Global Garage And Service Station Market

Market Size in USD Billion

CAGR :

%

USD

2.71 Billion

USD

5.91 Billion

2025

2033

USD

2.71 Billion

USD

5.91 Billion

2025

2033

| 2026 –2033 | |

| USD 2.71 Billion | |

| USD 5.91 Billion | |

|

|

|

|

What is the Global Garage and Service Station Market Size and Growth Rate?

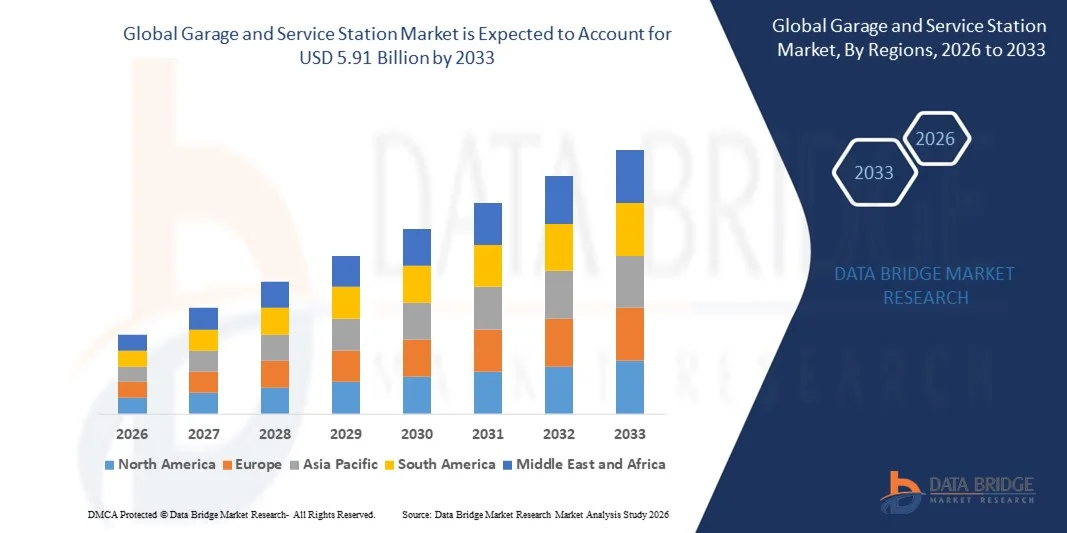

- The global garage and service station market size was valued at USD 2.71 billion in 2025 and is expected to reach USD 5.91 billion by 2033, at a CAGR of 10.20% during the forecast period

- The garage and service station market has a huge potential and is expected grow, owing to the high growth in automotive industry. In addition, the rise in safety concerns and increase in automotive aftermarket needs are also largely influencing the growth of the garage and service station market

What are the Major Takeaways of Garage and Service Station Market?

- The increase in automotive production across emerging economies and large number of auto service companies offering various car related services are also expected to boost the growth of the garage and service station market in the above mentioned forecast period

- However, the market of garage and service station though has certain limitations which are expected to obstruct the potential growth of the market such as the trust and consumer satisfaction with the garages and service stations, whereas the rise in technological developments are posing threat to the industry can challenge the growth of the garage and service station market

- North America dominated the garage and service station market with a 36.31% revenue share in 2025, driven by high vehicle ownership rates, an aging vehicle fleet, and strong demand for regular maintenance, diagnostics, and repair services across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.39% from 2026 to 2033, driven by rapid growth in vehicle ownership, expanding middle-class population, and increasing demand for affordable repair and maintenance services across China, India, Japan, South Korea, and Southeast Asia

- The Mechanical Repair segment dominated the market with a revenue share of 38.6% in 2025, driven by the high frequency of engine diagnostics, brake repairs, suspension servicing, and transmission maintenance across both passenger and commercial vehicles

Report Scope and Garage and Service Station Market Segmentation

|

Attributes |

Garage and Service Station Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Garage and Service Station Market?

Increasing Adoption of Digitized, Compact, and Technology-Enabled Service Stations

- The garage and service stations market is witnessing a strong shift toward digitally enabled, compact, and technology-integrated service setups to improve service speed, accuracy, and customer experience

- Service providers are increasingly adopting diagnostic tools, connected equipment, EV service solutions, and software-driven maintenance systems to handle modern vehicle architectures

- Rising demand for cost-efficient, space-optimized, and multi-service garages is driving adoption across urban service centers, independent workshops, and franchised service stations

- For instance, companies such as Bosch, Castrol, Midas, and Mahindra First Choice are upgrading service stations with digital diagnostics, predictive maintenance tools, and cloud-based service platforms

- Increasing need for faster vehicle turnaround, real-time fault detection, and multi-brand servicing is accelerating the transition toward smart and tech-enabled garages

- As vehicles become more connected, electric, and software-driven, garage and service stations will remain essential for advanced diagnostics, preventive maintenance, and efficient vehicle lifecycle management

What are the Key Drivers of Garage and Service Station Market?

- Rising global vehicle parc, increasing average vehicle age, and growing demand for regular maintenance, repair, and aftermarket services are major growth drivers

- For instance, during 2024–2025, leading service networks such as Bosch Car Service, Jiffy Lube, and Firestone expanded their digital service capabilities and multi-brand offerings

- Growing adoption of EVs, connected cars, ADAS-equipped vehicles, and hybrid models is increasing demand for specialized service infrastructure and trained technicians

- Advancements in automotive diagnostics, lubrication technologies, predictive analytics, and workshop automation are enhancing service efficiency and accuracy

- Increasing consumer preference for quick service, transparency, service packages, and warranty-backed repairs is boosting organized garage adoption

- Supported by rising automotive ownership, urbanization, and aftermarket investments, the Garage and Service Stations market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Garage and Service Station Market?

- High initial investment required for modern diagnostic equipment, EV servicing infrastructure, and digital workshop upgrades limits adoption among small and independent garages

- For instance, during 2024–2025, rising costs of diagnostic tools, EV chargers, and skilled technician training increased operational expenses for service providers

- Rapid technological evolution in vehicles increases skill gaps, requiring continuous technician training and certification

- Limited awareness and affordability challenges in emerging markets restrict penetration of organized and technology-enabled garages

- Intense competition from OEM-authorized service centers, informal workshops, and mobile service platforms creates pricing pressure

- To overcome these challenges, market players are focusing on franchise models, technician upskilling, modular equipment deployment, and digital service platforms to expand Garage and service station adoption globally

How is the Garage and Service Station Market Segmented?

The market is segmented on the basis of product type, ownership, and sector.

- By Product Type

On the basis of product type, the Garage and Service Station market is segmented into Mechanical Repair, Collision Repair, Car Washes, Oil Change and Lubrication, and Others. The Mechanical Repair segment dominated the market with a revenue share of 38.6% in 2025, driven by the high frequency of engine diagnostics, brake repairs, suspension servicing, and transmission maintenance across both passenger and commercial vehicles. Rising vehicle ownership, increasing average vehicle age, and growing complexity of automotive systems continue to fuel demand for mechanical repair services across independent and organized garages.

The Oil Change and Lubrication segment is expected to witness the fastest CAGR from 2026 to 2033, supported by growing preventive maintenance awareness, shorter service cycles, and expansion of quick-service formats. Increasing adoption of synthetic lubricants, service subscription models, and express oil-change centers further accelerates growth in this segment.

- By Ownership

Based on ownership, the Garage and Service Station market is segmented into Automobile Dealerships, Franchise General Repair Shops, Franchise Specialty Shops, and Locally Owned Repair Establishments. Locally Owned Repair Establishments dominated the market with a 41.2% share in 2025, owing to their widespread presence, cost-effective services, strong local customer relationships, and flexibility in servicing multi-brand vehicles. These establishments remain the primary choice in developing regions and semi-urban areas due to affordability and accessibility.

The Franchise General Repair Shops segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising consumer preference for standardized service quality, transparent pricing, digital appointment systems, and warranty-backed repairs. Expansion of organized franchise networks, adoption of advanced diagnostics, and brand trust are strengthening growth across urban and metropolitan markets.

- By Sector

On the basis of sector, the Garage and Service Station market is segmented into Organized and Unorganized sectors. The Unorganized sector held the largest market share of 57.4% in 2025, supported by a vast network of small independent garages offering low-cost repairs, quick turnaround times, and localized services, particularly in emerging economies. These players continue to dominate due to minimal operational overheads and strong informal customer loyalty.

The Organized sector is expected to register the fastest CAGR from 2026 to 2033, driven by increasing vehicle technology complexity, rising EV penetration, demand for certified technicians, and growing consumer preference for reliable and transparent service experiences. Investments in digital platforms, EV-ready infrastructure, and multi-brand service capabilities are accelerating the transition toward organized garage and service station models globally.

Which Region Holds the Largest Share of the Garage and Service Station Market?

- North America dominated the garage and service station market with a 36.31% revenue share in 2025, driven by high vehicle ownership rates, an aging vehicle fleet, and strong demand for regular maintenance, diagnostics, and repair services across the U.S. and Canada. Widespread adoption of advanced diagnostic tools, digital service platforms, and preventive maintenance practices continues to support strong demand across independent garages, dealership service centers, and franchise repair networks

- Leading players in North America are expanding multi-brand service offerings, digital appointment systems, EV servicing capabilities, and subscription-based maintenance models, strengthening the region’s leadership. Continuous investments in EV infrastructure, ADAS calibration services, and connected vehicle diagnostics further fuel long-term market growth

- A mature automotive ecosystem, high consumer spending on vehicle upkeep, and strong regulatory emphasis on safety and emissions compliance reinforce North America’s dominant market position

U.S. Garage and Service Station Market Insight

The U.S. is the largest contributor in North America, supported by a vast vehicle parc, high penetration of organized service chains, and increasing complexity of vehicle electronics. Rising demand for EV servicing, fleet maintenance, collision repair, and advanced diagnostics across passenger and commercial vehicles continues to drive market expansion. Strong presence of national franchises, OEM dealerships, and technology-enabled service providers further accelerates growth.

Canada Garage and Service Station Market Insight

Canada contributes significantly to regional growth, driven by rising vehicle longevity, increasing demand for winter-related maintenance services, and growing adoption of preventive servicing. Expansion of organized service networks, government focus on vehicle safety standards, and increasing EV adoption are strengthening market penetration across urban and suburban areas.

Asia-Pacific Garage and Service Station Market

Asia-Pacific is projected to register the fastest CAGR of 9.39% from 2026 to 2033, driven by rapid growth in vehicle ownership, expanding middle-class population, and increasing demand for affordable repair and maintenance services across China, India, Japan, South Korea, and Southeast Asia. Urbanization, ride-hailing fleets, and growth of used-car markets are accelerating service demand.

China Garage and Service Station Market Insight

China is the largest contributor in Asia-Pacific, supported by the world’s largest vehicle population and rapid expansion of organized service chains. Rising EV penetration, government focus on emissions compliance, and digital service platforms are driving strong growth.

Japan Garage and Service Station Market Insight

Japan shows steady growth, driven by an aging vehicle fleet, high service quality standards, and strong demand for preventive maintenance and hybrid/EV servicing. Technological sophistication and reliability-focused consumers support premium service adoption.

India Garage and Service Station Market Insight

India is emerging as a high-growth hub, driven by rising passenger vehicle sales, expanding two-wheeler and used-car markets, and rapid growth of organized multi-brand service chains. Increasing digitalization and franchise expansion are accelerating market penetration.

South Korea Garage and Service Station Market Insight

South Korea contributes significantly, supported by strong automotive manufacturing, rising EV adoption, and demand for advanced diagnostics and software-based vehicle servicing. Technological innovation and consumer preference for organized service centers continue to drive growth.

Which are the Top Companies in Garage and Service Station Market?

The garage and service station industry is primarily led by well-established companies, including:

- Firestone Complete Auto Care (U.S.)

- Meineke Car Care Centers, LLC (U.S.)

- Jiffy Lube International, Inc. (U.S.)

- Midas (U.S.)

- Safelite Group (U.S.)

- MONRO, INC. (U.S.)

- 3M (U.S.)

- Automovill Technologies Pvt. Ltd. (India)

- BMW AG (Germany)

- Carnation (U.S.)

- Carxpert (U.K.)

- Castrol (U.K.)

- Groupe Renault (France)

- Honda Motor Co. Ltd. (Japan)

- Robert Bosch GmbH (Germany)

- Toyota Motor Corporation (Japan)

- Volkswagen (Germany)

- Exxon Mobil Corporation (U.S.)

- Mahindra First Choice Services (India)

- Tilden International Inc. (U.S.)

What are the Recent Developments in Global Garage and Service Station Market?

- In April 2024, Meta Mechanics, a leading auto repair center in Dubai, introduced an expanded portfolio of comprehensive car services focused on reliability, transparency, and enhanced customer experience. This launch strengthens Meta Mechanics’ positioning as a premium, customer-centric service provider in the Middle East automotive aftermarket

- In April 2024, Nippon Paint, a major Asia-Pacific paint and coatings company, launched its automotive body and paint repair service brand, Mastercraft, offering services ranging from advanced body and paint repairs to routine vehicle maintenance and quick repair solutions. This initiative marks Nippon Paint’s strategic entry into organized automotive repair services, expanding its value chain presence

- In January 2024, Lotus partnered with Bosch and Mobilize Power Solutions to provide Eletre and Emeya EV owners access to more than 600,000 charging stations across Europe, along with home charging solutions, fast-charging options, and smart route planning. This collaboration significantly enhances EV ownership convenience and supports faster adoption of electric mobility

- In December 2022, Commercial Development Resources partnered with AutoNation to complete one of the largest automotive service centers in the United States, aimed at expanding AutoNation’s servicing capacity and operational footprint. The development reinforces AutoNation’s leadership in large-scale, high-efficiency automotive service infrastructure

- In June 2022, Valvoline expanded its automotive service offerings to include heavy-duty vehicles by adapting its Valvoline Instant Oil ChangeSM service model for Class 5–8 vehicles weighing over 30,000 pounds. This expansion enabled Valvoline to diversify its customer base and capture growing demand in the commercial vehicle servicing segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.