliver predictive insights, optimize clinical outcomes, and enhance operational efficiency across hospitals and health systems

- This widespread adoption is further fueled by government initiatives such as the HITECH Act and the 21st Century Cures Act, as well as the presence of key players such as Optum, IBM Watson Health, and SAS, which are continuously advancing AI-driven and cloud-based analytics solutions to meet evolving clinical and administrative needs

U.S. Healthcare Analytics Market Insight

The U.S. healthcare analytics market captured the largest revenue share of 36.2% within North America in 2024, fueled by the rapid adoption of advanced digital health technologies and the increasing focus on value-based care. Healthcare providers are prioritizing the use of predictive and prescriptive analytics to enhance patient outcomes, optimize operational efficiency, and reduce costs. The growing integration of AI and machine learning in clinical decision support systems, combined with widespread electronic health record (EHR) adoption, is significantly driving the healthcare analytics market. Furthermore, government initiatives supporting health IT modernization and data interoperability continue to strengthen market expansion.

Europe Healthcare Analytics Market Insight

The European healthcare analytics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and the rising demand for data-driven patient care. The aging population and increasing chronic disease burden are accelerating the adoption of advanced analytics tools for improved disease management and healthcare resource planning. European healthcare systems emphasize patient safety, data security, and outcome-based care, encouraging investment in comprehensive analytics platforms. The growing presence of AI-powered solutions in hospitals and clinics, alongside government support for digital health innovation, is fostering robust market growth.

U.K. Healthcare Analytics Market Insight

The U.K. healthcare analytics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the NHS’s increasing digital transformation efforts and an emphasis on enhancing patient safety and clinical effectiveness. The adoption of healthcare analytics solutions supports personalized medicine, population health management, and predictive modeling to reduce hospital readmissions and improve care quality. Government policies promoting data sharing and interoperability, along with investments in health IT infrastructure, are key factors propelling market growth in the U.K. The focus on cost containment and efficiency gains further boosts demand for healthcare analytics tools.

Germany Healthcare Analytics Market Insight

The German healthcare analytics market is expected to expand at a considerable CAGR during the forecast period, fueled by growing healthcare digitization and the demand for patient-centric, data-driven care. Germany’s strong healthcare infrastructure and commitment to innovation promote the integration of analytics in clinical workflows and hospital management. The market benefits from increasing investments in AI and big data solutions to enhance diagnostics, treatment planning, and operational efficiency. Enhanced regulatory frameworks and rising healthcare expenditure further support the adoption of advanced healthcare analytics technologies in Germany.

Asia-Pacific Healthcare Analytics Market Insight

The Asia-Pacific healthcare analytics market is poised to grow at the fastest CAGR of 8.5% in 2024, driven by expanding healthcare investments, rising technological adoption, and increasing healthcare awareness across key markets such as China, Japan, and India. Government initiatives promoting healthcare digitization and modernization, along with rising demand for population health management and chronic disease monitoring, are major growth factors. The region is also benefiting from increasing affordability and accessibility of analytics platforms, supported by growing local manufacturing capabilities and a rapidly expanding healthcare infrastructure.

Japan Healthcare Analytics Market Insight

The Japan healthcare analytics market is gaining momentum due to the country’s advanced technological landscape, aging population, and increasing demand for precision healthcare solutions. Japanese healthcare providers emphasize patient safety and continuous monitoring, driving adoption of AI-powered analytics and IoT integration within healthcare systems. The government’s push towards healthcare innovation and smart hospitals facilitates widespread implementation of healthcare analytics tools. Japan’s focus on improving clinical outcomes and managing chronic diseases among elderly populations is accelerating market growth.

China Healthcare Analytics Market Insight

The China healthcare analytics market accounted for the largest revenue share in Asia Pacific in 2024, attributed to rapid urbanization, expanding healthcare infrastructure, and aggressive adoption of digital health technologies. China’s healthcare sector is increasingly leveraging AI, big data, and cloud-based analytics to improve hospital efficiency, disease surveillance, and personalized medicine. Strong government support for healthcare reform and investments in health IT ecosystems are significant drivers. In addition, the rising prevalence of chronic diseases and increasing patient demand for quality care further boost the market.

Healthcare Analytics Market Share

The healthcare analytics industry is primarily led by well-established companies, including:

- IBM (U.S.)

- Wipro (India)

- Veradigm LLC (U.S.)

- Health Catalyst (U.S.)

- Inovalon (U.S.)

- MCKESSON CORPORATION (U.S.)

- MedeAnalytics, Inc. (U.S.)

- Optum, Inc. (U.S.)

- Oracle (U.S.)

- SAS Institute Inc. (U.S.)

- ExlService Holdings, Inc. (U.S.)

- CitiusTech Inc (U.S.)

- IQVIA (U.S.)

- General Electric Company (U.S.)

Latest Developments in Global Healthcare Analytics Market

- In May 2024, BrightInsight and Google Cloud expanded their partnership to integrate Google's Gemini models and Vertex AI into BrightInsight's Disease Management Solution. This collaboration aims to enhance patient applications, accelerate research and development, and provide actionable insights from patient data for improved outcomes

- In May 2024, the World Economic Forum and Capgemini launched a global "Digital Healthcare Transformation Community." This initiative aims to foster health data collaboration, promote interoperability, and support universal health coverage through data sharing initiatives

- In May 2024, SOPHiA GENETICS announced a collaboration with Microsoft and NVIDIA to develop a streamlined, scalable whole genome sequencing (WGS) analytical solution. Hosted on Microsoft Azure and powered by NVIDIA Parabricks, this new application seeks to provide fully analyzed whole genome insights within the same day, benefiting patients with cancer and rare genetic disorders

- In March 2024, Komodo Health launched MapView, a no-code analytics tool within its MapLab platform. This tool is designed to accelerate patient cohort analysis and provide real-time insights, improving efficiency for life sciences professionals

- In February 2025, IBM Watson Health acquired a healthcare analytics firm specializing in AI for clinical decision support, further strengthening its portfolio in intelligent healthcare solutions. This strategic acquisition highlights a growing trend of major tech companies investing heavily in the healthcare analytics space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.