Global Gene Therapy Market

Market Size in USD Billion

CAGR :

%

USD

10.26 Billion

USD

39.38 Billion

2024

2032

USD

10.26 Billion

USD

39.38 Billion

2024

2032

| 2025 –2032 | |

| USD 10.26 Billion | |

| USD 39.38 Billion | |

|

|

|

|

Gene Therapy Market Size

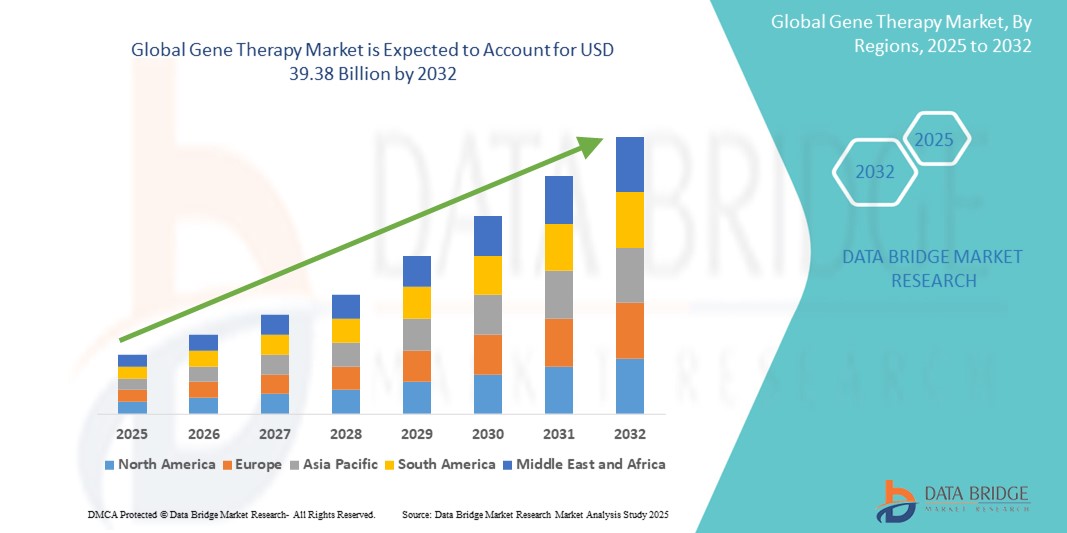

- The global gene therapy market size was valued at USD 10.26 billion in 2024 and is expected to reach USD 39.38 billion by 2032, at a CAGR of 18.30% during the forecast period

- The market growth is largely fueled by the growing demand for curative therapies and rising investments in gene therapy research. Technological advancements, particularly in gene editing and delivery methods, are significantly contributing to this expansion

- Furthermore, the increasing prevalence of genetic disorders and a robust clinical trial pipeline are establishing gene therapy as a promising treatment modality. Favorable regulatory environments are also accelerating the uptake of gene therapy solutions, thereby significantly boosting the industry's growth

Gene Therapy Market Analysis

- Gene therapies, involving the introduction, removal, or alteration of an individual's genetic material to treat or cure diseases, are increasingly vital components of modern medicine, offering potential cures for previously untreatable genetic disorders, cancers, and infectious diseases in both inherited and acquired conditions due to their targeted approach and disease-modifying potential

- The escalating demand for gene therapies is primarily fueled by the growing understanding of the genetic basis of diseases, significant advancements in gene editing technologies, and a rising need for effective treatments for rare and chronic conditions where conventional therapies offer limited success

- North America dominates the gene therapy market with the largest revenue share of 40.5% in 2025, characterized by strong research infrastructure, high healthcare expenditure, and the presence of leading biotechnology and pharmaceutical companies

- Asia-Pacific is expected to be the fastest growing region in the gene therapy market with a CAGR of 27.2%, during the forecast period due to increasing investments in healthcare infrastructure, a growing patient population with genetic disorders, and rising disposable incomes supporting access to advanced medical treatments

- Viral Vector segment is expected to dominate the gene therapy market with a market share of 85.5% in 2025, driven by the well-established efficacy and versatility of viral vectors such as adeno-associated viruses (AAVs) and lentiviruses in delivering therapeutic genes. These vectors have been extensively studied and successfully used in several approved gene therapies

Report Scope and Gene Therapy Market Segmentation

|

Attributes |

Gene Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gene Therapy Market Trends

“Enhanced Therapeutic Potential Through Advanced Gene Editing and Delivery"

- A significant and accelerating trend in the global gene therapy market is the deepening integration with advanced gene editing technologies, such as CRISPR-Cas9, and innovative gene delivery systems, such as adeno-associated viruses (AAVs) and non-viral vectors. This fusion of technologies is significantly enhancing the precision, efficacy, and safety of therapeutic interventions

- For instance, CRISPR-based therapies are being developed to precisely target and correct disease-causing genes in conditions such as sickle cell disease and beta-thalassemia, offering the potential for a one-time curative treatment. Similarly, advancements in AAV capsid engineering are improving the targeted delivery of therapeutic genes to specific tissues and organs, minimizing off-target effects

- The integration of advanced gene editing with sophisticated delivery mechanisms enables features such as highly specific gene modifications and efficient transduction of target cells, leading to more effective and potentially safer therapies

- The seamless integration of precise gene editing tools with efficient delivery platforms facilitates the development of more targeted and personalized gene therapies for a wider range of diseases. Through a combination of these technologies, researchers can engineer therapies that address the unique genetic profiles of individual patients, maximizing therapeutic benefit and minimizing adverse effects

- This trend towards more precise, efficient, and personalized gene therapies is fundamentally reshaping treatment paradigms for various diseases. Consequently, companies are heavily investing in the development of novel gene editing tools with improved accuracy and delivery systems that enhance tissue specificity and reduce immunogenicity

- The demand for gene therapies that offer seamless integration of advanced gene editing and delivery technologies is growing rapidly across various therapeutic areas, including genetic disorders, oncology, and infectious diseases, as clinicians and patients increasingly seek transformative and potentially curative treatment options

Gene Therapy Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Genetic Disorders and Demand for Effective Treatments"

- The increasing prevalence of genetic disorders across the globe, coupled with a growing demand for effective and potentially curative treatments, is a significant driver for the heightened demand for gene therapies

- For instance, in May 2025, several research institutions announced promising results from gene therapy trials for rare genetic diseases such as Duchenne muscular dystrophy, highlighting the potential of these therapies to address previously unmet medical needs. Such advancements are expected to drive the gene therapy industry growth in the forecast period

- As the understanding of the genetic basis of various diseases deepens and the limitations of conventional treatments become apparent, gene therapies offer the prospect of addressing the root cause of these conditions, providing a compelling alternative or superior treatment option

- Furthermore, the growing awareness of personalized medicine and the potential of tailoring treatments based on an individual's genetic makeup are making gene therapies an increasingly attractive approach for a range of diseases, including cancers and autoimmune disorders

- The potential for long-lasting therapeutic effects, or even cures, with a single administration, along with the ability to target specific disease mechanisms at the genetic level, are key factors propelling the adoption of gene therapies in both rare and more common diseases. The increasing investment in research and development, coupled with advancements in manufacturing and delivery technologies, further contributes to market growth.

Restraint/Challenge

“Concerns Regarding High Development Costs and Complex Manufacturing Processes”

- Concerns surrounding the high costs associated with the research, development, and manufacturing of gene therapies pose a significant challenge to broader market accessibility and penetration. The intricate nature of gene editing, vector development, and cell processing contributes to substantial upfront investments and ongoing production expenses, raising anxieties among payers and patients about the affordability of these treatments

- For instance, the complex and often personalized manufacturing processes for cell and gene therapies can lead to significant production costs and logistical hurdles, impacting the final price of the therapy

- Addressing these cost concerns through advancements in manufacturing technologies, economies of scale, and innovative pricing models is crucial for ensuring wider patient access. Companies are exploring strategies such as developing more efficient viral vector production methods and establishing centralized manufacturing facilities to reduce costs

- While the potential for long-term cost savings through curative therapies is recognized, the high initial investment can be a barrier to adoption, particularly in healthcare systems with budget constraints or for patients lacking comprehensive insurance coverage. The complexity of clinical trials and the need for specialized infrastructure and expertise further contribute to the overall cost of gene therapy development

- Overcoming these challenges through technological innovation in manufacturing, streamlined regulatory processes, and the development of sustainable reimbursement frameworks will be vital for realizing the full potential of gene therapies and ensuring their accessibility to a broader patient population

Gene Therapy Market Scope

The market is segmented on the basis of vector type, method, gene type, application, and end user

- By Vector Type

On the basis of vector type, the gene therapy market is segmented into viral vector and non-viral vector. The viral vector segment held a significant market revenue share of 85.5%, driven by the well-established efficacy and versatility of viral vectors such as adeno-associated viruses (AAVs) and lentiviruses in delivering therapeutic genes. These vectors have been extensively studied and successfully used in several approved gene therapies

The non-viral vector segment is anticipated to witness a rapid growth rate during the forecast period, fueled by increasing advancements in non-viral delivery systems such as lipid nanoparticles, naked DNA, and electroporation. These methods offer potential advantages in terms of safety, immunogenicity, and the ability to carry larger genetic payloads, making them increasingly attractive for certain applications and overcoming some limitations associated with viral vectors.

- By Method

On the basis of method, the gene therapy market is segmented into ex-vivo and in-vivo. The in-vivo segment held a larger market revenue share currently, driven by its broader applicability across a wider range of diseases and the potential for treating large patient populations. In-vivo approaches involve directly delivering the therapeutic gene into the patient's body

The ex-vivo segment is also experiencing significant growth, particularly in areas such as cell-based gene therapies for cancer and certain genetic disorders. This method involves modifying cells outside the patient's body and then transplanting them back. The controlled environment for genetic modification offers advantages for specific therapeutic applications

- By Gene Type

On the basis of gene type, the gene therapy market is segmented into antigen, cytokine, tumor suppressor, suicide, deficiency, growth factors, receptors, and others. The deficiency segment accounted for the largest market share, driven by the focus on treating inherited genetic disorders caused by a lack of a functional gene product

The oncological disorders segment (under application, but driven by gene type approaches such as tumor suppressor and suicide genes) is anticipated to witness significant growth due to the potential of gene therapies to offer targeted and effective treatments for various cancers. Other gene types such as antigens (for vaccine development) and cytokines (for immunomodulation) are also contributing to market growth in their respective applications.

- By Application

On the basis of application, the gene therapy market is segmented into oncological disorders, cardiovascular diseases, infectious diseases, rare diseases, neurological disorders, and other diseases. The oncological disorders segment likely holds the largest market revenue share currently, driven by the intense research and development efforts and the significant unmet medical needs in various cancer type.

The rare diseases segment is expected to witness a significant growth rate during the forecast period, fueled by increasing regulatory support and incentives for developing therapies for rare genetic disorders, as well as the promising results demonstrated by gene therapies in this area. Other application areas such as neurological disorders and cardiovascular diseases are also seeing increasing research and clinical development activities

- By End User

On the basis of end user, the gene therapy market is segmented into cancer institutes, hospitals, research institutes, and others. Hospitals segment is the largest end-user segment, driven by their direct involvement in patient treatment and the administration of approved gene therapies.

Research institutes play a crucial role in the early stages of gene therapy development and are expected to remain a significant end user, contributing to the pipeline of novel therapies

Gene Therapy Market Regional Analysis

- North America dominates the gene therapy market with the largest revenue share of 40.5% in 2024, driven strong research infrastructure, high healthcare expenditure, and the presence of leading biotechnology and pharmaceutical companies

- The region benefits from the presence of key market players, advanced healthcare infrastructure, and a high adoption rate of innovative medical technologies. Furthermore, the increasing prevalence of genetic disorders and cancer, coupled with favorable reimbursement policies, contributes to the strong market position of North America.

- This widespread activity is further supported by significant funding for clinical trials, collaborations between academic institutions and industry, and a proactive approach by regulatory agencies to expedite the approval of promising gene therapies, establishing the region as a leader in the development and commercialization of these advanced treatments

U.S. Gene Therapy Market Insight

The U.S. gene therapy market captured the largest revenue share within North America in 2025 with a market share of 63.2%, fueled by a strong biopharmaceutical industry, significant research funding, and a proactive regulatory environment. Consumers (patients and healthcare providers) are increasingly prioritizing the potential of gene therapies to provide long-lasting or curative treatments for various diseases. The growing prevalence of genetic disorders and cancer, combined with the demand for innovative therapies, further propels the gene therapy industry. Moreover, the increasing integration of gene therapies into standard treatment protocols and the availability of reimbursement pathways are significantly contributing to the market's expansion.

Europe Gene Therapy Market Insight

The European gene therapy market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in research and development, growing regulatory support for advanced therapies, and a rising awareness of the potential of gene therapies for unmet medical needs. The increase in collaborations between academic institutions and industry, coupled with the demand for innovative treatments for genetic and chronic diseases, is fostering the adoption of gene therapies. European patients and healthcare systems are also drawn to the potential for long-term efficacy and improved quality of life these therapies offer. The region is experiencing significant growth across various therapeutic areas, with gene therapies being explored for both rare and common diseases.

U.K. Gene Therapy Market Insight

The U.K. gene therapy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a strong scientific base, government support for life sciences innovation, and a growing need for effective treatments for genetic disorders and cancer. In addition, concerns regarding the limitations of traditional therapies and the promise of gene therapies are encouraging both patients and healthcare providers to explore these advanced options. The U.K.'s robust healthcare system and its commitment to adopting cutting-edge medical technologies are expected to continue to stimulate market growth.

Germany Gene Therapy Market Insight

The German gene therapy market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing research activities, a strong pharmaceutical sector, and a growing demand for innovative and personalized medicine approaches. Germany's well-developed healthcare infrastructure, combined with its emphasis on scientific excellence and patient access to advanced treatments, promotes the adoption of gene therapies, particularly in specialized treatment centers and research hospitals. The integration of gene therapies into clinical practice is also becoming increasingly prevalent, with a strong focus on safety and efficacy aligning with local healthcare standards.

Asia-Pacific Gene Therapy Market Insight

The Asia-Pacific gene therapy market is poised to grow at the fastest CAGR of 27.2% in 2025, driven by increasing healthcare expenditure, a large patient pool with genetic disorders and cancer, and growing investments in biotechnology and pharmaceutical research in countries such as China, Japan, and India. The region's growing inclination towards advanced medical treatments, supported by government initiatives promoting healthcare innovation, is driving the adoption of gene therapies. Furthermore, as APAC emerges as a significant region for clinical trials and potential manufacturing of gene therapy products, the accessibility and affordability of these therapies are expanding to a wider patient base.

Japan Gene Therapy Market Insight

The Japan gene therapy market is gaining momentum due to the country’s strong focus on regenerative medicine, a rapidly aging population with increasing prevalence of age-related diseases, and government support for innovative medical technologies. The Japanese market places a significant emphasis on safety and efficacy, and the adoption of gene therapies is driven by the increasing number of clinical trials and the potential for treating previously untreatable conditions. The integration of gene therapies into national healthcare policies and the presence of domestic pharmaceutical companies investing in this field are fueling growth. Moreover, Japan's well-established healthcare system provides a pathway for the adoption and reimbursement of approved gene therapies.

India Gene Therapy Market Insight

The India gene therapy market witness the highest compound annual growth rate (CAGR), attributed to the country's large patient population with genetic disorders, increasing healthcare awareness, and a growing biopharmaceutical industry. India stands as a significant market for pharmaceuticals and biotechnology, and gene therapies are becoming increasingly recognized for their potential to address prevalent genetic diseases. The increasing investment in healthcare infrastructure, the rise of local biopharmaceutical companies, and the potential for more affordable gene therapy options are key factors propelling the market in India.

Gene Therapy Market Share

The Gene Therapy industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Pfizer Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- BioMarin (U.S.)

- bluebird bio, Inc. (U.S.)

- Sarepta Therapeutics, Inc. (U.S.)

- Vertex Pharmaceuticals Incorporated (U.S.)

- CRISPR Therapeutics (Switzerland)

- Intellia Therapeutics, Inc. (U.S.)

- Editas Medicine (U.S.)

- uniQure NV. (Netherlands)

- Orchard Therapeutics plc (U.K.)

- Bayer AG (U.S.)

- Krystal Biotech, Inc. (U.S.)

- Beam Therapeutics (U.S.)

- MeiraGTx Limited (U.S.)

- Sangamo Therapeutics (U.S.)

- BridgeBio Pharma, Inc. (U.S.)

- PTC Therapeutics. (U.S.)

Latest Developments in Global Gene Therapy Market

- In April 2025, Vertex Pharmaceuticals announced positive Phase 3 clinical trial results for its ex-vivo CRISPR-Cas9 gene-edited therapy for sickle cell disease. The data demonstrated a significant reduction in vaso-occlusive crises, a major complication of the disease, highlighting the transformative potential of gene editing in treating genetic blood disorders. This advancement underscores the progress in utilizing CRISPR technology to develop durable therapies for severe genetic conditions

- In March 2025, BioMarin Pharmaceutical Inc. received regulatory approval in a major European market for its gene therapy targeting a specific rare genetic liver disorder. This approval marks another milestone in expanding the availability of gene therapies for rare diseases, offering a potentially life-altering treatment option for patients with limited therapeutic alternatives. The decision reflects the growing confidence of regulatory bodies in the safety and efficacy of gene therapies for such conditions

- In February 2025, Novartis announced a strategic partnership with a leading gene therapy manufacturing company to enhance its production capabilities for adeno-associated virus (AAV) vectors, a critical component in many gene therapies. This collaboration aims to address the manufacturing bottlenecks that have been a challenge in the gene therapy field, ensuring a more reliable and scalable supply of viral vectors for clinical trials and commercialization. The move underscores the growing importance of robust manufacturing infrastructure for the widespread adoption of gene therapies

- In January 2025, bluebird bio, Inc. presented long-term follow-up data from its clinical trials for gene therapies in beta-thalassemia and cerebral adrenoleukodystrophy (CALD) at a major medical conference. The data showed sustained therapeutic benefits over several years, providing further evidence for the durability of gene therapy approaches for these severe genetic diseases. These long-term outcomes are crucial for demonstrating the lasting impact of gene therapies and building confidence among patients and clinicians

- In December 2022, Ferring Pharmaceuticals saw FDA approval for Adstiladrin, a gene therapy for high-risk, BCG-unresponsive non-muscle invasive bladder cancer. This novel therapy, based on an adenovirus vector, targets adult patients with carcinoma in situ, with or without papillary tumors, bolstering the company's product range and therapeutic options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.