Global Glass Packaging Market

Market Size in USD Billion

CAGR :

%

USD

65.58 Billion

USD

91.38 Billion

2021

2029

USD

65.58 Billion

USD

91.38 Billion

2021

2029

| 2022 –2029 | |

| USD 65.58 Billion | |

| USD 91.38 Billion | |

|

|

|

|

Glass Packaging Market Analysis and Size

The increasing consumer demand for safe and healthier packaging, acts as one of the major factors driving the growth of glass packaging market. The introduction of innovative technologies for embossing, shaping and adding artistic finishes to glass and the growing popularity of the glass packaging among end-users as it is one of the most trusted forms of packaging for health, taste and environmental safety accelerating the glass packaging market growth. The rise in demand for eco-friendly products, surge in demand from the food and beverage and the inclination towards lightweight glass as it provides higher stability and reduced volume of raw materials used and CO2 emitted further influencing the glass packaging market.

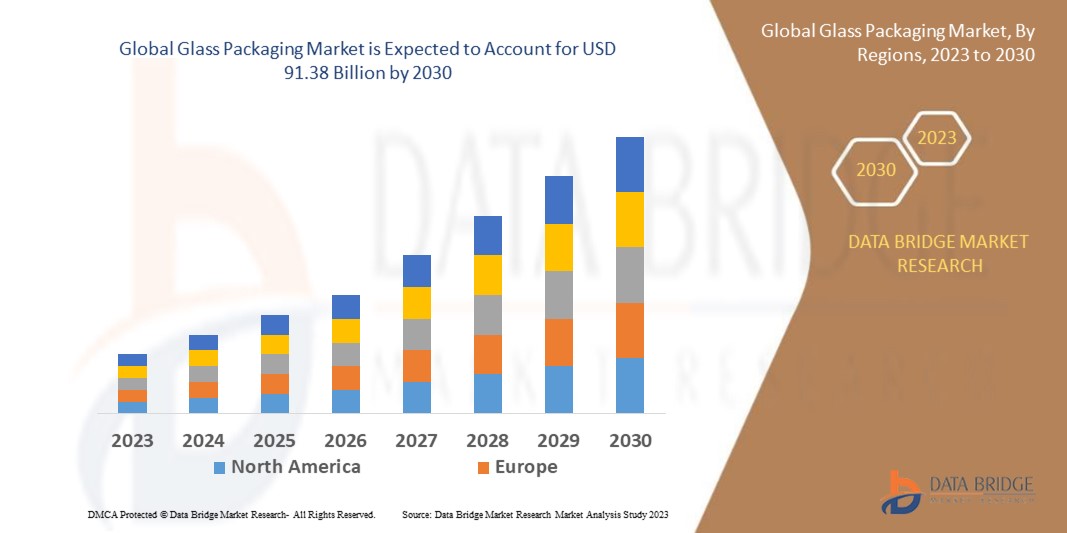

Data Bridge Market Research analyses that the glass packaging market which was USD 65.58 billion in 2022, would rocket up to USD 91.38 billion by 2030, and is expected to undergo a CAGR of 4.3% during the forecast period of 2023 to 2030. “Alcoholic beverage” dominates the application segment of the glass packaging market due to its ability to preserve the quality and taste of the contents. Glass bottles are often preferred for premium alcoholic beverages, and this demand has historically been strong.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Glass Packaging Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Kilo Tons, Pricing in USD |

|

Segments Covered |

Glass Type (Type I, Type II, Type III, and Others), Jar Size (20-50 mL, 51-100 mL, 101-250 mL, 251-500 mL, and Above 500 mL), Raw Material (Cullet, Selenium, Cobalt Oxide, Limestone, Dolomite, Coloring Material, and Others), Application (Alcoholic Beverage, Non-Alcoholic Beverage, Food, Pharmaceutical, Personal Care, Beauty Products, and Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, U.A.E., Saudi Arabia, Egypt, South Africa, Israel, and the rest of Middle East and Africa |

|

Market Players Covered |

Saint-Gobain (France), Owens-Illinois, Inc. (U.S.), Amcor plc (Australia), Ardagh Group S.A. (Ireland), HEINZ-GLAS GmbH & Co. KGaA (Germany), BA GLASS GROUP (Portugal), Bormioli Rocco S.p.A (Italy), Consol (South Africa), Gerresheimer AG (Germany), Hindusthan National Glass & Industries Limited (India), Koa Glass Co., Ltd. (Japan), Nihon Yamamura Glass Co., Ltd. (Japan), Orora Packaging Australia Pty Ltd (Australia), Piramal Enterprises Ltd. (India), Rockwood & Hines Glass Group (Canada), Shanghai Vista Packaging Co., Ltd. (China), Sisecam Group (Turkey), Stölzle-Oberglas GmbH (Austria), Vetropack (Switzerland), Vidrala (Spain), and Wiegand-Glas GmbH (Germany) |

|

Market Opportunities |

|

Market Definition

Glass packaging refers to a rigid packaging method that assists in protecting the contents by covering them with different density, sizes and shapes of glass packaging product. Containers and bottles among others are the different types of glass packaging materials available in the market. These material do not affect the texture, composition and taste of the material present in the jar. This type of packaging is extensively used in alcoholic beverage, non-alcoholic beverage, food, pharmaceutical, personal care, beauty products and others.

Global Glass Packaging Market Dynamics

Drivers

- Expanding Beverage Industry

The global beverage industry, including alcoholic and non-alcoholic beverages, continues to expand. Glass bottles are the preferred choice for premium alcoholic beverages, and they are gaining popularity in specialty non-alcoholic beverages as well. Urbanization and rising disposable incomes in emerging markets have boosted the demand for packaged goods, including beverages and cosmetics. Glass packaging is often seen as a symbol of quality and is well received in these markets

- Increasing Consumer Preference for Transparency

Transparency is a significant advantage for glass packaging. Consumers appreciate being able to see the contents, which builds trust and aids in purchasing decisions. This is particularly important in industries such as food, beverages, and cosmetics. Glass is impermeable to gases and moisture, offering superior protection to the contents. It does not interact chemically with the packaged products, preserving their quality and taste. This property is especially critical for sensitive items such as pharmaceuticals, alcoholic beverages, and certain food products

- Rising Sustainability and Environmental Concerns

Increasing awareness of environmental sustainability has prompted a shift toward eco-friendly packaging materials. Glass packaging, being 100% recyclable and inert, aligns with these sustainability goals. Governments and consumers are increasingly favoring glass due to its minimal environmental impact and its ability to reduce carbon footprint. Glass packaging meets stringent regulatory requirements for the packaging of certain products, such as pharmaceuticals and food. Its non-reactive nature ensures compliance with health and safety standards, contributing to its widespread use in regulated industries

Restraints

- High Costs and Weight

Glass packaging is heavier and more fragile compared to alternatives such as plastic and aluminium. This results in higher transportation costs due to increased weight and greater susceptibility to breakage during transit. As businesses seek to optimize supply chains and reduce costs, the weight and fragility of glass containers can be a significant drawback

- Limitations in Terms of Handling

Glass packaging is inherently fragile, making it susceptible to breakage during handling and transportation. This can result in higher production losses and increased costs associated with damaged goods. To mitigate this, additional packaging, such as bubble wrap or cushioning, may be required, adding to expenses

Opportunities

- Rising Regulatory Compliance

Glass packaging meets stringent regulatory requirements for the packaging of certain products, such as pharmaceuticals and food. Its non-reactive nature ensures compliance with health and safety standards, contributing to its widespread use in regulated industries. Glass is inherently resistant to chemical and biological contamination. This makes it an ideal choice for pharmaceuticals, where product safety is paramount. The absence of leaching or off flavors ensures the purity and safety of the packaged products

- Growing Technological Advancements

Advancements in glass manufacturing and packaging technologies have made glass containers lighter, more cost effective, and safer to produce and transport. These innovations have expanded the scope of glass packaging applications. Glass packaging can be molded into various shapes and sizes, allowing for customization to meet specific branding and marketing objectives. This flexibility appeals to diverse industries, including food, beverages, and personal care products

Challenges

- High Competition from Alternative Packaging Solutions

Glass faces competition from alternative packaging materials, such as plastics and aluminium, which have gained popularity due to their lighter weight, cost-effectiveness, and ease of production. These materials often offer greater design flexibility, which can be appealing to brands seeking innovative packaging solutions

- Limited Design Flexibility

Compared to materials such as plastic, glass has limitations in terms of design flexibility. While glass containers can be aesthetically appealing, they are generally less adaptable to unique shapes and sizes, which may limit their use in certain product categories where innovative packaging designs are valued

This glass packaging market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the glass packaging market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth

Recent Development

- In September 2022, Vetropack introduced the Echovai bottle, made from tempered lightweight glass, weighing up to 30% less than standard returnable bottles. It boasts increased durability, resistance to abrasion, and reduces logistical effort while emitting 25% less carbon dioxide. Vetropack plans to phase in its production, partnering with Austrian brewery Mohrenbrauerei initially and later expanding across Europe and licensing the technology to third parties. This innovation has the potential to impact the global glass packaging market positively

Global Glass Packaging Market Scope

The glass packaging market is segmented on the basis of glass type, jar size, raw material, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Glass Type

- Type I

- Type II

- Type III

- Others

Jar Size

- 20-50 mL

- 51-100 mL

- 101-250 mL

- 251-500 mL

- Above 500 mL

Raw Material

- Cullet, Selenium

- Cobalt Oxide

- Limestone

- Dolomite

- Coloring Material

- Others

Application

- Alcoholic Beverage

- Non-Alcoholic Beverage

- Food

- Pharmaceutical

- Personal Care

- Beauty Products

- Others

Glass Packaging Market Regional Analysis/Insights

The glass packaging market is analyzed and market size insights and trends are provided by glass type, jar size, raw material, and application are referenced above.

The countries covered in the glass packaging market report are U.S., Canada, and Mexico in North America, Brazil, Argentina, and the rest of South America in South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, and the rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and the rest of Asia-Pacific in Asia-Pacific, and U.A.E., Saudi Arabia, Egypt, South Africa, Israel, and the rest of the Middle East and Africa in Middle East and Africa.

Asia-Pacific dominates the glass packaging market due to the increasing use of glass in various end-use industries including food and beverages, pharmaceuticals and alcoholic beverages in developing nations, high availability of raw materials including silica and the presence of huge consumer base in these countries.

North America is expected to witness the fastest growth during the forecast period due to the high use in pharmaceutical packaging and technological advancements in the region in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Glass Packaging Market Share Analysis

The glass packaging market competitive landscape provides details by competitors. details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the company’s focus related to the glass packaging market.

Some of the major players operating in the glass packaging market are:

- Saint-Gobain (France)

- Owens-Illinois, Inc. (U.S.)

- Amcor plc (Australia)

- Ardagh Group S.A. (Ireland)

- HEINZ-GLAS GmbH & Co. KGaA (Germany)

- BA GLASS GROUP (Portugal)

- Bormioli Rocco S.p.A (Italy)

- Consol (South Africa)

- Gerresheimer AG (Germany)

- Hindusthan National Glass & Industries Limited (India)

- Koa Glass Co., Ltd. (Japan)

- Nihon Yamamura Glass Co., Ltd. (Japan)

- Orora Packaging Australia Pty Ltd (Australia)

- Piramal Enterprises Ltd. (India)

- Rockwood & Hines Glass Group (Canada)

- Shanghai Vista Packaging Co., Ltd. (China)

- Sisecam Group (Turkey)

- Stölzle-Oberglas GmbH (Austria)

- Vetropack (Switzerland)

- Vidrala (Spain)

- Wiegand-Glas GmbH (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Glass Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Glass Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Glass Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.