Global Gas Sensors Market

Market Size in USD Billion

CAGR :

%

USD

1.68 Billion

USD

2.60 Billion

2024

2032

USD

1.68 Billion

USD

2.60 Billion

2024

2032

| 2025 –2032 | |

| USD 1.68 Billion | |

| USD 2.60 Billion | |

|

|

|

|

Gas Sensors Market Size

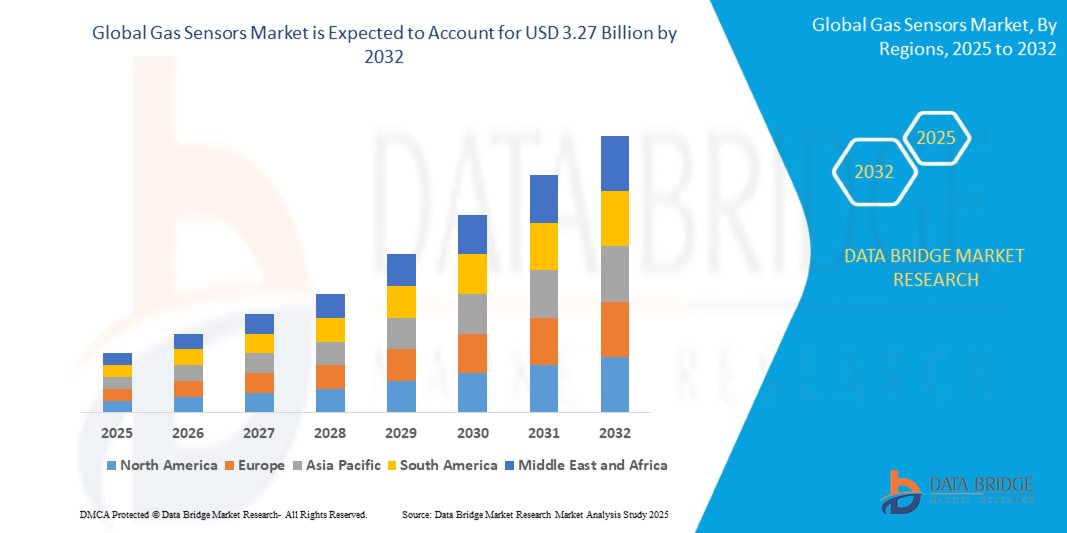

- The global gas sensors market size was valued at USD 1.68 billion in 2024 and is expected to reach USD 3.27 billion by 2032, at a CAGR of 8.70% during the forecast period

- This growth is driven by factors such as increasing demand for air quality monitoring, rising industrial safety regulations, and advancements in sensor technologies including miniaturization and IoT integration

Gas Sensors Market Analysis

- Gas sensors are essential components in a wide range of applications, including environmental monitoring, industrial safety, automotive systems, and smart home devices. They detect the presence of various gases such as carbon monoxide, methane, and nitrogen oxides with high sensitivity and accuracy

- The demand for gas sensors is significantly driven by growing environmental concerns, rising regulatory pressure for air quality monitoring, and increased adoption in consumer electronics and industrial automation

- Asia-Pacific is expected to dominate the gas sensors market with largest market share of 32.01%, due to the increasing awareness of the health effects associated with air pollutants in countries like India and China

- North America is expected to be the fastest growing region in the gas sensors market during the forecast period due to increased industrialization, stringent safety regulations, and adopting advanced monitoring solutions to ensure workplace safety and compliance further accelerates the growth of the gas sensors market in North America

- Wired segment is expected to dominate the market with a largest market share of 55.01% due to its benefits, such as low maintenance, compact size, low cost, and higher accuracy. In many situations, wired sensors are among the most reliable systems as they directly link the sensor to the device receiving the input, making them suitable for use in mines, oil rigs, and nuclear power plants

Report Scope and Gas Sensors Market Segmentation

|

Attributes |

Gas Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Gas Sensors Market Trends

“Integration of Gas Sensors with IoT and Smart Technologies”

- One prominent trend shaping the gas sensors market is the increasing integration of sensors with Internet of Things (IoT) platforms and smart technologies across residential, industrial, and commercial applications

- This convergence enables real-time monitoring, remote diagnostics, and predictive maintenance, significantly improving safety, operational efficiency, and energy management

- For instance, advanced gas sensors embedded in smart HVAC systems and industrial safety platforms allow continuous monitoring of gases like CO₂, VOCs, and NOx, triggering automated alerts and ventilation adjustments based on threshold levels

- This trend is transforming the gas sensing landscape by enhancing connectivity and data intelligence, thereby fueling demand for compact, energy-efficient, and multi-gas sensor solutions in smart homes, factories, and cities

Gas Sensors Market Dynamics

Driver

“Rising Environmental Concerns and Industrial Safety Regulations”

- The increasing concern over air pollution, greenhouse gas emissions, and toxic gas exposure is significantly driving the demand for gas sensors across industrial, residential, and commercial sectors

- Governments and regulatory bodies around the world are implementing stringent safety and environmental regulations, compelling industries to adopt gas detection systems to ensure compliance and workplace safety

- This rising focus on monitoring hazardous gases such as carbon monoxide, methane, ammonia, and volatile organic compounds (VOCs) is leading to a surge in deployment of gas sensors in manufacturing, oil & gas, and mining industries

For instance,

- In June 2023, the European Union reinforced its industrial emissions directive, mandating continuous emission monitoring in manufacturing facilities, thereby fueling demand for advanced gas sensor technologies

- As a result, gas sensors are increasingly viewed as essential tools in maintaining air quality, reducing health risks, and meeting regulatory requirements, driving their widespread adoption globally

Opportunity

“Integration of AI and Machine Learning in Gas Sensor Technology”

- AI and machine learning are transforming the gas sensor market by enabling real-time data analysis, predictive maintenance, and automated decision-making, which can optimize sensor performance and operational efficiency

- AI algorithms can analyze sensor data from various sources, offering deeper insights into air quality patterns, gas leaks, and emission trends, providing early warnings of potential hazards and optimizing energy use

For instance,

- In February 2024, an article published by the International Journal of Environmental Science highlighted the application of AI in air quality monitoring systems, where machine learning models predict pollution levels and optimize sensor calibration based on environmental changes. This development enhances the accuracy of gas detection and provides actionable insights in real-time

- The integration of AI with gas sensors presents a significant market opportunity by improving sensor capabilities, reducing maintenance costs, and offering value-added services, ultimately driving adoption across smart cities, industrial applications, and consumer electronics

Restraint/Challenge

“High Sensor Costs and Integration Complexity Hindering Market Growth”

- The high cost of advanced gas sensors, especially multi-gas detectors and sensors used in critical applications, poses a significant challenge for wide-scale adoption, particularly in cost-sensitive industries and regions

- These sensors, which are crucial for ensuring safety and compliance in industrial, environmental, and residential applications, can often be expensive, ranging from several hundred to thousands of dollars per unit

- The integration of these sensors with existing infrastructure or automation systems also presents a challenge due to compatibility issues, complexity of installation, and the need for specialized expertise

For instance,

- In July 2023, an article published by the International Society of Industrial Safety highlighted that small and medium-sized enterprises (SMEs) in manufacturing and chemical industries often face financial constraints when considering advanced gas detection systems. As a result, they rely on cheaper, less effective alternatives, which compromises safety and regulatory compliance

- Consequently, these factors can limit the growth of the gas sensor market by making it difficult for certain industries and regions to access advanced sensor technologies, potentially leading to slower adoption rates and inconsistent market penetration

Gas Sensors Market Scope

The market is segmented on the basis of technology, gas type, type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Gas Type |

|

|

By Type |

|

|

By End User |

|

In 2025, the wired is projected to dominate the market with a largest share in type segment

The wired segment is expected to dominate the gas sensors market with the largest share of 55.01% due to its benefits, such as low maintenance, compact size, low cost, and higher accuracy. In many situations, wired sensors are among the most reliable systems as they directly link the sensor to the device receiving the input, making them suitable for use in mines, oil rigs, and nuclear power plants

The carbon dioxide is expected to account for the largest share during the forecast period in gas type segment

In 2025, the carbon dioxide segment is expected to dominate the market with the largest market share of 31.01% due to mainly used for monitoring indoor air quality in homes, office buildings, automotive, healthcare, and other applications. Numerous companies are focusing on developing MEMS-based carbon dioxide sensors for various applications

Gas Sensors Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Gas Sensors Market”

- The Asia-Pacific region dominates the global gas sensors market, driven by rapid industrialization, urbanization, and increasing environmental awareness across major economies such as China, India, and Japan

- China is a significant contributor with a largest market share of approximately 50%, due to its robust manufacturing base, large-scale adoption of industrial safety protocols, and growing demand for air quality monitoring systems in urban areas

- India’s rising concerns about pollution and expanding automotive and industrial sectors are fueling demand for gas sensors in both public and private initiatives aimed at improving environmental and workplace safety

- Furthermore, government regulations on emission control and increasing investments in smart city development are boosting gas sensor adoption across the region

“North America is Projected to Register the Highest CAGR in the Gas Sensors Market”

- North America is expected to witness the highest growth rate in the gas sensors market, primarily due to technological advancements, strict environmental regulations, and a mature industrial automation ecosystem

- The U.S., in particular, benefits from a well-developed regulatory framework focused on emissions control, workplace safety, and consumer health, driving widespread implementation of gas sensors in residential, commercial, and industrial settings

- Increasing integration of gas sensors in smart home devices, HVAC systems, and connected IoT platforms is further accelerating market growth in the region

- The strong presence of key players and rising R&D investments in next-generation sensor technologies also contribute to the region's rapid expansion in the gas sensors landscape

Gas Sensors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Honeywell International Inc. (U.S.)

- MSA Safety Incorporated (U.S.)

- Amphenol Corporation (U.S.)

- Figaro Engineering Inc. (Japan)

- Alphasense Ltd. (U.K.)

- Sensirion AG (Switzerland)

- Bosch Sensortec GmbH (Germany)

- Siemens AG (Germany)

- Denso Corporation (Japan)

- Renesas Electronics Corporation (Japan)

- Membrapor AG (Switzerland)

- Infineon Technologies AG (Germany)

- Fuji Electric Co., Ltd. (Japan)

- Nissha Co., Ltd. (Japan)

- Renesas Electronics Corporation (Japan)

- Danfoss A/S (Denmark)

- Gasera Ltd. (Finland)

- Toshiba Corporation (Japan)

- New Cosmos Electric Co., Ltd. (Japan)

- Process Sensing Technologies Ltd. (U.K.)

Latest Developments in Global Gas Sensors Market

- In December 2023, CO2Meter.com, a Florida-based company, introduced the CM-900 industrial gas detector designed to monitor Carbon Dioxide (CO₂) or oxygen levels, ensuring the safety of personnel operating in hazardous gas environments. This product launch aligns with the growing global demand for advanced gas detection technologies, particularly in industrial and commercial sectors, where regulatory pressure and safety concerns are driving the adoption of real-time gas monitoring solutions

- In April 2023, Figaro Engineering showcased its latest portfolio of gas sensor technologies at the NFPA Conference and Expo held in Las Vegas. The launch underscores a growing trend in the global gas sensors market toward the development of compact, power-efficient, and highly responsive sensors to meet increasing demand across residential, industrial, and environmental safety applications

- In February 2023, Figaro Engineering introduced its latest NDIR CO₂ sensor, the CDM7162, featuring a compact design with a thickness of just 8 mm, tailored for reliable long-term performance. This launch reflects the increasing global demand for compact and efficient gas sensors, particularly in residential, commercial, and HVAC systems

- In September 2022, Sensorix announced the launch of its 'Satellix' gas sensor platform, integrating electrochemical sensors with pellistors for lower explosive limit (LEL) gas monitoring. The introduction of Satellix reinforces Sensorix’s role in supporting the expanding global gas sensors market, particularly in specialized industrial applications where innovation and precision are critical

- In April 2022, MEMBRAPOR introduced the ETO/CA-10 gas sensor, specifically developed for the selective detection of ethylene oxide with significantly reduced cross-sensitivity to carbon monoxide. This product launch supports the global gas sensors market's shift toward high-precision, application-specific solutions that improve selectivity and reduce false alarms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gas Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gas Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gas Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.