Global Glass Fiber Reinforced Plastics Composites Market

Market Size in USD Billion

CAGR :

%

USD

24.00 Billion

USD

51.82 Billion

2024

2032

USD

24.00 Billion

USD

51.82 Billion

2024

2032

| 2025 –2032 | |

| USD 24.00 Billion | |

| USD 51.82 Billion | |

|

|

|

|

Glass Fiber Reinforced Plastics Composites Market Size

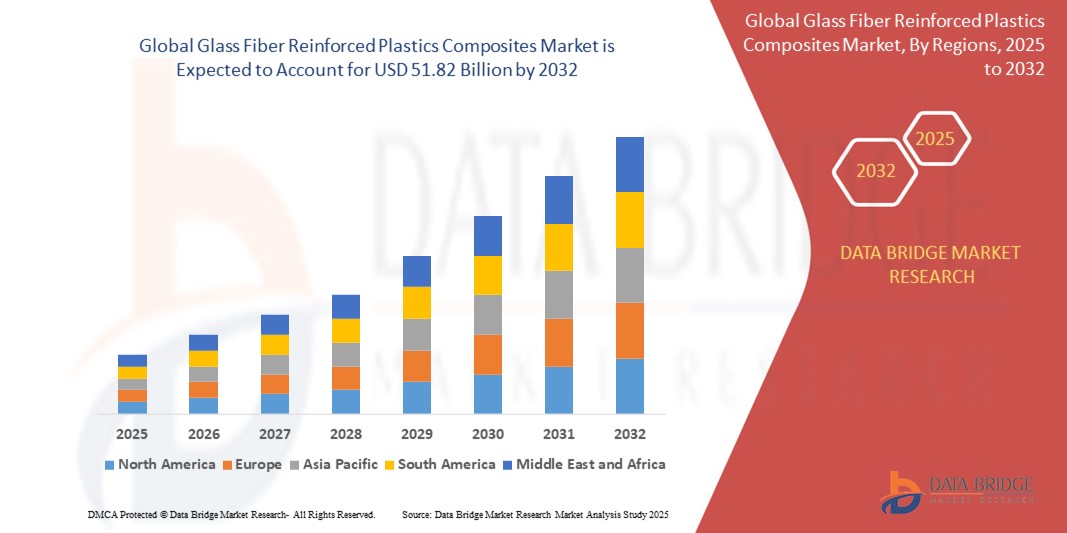

- The Global Glass Fiber Reinforced Plastics Composites Market size was valued at USD 24.00 Billion in 2024 and is expected to reach USD 51.82 Billion by 2032, at a CAGR of 10.10% during the forecast period

- The market growth is largely fueled by increasing demand for lightweight and durable materials in automotive, aerospace, and construction industries

- Furthermore, the increasing adoption of lightweight materials in the transportation sector, are further anticipated to propel the growth of the Glass Fiber Reinforced Plastics Composites Market

Glass Fiber Reinforced Plastics Composites Market Analysis

- The market for glass fiber reinforced plastics composites is experiencing strong growth as industries focus on reducing overall material weight while maintaining strength and durability

- Increasing use of these composites in various end-use sectors is supporting advancements in production processes and materials innovation.

- North America dominates the Glass Fiber Reinforced Plastics Composites Market with the largest revenue share of 38.21% in 2024, characterized by well-established manufacturing sectors, particularly automotive and aerospace, which drive the demand for high-performance composites.

- Asia-Pacific is expected to be the fastest growing region in the Glass Fiber Reinforced Plastics Composites Market during the forecast period due to rapid industrialization and increased demand for lightweight materials in automotive and construction industries

- The polyester segment is expected to dominate the Glass Fiber Reinforced Plastics Composites Market with a market share of 34.5% in 2024, driven by its cost-effectiveness, excellent mechanical properties, and wide applicability in various industries such as automotive, construction, and infrastructure

Report Scope and Glass Fiber Reinforced Plastics Composites Market Segmentation

|

Attributes |

Glass Fiber Reinforced Plastics Composites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glass Fiber Reinforced Plastics Composites Market Trends

“Integration of Smart Manufacturing Technologies”

- The adoption of automated manufacturing processes, including robotic assembly and digital twin simulations, is enhancing the efficiency and precision of glass fiber reinforced plastics composites production

- Companies are increasingly implementing real-time monitoring systems powered by artificial intelligence to optimize production parameters and ensure consistent product quality

- The development of advanced manufacturing techniques, such as automated fiber placement and resin transfer molding, is enabling the production of complex composite structures with reduced labor costs

- Industry leaders are investing in research and development to integrate smart sensors into composite materials, allowing for real-time monitoring of structural health and performance during service.

- For instances, in 2023, Hexcel Corporation partnered with Siemens to implement digital twin technology in composite production, improving speed and reducing material waste

Glass Fiber Reinforced Plastics Composites Market Dynamics

Driver

“Increasing Demand from Transportation and Construction Sectors”

- The increasing adoption of lightweight materials in the transportation sector is a key driver for GFRP composites due to their high strength-to-weight ratio and durability

- For instance, BMW uses GFRP in several of its models including the BMW i3 and i8 to reduce vehicle weight and enhance efficiency

- In the automotive and aerospace industries, GFRP components help improve fuel economy and reduce emissions

- For instance, General Motors integrates GFRP in structural panels to support emission reduction strategies in its newer vehicle lines

- GFRP’s corrosion resistance makes it ideal for infrastructure projects such as bridges, facades, and pipelines in harsh environments

- For instance, In Canada, the Chatham Bridge in Ontario used GFRP rebar for reinforcement to increase lifespan and minimize maintenance

- The construction sector is increasingly choosing GFRP over steel for its non-corrosive properties and long-term performance

- Government investments in smart infrastructure and sustainable urban development are boosting GFRP demand in both public and private sectors.

Restraint/Challenge

“Recycling and Environmental Concerns”

- The limited recyclability of thermoset-based GFRP materials poses a significant challenge due to their cross-linked polymer structure

- The disposal of decommissioned GFRP products is becoming an environmental burden, particularly for large-scale items such as wind turbines and automotive parts

- For instance, the decommissioning of wind turbine blades in the U.S. is a growing issue, with thousands of blades expected to be decommissioned in the coming years, creating landfill concerns

- European regulations are driving the need for sustainable end-of-life solutions for GFRP composites, pushing companies to seek alternative recycling methods

- Current recycling methods such as mechanical grinding and pyrolysis are energy-intensive and not widely implemented, adding to the challenge of increasing sustainability

- For instance, In France, the company Veolia is experimenting with pyrolysis to recycle wind turbine blades, but the high energy consumption of these methods makes them less economically feasible

- The lack of standardized recycling practices and insufficient infrastructure further complicates efforts to tackle the recyclability issue.

Glass Fiber Reinforced Plastics Composites Market Scope

The market is segmented on the basis of end-use industry, resin type, and manufacturing process.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into transportation, electrical & electronics, wind energy, pipes & tanks, construction & infrastructure, marine, aerospace & defense, and others. The Transportation segment dominates the largest market revenue share of 34.2% in 2025, driven by the need for lightweight and fuel-efficient materials in automotive and rail applications. GFRP components offer high strength-to-weight ratios, corrosion resistance, and design flexibility, supporting adoption in body panels, bumpers, and structural parts. OEM integration and EV development further contribute to sustained demand.

The Wind Energy segment is anticipated to witness the fastest growth rate of 9.7% from 2025 to 2032, fueled by increasing investments in renewable energy infrastructure. GFRP composites are essential in the fabrication of wind turbine blades due to their durability, fatigue resistance, and cost-effectiveness. As global wind power capacity expands, particularly in Asia-Pacific and Europe, GFRP usage is set to rise significantly.

- By Resin Type

On the basis of resin type, the market is segmented into epoxy, polyester, vinyl ester, polyurethane, thermoplastic, and others. The Polyester segment held the largest market revenue share in 2025, driven by its low cost, good mechanical properties, and ease of processing. Polyester resins are widely used in construction, automotive, and marine industries due to their fast cure times and compatibility with multiple manufacturing methods. Their versatility and availability continue to support broad market application.

The Epoxy segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing demand in high-performance sectors such as aerospace, wind energy, and defense. Epoxy-based GFRP composites exhibit superior bonding strength, chemical resistance, and thermal stability, making them ideal for critical structural applications. The rise in epoxy-based innovations is also enhancing product performance and sustainability.

- By Manufacturing Process

On the basis of manufacturing process, the Global GFRP Composites Market is segmented into Compression & Injection Molding, RTM/VARTM, Layup, Filament Winding, Pultrusion, and Others. The Compression & Injection Molding segment dominates the largest market revenue share of 36.8% in 2025, supported by its high production efficiency and ability to produce complex geometries with minimal waste. This process is widely adopted in automotive and electrical component manufacturing for mass production of consistent and durable parts. Cost-effectiveness and automation compatibility further drive segment growth.

The Filament Winding segment is anticipated to witness the fastest growth rate of 8.5% from 2025 to 2032, propelled by its expanding use in pipes, tanks, and pressure vessels. The process enables precise fiber placement, high strength, and excellent corrosion resistance, making it ideal for fluid transport systems in oil & gas, water treatment, and chemical industries. Increased infrastructure investment is further boosting adoption globally.

Glass Fiber Reinforced Plastics Composites Market Regional Analysis

- North America dominates the Glass Fiber Reinforced Plastics Composites Market with the largest revenue share of 38.21% in 2024, driven by presence of key players in the region, such as manufacturers of automotive parts and wind turbine blades, ensures North America remains a major market

- In the automotive sector, manufacturers are increasingly opting for GFRP materials to improve vehicle performance and reduce weight for better fuel efficiency

- Aerospace and defense applications also contribute to the demand for GFRP due to its high strength-to-weight ratio

- Government investments in infrastructure and renewable energy are expected to further fuel growth in North America.

U.S. Glass Fiber Reinforced Plastics Composites Market Insight

The U.S. Glass Fiber Reinforced Plastics Composites Market captured the largest revenue share of 82.41% in 2025 within North America, fueled by significant oilfield development in Texas, North Dakota, and the Gulf of Mexico, along with federal government support for unconventional hydrocarbon resource development.

Europe Glass Fiber Reinforced Plastics Composites Market Insight

The European Glass Fiber Reinforced Plastics Composites Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region's focus on offshore drilling operations, particularly in the North Sea, and the increasing exploration of unconventional resources are contributing to market demand.

U.K. Glass Fiber Reinforced Plastics Composites Market Insight

The U.K. Glass Fiber Reinforced Plastics Composites Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by significant demand for drilling fluids in horizontal wells and offshore drilling activities. The country's investments in deepwater and offshore drilling projects are driving the need for high-performance drilling fluids.

Germany Glass Fiber Reinforced Plastics Composites Market Insight

The German Glass Fiber Reinforced Plastics Composites Market is expected to expand at a considerable CAGR during the forecast period, fueled by the country's commitment to reducing carbon emissions and increasing the use of renewable energy sources. The exploration of unconventional resources and investment in deepwater drilling are contributing to market growth.

Asia-Pacific Glass Fiber Reinforced Plastics Composites Market Insight

The Asia-Pacific Glass Fiber Reinforced Plastics Composites Market is poised to grow at the fastest CAGR of over 5.8% during the forecast period of 2025 to 2032, driven by significant growth as it explores deepwater and tight oil reserves. Implementing advanced technologies aimed at reducing production costs and improving efficiency plays a crucial role in the growth of the regional market.

Japan Glass Fiber Reinforced Plastics Composites Market Insight

The Japan Glass Fiber Reinforced Plastics Composites Market is gaining momentum due to technological innovation and a strong culture of environmental responsibility. The country's machinery and precision tools industries are turning to high-performance bio-lubricants for efficiency and lower toxicity.

China Glass Fiber Reinforced Plastics Composites Market Insight

China Glass Fiber Reinforced Plastics Composites Market accounted for the largest market revenue share in Asia Pacific in 2025, driven by massive industrial output and supportive green manufacturing policies. The government's focus on reducing pollution and the availability of local raw materials are boosting domestic production.

Glass Fiber Reinforced Plastics Composites Market Share

The Glass Fiber Reinforced Plastics Composites Industry is primarily led by well-established companies, including:

- PPG Industries Inc. (U.S.)

- Owens Corning (U.S.)

- Johns Manville (U.S.)

- Yuntianhua Group Co. Ltd. (China)

- Jushi Group (China)

- Saint-Gobain (France)

- ASAHI FIBER GLASS Co. Ltd. (Japan)

- Nippon Sheet Glass Co. Ltd. (Japan)

- AGY (U.S.)

- CTG Group (China)

- Nitto Boseki Co. Ltd. (Japan)

- Braj Binani Group (India)

- China Beihai Fiberglass Co. Ltd. (China)

- BGF Industries Inc. (U.S.)

- SAERTEX GmbH & Co. KG (Germany)

- Jiangsu Jiuding New Materials Co. Ltd. (China)

- Celanese Corporation (U.S.)

- Quantum Composites (U.S.)

- Reliance Industries Limited (India)

- PFG FIBER GLASS CORPORATION (U.S.)

- Advanced Composites Inc. (U.S.)

Latest Developments in Global Glass Fiber Reinforced Plastics Composites Market

- In 2022, Avient Corporation introduced nine new reSound BIO thermoplastic elastomers, developed using plant-based renewable materials.

- In 2022, Avient also unveiled new bio-based polymer solutions tailored for use in medical and pharmaceutical sectors.

- In 2022, Hexcel Corporation launched HexPly, a composite product made from bio-derived resins and natural fiber reinforcements.

- In 2022, Hexcel and Archer Aviation signed a letter of intent to explore a partnership involving the supply of high-performance carbon fiber materials.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Glass Fiber Reinforced Plastics Composites Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Glass Fiber Reinforced Plastics Composites Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Glass Fiber Reinforced Plastics Composites Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.