Global Gyroscope Market

Market Size in USD Billion

CAGR :

%

USD

4.06 Billion

USD

6.09 Billion

2024

2032

USD

4.06 Billion

USD

6.09 Billion

2024

2032

| 2025 –2032 | |

| USD 4.06 Billion | |

| USD 6.09 Billion | |

|

|

|

|

Gyroscope Market Size

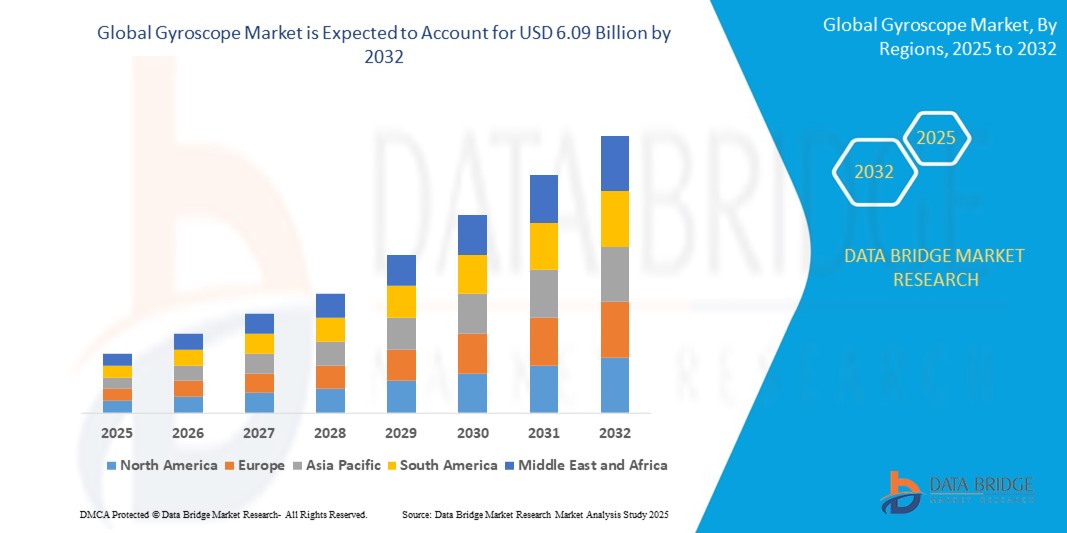

- The global gyroscope market size was valued at USD 4.06 billion in 2024 and is expected to reach USD 6.09 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by the rising adoption of gyroscopes across smartphones, autonomous vehicles, drones, and defense systems, driven by technological advancements in MEMS and fiber optic gyroscope technologies enabling greater precision, miniaturization, and cost-efficiency

- Furthermore, increasing demand for accurate navigation, motion sensing, and stability control across consumer electronics, automotive, aerospace, and industrial sectors is establishing gyroscopes as essential components for enhanced performance, reliability, and automation. These converging factors are accelerating gyroscope integration across diverse applications, thereby significantly boosting market growth

Gyroscope Market Analysis

- Gyroscopes are devices that measure angular velocity and orientation, enabling precise motion detection, navigation, and stabilization across a wide range of applications including smartphones, vehicles, aerospace platforms, industrial machinery, and defense systems

- The escalating demand for gyroscopes is primarily fueled by the growing deployment of autonomous vehicles, unmanned systems, smart consumer devices, and advanced defense technologies, as well as the need for accurate, real-time orientation and navigation solutions in both commercial and military environments

- North America dominated the gyroscope market with a share of 39.2% in 2024, due to increasing demand for advanced navigation systems, autonomous vehicles, and consumer electronics integration

- Asia-Pacific is expected to be the fastest growing region in the gyroscope market during the forecast period due to rapid industrialization, urbanization, and technological advancements across China, Japan, India, and South Korea

- MEMS gyroscope segment dominated the market with a market share of 48.8% in 2024, due to its compact size, low cost, and high integration with modern electronic devices. MEMS gyroscopes are extensively used in smartphones, tablets, wearable devices, and automotive safety systems, driven by advancements in miniaturization and the growing demand for motion-sensing capabilities across consumer and industrial applications. Their ability to offer reliable angular velocity measurement while maintaining low power consumption makes them the preferred choice in portable electronics and IoT devices

Report Scope and Gyroscope Market Segmentation

|

Attributes |

Gyroscope Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Gyroscope Market Trends

“Rising Adoption of MEMS Gyroscopes”

- A significant and accelerating trend in the global gyroscope market is the rising adoption of MEMS (Micro-Electro-Mechanical Systems) gyroscopes in consumer electronics, automotive, and aerospace applications such as smartphones, drones, and advanced driver-assistance systems

- For instance, companies such as STMicroelectronics and Bosch Sensortec are launching high-performance MEMS gyroscopes that offer compact size, low power consumption, and high sensitivity for integration into portable devices and autonomous systems

- The development of multi-axis MEMS gyroscopes enables advanced motion sensing and stabilization features in products such as virtual reality headsets, wearable fitness trackers, and robotics

- MEMS gyroscopes provide advantages such as reduced size, lower cost, and improved reliability compared to traditional mechanical and fiber optic gyroscopes, supporting widespread adoption across diverse industries

- This trend toward miniaturization and enhanced functionality is fundamentally reshaping product design and innovation in sectors such as consumer electronics and automotive safety. Companies such as Analog Devices and InvenSense are investing in research and development to improve gyroscope accuracy and robustness for demanding applications

- The demand for MEMS gyroscopes is growing rapidly across both established and emerging markets, as manufacturers increasingly prioritize compactness, performance, and cost efficiency in navigation and motion-sensing solutions

Gyroscope Market Dynamics

Driver

“Increasing Demand for Navigation Systems”

- The growing need for precise and reliable navigation systems in automotive, aerospace, marine, and consumer electronics is a significant driver for the global gyroscope market

- For instance, Honeywell and Northrop Grumman are supplying advanced gyroscope solutions for use in aircraft inertial navigation, missile guidance, and spacecraft attitude control

- As industries seek to enhance vehicle safety, automation, and autonomous operation, gyroscopes offer critical capabilities such as orientation sensing, motion tracking, and stabilization

- The trend toward connected vehicles, unmanned aerial vehicles, and smart transportation infrastructure is making gyroscopes an essential component for real-time navigation and control

- The convenience of integrating gyroscopes with GPS, accelerometers, and other sensors in multi-sensor fusion systems is propelling adoption in both commercial and defense applications. The expansion of autonomous vehicles and smart mobility solutions further contributes to market growth

Restraint/Challenge

“High Manufacturing Costs”

- Concerns surrounding the high manufacturing costs of precision gyroscopes, especially those required for aerospace and defense applications, pose a significant challenge to broader market adoption

- For instance, the production of high-accuracy fiber optic and ring laser gyroscopes by companies such as KVH Industries and Safran Electronics & Defense involves complex fabrication processes and stringent quality controls

- Addressing these challenges through advancements in MEMS technology, economies of scale, and streamlined manufacturing is crucial for reducing costs and expanding market access. Companies such as Bosch Sensortec and Analog Devices are focusing on cost-effective production methods and scalable designs

- The need for specialized materials, cleanroom facilities, and skilled personnel can be a barrier for new entrants and smaller manufacturers, impacting overall industry competitiveness

- Overcoming these challenges through industry collaboration, increased automation, and ongoing investment in research and development will be vital for sustained market growth and affordability

Gyroscope Market Scope

The market is segmented on the basis of technology type, product type, and end-user.

• By Technology Type

On the basis of technology type, the gyroscope market is segmented into MEMS gyroscope, fiber optic gyroscope (FOG), ring laser gyroscope (RLG), hemispherical resonator gyroscope (HRG), dynamically tuned gyroscope (DTG), and others. The MEMS gyroscope segment dominated the largest market revenue share of 48.8% in 2024, attributed to its compact size, low cost, and high integration with modern electronic devices. MEMS gyroscopes are extensively used in smartphones, tablets, wearable devices, and automotive safety systems, driven by advancements in miniaturization and the growing demand for motion-sensing capabilities across consumer and industrial applications. Their ability to offer reliable angular velocity measurement while maintaining low power consumption makes them the preferred choice in portable electronics and IoT devices.

The fiber optic gyroscope (FOG) segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption in aerospace, defense, and autonomous navigation systems. FOGs offer superior precision and resistance to electromagnetic interference, making them ideal for applications requiring high-accuracy inertial navigation, such as submarines, spacecraft, and unmanned vehicles. The growing emphasis on autonomous technologies, military modernization, and space exploration programs further propels the demand for advanced fiber optic gyroscopes.

• By Product Type

On the basis of product type, the gyroscope market is segmented into smartphones, tablets, cameras, game consoles, laptops, navigational devices, and others. The smartphones segment accounted for the largest market revenue share in 2024, driven by the ubiquitous integration of gyroscopes to enhance user experience in applications such as gaming, augmented reality (AR), navigation, and motion tracking. Gyroscopes in smartphones contribute to improved screen orientation, image stabilization, and immersive app functionalities, making them indispensable in the global smartphone ecosystem.

The navigational devices segment is expected to register the fastest CAGR from 2025 to 2032, fueled by rising demand for accurate positioning and orientation in vehicles, drones, and marine vessels. Navigational devices equipped with advanced gyroscopes enable reliable performance in GPS-denied environments, essential for critical defense, aviation, and maritime applications. The increasing deployment of autonomous vehicles and drones further amplifies the growth potential of high-performance gyroscope-enabled navigation systems.

• By End User

On the basis of end user, the gyroscope market is segmented into consumer electronics, automotive, aerospace and defense, industrial, marine, and others. The consumer electronics segment dominated the market revenue share in 2024, owing to the widespread use of gyroscopes in smartphones, gaming devices, virtual reality (VR) headsets, and smart wearables. The integration of gyroscopes in these devices enhances motion detection, gaming experiences, gesture recognition, and augmented reality functionalities, aligning with rising consumer expectations for interactive and responsive technology.

The aerospace and defense segment is projected to experience the fastest CAGR from 2025 to 2032, driven by the critical role of gyroscopes in inertial navigation, flight stabilization, and targeting systems. The demand for high-precision, durable gyroscopes is intensifying with the increasing adoption of unmanned aerial vehicles (UAVs), space exploration missions, and advanced military platforms. Moreover, ongoing investments in defense modernization and space programs worldwide are significantly contributing to the robust growth of gyroscopes in aerospace and defense applications.

Gyroscope Market Regional Analysis

- North America dominated the gyroscope market with the largest revenue share of 39.2% in 2024, driven by increasing demand for advanced navigation systems, autonomous vehicles, and consumer electronics integration

- The region’s technological maturity and strong presence of aerospace, defense, and automotive industries are major contributors to the widespread use of gyroscopes in various applications

- Growing investments in defense modernization, space exploration, and autonomous vehicle development continue to strengthen the demand for high-performance gyroscopes across North America

U.S. Gyroscope Market Insight

The U.S. gyroscope market captured the largest revenue share within North America in 2024, fueled by the country’s leadership in aerospace, defense, and consumer electronics sectors. The growing focus on autonomous vehicle technologies, space missions, and military modernization is significantly driving gyroscope demand. Furthermore, the high penetration of smartphones, gaming devices, and wearable electronics is propelling the adoption of MEMS gyroscopes for motion sensing and enhanced user experiences.

Europe Gyroscope Market Insight

The Europe gyroscope market is projected to expand at a substantial CAGR during the forecast period, driven by increasing investments in defense, aerospace, and industrial automation. Stringent safety standards and the rising need for precise navigation in both military and commercial sectors are fostering gyroscope adoption. The region is also witnessing notable demand for gyroscopes in consumer electronics, particularly in smartphones, tablets, and gaming devices.

U.K. Gyroscope Market Insight

The U.K. gyroscope market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the growing emphasis on defense capabilities, autonomous transport, and smart technologies. The increasing integration of gyroscopes in navigation systems for vehicles, defense platforms, and industrial equipment is contributing to market growth. Additionally, the rising demand for consumer electronics with motion-sensing features is boosting the adoption of MEMS gyroscopes.

Germany Gyroscope Market Insight

The Germany gyroscope market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong automotive and industrial sectors. With Germany being a hub for automotive innovation and Industry 4.0 initiatives, the need for gyroscopes in vehicle stability, navigation, and robotic automation is rising. Furthermore, advancements in aerospace technologies and growing adoption of high-precision fiber optic and ring laser gyroscopes are bolstering market growth.

Asia-Pacific Gyroscope Market Insight

The Asia-Pacific gyroscope market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, fueled by rapid industrialization, urbanization, and technological advancements across China, Japan, India, and South Korea. The rising production and consumption of smartphones, tablets, and navigation devices are driving MEMS gyroscope demand. Additionally, increasing investments in defense, aerospace, and autonomous vehicle development across the region are contributing to significant market expansion.

Japan Gyroscope Market Insight

The Japan gyroscope market is gaining momentum due to the country’s leadership in robotics, automotive, and consumer electronics industries. The growing demand for advanced navigation systems in autonomous vehicles and high-precision gyroscopes for aerospace and defense applications is fueling market growth. Japan’s strong focus on innovation, combined with its well-established electronics manufacturing base, supports the widespread adoption of both MEMS and fiber optic gyroscopes.

China Gyroscope Market Insight

The China gyroscope market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country's booming consumer electronics industry, rapid advancements in autonomous vehicles, and significant investments in defense and space programs. China is a major manufacturing hub for MEMS gyroscopes used in smartphones, gaming devices, and wearables. Furthermore, the country’s increasing deployment of drones, robotics, and navigation systems is accelerating the demand for high-performance gyroscope technologies.

Gyroscope Market Share

The gyroscope industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- Bosch Sensortec GmbH (Germany)

- Analog Devices, Inc. (U.S.)

- Trimble Inc. (U.S.)

- Murata Manufacturing Co., Ltd (Japan)

- Silicon Sensing Systems Limited (U.K.)

- Parker Hannifin Corp (U.S.)

- MEMSIC Semiconductor Co., Ltd. (China)

- Northrop Grumman (U.S.)

- EMCORE Corporation (U.S.)

- KVH Industries, Inc (U.S.)

- Safran (France)

- TDK Corporation (Japan)

- GEM elettronica (Italy)

- Optolink (Italy)

- STMicroelectronics (Switzerland)

- ROHM Co., Ltd. (U.S.)

- VectorNav Technologies, LLC (U.S.)

- NXP Semiconductors (Netherlands)

- Epson America, Inc (U.S.)

- Ina Labs (U.S.)

Latest Developments in Global Gyroscope Market

- In July 2024, Honeywell collaborated with Odys Aviation to create state-of-the-art ground control stations to facilitate the deployment of Odys Aviation’s hybrid VTOL aircraft throughout the Middle East and Pacific regions. This partnership aims to enhance operational efficiency and support the growing demand for advanced aerial mobility solutions in these areas

- In July 2024, Moog entered a strategic partnership with Finnair Technical Service, aimed at providing Finnair with global access to Moog's component pool and comprehensive repair support for various part numbers used in the airline’s fleet

- In March 2024, Honeywell acquired Civitanavi Systems, a company specializing in position, navigation, and timing technology for the aerospace and defense sectors

- In October 2023, Honeywell expanded its HGuide industrial navigation portfolio by introducing the HGuide i400 Inertial Measurement Unit (IMU). This new IMU is designed for a variety of defense, industrial, and autonomous applications across air, land, and sea vehicles. With a Gyro Bias Repeatability of less than one degree per hour, the HGuide i400 sets a new benchmark for compact precision, measuring only 28 mm x 25 mm without sacrificing performance

- In September 2023, EMCORE Corporation launched the TAC-440 MEMS Inertial Measurement Unit (IMU), the world's smallest 1°/hour IMU. This ultra-compact unit, under five cubic inches, offers superior performance as a form, fit, and function-compatible replacement for the Honeywell 1930 and 4930 IMUs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gyroscope Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gyroscope Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gyroscope Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.