Global Graphene Market

Market Size in USD Billion

CAGR :

%

USD

1.11 Billion

USD

17.04 Billion

2024

2032

USD

1.11 Billion

USD

17.04 Billion

2024

2032

| 2025 –2032 | |

| USD 1.11 Billion | |

| USD 17.04 Billion | |

|

|

|

|

What is the Global Graphene Market Size and Growth Rate?

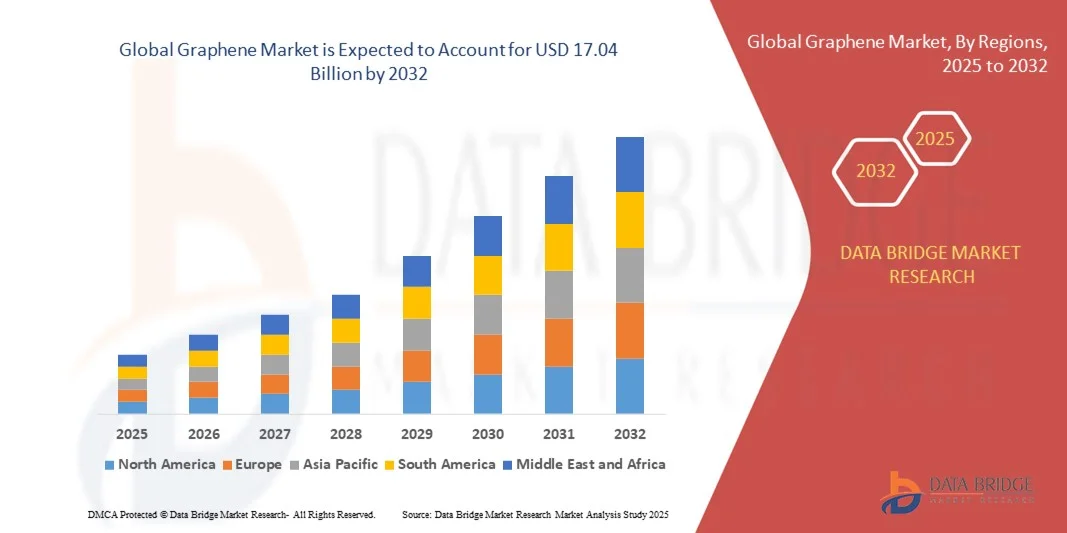

- The global graphene market size was valued at USD 1.11 billion in 2024 and is expected to reach USD 17.04 billion by 2032, at a CAGR of 40.62% during the forecast period

- The graphene market is experiencing rapid growth, driven by its unique properties and diverse applications across various industries. As a one-atom-thick layer of carbon atoms arranged in a hexagonal lattice, graphene exhibits exceptional strength, electrical conductivity, and thermal properties, making it a highly sought-after material in sectors such as electronics, energy storage, and composites

What are the Major Takeaways of Graphene Market?

- Recent developments in graphene production methods, such as chemical vapor deposition and liquid-phase exfoliation, have improved the scalability and cost-effectiveness of graphene manufacturing, facilitating its adoption in commercial applications. For instance, the integration of graphene in batteries is revolutionizing energy storage solutions by significantly enhancing charge capacity and reducing charging times

- In addition, the automotive and aerospace industries are increasingly utilizing graphene-reinforced composites to create lightweight materials that improve fuel efficiency without compromising strength. Furthermore, ongoing research into graphene's potential for use in biomedical applications, such as drug delivery and biosensing, is expanding its market appeal

- North America dominated the graphene market with the largest revenue share of 34.68% in 2024, driven by growing industrial adoption, investments in advanced materials, and a strong presence of key market players

- The Asia-Pacific graphene market is expected to witness the fastest CAGR of 7.98% during 2025–2032, driven by rising manufacturing capabilities, technological adoption, and expanding industrial demand in countries such as China, Japan, and India

- The Graphene Oxide segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its versatility and widespread adoption across coatings, composites, and energy storage applications

Report Scope and Graphene Market Segmentation

|

Attributes |

Graphene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Graphene Market?

Rising Adoption of Advanced Functional Applications

- A major trend in the global Graphene market is the increasing adoption of graphene across high-performance applications such as energy storage, electronics, composites, and coatings. This trend is driven by graphene’s exceptional mechanical, thermal, and electrical properties, which enable enhanced product performance and energy efficiency

- For instance, companies such as Applied Graphene Materials are incorporating graphene into coatings to provide superior corrosion resistance and conductivity, while Graphenea is supplying high-quality graphene for flexible electronics and sensors. These applications demonstrate graphene’s expanding role in multiple industries

- Graphene integration enables lightweight, durable, and highly conductive solutions, fostering innovations such as improved battery electrodes, enhanced thermal interface materials, and next-generation electronic devices. For instance, First Graphene has developed graphene-enhanced composites that improve structural strength without adding significant weight

- The widespread adoption of graphene in industrial applications is supported by partnerships between material manufacturers and end-use sectors, creating new opportunities for functional innovation in automotive, aerospace, and electronics

- This trend is reshaping expectations for material performance, pushing manufacturers to incorporate graphene-based solutions to gain a competitive edge. Companies such as Talga Group are developing graphene-enhanced products for energy storage and advanced composites, highlighting the market’s evolution toward functional, high-performance materials

- The growing demand for graphene in high-value applications is driving investments in R&D, production scale-up, and commercial deployment, signaling robust long-term growth potential for the market

What are the Key Drivers of Graphene Market?

- The rapid growth of electronics, energy storage, and advanced composites is a key driver for the graphene market, as industries increasingly require materials with superior strength, conductivity, and flexibility

- For instance, in 2024, Graphene One expanded its production of graphene powders for lithium-ion battery anodes, catering to the growing electric vehicle sector. Such strategic expansions are expected to fuel market growth

- Graphene’s lightweight and high-strength properties make it a preferred material for aerospace, automotive, and industrial applications, promoting the adoption of graphene-enhanced composites

- The push for energy-efficient solutions, including high-capacity batteries, supercapacitors, and thermal management systems, is creating new opportunities for graphene integration

- Availability of scalable graphene production technologies, such as chemical vapor deposition (CVD) and exfoliation, is facilitating commercial adoption across multiple industries. These advancements, combined with the increasing focus on sustainability and eco-friendly materials, are contributing to market expansion

Which Factor is Challenging the Growth of the Graphene Market?

- High production costs and scalability issues continue to challenge the broad adoption of graphene, particularly in cost-sensitive sectors. Producing consistent, high-quality graphene at large scale remains technically complex

- For instance, inconsistencies in material properties from different manufacturers can affect performance in sensitive applications, leading some end-users to hesitate in adoption.

- Technical challenges related to integrating graphene into existing products and manufacturing processes can increase development timelines and costs. Companies such as ACS Material and SuZhou Graphene Nanotech emphasize R&D to overcome these barriers, but high upfront investment remains a concern

- Market growth is also restrained by limited awareness and technical expertise among end-users regarding graphene’s potential benefits and proper utilization

- Overcoming these challenges through cost-effective production, standardized quality, strategic partnerships, and demonstration of performance advantages is critical for sustained growth in the graphene market

How is the Graphene Market Segmented?

The market is segmented on the basis of product type, application, and end-user.

- By Product Type

On the basis of product type, the Graphene market is segmented into Graphene Oxide, Graphene Nanoplatelets, Mono-layer and Bi-layer Graphene, Graphene Sheets and Films, Few Layer Graphene (FLG), Nanoribbons, and Others. The Graphene Oxide segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its versatility and widespread adoption across coatings, composites, and energy storage applications. Graphene Oxide’s exceptional mechanical, thermal, and electrical properties, combined with its ease of dispersion in various matrices, make it highly suitable for industrial and commercial applications.

The Nanoplatelets segment is anticipated to witness the fastest growth rate of 22.3% from 2025 to 2032, fueled by increasing demand in high-performance composites, electronics, and thermal management solutions. Nanoplatelets offer superior surface area, conductivity, and mechanical strength, supporting next-generation materials development.

- By Application

On the basis of application, the Graphene market is segmented into Composites, Paints, Coatings, and Inks, Energy Storage and Harvesting, Electronics, Catalyst Tires, and Others. The Composites segment held the largest market revenue share in 2024, driven by the automotive, aerospace, and construction sectors seeking lightweight and high-strength materials.

The Energy Storage and Harvesting segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the rising adoption of lithium-ion batteries, supercapacitors, and renewable energy systems that benefit from graphene-enhanced performance.

- By End User

On the basis of end user, the Graphene market is segmented into Automotive and Transportation, Aerospace, Electronics, Bio-medical and Healthcare, Military and Defense, and Others. The Automotive and Transportation segment accounted for the largest market revenue share in 2024, owing to the integration of graphene in tires, lightweight composites, and battery components for electric vehicles.

The Electronics segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for graphene in flexible electronics, sensors, and high-performance semiconductor devices.

Which Region Holds the Largest Share of the Graphene Market?

- North America dominated the graphene market with the largest revenue share of 34.68% in 2024, driven by growing industrial adoption, investments in advanced materials, and a strong presence of key market players

- Companies in the region leverage Graphene for high-performance applications across electronics, energy storage, and composites, increasing its demand

- The market’s growth is further supported by well-established research infrastructure, technological expertise, and high R&D spending, positioning North America as a leading consumer and innovator of Graphene products

U.S. Graphene Market Insight

The U.S. graphene market captured the largest revenue share of 81% in 2024 within North America, fueled by investments in aerospace, automotive, and electronics sectors. The demand for lightweight composites, enhanced battery technologies, and conductive materials drives market expansion. Furthermore, strong government support for advanced material research and active collaborations between academia and industry significantly contribute to growth.

Europe Graphene Market Insight

The Europe graphene market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising industrial applications in automotive, aerospace, and energy storage. Supportive regulations promoting sustainability and lightweight materials encourage adoption. The integration of Graphene in composites, coatings, and electronic devices further strengthens market growth across multiple European countries.

U.K. Graphene Market Insight

The U.K. graphene market is expected to grow at a noteworthy CAGR during the forecast period, fueled by the country’s focus on advanced materials research, government funding, and technology-driven startups. Increasing investments in automotive and electronics sectors, alongside collaborations with universities for innovative applications, are key growth drivers.

Germany Graphene Market Insight

The Germany graphene market is poised to expand at a considerable CAGR, supported by strong industrial infrastructure, emphasis on precision engineering, and sustainable technology adoption. The integration of Graphene into composites, energy storage, and electronic components is gaining traction, particularly for applications in the automotive and manufacturing industries.

Which Region is the Fastest Growing Region in the Graphene Market?

The Asia-Pacific graphene market is expected to witness the fastest CAGR of 7.98% during 2025–2032, driven by rising manufacturing capabilities, technological adoption, and expanding industrial demand in countries such as China, Japan, and India. Increased investment in research and development, government initiatives promoting advanced materials, and the growing electronics and energy sectors fuel regional growth.

Japan Graphene Market Insight

The Japan graphene market is gaining momentum due to high R&D investments, technological innovation, and strong industrial adoption. Graphene is increasingly applied in electronics, automotive components, and energy devices. The aging population and emphasis on sustainable, high-performance materials also spur growth across both commercial and industrial applications.

China Graphene Market Insight

The China graphene market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rapid industrialization, urbanization, and the country’s position as a global manufacturing hub. Strong domestic production, government incentives for advanced materials, and growing applications in energy storage, electronics, and automotive sectors are driving market expansion.

Which are the Top Companies in Graphene Market?

The graphene industry is primarily led by well-established companies, including:

- Applied Graphene Materials (U.K.)

- 2D Carbon Graphene Material Co., Ltd. (China)

- Thomas Swan & Co. Ltd. (U.K.)

- Metalgrass LTD (U.K.)

- Graphensic AB (Sweden)

- Graphene SQUARE INC (U.S.)

- AMO GmbH (Germany)

- Talga Group (Australia)

- ACS Material (U.S.)

- Transport company BGT (U.K.)

- CVD Equipment Corporation (U.S.)

- Directa Plus S.p.A. (Italy)

- Grafoid Inc (Canada)

- Graphenea, Inc. (Spain)

- NanoXplore Inc. (Canada)

- Haydale Graphene Industries plc (U.K.)

- Zentek Ltd. (Canada)

- Suzhou Graphene Nanotech. Co., Ltd. (China)

- Global Graphene Group (U.S.)

- GrapheneNanoChem (U.K.)

- First Graphene (Australia)

- Graphene One (U.S.)

What are the Recent Developments in Global Graphene Market?

- In April 2023, Haydale formed a partnership with CERN, the European particle physics laboratory, for a project focused on enhancing the longevity of lubricants through the incorporation of functionalized nanomaterials, including graphen

- In March 2023, Universal Matter UK Limited, a subsidiary of Universal Matter Inc., announced its acquisition of Applied Graphene Materials UK Limited and Applied Graphene Materials LLC, the key operating subsidiaries of Applied Graphene Materials PLC. This acquisition has reinforced the company's market presence

- In February 2023, Global Graphene Group revealed that Honeycomb Battery Company, its advanced battery technology subsidiary, signed a business combination agreement with Nubia Brand International Corp. to develop battery materials, with Honeycomb Battery Company expected to utilize graphene produced by Global Graphene Group

- In August 2022, Universal Matter entered into a three-year collaborative innovation agreement with the ChemQuest Technology Institute, strengthening the growth and validation of Universal Matter's graphene technology derived from sustainable feedstocks

- In May 2022, Imkemex, located in Mumbai, India, and Applied Graphene Materials formed an exclusive distribution agreement. This collaboration aims to enhance AGM's commercial presence in the region's liquid resins, coatings, composites, and polymers sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Graphene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Graphene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Graphene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.