Global Gel Permeation Chromatography Gpc Market

Market Size in USD Billion

CAGR :

%

USD

1.57 Billion

USD

2.65 Billion

2025

2033

USD

1.57 Billion

USD

2.65 Billion

2025

2033

| 2026 –2033 | |

| USD 1.57 Billion | |

| USD 2.65 Billion | |

|

|

|

|

Gel Permeation Chromatography (GPC) Market Size

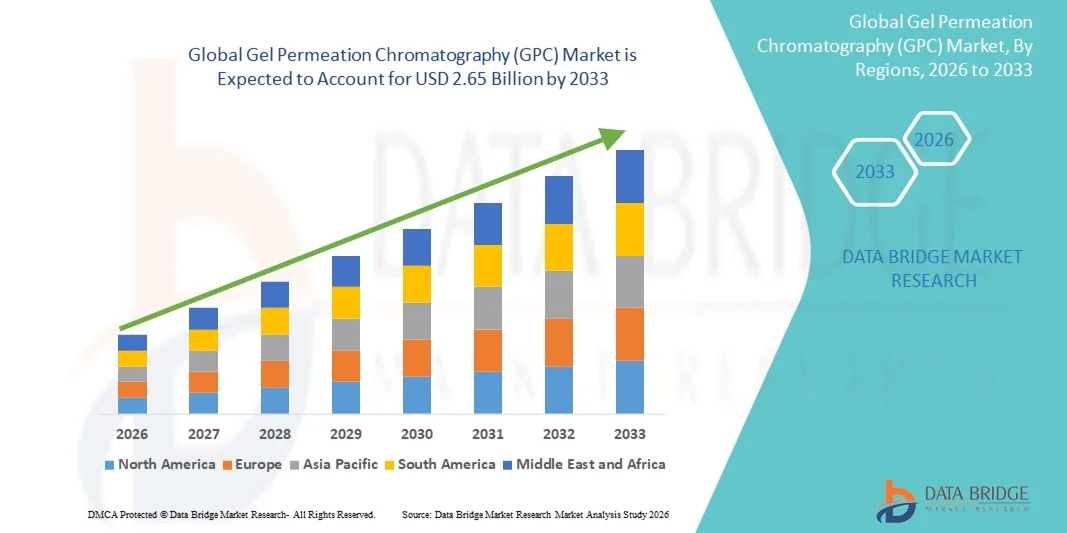

- The global gel permeation chromatography (GPC) market size was valued at USD 1.57 billion in 2025 and is expected to reach USD 2.65 billion by 2033, at a CAGR of 6.81% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced analytical technologies and the rising demand for precise molecular weight determination across pharmaceuticals, biotechnology, polymers, and petrochemicals. Growing R&D activities, especially in polymer development and biopharmaceutical characterization, are accelerating the need for high-accuracy GPC systems

- Furthermore, the expanding emphasis on quality control, regulatory compliance, and highly reliable material characterization is establishing Gel Permeation Chromatography (GPC) as a preferred analytical technique across industries. These converging factors are driving the adoption of GPC instruments, detectors, and software solutions, thereby significantly boosting the industry's overall growth

Gel Permeation Chromatography (GPC) Market Analysis

- Gel Permeation Chromatography (GPC), a critical analytical technique used for determining molecular weight distribution and polymer characterization, is becoming increasingly essential across pharmaceuticals, biotechnology, petrochemicals, and material science industries. Its ability to deliver highly accurate and reliable data on polymer structures is strengthening its adoption in both research and quality-control applications

- The rising demand for Gel Permeation Chromatography (GPC) is primarily driven by expanding R&D activities, the growing need for advanced polymer analysis, strict regulatory standards for material characterization, and the increasing development of biopharmaceuticals. The surge in new polymer innovations and specialty materials further accelerates the demand for high-precision GPC systems

- North America dominated the gel permeation chromatography (GPC) market with the largest revenue share of 37.4% in 2025, supported by strong research infrastructure, high investment in pharmaceutical and polymer R&D, and the presence of leading analytical instrument manufacturers. The U.S. continues to hold a major share due to the rapid expansion of biopharmaceutical development and rising demand for advanced analytical systems in both academic and industrial laboratories

- Asia-Pacific is expected to be the fastest-growing region in the gel permeation chromatography (GPC) market, projected to record a CAGR from 2026 to 2033, driven by expanding industrialization, increased polymer production, growth in academic research funding, and rising investments in pharmaceutical manufacturing across China, India, South Korea, and Japan

- The analytical systems segment dominated with a 61.9% market share in 2025, driven by growing demand for high-accuracy polymer and biomolecule characterization

Report Scope and Gel Permeation Chromatography (GPC) Market Segmentation

|

Attributes |

Gel Permeation Chromatography (GPC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Agilent Technologies (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Gel Permeation Chromatography (GPC) Market Trends

Advancements in Automation, Digitalization, and Intelligent Analytical Controls

- A significant and accelerating trend in the global gel permeation chromatography (GPC) market is the increasing integration of advanced automation systems, digital monitoring tools, and intelligent analytical software. These improvements enhance operational efficiency, analytical accuracy, and user control over polymer characterization workflows

- For instance, Waters Corporation's Empower GPC/SEC software suite now provides automated calibration, molecular weight analysis, and real-time data validation, enabling laboratories to reduce manual intervention and improve repeatability. Similarly, Agilent’s GPC/SEC software offers integrated reporting and automated elution time correction, supporting consistent polymer analysis.

- Intelligent analytical systems used in GPC facilitate automated method optimization, baseline correction, peak separation, and advanced molecular weight distribution calculations. For example, Malvern’s OMNISEC system utilizes intelligent detectors to refine multi-angle light scattering and viscosity measurements for high-accuracy polymer characterization

- The integration of digital and cloud-based platforms allows centralized data management, remote monitoring of chromatography runs, and streamlined compliance reporting. Through a single interface, users can manage methods, oversee instrument performance, store audit trails, and share results across labs, improving the overall analytical workflow

- This trend toward more automated, intuitive, and integrated GPC systems is reshaping laboratory expectations, driving demand for systems that reduce manual workload while improving analytical precision. Companies such as Shimadzu and Tosoh Bioscience are increasingly offering GPC instruments with enhanced software-driven automation, multi-detector compatibility, and simplified user interfaces

- The demand for advanced GPC instruments with seamless digital integration is growing rapidly across polymer research, pharmaceuticals, bioplastics, and specialty chemicals, as laboratories prioritize efficiency, accuracy, and high-throughput analytical capacity

Gel Permeation Chromatography (GPC) Market Dynamics

Driver

Growing Need for Polymer Characterization and Rising Use Across Manufacturing Industries

- The rising demand for polymer quality assessment and molecular weight analysis in industries such as pharmaceuticals, bioplastics, petrochemicals, and packaging is a major driver boosting the GPC market

- For instance, in February 2024, Agilent Technologies launched an upgraded InfinityLab GPC system integrating improved detectors and higher-precision temperature control to meet increasing analytical demands in polymer R&D

- As industries develop more complex polymers, specialty plastics, elastomers, and biopolymers, the need for precise molecular weight distribution analysis becomes essential for performance validation and regulatory compliance

- Furthermore, the continuous expansion of biopharmaceutical research and the growing production of biologics have increased the use of GPC for analyzing protein aggregation, molecular degradation, and excipient interactions

- The ability to provide high accuracy, reproducible measurements, and compatibility with multiple detection systems—such as refractive index, MALS, UV, and viscometers—makes GPC an integral tool across both academic and industrial laboratories. The shift toward high-throughput research workflows and the availability of user-friendly GPC/SEC instruments further contribute to market growth

Restraint/Challenge

High Instrumentation Costs and Technical Complexity in Operation

- The high cost of advanced GPC systems, multi-detector setups, and maintenance requirements poses a substantial challenge to wider adoption, particularly for small laboratories and institutions with limited budgets

- For instance, reports on the rising costs of multi-detector GPC systems—including MALS-equipped setups—highlight that procurement and upkeep expenses often exceed the budgets of smaller polymer or academic labs

- Addressing these barriers requires improved affordability, modular system designs, and reduced maintenance burden. Companies such as Tosoh Bioscience and Malvern Panalytical emphasize long-term reliability and low-maintenance detector technology to increase system accessibility. In addition, the technical complexity of GPC—such as calibration challenges, detector sensitivity issues, and data interpretation hurdles—can limit adoption among non-specialist users

- Although advancements in software-based automation are gradually reducing operational difficulty, the perceived complexity of GPC analysis may still hinder adoption, especially in emerging research laboratories

- Overcoming these challenges through simplified workflows, cost-effective instrument configurations, enhanced training programs, and improved user interfaces will be critical for sustained market growth

Gel Permeation Chromatography (GPC) Market Scope

The market is segmented on the basis of product, application, type, end users, and temperature.

- By Product

On the basis of product, the Gel Permeation Chromatography (GPC) market is segmented into detectors and systems. The systems segment dominated the market with the largest revenue share of 58.4% in 2025, driven by the rising adoption of advanced chromatographic systems across pharmaceutical, chemical, and biochemical laboratories. Increasing requirements for high-precision molecular weight determination and polymer characterization are strengthening the demand for fully automated GPC systems. The dominance of this segment is also supported by technological enhancements such as multi-detector integration, improved pump precision, and enhanced throughput. Industries such as biotechnology and polymer research rely heavily on GPC systems for critical quality control and molecular structure verification, further driving adoption. Growing regulatory emphasis on accurate macromolecule analysis in pharmaceuticals also pushes laboratories toward high-performance systems. Increasing R&D spending in polymers, biopolymers, and nanomaterials contributes significantly to segment expansion. In addition, the expanding use of GPC systems in academic and government research institutions strengthens market share.

The detectors segment is expected to witness the fastest growth, registering a CAGR of 19.6% from 2026 to 2033, driven by advancements in multi-angle light scattering (MALS), refractive index (RI), and UV detectors. The growing trend toward high-resolution characterization of polymer structures and molecular weight distribution is accelerating detector adoption. The segment benefits from increasing demand for real-time, accurate, and automated analysis systems that improve data quality and experimental efficiency. Research laboratories increasingly prefer standalone detectors for integration into custom analytical workflows. Detectors are also gaining traction due to their lower cost relative to full systems, making them attractive for small and mid-sized laboratories. Advancements in software analytics for detector output interpretation further support growth. Moreover, the expansion of academic research programs and polymer study initiatives globally increases detector demand. Rising focus on pharmaceutical impurity profiling using advanced detection methods also contributes significantly to CAGR.

- By Application

On the basis of application, the market is segmented into salts and amino acids separate from proteins, fractionation and purification of proteins, polysaccharides, and nucleic acids, and others. The fractionation and purification of proteins, polysaccharides, and nucleic acids segment dominated, accounting for 46.7% of the market in 2025, driven by increasing biomolecule research and the rising demand for precise purification techniques in biotechnology and pharmaceutical industries. The segment benefits from growing genetic engineering research, demand for high-purity biopolymers, and advancements in biotherapeutics. GPC is widely used for separating high-molecular-weight compounds and evaluating biomolecular interactions, boosting adoption. Moreover, increasing application in vaccine development, protein formulation, and carbohydrate research strengthens dominance. Pharmaceutical regulators emphasize purity analysis for biologics, increasing GPC uptake. Academic and molecular biology research facilities use GPC extensively for nucleic acid purification, supporting sustained growth. Expanding usage in glycomics, proteomics, and gene therapy R&D also contributes to segment leadership.

The salts and amino acids separate from proteins segment is expected to register the fastest CAGR of 20.3% between 2026 and 2033, driven by the rising adoption of GPC in analytical biochemistry and pharmaceutical quality control. Growing focus on separating low-molecular-weight molecules from complex biological mixtures is a major growth factor. This segment benefits from increased development of peptide-based therapeutics, amino acid metabolism studies, and protein formulation workflows. The need for highly accurate separation techniques in drug discovery boosts adoption. The segment is also driven by expanding nutraceutical and amino acid supplement industries. Research institutions increasingly use GPC for studying metabolic disorders, supporting strong demand. Growing use in food chemistry, agricultural research, and environmental testing further accelerates CAGR. The development of high-resolution columns specifically designed for low-molecular-weight separation also enhances adoption.

- By Type

On the basis of type, the market is segmented into analytical systems and clean-up systems. The analytical systems segment dominated with a 61.9% market share in 2025, driven by growing demand for high-accuracy polymer and biomolecule characterization. Analytical GPC systems are widely used in pharmaceutical, chemical, and materials science laboratories for determining molecular weight distribution, branching structures, and polymer uniformity. The dominance of this segment is supported by advancements in detector technologies and automation features. These systems are critical in ensuring regulatory compliance for biopharmaceuticals and polymer-based medical products. Increased global R&D spending in nanomaterials and synthetic polymers further strengthens segment leadership. Industries rely on analytical GPC for detailed structural analysis, enhancing product quality. Moreover, these systems offer higher throughput and data precision, making them essential for industrial and academic applications. The growing emphasis on biopolymer development also contributes to dominance.

The clean-up systems segment is projected to grow at the fastest CAGR of 18.8% from 2026 to 2033, driven by rising demand for sample preparation, impurity removal, and matrix clean-up in analytical procedures. Clean-up systems are increasingly adopted to enhance accuracy and reliability in downstream GPC workflows. Growth is fueled by expanding applications in food testing, environmental chemistry, and pharmaceutical impurity profiling. Laboratories prefer automated clean-up systems due to time-saving advantages and improved reproducibility. The segment benefits from growing regulatory emphasis on contaminant removal before analytical testing. Increasing use in process development, polymer sample conditioning, and bioanalysis enhances market momentum. Rising adoption of chromatography-based purification in academia and industry also contributes. The need for better sample integrity and improved detector compatibility further pushes CAGR.

- By End Users

On the basis of end users, the market is segmented into academic institutions, chemical and biochemical companies, government agencies, and others. The chemical and biochemical companies segment dominated with 49.1% of the market share in 2025, driven by the extensive use of GPC in polymer development, biochemical analysis, and pharmaceutical formulation. These companies depend heavily on GPC for molecular weight determination, polymer structure verification, and purity assessment. The increasing industrial focus on biopolymers, specialty chemicals, and advanced materials supports segment dominance. Biochemical companies utilize GPC for analyzing proteins, nucleic acids, and polysaccharides, aligning with rising demand for biologics. Regulatory compliance requirements in pharmaceutical manufacturing further boost adoption. Chemical companies also integrate GPC in quality control workflows for raw materials and finished products. The segment benefits from continuous innovation in material science research. In addition, strong expansion in polymer industries across North America and Asia strengthens its leadership position.

The academic institutions segment is expected to grow at the highest CAGR of 21.1% from 2026 to 2033, driven by the increasing focus on polymer science, biotechnology, and molecular biology research programs worldwide. Academic laboratories extensively use GPC for training, research, and advanced analytical studies. Growth is driven by rising government and private funding for scientific research infrastructure. Universities are increasingly acquiring advanced chromatography systems to support interdisciplinary studies across chemistry, biochemistry, nanoscience, and life sciences. The expansion of research involving biopolymers, nucleic acids, and protein purification boosts demand. Academic institutions also contribute to method development and innovation in GPC technologies. In addition, the establishment of specialized research centers and collaborations with industry accelerates adoption. Growing emphasis on scientific publications and advanced analytical techniques further drives CAGR.

- By Temperature

On the basis of temperature, the market is segmented into ambient temperature and high temperature. The ambient temperature segment dominated the market with 63.5% share in 2025, driven by its widespread applicability across proteins, polysaccharides, nucleic acids, and most polymer types. Ambient GPC is preferred for general analytical workflows due to ease of operation, lower equipment cost, and compatibility with a wide range of samples. Its dominance is supported by extensive use in pharmaceutical research, academic studies, and biochemical analysis. Ambient systems also require less maintenance and energy consumption, making them cost-effective for laboratories. Growth in molecular biology and protein research enhances demand for ambient GPC setups. Moreover, ambient temperature systems are ideal for sensitive biological samples. Increasing adoption in quality control labs boosts segment leadership. Expansion in polymer R&D that does not require high-temperature conditions also contributes.

The high-temperature segment is expected to register the fastest CAGR of 20.7% from 2026 to 2033, driven by rising demand for analyzing highly crystalline and high-molecular-weight polymers such as polyethylene, polypropylene, and engineering plastics. High-temperature GPC is essential for dissolving and analyzing polymers that require elevated temperatures to reach solubility. Growth is driven by increasing production of advanced plastics, biodegradable polymers, and specialty materials. The segment benefits from expanding automotive, aerospace, and packaging industries that rely heavily on engineering polymers. Technological innovations, such as improved thermal stability columns and high-temperature detectors, support adoption. Research institutions and polymer manufacturers use high-temperature GPC for quality control and molecular weight verification. Rising global demand for performance polymers and composite materials further boosts CAGR.

Gel Permeation Chromatography (GPC) Market Regional Analysis

- North America dominated the gel permeation chromatography (GPC) market with the largest revenue share of 37.4% in 2025

- Supported by strong research infrastructure, high investment in pharmaceutical and polymer R&D, and the presence of leading analytical instrument manufacturers

- The market continues to hold a major share due to the rapid expansion of biopharmaceutical development and rising demand for advanced analytical systems in both academic and industrial laboratories

U.S. Gel Permeation Chromatography (GPC) Market Insight

The U.S. gel permeation chromatography (GPC) market captured the largest revenue share of 79% in 2025 within North America, driven by the increasing adoption of advanced analytical techniques in polymer, protein, and biopharmaceutical characterization. Strong academic research programs, rapid growth in biologics development, and robust investments in R&D laboratories further propel market expansion.

Europe Gel Permeation Chromatography (GPC) Market Insight

The Europe gel permeation chromatography (GPC) market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing polymer production, growing biotechnology research, and high demand for quality control and characterization in chemical and pharmaceutical industries. Germany, France, and the U.K. are leading countries in terms of adoption due to established research infrastructure and regulatory compliance requirements.

U.K. Gel Permeation Chromatography (GPC) Market Insight

The U.K. gel permeation chromatography (GPC) market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong pharmaceutical and polymer research sectors, high adoption of advanced analytical instruments, and government-backed research initiatives in biotechnology and materials science.

Germany Gel Permeation Chromatography (GPC) Market Insight

The Germany gel permeation chromatography (GPC) market is expected to expand at a considerable CAGR from 2026 to 2033, driven by rising industrial polymer production, growth in academic and industrial research funding, and increasing investment in analytical instrumentation for quality assurance and biopharmaceutical characterization.

Asia-Pacific Gel Permeation Chromatography (GPC) Market Insight

The Asia-Pacific gel permeation chromatography (GPC) market is expected to be the fastest-growing region, projected to record a CAGR of 12.9% from 2026 to 2033, driven by expanding polymer manufacturing, rapid growth of pharmaceutical and biotechnology industries, increasing academic research funding, and rising investments in advanced laboratory infrastructure in countries such as China, India, Japan, and South Korea.

China Gel Permeation Chromatography (GPC) Market Insight

The China gel permeation chromatography (GPC) market accounted for the largest revenue share in Asia-Pacific in 2025, fueled by growing polymer and chemical industries, rapid expansion of pharmaceutical manufacturing, and strong government and private investments in analytical R&D facilities.

India Gel Permeation Chromatography (GPC) Market Insight

India gel permeation chromatography (GPC) market is expected to be the fastest-growing country in the Gel Permeation Chromatography (GPC) market during the forecast period, projected to record a CAGR of 14.2% from 2026 to 2033, driven by rising investments in academic research, biotechnology, and pharmaceutical manufacturing, as well as increasing demand for polymer analysis and biopharmaceutical characterization.

Gel Permeation Chromatography (GPC) Market Share

The Gel Permeation Chromatography (GPC) industry is primarily led by well-established companies, including:

• Agilent Technologies (U.S.)

• Waters Corporation (U.S.)

• Shimadzu Corporation (Japan)

• Tosoh Corporation (Japan)

• Malvern Panalytical (U.K.)

• JASCO Corporation (Japan)

• Knauer Wissenschaftliche Geräte (Germany)

• Phenomenex (U.S.)

• Polymer Laboratories (U.K.)

• Postnova Analytics (Germany)

• Viscotek (U.S.)

• Hitachi High-Tech Corporation (Japan)

• PSS Polymer Standards Service (Germany)

• SEC Group (U.S.)

• Chromatix (U.S.)

• EcoAnalytica (Germany)

Latest Developments in Global Gel Permeation Chromatography (GPC) Market

- In August 2022, Agilent’s acquisition of PSS (which specialized in polymer characterization standards and GPC materials) strengthened its global GPC product line — allowing the company to leverage PSS’s hardware, software, and standards to extend reach into biopharmaceuticals, polymers, and chemical industries. This consolidation is seen as a major strategic shift that could drive broader adoption of GPC/SEC globally

- In June 2023, Agilent Technologies expanded its GPC/SEC offering by unveiling a significantly enhanced InfinityLab GPC/SEC solution at the HPLC 2023 conference — incorporating products and expertise from its recent acquisition of Polymer Standards Service Ltd. (PSS). The improved portfolio now includes a GPC/SEC Column Thermostat, a Multi‑Angle Light Scattering (MALS) detector, a GPC/SEC‑Ready Kit, and updated WinGPC software, making it one of the most comprehensive one‑vendor solutions for polymer and macromolecule characterization worldwide

- In May 2024, according to market‑size data and industry analyses, global demand for GPC systems surged as polymer research, bioplastics development, and quality-control needs increased — especially in sectors like pharmaceuticals, sustainable materials, and specialty chemicals. The push towards using GPC for molecular weight distribution analysis and structural quality control reflects broader expansion in applications across materials science and life science

- In July 2025, TESTA Analytical announced the launch of a high-performance viscometer detector optimized for GPC/SEC systems, offering dramatically improved sensitivity (reportedly an order of magnitude better signal-to-noise compared to existing detectors). This new detector aims to support high‑precision macromolecular structure analysis, expanding GPC’s utility for advanced polymer and protein characterization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.