Global Gluten Free Products Market

Market Size in USD Billion

CAGR :

%

USD

7.23 Billion

USD

11.91 Billion

2024

2032

USD

7.23 Billion

USD

11.91 Billion

2024

2032

| 2025 –2032 | |

| USD 7.23 Billion | |

| USD 11.91 Billion | |

|

|

|

|

Gluten-Free Products Market Size

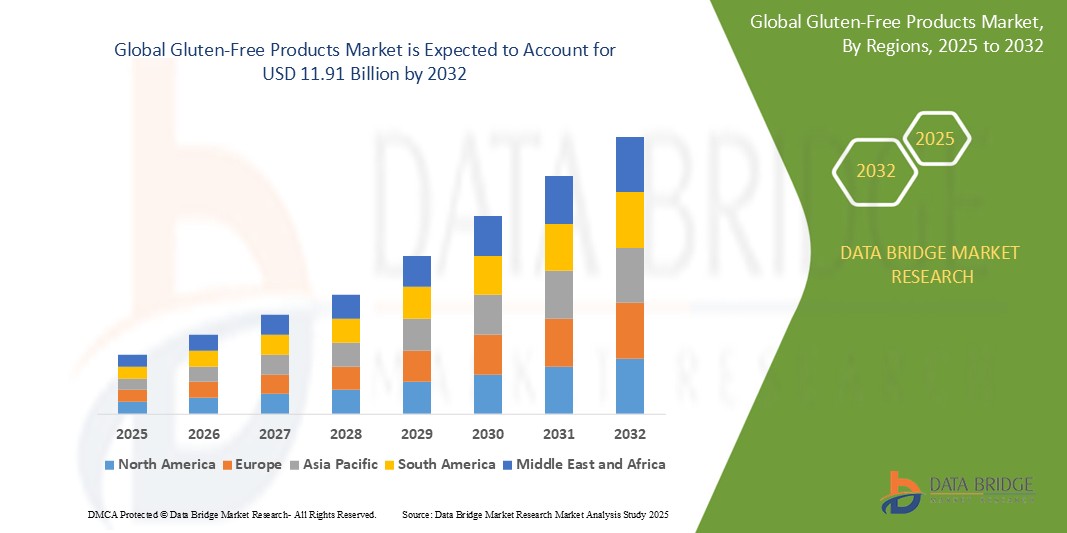

- The global gluten-free products market size was valued at USD 7.23 billion in 2024 and is expected to reach USD 11.91 billion by 2032, at a CAGR of 6.44% during the forecast period

- The market growth is largely fueled by increasing consumer awareness about gluten intolerance and a rising trend toward healthier, clean-label diets

- Rising prevalence of celiac disease and gluten sensitivity is driving demand for gluten-free alternatives across all age groups globally, as consumers seek to manage health conditions through dietary changes

- Expansion of gluten-free offerings in mainstream retail is making these products more accessible, with major brands and supermarkets increasing shelf space and variety to meet growing demand

Gluten-Free Products Market Analysis

- The gluten-free products market is currently driven by the growing popularity of bakery items such as bread, cookies, and cakes, which attract consumers seeking convenient and tasty gluten-free options for everyday consumption

- The well-known brands expanding their gluten-free baked goods range have seen strong customer acceptance, making bakery products a key focus area in the market

- North America dominates the gluten-free products market with the largest revenue share of 35.06% in 2024, driven by strong consumer awareness and early adoption of gluten-free diets across both medical and lifestyle segments

- Asia-pacific is expected to be the fastest growing region in the gluten-free products market due to increasing urbanization, rising disposable incomes, and technological advancements in countries

- The bakery products segment held the largest market revenue share of 38.13% in 2024, driven by the strong demand for gluten-free alternatives to traditional bread, cakes, and pastries.

Report Scope and Gluten-Free Products Market Segmentation

|

Attributes |

Gluten-Free Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gluten-Free Products Market Trends

“Increasing Consumer Demand for Healthier Food Options”

- The gluten-free bakery market is experiencing significant growth, driven by increasing consumer demand for healthier and more inclusive food options

- For instance, Arnott's, a major player in the Australian biscuit industry, has expanded its gluten-free product line since its launch in 2021, with sales reaching $35.6 million and comprising 3% of its total biscuit sales

- This growth is primarily fueled by the increasing popularity of gluten-free bakery products, which accounted for the largest revenue share of 30.8% in 2024

- The rise in health-conscious consumers and those with gluten sensitivities is fueling the demand for gluten-free bakery products

- Technological advancements in food processing and ingredient innovation have improved the taste and texture of gluten-free baked goods, making them more appealing to a broader audience

- The consistent demand for gluten-free bakery items underscores their central role in driving overall market growth and shaping consumer purchasing preferences across retail shelves

Gluten-Free Products Market Dynamics

Driver

“Growing Consumer Awareness of Gluten-Related Health Issues”

- Increasing consumer awareness about gluten-related health issues such as celiac disease, gluten sensitivity, and wheat allergies is driving demand for gluten-free products as more people seek alternatives beyond diagnosed cases

- Celiac disease causes damage to the small intestine and symptoms such as digestive discomfort and fatigue, while non-celiac gluten sensitivity affects many who experience similar issues without intestinal damage, expanding the gluten-free consumer base

- Social media influencers and health campaigns have boosted awareness of the benefits of gluten-free diets for digestive health and overall well-being, attracting health-conscious consumers who adopt gluten-free as a lifestyle choice—for instance, the rise of gluten-free recipe creators on platforms such as Instagram and YouTube

- Food manufacturers are responding by investing in gluten-free product lines with wider variety and availability across baked goods, snacks, and beverages, such as General Mills expanding its gluten-free Cheerios lineup to meet growing demand

- The combination of increased health diagnoses and rising lifestyle adoption is encouraging continuous innovation and market expansion, making gluten-free products more accessible and appealing to a broader audience

Restraint/Challenge

“Higher Production Costs and Limited Ingredient Availability”

- Higher production costs are a major challenge in the gluten-free products market due to the need for alternative flours such as rice, almond, sorghum, and tapioca, which are more expensive than traditional wheat flour and increase overall manufacturing expenses

- Manufacturers face additional costs by implementing strict cross-contamination controls and often require separate processing lines or dedicated facilities to meet gluten-free certification standards, making production more complex and costly, especially for smaller businesses

- Sourcing quality gluten-free raw materials is difficult because many depend on specific growing conditions and have limited distribution, leading to supply shortages, price volatility, and disruptions in manufacturing consistency

- The higher retail prices of gluten-free products compared to conventional foods limit their accessibility, particularly for price-sensitive consumers, restricting the market mainly to niche buyers and slowing broader adoption

- Addressing these challenges will require innovations in ingredient sourcing, scaling up production, and improving processing efficiencies, but until such advances become widespread, cost and supply constraints will continue to restrain market growth

Gluten-Free Products Market Scope

The global gluten-free Products Market is segmented on the basis of source, type, and distribution channel.

- By Source

On the basis of source, the gluten-free products market is segmented into animal source and plant source. The plant source segment dominates the market, driven by its wide applicability and increasing consumer preference for natural, wholesome ingredients. This segment includes various gluten-free flours and plant-based alternatives that align with clean-label trends and offer nutritional completeness.

The animal source segment is anticipated to witness significant growth, fueled by the demand for protein-rich, gluten-free options such as dairy and processed meats among consumers following specific diets such as low-carb or ketogenic. Increasing awareness of gluten intolerance also drives manufacturers to ensure the absence of cross-contamination in these products.

- By Type

On the basis of type, the gluten-free products market is segmented into bakery products, snacks & RTE products, pizzas & pastas, condiments & dressings, seasonings & spreads, desserts & ice creams, rice, and others. The bakery products segment held the largest market revenue share of 38.13% in 2024, driven by the strong demand for gluten-free alternatives to traditional bread, cakes, and pastries. Innovations in food technology have significantly improved the taste and texture of these products, appealing to a broad consumer base.

The desserts & ice creams segment is expected to witness the fastest CAGR from 2025 to 2033, propelled by the rising prevalence of celiac disease and gluten intolerance, alongside growing consumer demand for healthier and specialized indulgent options. Product innovation, including plant-based varieties and improved flavors, is a key driver for this segment.

- By Distribution Channel

On the basis of distribution channel, the gluten-free products market is segmented into convenience stores, specialty stores, and drugstores & pharmacies. The supermarkets & hypermarkets segment held the largest market share of 30.12% in 2024, attributed to their extensive reach, wide product assortments, and the convenience they offer to consumers seeking a diverse range of gluten-free items.

The online retail segment is anticipated to witness the fastest CAGR from 2025 to 2030, driven by the increasing consumer preference for the convenience of home delivery, competitive pricing, and the vast selection of gluten-free products available through e-commerce platforms. This channel offers enhanced accessibility, particularly for niche or specialty gluten-free items.

Gluten-Free Products Market Regional Analysis

- North America dominates the gluten-free products market with the largest revenue share of 35.06% in 2024, driven by strong consumer awareness and early adoption of gluten-free diets across both medical and lifestyle segments

- High diagnosis rates of celiac disease and gluten sensitivity in the U.S. have led to widespread demand for gluten-free alternatives, supported by national health organizations and proactive labeling regulations

- Major food manufacturers and retailers in North America have expanded their gluten-free product lines, making a broad variety of options readily available in mainstream supermarkets and specialty stores

U.S. Gluten-Free Products Market Insight

The U.S. gluten-free products market captured a significant revenue share within North America in 2025, fueled by increasing health awareness and specific dietary needs. a notable driver is the growing popularity of plant-based and organic gluten-free products, aligning with broader health trends such as veganism and organic diets. the market is also benefiting from the expansion of product variety and innovation, with manufacturers catering to diverse consumer needs across categories such as bakery products, dairy alternatives, and prepared meals. the increasing availability of these products in traditional grocery stores, specialized health food stores, and online platforms further propels the industry. this is supported by rising diagnoses of celiac disease and gluten sensitivity, alongside a general consumer perception that gluten-free diets offer significant health benefits, such as improved digestion and weight control.

Europe Gluten-Free Products Market Insight

The European gluten-free products market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing consumer awareness regarding health and wellness, and the rising prevalence of celiac disease and gluten sensitivity. Many individuals are adopting gluten-free diets not solely due to medical necessity but also for perceived health benefits, leading to a diversified product offering from manufacturers. The market is witnessing a shift towards clean-label products, reflecting consumer preference for transparency in ingredients. The foodservice sector is increasingly catering to gluten-free demands, with more restaurants offering suitable options. Furthermore, innovations in product formulations, improving taste and texture, and the growing penetration of e-commerce channels are significantly contributing to the market's expansion across the region.

U.K. Gluten-Free Products Market Insight

The U.K. gluten-free products market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by escalating health consciousness among consumers and the desire for improved well-being. The increasing prominence of private-label brands and the growing demand for organic gluten-free food products are key accelerators. Concerns regarding various health issues, including gastrointestinal disturbances, are encouraging both homeowners and businesses to choose gluten-free solutions. The Uk’s embrace of health-oriented lifestyles, alongside its robust e-commerce and retail infrastructure, is expected to continue to stimulate market growth, with a particular demand for gluten-free bakery products.

Germany Gluten-Free Products Market Insight

The German gluten-free products market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of health and dietary preferences. The rise in gluten-related health issues, such as celiac disease and gluten sensitivity, has led more individuals to adopt gluten-free diets, prompting a surge in demand for alternatives. Germany’s well-developed infrastructure, combined with its emphasis on innovation and sustainability, promotes the adoption of gluten-free products, particularly in bakery and confectionery, and prepared foods. The integration of gluten-free products with broader health and wellness trends is also becoming increasingly prevalent, with a strong preference for secure, clean-label, and technologically advanced solutions aligning with local consumer expectations.

Asia-Pacific Gluten-Free Products Market Insight

The Asia-pacific gluten-free products market is poised to grow at the fastest CAGR in 2025, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards healthier lifestyles and the increasing concern regarding food allergies and intolerances are driving the adoption of gluten-free products. Supported by government initiatives promoting digitalization and health awareness, the market is seeing a surge in demand for prepared gluten-free foods. Furthermore, as APAC emerges as a manufacturing hub for gluten-free product components and systems, the affordability and accessibility of gluten-free products are expanding to a wider consumer base.

Japan Gluten-Free Products Market Insight

The Japan gluten-free products market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and a growing demand for health-conscious food options. The Japanese market places a significant emphasis on health, with consumers increasingly perceiving gluten-free diets as beneficial for overall well-being, even without a diagnosed intolerance. The adoption of gluten-free products is also influenced by the increasing number of foreign tourists who require such dietary options. Innovations in gluten-free ingredients, particularly the increased use of rice flour, are fueling product development. Moreover, Japan's high-tech culture and the integration of gluten-free products with other dietary trends contribute to its growth in both residential and commercial sectors.

China Gluten-Free Products Market Insight

The China gluten-free products market accounted for the largest market revenue share in Asia pacific in 2025, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. China stands as one of the largest markets for health-oriented food choices, and gluten-free products are becoming increasingly popular in residential, commercial, and rental properties. The push towards smart city initiatives and the availability of affordable gluten-free options, alongside strong domestic manufacturers and a rising emphasis on health awareness, are key factors propelling the market in China. The expanding e-commerce landscape also plays a vital role in increasing the accessibility and distribution of these products across the country.

Gluten-Free Products Market Share

The gluten-free products industry is primarily led by well-established companies, including:

- Amy's Kitchen, Inc (U.S.)

- Kelkin Ltd. (Ireland)

- Bob's Red Mill Natural Foods (U.S.)

- Seitz glutenfrei (Germany)

- Silly Yaks- For Real Taste (Australia)

- Warburtons (U.K.)

- Dun & Bradstreet, Inc. (U.S.)

- Big OZ (U.K.)

- Farmo S.P.A. (Italy)

- Enjoy Life Foods (U.S.)

- Dr. Schär AG / SPA (Italy)

- Raisio Plc (Finland)

- Ecotone (France)

- FREEDOM FOODS GROUP LIMITED (Australia)

- Quinoa Corporation (U.S.)

- Barilla G. e R., Fratelli S.p.A (Italy)

- Hero AG (Switzerland)

- Conagra Brands, Inc. (U.S.)

- Kellogg Co. (U.S.)

- The Kraft Heinz Company (U.S.)

Latest Developments in Global Gluten-Free Products Market

- In March 2025, Quiznos, the renowned sandwich chain known for its high-quality meats and cheeses, freshly sliced in-house daily and expertly toasted, announced the launch of new gluten-smart options across its U.S. locations. As part of this expansion, the brand introduced a limited-time offering, the Buffalo Chicken Club, featuring a spicy mayonnaise infused with Frank’s RedHot sauce, bacon, provolone cheese, tomatoes, and lettuce. The gluten-free bread is available for all sandwiches in regular and large sizes, with varying additional charges by location

- In December 2024, Revyve and Lallemand Bio-Ingredients Savory announced a strategic partnership in the North American market. This collaboration marked Lallemand as Revyve's exclusive distributor in the USA, Canada, and Mexico and strengthened their partnership, with Revyve sourcing a key raw material from Lallemand. Together, they aimed to set a new standard for sustainable, gluten-free, animal-free, GMO-free, and natural food innovations

- In October 2024, Dr. Schär launched three new gluten-free snacks: Peanut Butter Blondie Bites, Chocolate Brownie Bites, and Mini Honeygrams. The Peanut Butter Blondie Bites offer a blend of creamy and crunchy textures, while the Chocolate Brownie Bites provide a rich chocolate taste with a crispy wafer center. The Mini Honeygrams are bite-sized versions of Schär's classic graham-style cookies, lightly sweetened with honey. These snacks are designed to provide delicious, gluten-free options for various snacking occasions and are available online through the Schär Shop

- In August 2024, Lancaster Colony Corp. introduced its first gluten-free line of New York Bakery frozen bread, featuring Garlic Texas Toast and Five Cheese Texas Toast varieties. These products utilize a patent-pending dough recipe designed to closely mimic the texture and flavor of traditional breads, addressing common challenges associated with gluten-free alternatives. The company plans to leverage this innovative formulation as a foundation for expanding its gluten-free offerings in the future

- In February 2024, GOODLES, known for reinventing mac and cheese, invites everyone to celebrate the launch of its first gluten-free products: GLUTEN FREE VEGAN BE HEROES and GLUTEN FREE CHEDDY MAC. These offerings are nutrient-rich and delicious, delivering all the flavor without any gluten. Just such as all GOODLES mac and cheese varieties, these new products are packed with protein, fiber, prebiotics, and 21 plant-based nutrients

- In January 2023, Warburton announced the expansion of our gluten-free bakery range with the introduction of our latest offering, the Gluten-Free Cinnamon & Raisin Fruity Buns. This four-pack of buns is crafted using a brioche base infused with cinnamon, mixed spices, and caramelized sugar, imparting a distinctive and delicious flavor. Free from gluten, wheat, and milk, these buns can be enjoyed both toasted and untoasted

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gluten Free Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gluten Free Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gluten Free Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.