Global Graphite Recycling Market

Market Size in USD Million

CAGR :

%

USD

66.25 Million

USD

101.68 Million

2024

2032

USD

66.25 Million

USD

101.68 Million

2024

2032

| 2025 –2032 | |

| USD 66.25 Million | |

| USD 101.68 Million | |

|

|

|

|

Graphite Recycling Market Size

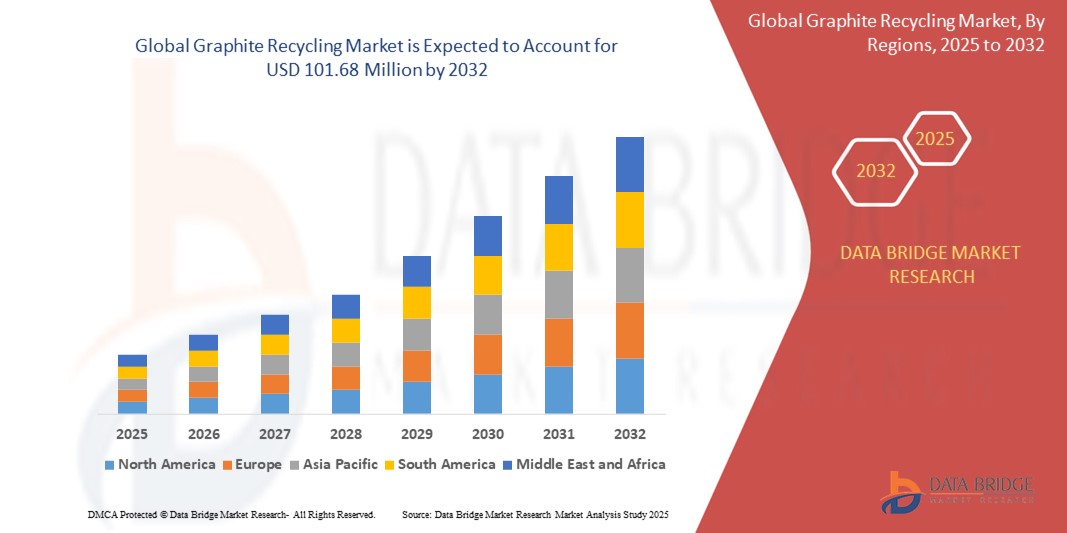

- The global graphite recycling market was valued at USD 66.25 million in 2024 and is expected to reach USD 101.68 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.5%, primarily driven by the growing demand for sustainable materials in industrial applications

- This growth is driven by factors such as the increasing use of electric vehicles, rising demand for graphite in energy storage systems, and environmental regulations promoting recycling practices

Graphite Recycling Market Analysis

- Graphite recycling plays a vital role in sustainable industrial practices by reclaiming valuable graphite from manufacturing waste, spent batteries, refractories, and other graphite-rich products. Recycled graphite is used across sectors such as metallurgy, batteries, lubricants, and electronics

- The demand for recycled graphite is significantly driven by the global shift toward circular economy models, rising consumption of lithium-ion batteries, and the need to reduce dependence on natural graphite mining. The growing electric vehicle (EV) and energy storage markets are especially key drivers

- The Asia-Pacific region stands out as one of the dominant regions for graphite recycling, fueled by a high concentration of battery manufacturers, government support for green energy initiatives, and a strong industrial base

- For instance, countries like China and South Korea have rapidly expanded their graphite recycling capabilities to support booming EV and electronics sectors. These nations are not only major consumers but also innovators in graphite recycling technologies

- Globally, recycled graphite is increasingly viewed as a strategic material, especially in high-demand sectors like clean energy and electronics. Its ability to reduce environmental impact while meeting industrial-grade requirements positions it as a pivotal component in the future of sustainable manufacturing

Report Scope and Graphite Recycling Market Segmentation

|

Attributes |

Graphite Recycling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Graphite Recycling Market Trends

“Increasing Focus on Sustainable Practices and Circular Economy”

- One prominent trend in the global graphite recycling market is the growing focus on sustainable practices and the adoption of circular economy models

- These approaches prioritize reducing waste and conserving natural resources by recycling graphite from various sources such as spent batteries, manufacturing scrap, and used electronics

- For instance, recycled graphite is increasingly being used in the production of new batteries for electric vehicles (EVs) and energy storage systems, significantly reducing the environmental impact of mining

- The integration of advanced recycling technologies has enhanced the efficiency and quality of recovered graphite, making it a more viable and sustainable alternative to mined graphite

- This trend is reshaping the graphite supply chain, driving demand for recycled graphite, and positioning it as a critical material for a greener, more sustainable industrial future

Graphite Recycling Market Dynamics

Driver

“Increasing Demand for Sustainable Graphite due to Growing Use in Electric Vehicles (EVs) and Energy Storage”

- The rising demand for electric vehicles (EVs) and energy storage systems is significantly contributing to the increased demand for recycled graphite

- As global adoption of EVs accelerates, the need for lithium-ion batteries—one of the largest consumers of graphite—has surged, creating a significant market for recycled graphite to reduce dependency on mined resources

- The global shift towards renewable energy and energy storage solutions also increases the need for graphite, as it is a key material in the construction of batteries for grid storage and solar energy systems

- Recycling graphite reduces environmental impact by conserving natural graphite resources, thus supporting the circular economy and meeting the rising demand for sustainable materials

- As demand for clean energy and green technologies grows, so does the need for recycled graphite to support these innovations in the energy and automotive sectors

For instance,

- In 2023, a report from the International Energy Agency (IEA) highlighted that the global EV market is projected to grow at an accelerated pace, leading to an increased demand for critical materials like graphite. This trend is acting as a key driver for the global graphite recycling market, as recycling becomes a crucial solution to meet this demand sustainably

- In 2022, the U.S. Department of Energy’s Advanced Research Projects Agency-Energy (ARPA-E) initiative highlighted the need for developing advanced battery recycling technologies to ensure a sustainable supply of materials for energy storage systems, which heavily rely on graphite

- As a result, the increasing demand for sustainable graphite to support clean energy initiatives and EV adoption is significantly driving the growth of the global graphite recycling market

Opportunity

“Advancing Graphite Recycling with Automation and AI Integration”

- AI-powered systems and automation technologies are increasingly being integrated into graphite recycling processes to enhance efficiency, improve recovery rates, and reduce operational costs

- AI algorithms can analyze large datasets from recycling operations, optimizing graphite recovery and quality control by identifying the best techniques for separating graphite from waste materials

- Additionally, AI-driven predictive maintenance tools can help ensure the longevity and reliability of recycling equipment by forecasting potential issues and preventing downtime, leading to more efficient operations

For instance,

- In 2024, a report from the International Journal of Recycling Technology highlighted the potential of AI to optimize the sorting process in graphite recycling, identifying impurities and improving the quality of the recovered graphite for battery and energy storage applications

- In November 2023, a study by the World Economic Forum demonstrated how AI is being used to enhance the processing of recycled materials in electric vehicle battery production, focusing on maximizing graphite recovery rates and improving overall sustainability

- The integration of AI and automation in graphite recycling can significantly improve the scalability of recycling operations, making recycled graphite a more viable and sustainable option for industries like EVs and energy storage, presenting a key growth opportunity for the market

Restraint/Challenge

“High Recycling Costs and Technical Challenges”

- The high cost of graphite recycling processes poses a significant challenge for the market, particularly in terms of the economic viability and scalability of recycling operations

- The complex processes involved in recovering high-purity graphite from waste materials—such as spent batteries or industrial scrap—require advanced technologies and specialized equipment, which can be costly to implement and maintain

- This substantial financial barrier can deter smaller recycling facilities or companies in developing regions from adopting or scaling up graphite recycling operations, leading to a reliance on mined graphite and limiting the market's growth potential

For instance,

- In September 2024, according to an article published by the International Journal of Energy and Resources, the high costs associated with advanced graphite recovery technologies, such as chemical purification and high-temperature furnaces, present a major hurdle for large-scale adoption of recycling practices in emerging markets

- Consequently, these technical and financial constraints can lead to inefficiencies in graphite recycling operations, resulting in higher costs for recycled graphite and hindering the overall growth and accessibility of sustainable graphite solutions

Graphite Recycling Market Scope

The market is segmented on the basis of source, type, and application

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Type |

|

|

By Application |

|

Graphite Recycling Market Regional Analysis

“North America is the Dominant Region in the Graphite Recycling Market”

- North America dominates the graphite recycling market, driven by its advanced industrial infrastructure, growing electric vehicle (EV) adoption, and increasing demand for sustainable materials in energy storage and battery manufacturing

- The U.S. holds a significant share due to its booming EV industry, government initiatives promoting green energy technologies, and growing investments in battery recycling technologies

- The presence of key market players, such as major battery manufacturers and recycling companies, along with well-established policies encouraging the circular economy, further strengthens the market

- In addition, the rising need for sustainable graphite sourcing to meet the demand in sectors like electronics and renewable energy is fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the graphite recycling market, driven by rapid industrialization, increasing demand for EVs, and government policies promoting recycling and sustainability

- Countries such as China, Japan, and South Korea are emerging as key markets due to their large-scale manufacturing capabilities, strong EV markets, and commitment to green technologies

- China, as a global leader in graphite production and recycling, continues to make significant investments in improving graphite recovery methods, aiming to reduce its reliance on natural graphite mining

- India, with its growing renewable energy sector and increasing adoption of electric mobility, is also witnessing a rise in government and private sector investments to scale up recycling operations and reduce environmental impact. The expanding presence of global recycling firms and improved access to advanced technologies are contributing to market growth in the region

Graphite Recycling Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SGL Carbon SE (Germany)

- Umicore SA (Belgium)

- Dowa Holdings Co., Ltd. (Japan)

- Tokai Carbon Co., Ltd. (Japan)

- Stena Metall AB (Sweden)

- Altilium Group Ltd. (U.K.)

- tozero GmbH (Germany)

- Northern Graphite Corporation (Canada)

- ReElement Technologies, Inc. (U.S.)

- Graphite India Limited (India)

- Tianqi Lithium Corporation (China)

- Zhejiang Jinhui Graphite Co., Ltd. (China)

- Mason Graphite Inc. (Canada)

- Focus Graphite Inc. (Canada)

- Syrah Resources Limited (Australia)

- Graphene Manufacturing Group (Australia)

- NanoXplore Inc. (Canada)

- Lomiko Metals Inc. (Canada)

- Eagle Graphite Incorporated (Canada)

- Tianjin Tianshun Graphite Co., Ltd. (China)

Latest Developments in Global Graphite Recycling Market

- In April 2023, NextSource Materials Inc. successfully launched its Molo Mine in Madagascar, with an annual production capacity of 17,000 tons of graphite. The company is also poised to begin production at its battery anode plant in Mauritius in 2024, with an expected capacity of 3,600 tons per year. The development of the Molo Mine and the planned Mauritius facility not only contributes to securing a reliable supply of natural graphite but also aligns with global efforts to reduce reliance on mined graphite by enhancing the potential for graphite recycling in the future

- In January 2023, Showa Denko K.K. and Showa Denko Materials Co., Ltd. merged to form Resonac Holdings Corporation. The graphite division of Resonac is now headquartered in the U.S., positioning the company as a significant player in the global graphite industry. The strategic focus of Resonac's graphite division further underscores the importance of sustainable sourcing and recycling as the demand for graphite continues to rise

- In October 2024, Hazer Group and Mitsui & Co. announced the extension of their strategic collaboration focused on the advancement of Hazer Graphite, with an emphasis on sustainable graphite production. Hazer’s proprietary technology, which converts natural gas into hydrogen and synthetic graphite, is a key innovation in building a more sustainable and resilient supply chain for graphite—particularly in critical sectors such as electric vehicles (EVs) and battery storage. This initiative is highly relevant to the global graphite recycling market, as it complements recycling efforts by diversifying sustainable graphite sources and reducing dependence on traditional mining

- In July 2024, BASF and Graphit Kropfmühl, a subsidiary of AMG Critical Materials, entered into a strategic partnership aimed at reducing the carbon footprint of graphite production. As part of the initiative, BASF is supplying renewable energy certificates to Graphit Kropfmühl’s Hauzenberg facility, resulting in a minimum 25% reduction in the product carbon footprint of the graphite produced at the site. This sustainably sourced graphite is utilized in BASF’s Neopor insulation materials, further enhancing the environmental performance of its product portfolio. This initiative is highly relevant to the global graphite recycling market, as it emphasizes the growing demand for low-carbon graphite solutions

- In December 2023, Graphite India Limited, a leading graphite producer based in India, announced the acquisition of a 31% equity stake in Godi India, a company specializing in battery materials manufacturing. This strategic investment marks Graphite India’s entry into the advanced battery materials sector, aligning with the increasing demand for energy storage solutions and electric mobility. This development holds significant relevance for the global graphite recycling market, as the integration of upstream graphite production with downstream battery applications highlights the importance of sustainable material sourcing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Graphite Recycling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Graphite Recycling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Graphite Recycling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.