Global Genetic Testing Market

Market Size in USD Billion

CAGR :

%

USD

21.49 Billion

USD

72.93 Billion

2024

2032

USD

21.49 Billion

USD

72.93 Billion

2024

2032

| 2025 –2032 | |

| USD 21.49 Billion | |

| USD 72.93 Billion | |

|

|

|

|

Genetic Testing Market Size

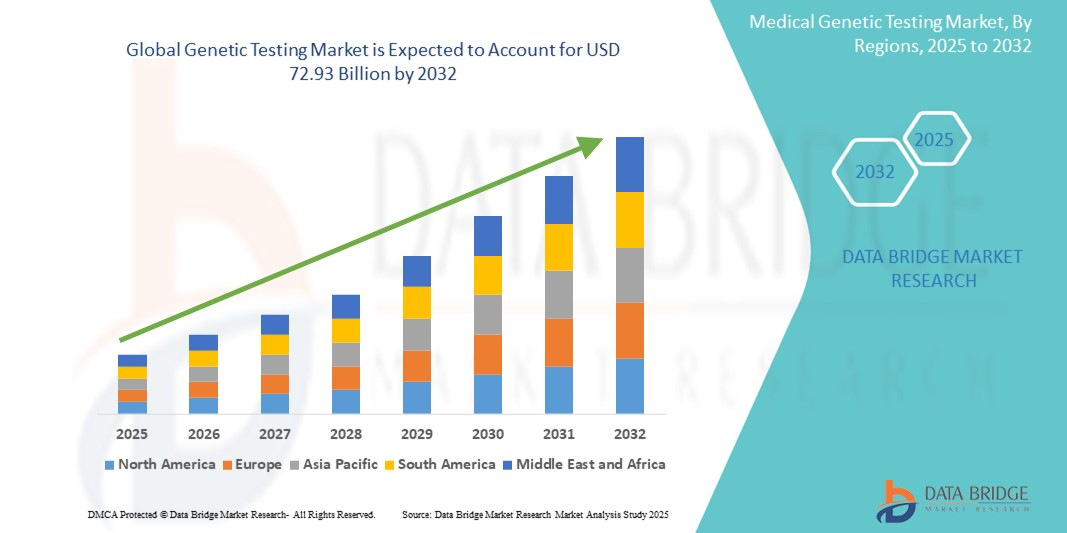

- The global genetic testing market size was valued at USD 21.49 billion in 2024 and is expected to reach USD 72.93 billion by 2032, at a CAGR of 16.5% during the forecast period

- The market growth is largely fueled by the increasing prevalence of genetic disorders, cancer, and chronic diseases, as well as the growing awareness and availability of personalized medicine and early disease detection methods

- Furthermore, rising consumer demand for predictive testing, improved sequencing technologies, and greater accessibility through direct-to-consumer channels is establishing genetic testing as a cornerstone in preventive healthcare. These converging factors are accelerating the uptake of genetic tests, thereby significantly boosting market expansion

Genetic Testing Market Analysis

- Genetic testing, enabling the identification of genetic disorders, disease predisposition, and ancestry, is becoming an essential component of personalized medicine and preventive healthcare across both clinical and direct-to-consumer applications due to its diagnostic accuracy, rapid technological advancements, and increasing affordability

- The escalating demand for genetic testing is primarily fueled by the growing prevalence of chronic and hereditary diseases, rising awareness of early disease detection, and expanding use of genomics in oncology, prenatal screening, and pharmacogenomics

- North America dominated the genetic testing market with the largest revenue share of 48.1% in 2024, driven by a well-established healthcare infrastructure, favorable reimbursement policies, and the presence of leading genetic testing companies, with the U.S. at the forefront due to high testing volumes and adoption of next-generation sequencing technologies

- Asia-Pacific is expected to be the fastest growing region in the genetic testing market during the forecast period due to increasing healthcare expenditures, growing awareness about genetic diseases, and expanding government initiatives to promote genomic research

- The predictive testing segment dominated the genetic testing market with a market share of 37.3% in 2024, driven by its critical role in early diagnosis, risk assessment, and personalized treatment planning across various disease areas

Report Scope and Genetic Testing Market Segmentation

|

Attributes |

Genetic Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Genetic Testing Market Trends

“Rising Integration with AI and Big Data for Personalized Medicine”

- A significant and accelerating trend in the global genetic testing market is the growing integration of artificial intelligence (AI), machine learning, and big data analytics to enhance diagnostic accuracy, streamline test interpretation, and enable personalized treatment recommendations based on genetic profiles

- For instance, companies such as Tempus and PathAI are leveraging AI-powered platforms to interpret complex genomic data, helping physicians tailor therapies, particularly in oncology. AI tools assist in identifying rare mutations and matching patients with targeted treatments or clinical trials

- AI integration in genetic testing enables faster processing of vast genomic datasets, improves variant classification, and reduces the likelihood of diagnostic errors. It also supports the development of polygenic risk scores, which are becoming increasingly useful for predicting the likelihood of common diseases such as diabetes and cardiovascular conditions

- Moreover, cloud-based platforms such as Illumina Connected Analytics and Invitae’s Data Platform offer scalable infrastructure for storing and analyzing genetic data, facilitating seamless collaboration between laboratories, clinicians, and researchers

- The ability to integrate genetic testing with electronic health records (EHRs) and other healthcare platforms allows for real-time clinical decision support, thereby increasing the utility of genetic data in everyday medical practice

- This shift towards more intelligent, data-driven, and interconnected genetic testing solutions is transforming how genetic information is used in healthcare. Consequently, companies such as 23andMe and Fulgent Genetics are increasingly investing in AI-powered genomic platforms to expand their capabilities in disease prediction and personalized medicine

- The demand for genetic testing solutions that offer precision, scalability, and actionable insights is growing rapidly across clinical diagnostics, research, and consumer segments, as stakeholders seek more targeted and effective healthcare solutions

Genetic Testing Market Dynamics

Driver

“Growing Demand for Early Detection and Personalized Healthcare”

- The increasing burden of genetic and chronic diseases, coupled with a heightened focus on early diagnosis and preventive healthcare, is a key driver of growth in the global genetic testing market

- For instance, in January 2024, Illumina partnered with Janssen to accelerate the use of whole-genome sequencing in identifying rare genetic disorders, signaling a broader move toward integrating genomics in mainstream healthcare

- As healthcare systems globally shift toward value-based care, genetic testing offers actionable insights that can prevent disease progression, optimize treatment selection, and reduce overall healthcare costs

- The rising popularity of personalized medicine is also driving demand, as physicians increasingly rely on genetic information to tailor drug therapies—especially in oncology, cardiology, and rare disease management

- Moreover, the growing accessibility of direct-to-consumer genetic tests from companies such as 23andMe and AncestryDNA is expanding consumer awareness and uptake, contributing to market expansion beyond traditional clinical settings

Restraint/Challenge

“Ethical, Regulatory, and Privacy Concerns”

- Ethical and regulatory challenges related to data privacy, informed consent, and potential misuse of genetic information pose significant barriers to the wider adoption of genetic testing

- For instance, fears about genetic discrimination in employment or insurance have led to legislative action in some countries, such as the Genetic Information Nondiscrimination Act (GINA) in the U.S., yet gaps in global regulatory frameworks remain

- The secure handling of sensitive genetic data is a major concern, especially in light of recent data breaches in the healthcare sector. Companies must implement robust cybersecurity measures and transparent data governance to build public trust

- In addition, the complexity of interpreting genetic results can lead to anxiety or misinformed decisions if not properly explained. This underscores the need for genetic counseling and clinician training as part of the testing process

- The high cost of some advanced genetic tests, particularly in low- and middle-income countries, also limits accessibility, though prices are gradually declining with the rise of high-throughput technologies such as next-generation sequencing

Genetic Testing Market Scope

The market is segmented on the basis of type, technology, disease, and end user.

- By Type

On the basis of type, the genetic testing market is segmented into carrier testing, diagnostic testing, newborn screening, predictive testing, presymptomatic testing, and others. The predictive testing segment dominated the market with the largest revenue share of 37.3% in 2024, driven by the rising demand for early risk assessment and proactive disease management. Predictive tests are widely used to evaluate the such aslihood of developing hereditary conditions such as breast cancer, Alzheimer’s disease, and cardiovascular disorders

The diagnostic testing segment is anticipated to witness steady growth from 2025 to 2032, supported by technological advancements and increasing demand for precise identification of genetic abnormalities to guide treatment decisions. Diagnostic testing remains crucial in rare disease identification, oncology, and neurological disorders, offering healthcare providers actionable insights for personalized treatment planning.

- By Technology

On the basis of technology, the genetic testing market is segmented into DNA sequencing, polymerase chain reaction, microarrays, whole genome sequencing, fluorescence in situ hybridization (FISH), and others. The DNA sequencing segment, particularly NGS-based testing, held the largest market share in 2024 due to its high accuracy, scalability, and ability to process large volumes of genetic data quickly. NGS is extensively used in oncology, rare disease diagnosis, and pharmacogenomics, offering comprehensive insights into genetic variants and mutations.

Whole genome sequencing is expected to register the fastest CAGR during the forecast period, driven by advancements in sequencing speed and cost-efficiency. It provides a complete overview of an individual's genetic makeup, making it increasingly valuable for personalized medicine and research applications. Its expanding use in population genomics projects and large-scale clinical studies further propels its growth

- By Disease

On the basis of disease, the genetic testing market is segmented into rare genetic disorders, cancer, cystic fibrosis, sickle cell anemia, Duchenne muscular dystrophy, thalassemia, Huntington’s disease, fragile X syndrome, and others. The cancer segment dominated the market in 2024 owing to the widespread adoption of genetic testing in oncology for early detection, risk stratification, and treatment selection. Genetic tests for BRCA mutations, Lynch syndrome, and companion diagnostics for targeted therapies are increasingly used in clinical practice.

The rare genetic disorder segment is projected to witness the highest growth rate from 2025 to 2032 due to advancements in diagnostic technologies and growing awareness among healthcare professionals. Early identification through genetic testing enables timely interventions for conditions that may otherwise go undiagnosed. Global initiatives to support rare disease research and newborn screening programs are also contributing to this segment’s expansion.

- By End User

On the basis of end user, the genetic testing market is segmented into hospitals, clinics, diagnostic centers, private clinics, laboratory service providers, and private laboratories. The laboratory service providers segment held the largest revenue share in 2024 due to the high volume of tests processed, the presence of advanced infrastructure, and partnerships with healthcare institutions for outsourced genetic testing services. Key players such as Quest Diagnostics and LabCorp continue to expand their genomic service offerings, fueling this segment’s dominance.

The private laboratories segment is expected to exhibit the fastest growth through 2032, driven by increasing demand for flexible, decentralized testing solutions, especially in urban and semi-urban settings. The rise of DTC genetic testing and personalized wellness services offered by private labs is reshaping the consumer genetics landscape, attracting health-conscious individuals seeking tailored health insights.

Genetic Testing Market Regional Analysis

- North America dominated the genetic testing market with the largest revenue share of 48.1% in 2024, driven by a well-established healthcare infrastructure, favorable reimbursement policies, and the presence of leading genetic testing companies, with the U.S. at the forefront due to high testing volumes and adoption of next-generation sequencing technologies

- Consumers and healthcare providers in the region place high value on early diagnosis, tailored treatment plans, and proactive health management, all of which are enabled by advanced genetic testing solutions

- This strong market position is further supported by favorable reimbursement policies, significant investments in genomics research, and the presence of leading industry players offering both clinical and direct-to-consumer testing services

U.S. Genetic Testing Market Insight

The U.S. genetic testing market captured the largest revenue share of 89% in 2024 within North America, driven by widespread adoption of precision medicine, high testing volumes, and robust healthcare infrastructure. Consumers and healthcare providers are increasingly leveraging genetic tests for disease risk assessment, early diagnosis, and treatment personalization. Government support for genomic research, strong reimbursement frameworks, and the presence of leading players such as Invitae, Myriad Genetics, and LabCorp are further accelerating market growth. Direct-to-consumer testing also continues to gain traction, particularly in wellness and ancestry applications.

Europe Genetic Testing Market Insight

The Europe genetic testing market is projected to expand at a substantial CAGR throughout the forecast period, driven by supportive healthcare policies, increasing awareness of genetic disorders, and rising demand for personalized treatment options. Government-funded initiatives and pan-European genomics programs are fostering wider test accessibility. Adoption is particularly strong in oncology and rare disease diagnostics. Furthermore, regulations such as GDPR emphasize data privacy and ethical testing, shaping responsible growth across clinical and research applications in the region.

U.K. Genetic Testing Market Insight

The U.K. genetic testing market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the National Health Service’s (NHS) continued investment in genomics and early disease detection. The country’s Genomic Medicine Service is a key enabler for integrating genetic testing into routine care. Public awareness campaigns and strong academic-industry collaborations are further driving adoption in oncology, cardiovascular, and prenatal screening. In addition, the U.K.'s robust research environment supports advancements in sequencing technologies and population health genomics.

Germany Genetic Testing Market Insight

The Germany genetic testing market is expected to expand at a considerable CAGR during the forecast period, supported by high demand for advanced diagnostics, a well-funded healthcare system, and a growing focus on rare disease detection and pharmacogenomics. Germany is a key player in Europe’s biotechnology and diagnostics sectors, with strong academic and commercial R&D infrastructure. The adoption of genetic testing in hospitals and specialty clinics is rising, with emphasis on privacy-compliant and ethically administered solutions aligned with local regulations.

Asia-Pacific Genetic Testing Market Insight

The Asia-Pacific genetic testing market is poised to grow at the fastest CAGR of 22.3% during the forecast period of 2025 to 2032, driven by expanding healthcare access, rising awareness of genetic disorders, and government-led digital health initiatives. Countries such as China, Japan, and India are witnessing rapid growth in demand for prenatal testing, cancer screening, and ancestry services. Lower sequencing costs, growing investments in genomics, and the emergence of domestic players are making genetic testing more affordable and accessible across the region.

Japan Genetic Testing Market Insight

The Japan genetic testing market is gaining momentum, driven by its aging population, advanced healthcare infrastructure, and a cultural emphasis on preventive medicine. Genomic testing is being increasingly adopted for cancer diagnosis, pharmacogenomics, and rare disease identification. Government initiatives such as the "Genome Medical Care" strategy aim to integrate precision medicine across the national healthcare system. Japan's focus on innovation and clinical quality is fostering growth in both clinical diagnostics and research-based testing.

India Genetic Testing Market Insight

The India genetic testing market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, an expanding middle class, and increased awareness of genetic conditions. The country is witnessing a surge in demand for low-cost genetic screening in prenatal care, oncology, and metabolic disorders. Government initiatives promoting digital health and population screening, combined with the presence of local genetic testing startups, are accelerating market penetration. India’s robust IT infrastructure and telehealth adoption further support access to genetic services in both urban and rural areas.

Genetic Testing Market Share

The genetic testing industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Invitae Corporation (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- PerkinElmer (U.S.)

- Illumina, Inc. (U.S.)

- QIAGEN (Germany)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Fulgent Genetics (U.S.)

- Myriad Genetics, Inc. (U.S.)

- Abbott (U.S.)

- Eurofins Scientific (Luxembourg)

- Sorenson Genomics (U.S.)

- BIO-HELIX (U.S.)

- Biocartis (Belgium)

- Cepheid (U.S.)

- PacBio (U.S.)

- ELITechGroup (France)

- Genes2Me (India)

- Eugene Labs (U.S.)

- Otogenetics (U.S.)

- Mapmygenome (India)

- MedGenome (India)

- BioReference Health, LLC (U.S.)

- Natera, Inc. (U.S.)

What are the Recent Developments in Global Genetic Testing Market?

- In April 2023, Illumina Inc., a global leader in DNA sequencing and array-based technologies, partnered with Janssen Biotech Inc. to expand the application of whole-genome sequencing (WGS) for identifying rare and undiagnosed genetic diseases. This strategic collaboration aims to accelerate research and improve early diagnosis capabilities, reinforcing Illumina’s commitment to advancing genomic medicine and expanding the reach of genetic testing in complex disease areas

- In March 2023, 23andMe Holding Co., a prominent player in the direct-to-consumer genetic testing segment, launched a new pharmacogenetics report as part of its health service offerings. This report helps consumers understand how their genetic profile may affect their response to certain medications. The move highlights the growing demand for personalized health insights and reflects 23andMe’s ongoing efforts to integrate clinically relevant testing into consumer-accessible platforms

- In February 2023, Myriad Genetics Inc. announced the release of its updated MyRisk Hereditary Cancer Test, featuring a new panel with expanded gene coverage and enhanced predictive accuracy. This development aims to provide broader insights for individuals at risk of hereditary cancers such as breast, ovarian, and colorectal cancers. Myriad’s innovation emphasizes the role of genetic testing in early cancer detection and risk assessment, supporting personalized preventive strategies

- In February 2023, Thermo Fisher Scientific Inc. launched its Ion Torrent Genexus Dx Integrated Sequencer, a fully automated next-generation sequencing (NGS) platform designed for clinical diagnostics. This system allows for same-day results with minimal hands-on time, marking a significant advancement in workflow efficiency and clinical decision-making. The launch reinforces Thermo Fisher’s focus on enabling precision medicine through accessible, high-throughput genetic testing solutions

- In January 2023, Invitae Corporation entered into a strategic partnership with NTT DATA to expand access to its genetic testing platform in emerging markets. This collaboration aims to enhance global reach and reduce barriers to genetic diagnostics by leveraging digital health infrastructure. The partnership reflects Invitae’s mission to make comprehensive genetic information accessible and actionable for all patients, particularly in underrepresented regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.