Global Golf Equipment Market

Market Size in USD Billion

CAGR :

%

USD

8.43 Billion

USD

11.28 Billion

2024

2032

USD

8.43 Billion

USD

11.28 Billion

2024

2032

| 2025 –2032 | |

| USD 8.43 Billion | |

| USD 11.28 Billion | |

|

|

|

|

What is the Global Golf Equipment Market Size and Growth Rate?

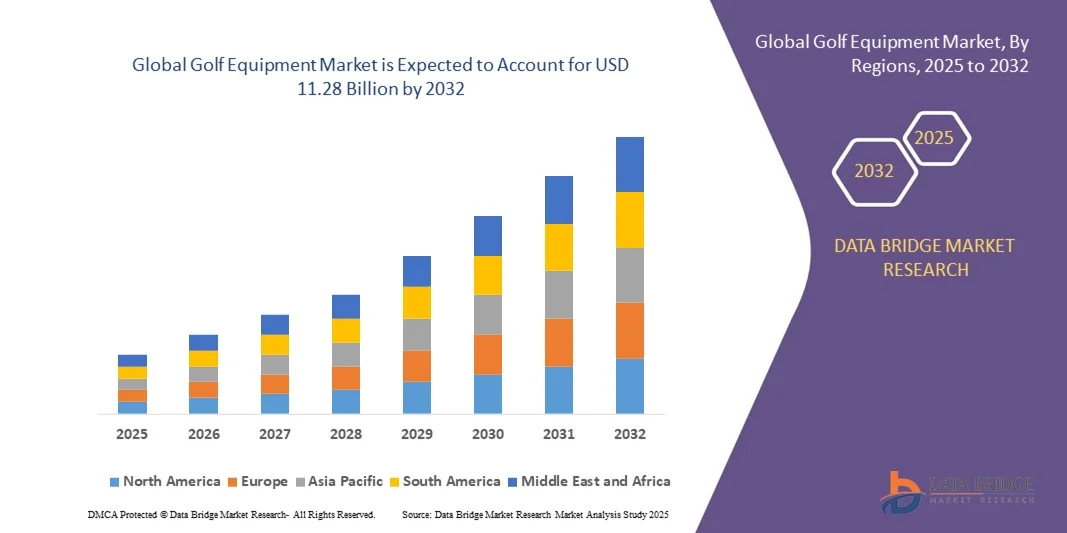

- The global Golf Equipment market size was valued at USD 8.43 billion in 2024 and is expected to reach USD 11.28 billion by 2032, at a CAGR of 3.71% during the forecast period

- The global golf equipment market is experiencing robust growth, driven by several key factors. Increasing participation in golf, fueled by rising disposable incomes and a growing interest in recreational sports, is a primary driver. The sport's popularity is particularly high in North America, where a culture of luxury and leisure, supports sustained demand for premium golf equipment

- Technological advancements in golf equipment, such as the development of high-performance clubs and balls, are also enhancing the playing experience, attracting more enthusiasts and professionals

What are the Major Takeaways of Golf Equipment Market?

- Exclusive product offerings, strategic collaborations, and endorsements by professional golfers are bolstering market growth. However, the high cost of advanced equipment and economic fluctuations can pose challenges to market stability

- Overall, the golf equipment market is poised for substantial growth, underpinned by increasing global interest in the sport and continuous product innovation

- North America dominated the golf equipment market with the largest revenue share of 33.65% in 2024, driven by a high demand for premium golf equipment, growing awareness of advanced technology in sports, and the strong presence of professional golf tournaments

- The Asia-Pacific Golf Equipment market is poised to grow at the fastest CAGR of 9.41% during 2025–2032, driven by rapid urbanization, rising disposable incomes, and increasing interest in golf as a recreational and professional sport in countries such as China, Japan, India, and South Korea

- The Golf Clubs segment dominated the market with the largest revenue share of 38.5% in 2024, driven by strong demand from both professional and amateur golfers seeking performance-enhancing clubs

Report Scope and Golf Equipment Market Segmentation

|

Attributes |

Golf Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Golf Equipment Market?

Advanced Technology Integration and Smart Features

- A major and accelerating trend in the global golf equipment market is the incorporation of advanced technologies, including AI-driven swing analysis, sensors, and connected platforms that enhance performance tracking and training insights. This integration is revolutionizing how golfers of all skill levels optimize their game

- For instance, smart golf clubs and sensors can analyze swing speed, trajectory, and clubface impact, providing instant feedback via connected apps. Companies such as Arccos and Shot Scope offer AI-powered wearables and clubs that deliver actionable insights to improve performance

- AI and sensor integration enables features such as personalized coaching, predictive analytics, and performance tracking over time, helping golfers refine techniques. Voice-enabled apps also allow golfers to access real-time statistics hands-free, enhancing convenience on the course

- The seamless connection of golf equipment with smartphones and tablets enables centralized management of performance data, allowing golfers to monitor progress, compare statistics, and plan training sessions efficiently

- This trend toward data-driven, tech-enhanced equipment is reshaping golfer expectations, pushing companies such as Callaway and TaylorMade to develop smart clubs, connected rangefinders, and AI-assisted training tools

- The growing demand for technologically advanced golf equipment is evident across amateur and professional segments, as consumers increasingly prioritize performance optimization, convenience, and personalized training experiences

What are the Key Drivers of Golf Equipment Market?

- The rising popularity of golf worldwide and increasing participation in amateur and professional tournaments are major drivers of the golf equipment market

- For instance, in 2024, Callaway introduced the Apex Pro 21, leveraging advanced materials and AI-based design to enhance performance, reflecting industry-wide innovation strategies expected to drive market growth

- Golfers are seeking equipment that improves performance, accuracy, and consistency, encouraging demand for technologically advanced clubs, smart balls, and GPS-enabled rangefinders

- Furthermore, the increasing influence of professional tours and celebrity endorsements encourages adoption of premium golf equipment among enthusiasts and beginners asuch as

- The convenience of connected apps, performance tracking, and remote coaching tools adds value, while the trend of personalized, AI-assisted golf equipment continues to drive growth across both amateur and professional segments

Which Factor is Challenging the Growth of the Golf Equipment Market?

- The high cost of technologically advanced golf equipment and smart devices presents a significant barrier to adoption, particularly among budget-conscious consumers

- For instance, smart sensors, AI-assisted clubs, and connected rangefinders often carry premium price tags, which may limit accessibility in emerging markets

- Moreover, integrating advanced technology requires consumer familiarity and willingness to adopt digital tools, which can slow uptake among traditional golfers

- While prices for basic equipment remain affordable, the perceived premium for AI-enabled clubs, sensors, and connected apps can restrain growth in certain regions

- To overcome these challenges, companies are focusing on developing cost-effective solutions, educating consumers about the benefits of smart equipment, and providing seamless user experiences to encourage widespread adoption

How is the Golf Equipment Market Segmented?

The market is segmented on the basis of ty product and distribution channel.

- By Product

On the basis of product, the golf equipment market is segmented into Golf Balls, Golf Clubs, Golf Shoes, Golf Bags and Accessories, Apparel, Footwear, and Others. The Golf Clubs segment dominated the market with the largest revenue share of 38.5% in 2024, driven by strong demand from both professional and amateur golfers seeking performance-enhancing clubs. Technological innovations, including AI-assisted club fitting, advanced materials, and precision engineering, have further fueled the popularity of golf clubs. In addition, clubs form the core of any golfer’s kit, making them indispensable and a primary driver of revenue in the market.

The Golf Balls segment is anticipated to witness the fastest growth rate of 20.3% from 2025 to 2032, driven by the introduction of high-performance balls with optimized aerodynamics, spin control, and distance enhancement, appealing to both recreational and competitive golfers. Overall, product innovation and performance optimization continue to drive revenue across the Golf Equipment product portfolio.

- By Distribution Channel

On the basis of distribution channel, the golf equipment market is segmented into Offline Retail Stores, Sports Goods Chains, Specialty Sports Shops, On-Course Shops, Online Stores, and Others. The Offline Retail Stores segment held the largest revenue share of 42% in 2024, as customers value the ability to physically test and experience equipment before purchase. Large retail outlets and sports chains provide a wide range of products, expert guidance, and brand credibility, making them the preferred choice for most consumers.

The Online Stores segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, driven by the growing adoption of e-commerce, convenience of home delivery, product comparison tools, and virtual club-fitting technologies. Online channels are increasingly providing tailored solutions, personalized recommendations, and access to premium brands, making them a rapidly expanding segment. The rise of omnichannel strategies also complements this growth, bridging physical and digital retail experiences.

Which Region Holds the Largest Share of the Golf Equipment Market?

- North America dominated the golf equipment market with the largest revenue share of 33.65% in 2024, driven by a high demand for premium golf equipment, growing awareness of advanced technology in sports, and the strong presence of professional golf tournaments

- Consumers in the region highly value product quality, brand reputation, and innovation, making North America a key hub for both recreational and professional golfers

- This widespread adoption is further supported by high disposable incomes, well-established sports infrastructure, and increasing participation in golf-related activities, establishing North America as the leading market for golf equipment

U.S. Golf Equipment Market Insight

The U.S. golf equipment market captured the largest revenue share of 81% in 2024 within North America, driven by strong consumer preference for technologically advanced equipment, including smart golf clubs, high-performance balls, and GPS-enabled accessories. Rising participation in amateur and professional tournaments, coupled with innovations in product design and performance optimization, continues to propel the market. In addition, the presence of key global brands and retail chains enhances accessibility, ensuring sustained growth.

Europe Golf Equipment Market Insight

The Europe golf equipment market is projected to expand at a substantial CAGR throughout the forecast period, fueled by increasing participation in golf, rising demand for premium and eco-friendly equipment, and the expansion of golf courses across urban areas. European consumers prioritize quality, durability, and performance, contributing to steady market growth. Countries such as the U.K., Germany, and France are experiencing growth in both recreational and professional segments, with emphasis on technologically advanced clubs and balls.

U.K. Golf Equipment Market Insight

The U.K. golf equipment market is expected to grow at a noteworthy CAGR during the forecast period, driven by increased participation in golf as a recreational and professional sport. Growing awareness about the health and social benefits of golf, along with the expansion of golf clubs and retail networks, supports adoption. In addition, consumer preference for technologically enhanced equipment, such as smart clubs and performance-tracking balls, is expected to sustain growth.

Germany Golf Equipment Market Insight

The Germany golf equipment market is anticipated to witness steady growth, driven by the country’s focus on sports innovation, high disposable incomes, and increasing awareness about fitness and recreational sports. German consumers show preference for high-quality, sustainable, and precision-engineered products. Integration of smart technologies in clubs, balls, and accessories enhances performance monitoring, which further propels adoption in both professional and recreational segments.

Which Region is the Fastest Growing Region in the Golf Equipment Market?

The Asia-Pacific golf equipment market is poised to grow at the fastest CAGR of 9.41% during 2025–2032, driven by rapid urbanization, rising disposable incomes, and increasing interest in golf as a recreational and professional sport in countries such as China, Japan, India, and South Korea. Expansion of golf courses, growing tourism-related golfing facilities, and government initiatives promoting sports infrastructure are fueling growth.

Japan Golf Equipment Market Insight

The Japan golf equipment market is gaining momentum due to the country’s high participation in golf and technological adoption in sports equipment. Consumers prefer high-precision, performance-oriented golf clubs, balls, and smart accessories. The integration of wearable and tracking devices with golf equipment enhances training and performance, further boosting demand across amateur and professional segments.

China Golf Equipment Market Insight

The China golf equipment market accounted for the largest revenue share in Asia-Pacific in 2024, owing to rising interest in golf among the middle and upper-middle-class population, expansion of golf courses, and increasing awareness of health and recreational activities. Growth is supported by domestic and international brands offering innovative and affordable equipment, making golf increasingly accessible to new players and driving overall market expansion.

Which are the Top Companies in Golf Equipment Market?

The golf equipment industry is primarily led by well-established companies, including:

- Acushnet Holdings Corp (U.S.)

- Roger Cleveland Golf Company, Inc. (U.S.)

- Golfsmith International Holdings, Inc. (U.S.)

- Amer Sports (Finland)

- Bridgestone Corporation (Japan)

- Callaway Golf (U.S.)

- TaylorMade Golf Co. (U.S.)

- PING (U.S.)

- Wilson Sporting Goods (U.S.)

- MIZUNO GOLF (U.S.)

- Dunlop Sports Co. Ltd. (Japan)

- Turner Sports Interactive Inc. (U.S.)

- Dixon Golf (U.S.)

- Ralph Lauren (U.S.)

- Under Armour, Inc. (U.S.)

- Dick's Sporting Goods (U.S.)

What are the Recent Developments in Global Golf Equipment Market?

- In May 2023, the Ladies Professional Golf Association (LPGA) launched an exclusive range of affordable golf clubs, accessories, and footwear specifically designed for female beginners and children. These select products are being sold exclusively at Walmart, improving accessibility to entry-level golf equipment for women and girls, and supporting greater participation in the sport

- In January 2023, Callaway Golf, a leader in golf equipment design and innovation, introduced its new Paradym Family of Woods and Irons. These products are engineered to deliver enhanced distance, forgiveness, and a complete performance upgrade, offering golfers a modern, high-quality playing experience

- In May 2022, Cool Clubs, the global leader in personalized golf club fitting technology, launched SpinLaunch, a cutting-edge golf equipment testing statistic. This innovation provides precise performance analytics, helping golfers improve their swing and overall game, and reinforcing the company’s commitment to technological advancement in golf

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL GOLF EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL GOLF EQUIPMENT MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL GOLF EQUIPMENT MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 BRAND ANALYSIS

5.7 RAW MATERIAL SOURCING ANALYSIS

5.8 IMPORT EXPORT SCENARIO

6 BRAND OUTLOOK GRID

7 IMPACT OF ECONOMIC SLOWDOWN

7.1 IMPACT ON PRICES

7.2 IMPACT ON SUPPLY CHAIN

7.3 IMPACT ON SHIPMENT

7.4 IMPACT ON DEMAND

7.5 IMPACT ON STRATEGIC DECISIONS

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 GLOBAL GOLF EQUIPMENT MARKET, BY PRODUCT,2022-2031,(USD MILLION), (MILLION UNITS)

9.1 OVERVIEW

9.2 GOLF CLUBS

9.2.1 GOLF CLUBS, BY TYPE

9.2.1.1. WOODS

9.2.1.2. IRONS

9.2.1.3. HYBRIDS

9.2.1.4. WEDGES

9.2.2 WEDGES, BY TYPE

9.2.2.1. PITCHING WEDGES

9.2.2.2. GAP WEDGES

9.2.2.3. SAND WEDGES

9.2.2.4. LOB WEDGES

9.2.3 PUTTERS

9.3 BALL

9.3.1 BALL, BY CONSTRUCTION

9.3.1.1. ONE-PIECE GOLF BALLS

9.3.1.2. TWO-PIECE GOLF BALLS

9.3.1.3. THREE-PIECE GOLF BALLS

9.3.1.4. FOUR-PIECE GOLF BALLS

9.3.1.5. FIVE-PIECE GOLF BALLS

9.3.2 BALL, BY SPIN

9.3.2.1. LOW SPIN GOLF BALLS

9.3.2.2. MID SPIN GOLF BALLS

9.3.2.3. HIGH SPIN GOLF BALLS

9.4 BALL MARKERS

9.5 GOLF BAG

9.5.1 GOLF BAG, BY TYPE

9.5.1.1. TOUR BAGS

9.5.1.2. CART BAGS

9.5.1.3. STAND BAGS

9.5.1.4. PENCIL BAGS

9.5.1.5. TRAVEL BAGS

9.6 GOLF CART

9.6.1 GOLF CART, BY TYPE

9.6.1.1. PUSH CARTS

9.6.1.2. PULL CARTS

9.6.1.3. GAS CARTS

9.6.1.4. ELECTRIC CARTS

9.6.1.5. DIESEL CARTS

9.6.1.6. REMOTE CONTROLLED GOLF CARTS

9.6.1.7. OTHERS

9.7 APPAREL

9.7.1 POLO SHIRTS

9.7.1.1. POLO SHIRTS, BY TYPE

9.7.1.1.1. SLEEVELESS

9.7.1.1.2. WITH SLEEVES

9.7.1.1.3. HALF SLEEVES

9.7.1.1.4. ¾ SLEEVES

9.7.1.1.5. FULL SLEEVES

9.7.1.2. POLO SHIRTS, BY NECK TYPE

9.7.1.2.1. BUTTONED

9.7.1.2.2. V-NECK

9.7.2 JACKETS

9.7.2.1. TOPWEAR, BY MATERIAL TYPE

9.7.2.1.1. POLYSTER

9.7.2.1.2. 1

9.7.2.1.3. 0.83

9.7.2.1.4. OTHERS

9.7.2.1.5. NYLON

9.7.2.1.6. WATER RESISTANT

9.7.2.1.7. OTHERS

9.7.2.2. TOPWEAR, BY SIZE

9.7.2.2.1. X-SMALL

9.7.2.2.2. SMALL

9.7.2.2.3. MEDIUM

9.7.2.2.4. LARGE

9.7.2.2.5. X-LARGE

9.7.2.2.6. 2X-LARGE

9.7.2.2.7. 3X-LARGE

9.7.3 TOWELS

9.7.4 GLOVES

9.7.4.1. GLOVES, BY TYPE

9.7.4.1.1. LEATHER

9.7.4.1.2. SYNTHETIC

9.7.4.1.3. ALL-WEATHER

9.7.4.1.4. THERMAL

9.7.4.1.5. OTHERS

9.7.5 BOTTOMWEAR

9.7.5.1. BOTTOMWEAR, BY TYPE

9.7.5.1.1. FULL LENGTH PANTS

9.7.5.1.2. HALF LENGTH PANTS

9.7.5.1.3. WATER RESISTANT

9.7.5.2. BOTTOMWEAR, BY SIZE

9.7.5.2.1. SMALL

9.7.5.2.2. MEDIUM

9.7.5.2.3. LARGE

9.7.5.2.4. X-LARGE

9.7.5.2.5. 2X-LARGE

9.7.5.2.6. 3X-LARGE

9.8 FOOTWEAR

9.8.1 BY TYPE

9.8.1.1. SPIKED SHOES

9.8.1.2. SPIKELESS SHOES

9.8.1.3. BOOTS

9.8.1.4. SANDALS

9.8.1.5. WATER REISTANT

9.8.2 BY SIZE

9.8.2.1. UNDER 8D

9.8.2.2. 8D

9.8.2.3. 8.5D

9.8.2.4. 9D

9.8.2.5. 9D AND ABOVE

9.8.3 BY PRICE-BASED

9.8.3.1. ECONOMY

9.8.3.2. MID

9.8.3.3. PREMIUM

9.8.3.4. SUPER-PREMIUM

9.8.4 BY SHOE MATERIALS

9.8.4.1. LEATHER

9.8.4.1.1. GENUINE LEATHER

9.8.4.1.2. TAN GENUINE LEATHER

9.8.4.1.3. SUEDE LEATHER

9.8.4.1.4. SYNTHETIC LEATHER

9.8.4.1.5. OTHERS

9.8.4.2. TEXTILES

9.8.4.2.1. COTTON

9.8.4.2.2. POLYESTER

9.8.4.2.3. WOOL

9.8.4.2.4. NYLON

9.8.4.2.5. OTHERS

9.8.4.3. SYNTHETIC

9.8.4.4. RUBBER

9.8.4.5. FOAM

9.8.4.5.1. OPEN CELL

9.8.4.5.2. CLOSED CELL

9.8.4.6. OTHERS

9.9 GEAR

9.1 OTHERS

10 GLOBAL GOLF EQUIPMENT MARKET, BY DEMOGRAPHICS, 2022-2031,(USD MILLION),

10.1 OVERVIEW

10.2 MEN

10.3 WOMEN

10.4 KIDS

11 GLOBAL GOLF EQUIPMENT MARKET, BY PRICE RANGE, 2022-2031,(USD MILLION),

11.1 OVERVIEW

11.2 ECONOMY

11.3 MID RANGE

11.4 PREMIUM

11.5 SUPER PREMIUM

12 GLOBAL GOLF EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL,2022-2031,(USD MILLION),

12.1 OVERVIEW

12.2 OFFLINE

12.2.1 SUPERMARKETS & HYPERMARKETS

12.2.2 DEPARTMENTAL STORES

12.2.3 SPECIALTY STORES/BRAND STORES

12.2.4 SPORT STORES

12.2.5 GOLF RESORTS AND CLUBS

12.2.6 OTHERS

12.3 ONLINE

12.3.1 E-COMMERCE WEBSITE

12.3.2 COMPANY OWNED WEBSITE

13 GLOBAL GOLF EQUIPMENT, BY REGION, (2022-2031), (USD MILLION)

Global GOLF EQUIPMENT Market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 U.K.

13.2.3 ITALY

13.2.4 FRANCE

13.2.5 SPAIN

13.2.6 RUSSIA

13.2.7 SWITZERLAND

13.2.8 TURKEY

13.2.9 BELGIUM

13.2.10 NETHERLANDS

13.2.11 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 SINGAPORE

13.3.6 THAILAND

13.3.7 INDONESIA

13.3.8 MALAYSIA

13.3.9 PHILIPPINES

13.3.10 AUSTRALIA & NEW ZEALAND

13.3.11 REST OF ASIA-PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 UNITED ARAB EMIRATES

13.5.5 ISRAEL

13.5.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL GOLF EQUIPMENT MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS AND ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

16 GLOBAL GOLF EQUIPMENT MARKET – COMPANY PROFILE

16.1 CALLAWAY GOLF COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 SWOT ANALYSIS

16.1.4 REVENUE ANALYSIS

16.1.5 RECENT UPDATES

16.2 NIKE, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 SWOT ANALYSIS

16.2.4 REVENUE ANALYSIS

16.2.5 RECENT UPDATES

16.3 DIXON GOLF, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 SWOT ANALYSIS

16.3.4 REVENUE ANALYSIS

16.3.5 RECENT UPDATES

16.4 MIZUNO CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 SWOT ANALYSIS

16.4.4 REVENUE ANALYSIS

16.4.5 RECENT UPDATES

16.5 BRIDGESTONE GOLF, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 SWOT ANALYSIS

16.5.4 REVENUE ANALYSIS

16.5.5 RECENT UPDATES

16.6 SUMITOMO RUBBER INDUSTRIES

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 SWOT ANALYSIS

16.6.4 REVENUE ANALYSIS

16.6.5 RECENT UPDATES

16.7 TAYLORMADE GOLF COMPANY, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 SWOT ANALYSIS

16.7.4 REVENUE ANALYSIS

16.7.5 RECENT UPDATES

16.8 ACUSHNET HOLDINGS CORP.( FILA HOLDING CORPORATION)

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 SWOT ANALYSIS

16.8.4 REVENUE ANALYSIS

16.8.5 RECENT UPDATES

16.9 AMER SPORTS CORPORATION

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 SWOT ANALYSIS

16.9.4 REVENUE ANALYSIS

16.9.5 RECENT UPDATES

16.1 DECATHLON GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 SWOT ANALYSIS

16.10.4 REVENUE ANALYSIS

16.10.5 RECENT UPDATES

16.11 YONEX CO., LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 SWOT ANALYSIS

16.11.4 REVENUE ANALYSIS

16.11.5 RECENT UPDATES

16.12 ADIDAS AG

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 SWOT ANALYSIS

16.12.4 REVENUE ANALYSIS

16.12.5 RECENT UPDATES

16.13 PUMA SE

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 SWOT ANALYSIS

16.13.4 REVENUE ANALYSIS

16.13.5 RECENT UPDATES

16.14 KARSTEN MANUFACTURING CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 SWOT ANALYSIS

16.14.4 REVENUE ANALYSIS

16.14.5 RECENT UPDATES

16.15 WILSON SPORTING GOODS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 SWOT ANALYSIS

16.15.4 REVENUE ANALYSIS

16.15.5 RECENT UPDATES

16.16 BIG MAX GOLF

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 SWOT ANALYSIS

16.16.4 REVENUE ANALYSIS

16.16.5 RECENT UPDATES

16.17 YONEX CO., LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 SWOT ANALYSIS

16.17.4 REVENUE ANALYSIS

16.17.5 RECENT UPDATES

16.18 ROGER CLEVELAND GOLF COMPANY, INC

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 SWOT ANALYSIS

16.18.4 REVENUE ANALYSIS

16.18.5 RECENT UPDATES

16.19 DUNLOP SPORTS CO. LTD

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 SWOT ANALYSIS

16.19.4 REVENUE ANALYSIS

16.19.5 RECENT UPDATES

16.2 RALPH LAUREN

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 SWOT ANALYSIS

16.20.4 REVENUE ANALYSIS

16.20.5 RECENT UPDATES

16.21 UNDER ARMOUR, INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 SWOT ANALYSIS

16.21.4 REVENUE ANALYSIS

16.21.5 RECENT UPDATES

16.22 DICK'S SPORTING GOODS

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 SWOT ANALYSIS

16.22.4 REVENUE ANALYSIS

16.22.5 RECENT UPDATES

16.23 DYNAMIC BRANDS(BAGBOY)

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 SWOT ANALYSIS

16.23.4 REVENUE ANALYSIS

16.23.5 RECENT UPDATES

16.24 SUNMOUNTAINSPORTS.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 SWOT ANALYSIS

16.24.4 REVENUE ANALYSIS

16.24.5 RECENT UPDATES

16.25 FORGAN OF ST ANDREWS(CONFIDENCE SPORTING GOODS, INC)

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 SWOT ANALYSIS

16.25.4 REVENUE ANALYSIS

16.25.5 RECENT UPDATES

16.26 ASICS CORPORATION

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 SWOT ANALYSIS

16.26.4 REVENUE ANALYSIS

16.26.5 RECENT UPDATES

16.27 DUCA DEL COSMA

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 SWOT ANALYSIS

16.27.4 REVENUE ANALYSIS

16.27.5 RECENT UPDATES

16.28 NEW BALANCE

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 SWOT ANALYSIS

16.28.4 REVENUE ANALYSIS

16.28.5 RECENT UPDATES

17 QUESTIONAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.