Global Glass Substrate Market

Market Size in USD Billion

CAGR :

%

USD

7.01 Billion

USD

12.33 Billion

2024

2032

USD

7.01 Billion

USD

12.33 Billion

2024

2032

| 2025 –2032 | |

| USD 7.01 Billion | |

| USD 12.33 Billion | |

|

|

|

|

Glass Substrate Market Size

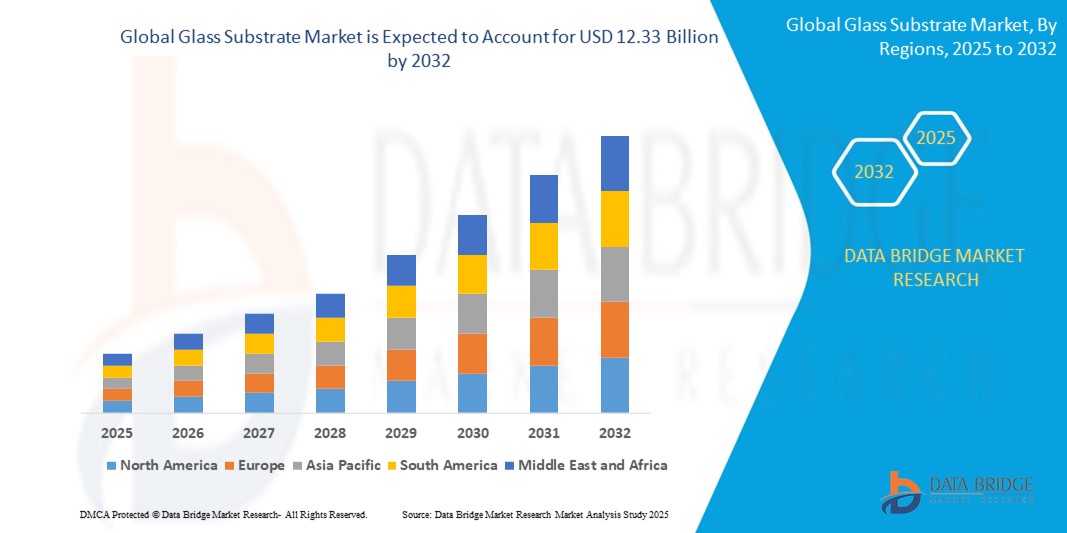

- The global glass substrate market size was valued at USD 7.01 billion in 2024 and is expected to reach USD 12.33 billion by 2032, at a CAGR of 7.30% during the forecast period

- The market growth is largely fuelled by the increasing demand for advanced display technologies in consumer electronics, such as smartphones, tablets, and televisions, as well as the expanding applications in solar panels and flexible electronics

- In addition, rising adoption of OLED and AMOLED displays, which require high-quality glass substrates for better performance and durability, is further driving the market expansion globally

Glass Substrate Market Analysis

- The glass substrate market is expanding due to growing demand for high-performance displays in consumer electronics, offering enhanced durability and clarity for devices such as smartphones and televisions

- Manufacturers are focusing on developing thinner and more flexible glass substrates to meet the evolving needs of flexible and foldable display technologies

- North America dominated the glass substrate market with the largest revenue share in 2024, driven by a robust electronics industry, growing demand for advanced display technologies, and the presence of leading semiconductor manufacturers

- The Asia-Pacific region is expected to witness the highest growth rate in the global glass substrate market, driven by rapid industrialization, expanding electronics manufacturing, and increasing demand for semiconductors and display panels in countries such as China, Japan, South Korea, and India

- The borosilicate-based segment dominated the market with the largest market revenue share in 2024, driven by its high thermal and chemical resistance, making it suitable for a variety of microelectronics and photonics applications. The demand for borosilicate substrates is strong in semiconductor packaging due to their dimensional stability and cost-effectiveness

Report Scope and Glass Substrate Market Segmentation

|

Attributes |

Glass Substrate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Glass Substrate Market Trends

“Rise of Flexible and Foldable Display Glass Substrates”

- The glass substrate market is witnessing a significant trend toward the development and adoption of flexible and foldable glass substrates, driven by the increasing popularity of foldable smartphones and wearable devices

- Manufacturers are innovating ultra-thin and bendable glass materials that can withstand repeated folding without compromising durability or display clarity

- For instance, Samsung’s foldable smartphones and Microsoft’s Surface Duo utilize flexible glass substrates, highlighting the commercial viability and consumer demand for such technologies

- This trend is pushing glass producers to enhance glass toughness and elasticity through advanced chemical strengthening and coating techniques

- In addition, the trend supports the growth of new product categories in consumer electronics, such as rollable displays and flexible tablets, opening fresh opportunities for glass substrate applications beyond traditional rigid displays

Glass Substrate Market Dynamics

Driver

“Increasing Demand for Advanced Display Technologies”

- The growing demand for advanced display technologies is driving the glass substrate market, as consumers seek high-resolution, durable, and user-friendly devices

- Glass substrates are essential for displays such as liquid crystal displays, organic light-emitting diodes, and emerging flexible and foldable screens, providing a smooth and flat surface for uniform electronic layers

- Innovations such as ultra-thin and chemically strengthened glass allow for lighter and more robust screens, meeting consumer needs for sleek yet durable gadgets

- The widespread adoption of smartphones, tablets, laptops, and televisions with advanced displays is accelerating market growth; for instance, major smartphone brands use chemically strengthened glass to enhance scratch resistance and durability

- New display formats, including flexible and rollable screens, depend on specialized glass substrates that maintain flexibility without sacrificing transparency or strength, expanding usage in automotive dashboards and wearable devices

- For instance, Samsung’s latest foldable smartphones use ultra-thin, chemically strengthened glass substrates that allow the screen to bend smoothly while maintaining durability and clarity

Restraint/Challenge

“High Production Costs and Manufacturing Complexities”

- The glass substrate market faces challenges due to the high costs involved in producing advanced glass materials, especially those that are ultra-thin or chemically treated

- Manufacturing requires multiple precise stages such as melting, forming, annealing, and chemical strengthening, each needing strict quality checks and specialized equipment

- Producing flexible glass substrates involves maintaining bendability and optical clarity, which is technically demanding and raises operational costs

- For instance, developing ultra-thin flexible glass for foldable displays requires nano-level thickness control to prevent breakage while ensuring visual performance

- Alternative materials such as plastic substrates, though less durable, are gaining popularity for flexible displays due to lower production costs and easier processing

Glass Substrate Market Scope

The market is segmented on the basis of type, wafer diameter, application, and end-use.

- By Type

On the basis of type, the high glass substrate market is segmented into borosilicate based, fused silica/quartz based, silicon, and others. The borosilicate-based segment dominated the market with the largest market revenue share in 2024, driven by its high thermal and chemical resistance, making it suitable for a variety of microelectronics and photonics applications. The demand for borosilicate substrates is strong in semiconductor packaging due to their dimensional stability and cost-effectiveness.

The fused silica/quartz-based segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its exceptional optical transparency and low coefficient of thermal expansion. These properties make it ideal for high-frequency electronics, optical components, and advanced lithography, particularly in semiconductor and aerospace applications.

- By Wafer Diameter

On the basis of wafer diameter, the high glass substrate market is segmented into 300 mm, 200 mm, 150 mm, 125 mm, above 300 mm, and up to 100 mm. The 200 mm segment held the largest market revenue share in 2024, supported by its extensive use in legacy semiconductor fabrication facilities and its cost-efficiency in producing MEMS and analog devices.

The 300 mm segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by ongoing advancements in semiconductor manufacturing, including 3D packaging and high-volume IC production. As foundries shift towards larger wafers to improve yield and reduce cost per chip, demand for 300 mm glass substrates is rapidly increasing.

- By Application

On the basis of application, the high glass substrate market is segmented into wafer packaging, substrate carrier, and TGV interposer. The wafer packaging segment accounted for the largest market revenue share in 2024, propelled by growing demand for high-density and miniaturized packaging solutions in consumer electronics and communication devices. Glass substrates provide excellent planar surfaces and thermal performance ideal for wafer-level packaging.

The TGV interposer segment is anticipated to witness the fastest growth rate from 2025 to 2032, due to increasing adoption of Through Glass Via technology in advanced chip integration and heterogeneous packaging. Its high precision and low dielectric loss characteristics are appealing for high-performance computing and RF applications.

- By End-Use

On the basis of end-use, the high glass substrate market is segmented into electronics, optical applications, aerospace & defense, automotive & solar, and medical. The electronics segment dominated the market in 2024, driven by the surging demand for smartphones, wearables, and semiconductor devices requiring compact and efficient substrate solutions.

The medical segment is anticipated to witness the fastest growth rate from 2025 to 2032, due to the rising adoption of biosensors, microfluidic chips, and lab-on-a-chip technologies that utilize glass substrates for their biocompatibility, chemical stability, and transparency.

Glass Substrate Market Regional Analysis

- North America dominated the glass substrate market with the largest revenue share in 2024, driven by a robust electronics industry, growing demand for advanced display technologies, and the presence of leading semiconductor manufacturers

- The region benefits from increasing investments in R&D for microelectronics and optoelectronic applications, which is bolstering the demand for high-performance glass substrates

- In addition, supportive government initiatives and the expansion of fabrication facilities across the U.S. and Canada are accelerating market adoption across end-use industries such as automotive, aerospace, and healthcare

U.S. Glass Substrate Market Insight

The U.S. glass substrate market captured the largest revenue share in North America in 2024, propelled by the strong presence of leading electronics and semiconductor companies. The country’s advanced technological ecosystem, coupled with high demand for miniaturized and high-precision components in consumer electronics, fuels the market. Increasing applications in medical imaging devices and photovoltaic modules also contribute to growth. Continued innovation in glass fabrication techniques and material science further enhances the market's outlook.

Europe Glass Substrate Market Insight

The Europe glass substrate market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising investments in photonics, MEMS, and display technologies. The region’s strong foothold in automotive electronics, coupled with growing adoption of smart displays and optical components, supports sustained market demand. Stringent environmental and quality regulations are also fostering the use of high-purity, sustainable glass substrates in multiple applications across Germany, France, and the U.K.

U.K. Glass Substrate Market Insight

The U.K. glass substrate market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for advanced materials in the medical, aerospace, and optoelectronics industries. Innovations in flexible electronics and optical sensors, as well as government support for domestic manufacturing, are enhancing the market outlook. Moreover, the country’s emphasis on sustainability and precision manufacturing is encouraging adoption across emerging high-tech sectors.

Germany Glass Substrate Market Insight

The Germany glass substrate market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s leadership in automotive technology, optics, and industrial automation. With a strong focus on precision engineering and high-performance materials, Germany is investing heavily in microfabrication and advanced substrate materials. The rise of Industry 4.0 and smart factories is further increasing demand for glass substrates in sensor and display integration.

Asia-Pacific Glass Substrate Market Insight

The Asia-Pacific glass substrate market is expected to witness the fastest growth rate from 2025 to 2032, attributed to booming consumer electronics production, favorable government policies, and rapid industrialization. Countries such as China, Japan, South Korea, and Taiwan are at the forefront of innovation in display panels, semiconductors, and solar technology. The availability of low-cost manufacturing, skilled labor, and strategic investments in cleanroom facilities is significantly accelerating regional growth.

Japan Glass Substrate Market Insight

The Japan glass substrate market is expected to witness the fastest growth rate from 2025 to 2032, due to its deep-rooted expertise in precision materials, microelectronics, and high-end optical technologies. Japan’s mature consumer electronics and display panel industries are key drivers of demand. In addition, applications in automotive HUDs, photomasks, and advanced medical equipment are bolstering adoption. Emphasis on product miniaturization and durability further strengthens the market’s position in high-value applications.

China Glass Substrate Market Insight

The China glass substrate market accounted for the largest revenue share in Asia-Pacific in 2024, supported by mass production of smartphones, tablets, and display devices. The country's aggressive push for semiconductor self-sufficiency and expansion of photovoltaic manufacturing are driving the need for quality glass substrates. With strong domestic suppliers and government incentives backing technology development, China continues to lead regional growth in both volume and capacity expansion.

Glass Substrate Market Share

The Glass Substrate industry is primarily led by well-established companies, including:

- AGC Inc. (Japan)

- SCHOTT (Germany)

- AvanStrate Inc. (Japan)

- Dongxu Group Co., Ltd. (China)

- Irico Group New Energy Company Limited (China)

- TECNISCO, LTD. (Japan)

- Corning Incorporated (U.S.)

- Nippon Electric Glass Co., Ltd. (Japan)

- HOYA Corporation (Japan)

- Plan Optik AG (Germany)

- Ohara Inc. (Japan)

Latest Developments in Global Glass Substrate Market

- In April 2024, AGC Inc. achieved an Environmental Product Declaration (EPD) for its architectural float glass from the Kashima facility, validated by SuMPO. This initiative aims to help buyers assess environmental impacts more transparently and supports compliance with green building standards such as LEED. By aligning with its medium-term goal of reducing environmental impact, AGC strengthens its green sourcing strategy, enhancing growth opportunities in the construction sector

- In January 2024, SCHOTT expanded its collaboration with Lumus to meet the rising demand for augmented reality (AR) glasses. The expansion of SCHOTT’s Malaysian plant will support production of Lumus' Z-Lens waveguide technology. This partnership is set to streamline AR development from prototyping to mass production, making AR glasses more accessible and bolstering SCHOTT’s presence in consumer electronics

- In May 2023, Corning Incorporated implemented a 20% price increase on display glass substrates globally to address surging energy and raw material costs. This strategic pricing move is intended to maintain profitability amid inflation while capitalizing on the rising demand for display glass. The adjustment positions Corning for continued market leadership and revenue growth in a recovering electronics industry

- In April 2023, SCHOTT unveiled innovative kitchen solutions at AWE 2023 in Shanghai, introducing features such as CleanPlus coating for easy maintenance and CERAN Luminoir for advanced cooktop designs. These products, which received industry recognition, reflect SCHOTT’s dedication to smart kitchen innovation and strengthen its competitiveness in the home appliances market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Glass Substrate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Glass Substrate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Glass Substrate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.