Global Glaucoma Surgical Devices Market

Market Size in USD Billion

CAGR :

%

USD

513.93 Billion

USD

954.07 Billion

2025

2033

USD

513.93 Billion

USD

954.07 Billion

2025

2033

| 2026 –2033 | |

| USD 513.93 Billion | |

| USD 954.07 Billion | |

|

|

|

|

Glaucoma Surgical Devices Market Size

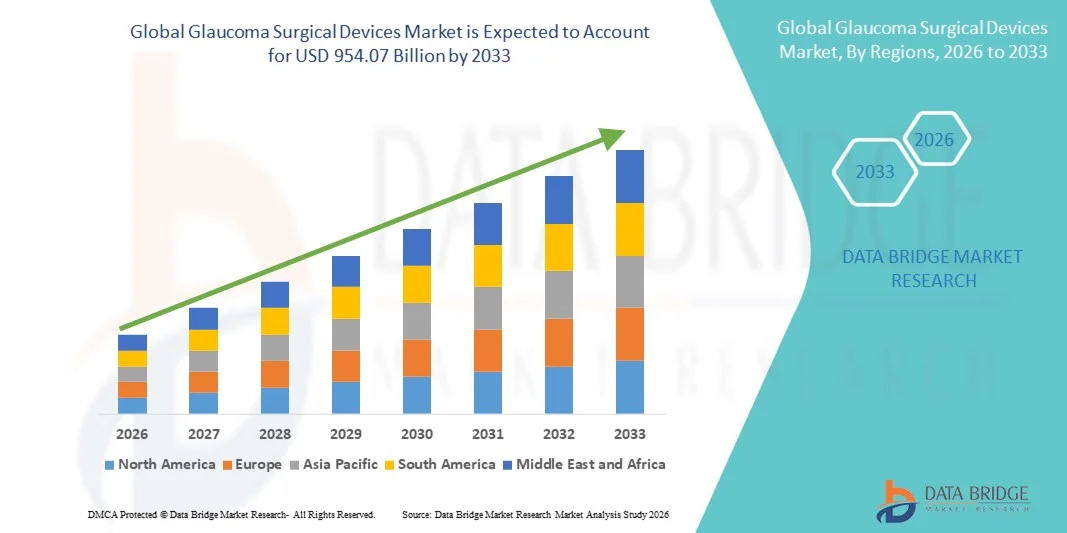

- The global glaucoma surgical devices market size was valued at USD 513.93 billion in 2025 and is expected to reach USD 954.07 billion by 2033, at a CAGR of 8.04% during the forecast period

- The market growth is largely driven by the rising prevalence of glaucoma worldwide, supported by an aging population, increasing incidence of intraocular pressure–related disorders, and improved disease awareness, leading to higher demand for effective surgical interventions in both developed and emerging healthcare markets

- Furthermore, continuous technological advancements in minimally invasive glaucoma surgery (MIGS) devices, along with growing preference for safer, less invasive procedures and improved clinical outcomes, are establishing glaucoma surgical devices as a critical component of modern ophthalmic care. These converging factors are accelerating the adoption of glaucoma surgical devices, thereby significantly boosting the overall market growth

Glaucoma Surgical Devices Market Analysis

- Glaucoma surgical devices, including minimally invasive glaucoma surgery (MIGS) systems, drainage implants, and laser-based devices, play a critical role in managing intraocular pressure and preventing vision loss in patients with moderate to advanced glaucoma. Their adoption is increasing across hospitals and ophthalmic specialty clinics due to improved safety profiles and faster recovery times

- The rising demand for glaucoma surgical devices is primarily driven by the growing prevalence of glaucoma, an expanding geriatric population, increasing screening and early diagnosis rates, and a shift toward minimally invasive surgical procedures that reduce complications and hospital stay durations

- North America dominated the glaucoma surgical devices market with a revenue share of approximately 38.5% in 2025, supported by advanced ophthalmic healthcare infrastructure, high awareness levels, favorable reimbursement policies, and strong presence of leading device manufacturers. The U.S. continues to lead regional growth due to rapid adoption of MIGS devices and continuous product innovations

- Asia-Pacific is expected to be the fastest-growing region in the glaucoma surgical devices market, registering a CAGR of around 9.8% during the forecast period. This growth is attributed to a large untreated patient pool, improving access to eye care services, rising healthcare expenditure, and increasing adoption of advanced glaucoma treatments in countries such as China and India

- The traditional glaucoma surgery segment accounted for the largest market revenue share of 44.2% in 2025, primarily due to its long-established clinical effectiveness in managing advanced and complex glaucoma cases

Report Scope and Glaucoma Surgical Devices Market Segmentation

|

Attributes |

Glaucoma Surgical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Glaucoma Surgical Devices Market Trends

Shift Toward Minimally Invasive and Device-Based Glaucoma Procedures

- A significant and accelerating trend in the global glaucoma surgical devices market is the growing shift toward minimally invasive glaucoma surgeries (MIGS), driven by the need for safer procedures with faster recovery times and fewer complications

- For instance, devices such as the iStent by Glaukos and the Hydrus Microstent by Alcon are increasingly adopted in combination with cataract surgery, enabling effective intraocular pressure (IOP) reduction with minimal tissue disruption

- Continuous innovation in device design is improving precision, safety, and long-term clinical outcomes, encouraging ophthalmologists to adopt surgical interventions earlier in the disease progression

- The trend is also supported by advancements in surgical visualization systems and micro-instrumentation, enhancing procedural accuracy

- Increasing preference for outpatient and ambulatory surgical procedures further strengthens the demand for compact and efficient glaucoma surgical devices

- As awareness grows regarding early surgical intervention, the adoption of advanced glaucoma devices is expected to expand across both developed and emerging markets

Glaucoma Surgical Devices Market Dynamics

Driver

Rising Prevalence of Glaucoma and Aging Population

- The increasing global prevalence of glaucoma, particularly among the aging population, is a primary driver of demand for glaucoma surgical devices

- For instance, in June 2024, the World Health Organization highlighted glaucoma as one of the leading causes of irreversible blindness worldwide, emphasizing the need for improved surgical management solutions

- The growing number of patients unresponsive to pharmacological treatments is accelerating the shift toward surgical intervention

- Improved access to ophthalmic care and expanded screening programs are leading to earlier diagnosis and higher procedural volumes

- Technological advancements that reduce surgical risks are encouraging clinicians to recommend device-based treatments more frequently

- Rising healthcare expenditure and increased adoption of advanced ophthalmic procedures further support market growth

Restraint/Challenge

High Procedure Costs and Limited Access in Developing Regions

- The high cost associated with glaucoma surgical devices and procedures remains a key restraint, particularly in low- and middle-income countries

- For instance, in 2023, several healthcare systems in Asia and Africa reported limited adoption of MIGS devices due to reimbursement constraints and lack of specialized surgical infrastructure

- Limited availability of trained ophthalmic surgeons restricts the use of advanced glaucoma devices in rural and underserved areas

- Inconsistent reimbursement policies across regions create disparities in patient access to surgical treatments

- Post-surgical complications and long-term device performance concerns also impact clinician adoption rates

- Addressing affordability, training gaps, and reimbursement standardization will be essential for sustained market expansion

Glaucoma Surgical Devices Market Scope

The market is segmented on the basis of product type, surgery method, and end-user.

- By Product Type

On the basis of product type, the Glaucoma Surgical Devices market is segmented into punches, USC marker, USC planner, USC shaver, forceps, Algerbrush, probes, diamond knives, glaucoma drainage devices, laser systems, and others. The glaucoma drainage devices segment dominated the largest market revenue share of 38.6% in 2025, driven by their widespread clinical use in managing moderate to severe glaucoma cases. These devices are highly effective in reducing intraocular pressure by facilitating controlled aqueous humor outflow, making them a preferred choice among ophthalmic surgeons. Increasing prevalence of glaucoma, especially among the aging population, continues to support demand. Strong clinical outcomes, long-term efficacy, and growing adoption in hospital-based ophthalmic surgeries further reinforce dominance. In addition, favorable reimbursement policies in developed markets and rising availability of advanced drainage implants contribute to sustained adoption. Technological advancements improving safety and biocompatibility also strengthen the segment’s leadership position.

The laser systems segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by the rising preference for minimally invasive and outpatient glaucoma procedures. Laser systems offer advantages such as reduced surgical trauma, shorter recovery times, and lower complication rates compared to conventional surgical tools. Increasing adoption of laser trabeculoplasty and laser-assisted glaucoma surgeries across ophthalmic clinics is accelerating growth. Technological advancements improving precision and treatment outcomes further enhance adoption. Growing patient awareness regarding laser-based treatments and expanding availability of advanced ophthalmic laser platforms support rapid growth. In addition, rising investments in ophthalmic care infrastructure across emerging markets are expected to significantly boost this segment.

- By Surgery Method

On the basis of surgery method, the Glaucoma Surgical Devices market is segmented into traditional glaucoma surgery, minimally invasive glaucoma surgery (MIGS), and laser surgery. The traditional glaucoma surgery segment accounted for the largest market revenue share of 44.2% in 2025, primarily due to its long-established clinical effectiveness in managing advanced and complex glaucoma cases. Procedures such as trabeculectomy remain widely practiced, particularly in hospital settings, owing to their proven long-term outcomes. High surgeon familiarity, availability of standardized surgical tools, and suitability for severe disease stages support dominance. In developing regions, traditional surgeries continue to be preferred due to lower procedural costs. In addition, continued use in refractory glaucoma cases reinforces sustained demand. The segment benefits from consistent procedural volumes in tertiary care hospitals worldwide.

The minimally invasive glaucoma surgery (MIGS) segment is projected to grow at the fastest CAGR of 21.3% from 2026 to 2033, driven by increasing demand for safer and less invasive treatment options. MIGS procedures offer faster recovery, reduced complication risks, and improved patient comfort compared to traditional surgeries. Rising adoption among ophthalmologists for early-to-moderate glaucoma treatment is accelerating growth. Technological innovations and increasing availability of FDA-approved MIGS devices further support expansion. Growing preference for outpatient procedures and shorter hospital stays also contribute to adoption. In addition, increasing patient awareness and favorable clinical outcomes are expected to sustain strong growth momentum.

- By End-User

On the basis of end-user, the Glaucoma Surgical Devices market is segmented into hospitals, ophthalmic clinics, and others. The hospitals segment dominated the largest market revenue share of 52.8% in 2025, driven by the high volume of glaucoma surgeries performed in hospital settings. Hospitals are equipped with advanced surgical infrastructure and skilled ophthalmic surgeons, enabling the management of complex glaucoma cases. Availability of comprehensive diagnostic facilities and post-operative care further supports dominance. Higher patient inflow, particularly for advanced-stage glaucoma, contributes significantly to revenue generation. In addition, favorable reimbursement frameworks and government funding for hospital-based eye care strengthen adoption. The presence of specialized ophthalmology departments further reinforces the segment’s leadership.

The ophthalmic clinics segment is expected to register the fastest CAGR of 20.1% from 2026 to 2033, supported by the increasing shift toward outpatient and specialty eye care services. Ophthalmic clinics offer quicker access to diagnosis and treatment, making them attractive for early-stage glaucoma management. Growing adoption of minimally invasive and laser-based procedures in clinic settings is accelerating growth. Rising establishment of specialty eye clinics, particularly in urban areas, supports expansion. Lower procedural costs and shorter waiting times further enhance patient preference. In addition, increasing investments by private healthcare providers are expected to drive strong growth in this segment.

Glaucoma Surgical Devices Market Regional Analysis

- North America dominated the glaucoma surgical devices market with a revenue share of approximately 38.5% in 2025, supported by advanced ophthalmic healthcare infrastructure, high disease awareness, and favorable reimbursement policies for glaucoma procedures

- The region benefits from the strong presence of leading medical device manufacturers, continuous product innovation, and early adoption of minimally invasive glaucoma surgery (MIGS) technologies across hospitals and specialty eye centers

- High surgical procedure volumes, a well-established network of ophthalmologists, and widespread access to advanced diagnostic and surgical tools further reinforce North America’s leading position in the global market

U.S. Glaucoma Surgical Devices Market Insight

The U.S. glaucoma surgical devices market accounted for the largest revenue share within North America in 2025, driven by high prevalence of glaucoma, strong awareness regarding early diagnosis, and rapid adoption of advanced surgical interventions. The country leads in the utilization of MIGS devices due to their favorable safety profile and reduced recovery time. Continuous FDA approvals, robust clinical research activity, and strong reimbursement coverage support sustained market growth. In addition, the presence of major industry players and ongoing investments in ophthalmic innovation further propel market expansion across hospitals and ambulatory surgical centers.

Europe Glaucoma Surgical Devices Market Insight

The Europe glaucoma surgical devices market is projected to expand at a steady CAGR during the forecast period, supported by increasing prevalence of glaucoma and strong emphasis on early disease management. Well-established public healthcare systems and growing adoption of advanced surgical techniques contribute to market growth. Countries across Western Europe benefit from rising healthcare expenditure and improved access to specialized ophthalmic care. Increasing use of laser-based procedures and MIGS devices in both hospital and clinic settings further supports adoption. Regulatory support for innovative medical technologies also enhances market penetration across the region.

U.K. Glaucoma Surgical Devices Market Insight

The U.K. glaucoma surgical devices market is anticipated to grow at a noteworthy CAGR over the forecast period, driven by increasing glaucoma screening initiatives and strong focus on preventive eye care. The National Health Service (NHS) plays a key role in supporting access to glaucoma diagnosis and treatment. Rising adoption of minimally invasive surgical procedures and laser therapies is improving patient outcomes and reducing hospital stays. Growing awareness among aging populations and continuous upgrades in ophthalmic surgical infrastructure further stimulate market growth in the country.

Germany Glaucoma Surgical Devices Market Insight

The Germany glaucoma surgical devices market is expected to expand at a considerable CAGR during the forecast period, supported by advanced healthcare infrastructure and high standards of ophthalmic care. Germany’s strong emphasis on medical technology innovation and clinical research drives the adoption of advanced glaucoma surgical devices. Increasing preference for precision-based and minimally invasive procedures contributes to market expansion. Favorable reimbursement frameworks and a strong network of specialty eye clinics further support sustained growth across the country.

Asia-Pacific Glaucoma Surgical Devices Market Insight

The Asia-Pacific glaucoma surgical devices market is expected to grow at the fastest CAGR of approximately 9.8% during the forecast period, driven by a large untreated patient population and improving access to eye care services. Rising healthcare expenditure, expanding hospital infrastructure, and increasing awareness about glaucoma management are key growth drivers. Countries such as China and India are witnessing rapid adoption of advanced glaucoma treatments due to urbanization and healthcare modernization. Government initiatives to reduce preventable blindness further accelerate market growth across the region.

Japan Glaucoma Surgical Devices Market Insight

The Japan glaucoma surgical devices market is gaining momentum due to the country’s aging population and high prevalence of age-related eye disorders. Strong adoption of technologically advanced surgical devices and laser-based procedures supports market growth. Japan’s well-developed healthcare system and emphasis on early diagnosis enable timely surgical intervention. Increasing use of minimally invasive glaucoma surgery techniques in hospitals and specialty clinics further enhances adoption. Continuous innovation in ophthalmic devices also contributes to sustained market expansion.

China Glaucoma Surgical Devices Market Insight

The China glaucoma surgical devices market accounted for a significant revenue share in Asia-Pacific in 2025, driven by rising glaucoma prevalence and rapid expansion of ophthalmic healthcare infrastructure. Increasing government investment in eye care services and growing awareness about vision preservation are key growth drivers. Adoption of advanced surgical devices is rising across large tertiary hospitals and private eye clinics. In addition, improving affordability of glaucoma treatments and expanding access to specialized care continue to strengthen China’s position as a major growth contributor in the regional market.

Glaucoma Surgical Devices Market Share

The Glaucoma Surgical Devices industry is primarily led by well-established companies, including:

• Alcon (Switzerland)

• Johnson & Johnson (U.S.)

• Abbott (U.S.)

• Bausch + Lomb (U.S.)

• Carl Zeiss Meditec (Germany)

• Santen Pharmaceutical (Japan)

• Iridex Corporation (U.S.)

• New World Medical (U.S.)

• Glaukos Corporation (U.S.)

• Ivantis (U.S.)

• Ellex Medical Lasers (Australia)

• Topcon Corporation (Japan)

• Lumenis (Israel)

• Optos (U.K.)

• NIDEK Co., Ltd. (Japan)

Latest Developments in Global Glaucoma Surgical Devices Market

- In July 2021, Sight Sciences, Inc., a U.S.-based ophthalmic medical device company, completed its initial public offering (IPO) on the Nasdaq Global Market, raising capital to accelerate the commercialization of its OMNI Surgical System for minimally invasive glaucoma surgery (MIGS). This development strengthened the company’s global presence and supported wider adoption of device-based glaucoma treatments

- In November 2021, Alcon announced the acquisition of Ivantis, Inc., the developer of the Hydrus Microstent, a widely used minimally invasive glaucoma surgical device. The acquisition expanded Alcon’s glaucoma surgical portfolio and reinforced its leadership position in the MIGS segment

- In August 2022, Glaukos Corporation received U.S. FDA 510(k) clearance for the iStent infinite Trabecular Micro-Bypass System, the first standalone MIGS device approved for patients with primary open-angle glaucoma uncontrolled by prior medical and surgical therapies. This milestone significantly broadened treatment options for advanced glaucoma patients

- In March 2023, the U.S. Food and Drug Administration approved Glaukos’ iDose® TR sustained-release intraocular implant, designed to continuously deliver travoprost for intraocular pressure reduction. This approval marked a major advancement in implantable glaucoma therapy and long-acting surgical drug-delivery solutions

- In May 2024, Alcon reported expanded global adoption of the Hydrus® Microstent following long-term clinical data demonstrating sustained intraocular pressure reduction, reinforcing confidence among ophthalmic surgeons and supporting continued growth of minimally invasive glaucoma surgical procedures

- In June 2025, Glaukos Corporation announced that its iStent inject W and iStent infinite devices received certification under the European Union Medical Device Regulation (EU MDR), enabling continued commercialization across European markets and underscoring compliance with stringent regulatory standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.