Global Fully Autonomous Delivery Robots Market, By Component (Hardware, Software and Services), Load Carrying Capacity (Up to 10kgs, 10.01 - 50kgs and More Than 50kgs), Number of Wheels (3 Wheels, 4 Wheels and 6 Wheels), Vertical (Hospitality, Retail, Logistics, Healthcare, Restaurants, Hotels and Others) – Industry Trends and Forecast to 2029.

Fully Autonomous Delivery Robots Market Analysis and Size

Autonomous delivery robots (ADR) have transformed delivery systems by making delivery cheaper and more efficient. Furthermore, the logistics sector consumes a large amount of natural resources to support multiple operations, such as product delivery. By releasing large amounts of greenhouse gases into the atmosphere, this has also contributed to global warming. Autonomous delivery systems are expected to mitigate such negative environmental effects by lowering carbon emissions in the atmosphere. Several laws are being enacted to combat global warming and protect the environment; such government initiatives contribute to the market's growth in ADR demand.

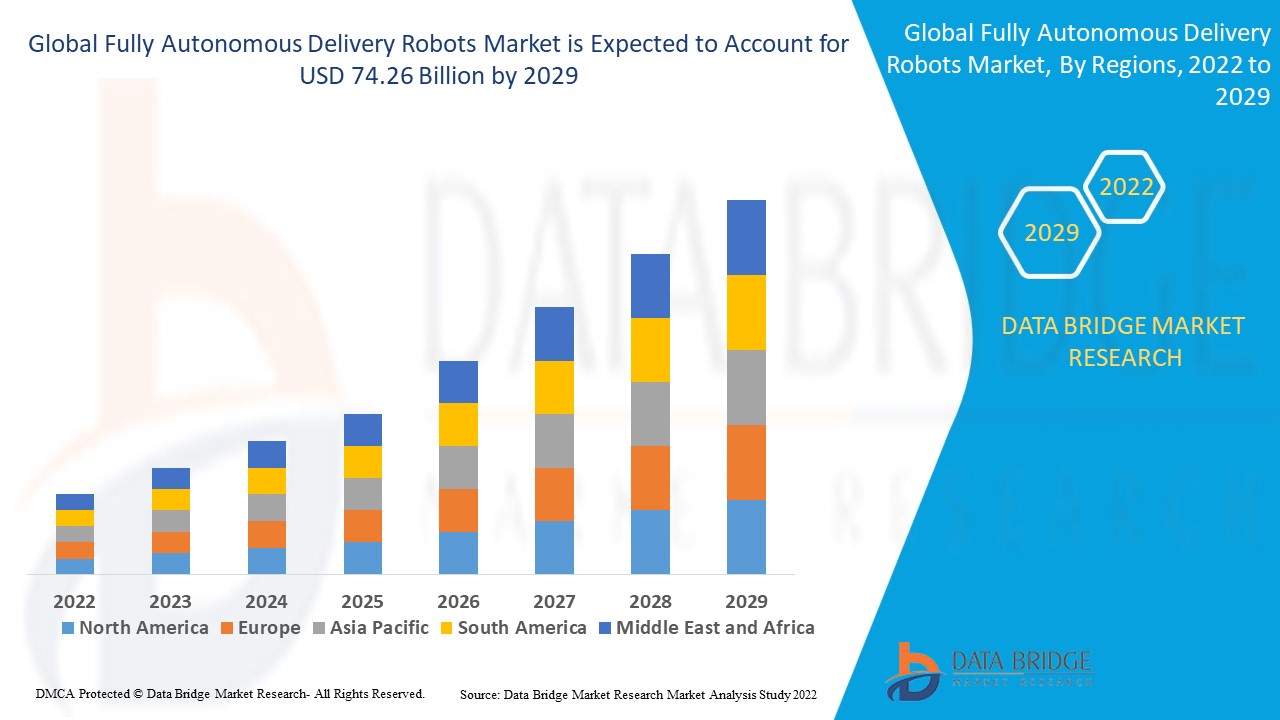

Data Bridge Market Research analyses that the fully autonomous delivery robots market which was growing at a value of 20.16 billion in 2021 and is expected to reach the value of USD 74.26 billion by 2029, at a CAGR of 17.70% during the forecast period of 2022-2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Fully Autonomous Delivery Robots Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Component (Hardware, Software and Services), Load Carrying Capacity (Up To 10kgs, 10.01 - 50kgs and more than 50kgs), Number of Wheels (3 Wheels, 4 Wheels and 6 Wheels), Vertical (Hospitality, Retail, Logistics, Healthcare, Restaurants, Hotels and Others),

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

ABB (Switzerland), AUBO Robotics (U.S.), Fanuc (Japan), F&P Robotics (Switzerland), Universal Robots (Denmark), Kawasaki Heavy Industries, Ltd. (U.S), Robert Bosch GmbH (Germany), Precise Automation & Control Pvt Ltd. (U.S.), Rethink Robotics GmbH (Germany), Stäubli International AG. (Switzerland), MABI AG (Switzerland), YASKAWA ELECTRIC CORPORATION. (Japan), KUKA AG (Germany), TECHMAN ROBOT INC. (Taiwan), and Doosan Robotics Inc. (South Korea)

|

|

Opportunities

|

|

Market Definition

Autonomous delivery robots are electric-powered motorised vehicles that are designed and programmed to deliver packages, food, and couriers to customers within a specific radius with no or minimal human intervention. They are intelligent machines that can perform delivery tasks. Customers can now receive delivery packages or items from autonomous robots due to advances in technology such as the internet of things and artificial intelligence. Fully autonomous delivery robots are fully automatic delivery robots that do not require human intervention while performing delivery operations.

Global Fully Autonomous Delivery Robots Market Dynamics

Drivers

- High penetration of e-commerce industry is augmenting market growth

In most supply chains, the final phase of product delivery, from the warehouse or distribution centre to the end user, accounts for more than 28% of total transportation costs. Last-mile delivery is affected by factors such as urban congestion, isolated locations, incorrect or erroneous address information, difficult-to-find destinations, and a severe labour shortage for providing on-demand delivery services. All of these issues are impeding the optimization of this phase. Customers in the realm of e-commerce are not only demanding, but they also prefer to purchase high-quality goods at a low cost. In e-commerce, autonomous delivery robots will not only provide customers with greater convenience at a lower cost, but they will also fundamentally alter the competitive landscape.

- Large scale robot manufacturing in the developed countries

The current COVID-19 pandemic has focused attention on delivery robots for contactless package deliveries all over the world, and strong market demand has pushed delivery robot developers to launch large-scale operations in a number of US cities. The deployment and adoption of delivery robot technology are expected to strengthen the market for delivery robots during the pandemic. Restaurant food is also delivered by delivery robots. Delivery robots have been in use for several years; however, during the epidemic, end users such as restaurants, grocery stores, and other delivery service organisations have expressed a strong interest in them.

Opportunity

- Environment friendly and cost efficient

These robots use sidewalks like pedestrians and travel at a slow speed with no emissions. These delivery robots combine low cost, convenience, and environmental friendliness. Companies bearing lower delivery costs and time in last mile deliveries are driving the growth of this market.

Restraints

- Strict rules and high capital requirements

Stringent rules and regulations imposed by governments of various emerging countries regarding the operation of delivery robots in public areas impedes global market growth. Furthermore, the high cost of manufacturing these delivery robots limits global market growth because many developing countries cannot afford it. The lack of awareness and availability of these robots in various countries is impeding growth.

This fully autonomous delivery robots market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the fully autonomous delivery robots market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Fully Autonomous Delivery Robots Market

The global COVID-19 pandemic has affected a large portion of the population. Many people have lost their jobs as a result of the global pandemic. It has had an impact on the dynamics and growth of a number of industries. During the lockdown, various end-user industries' operational activities were halted, resulting in a decrease in demand for the fully autonomous delivery robots market, which leads to decreased sales revenue. The supply chain networks were also disrupted, resulting in a decrease in profit margins. However, by properly strategizing according to market needs, the fully autonomous delivery robots market is expected to recover from this global pandemic by the end of the third quarter of the coming year.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures

Recent Development

- August 2022 - Ottonomy Inc. announced the completion of its USD 3.3 million seed funding round and the release of Ottobot 2.0, the most recent version of its autonomous delivery robot. Ottobot deployments in airports, retail stores, and restaurants will be expanded, according to the company.

- In November 2021 Google invested in Nuro, with the goal of delivering goods using robotic autonomous vehicles. In total, Tiger Global Management led a USD 600 million fundraising round for the company.

Global Fully Autonomous Delivery Robots Market Scope

The fully autonomous delivery robots market is segmented on the basis of component, load carrying capacity, number of wheels and verticals. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Components

- Hardware

- Software

- Services

Load Carrying Capacity

- Up To 10kgs

- 10.01 - 50kgs

- more than 50kgs

Number of wheels

- 3 Wheels

- 4 Wheels

- 6 Wheels

Verticals

- Hospitality

- Retail

- Logistics

- Healthcare

- Restaurants

- Hotels

- Others

Fully Autonomous Delivery Robots Market Regional Analysis/Insights

The fully autonomous delivery robots market is analysed and market size insights and trends are provided by country, component, load carrying capacity, number of wheels, and verticals as referenced above.

The countries covered in the fully autonomous delivery robots market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America currently has the largest market share for autonomous delivery robots because of the large number of start-ups and manufacturers working on the development of autonomous delivery robots.

Developing countries in the Asia-Pacific region are in the testing phase of autonomous delivery robots and are expected to grow rapidly in this market in the coming years.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Fully Autonomous Delivery Robots Market Share Analysis

The fully autonomous delivery robots market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to fully autonomous delivery robots market.

Some of the major players operating in the fully autonomous delivery Robots market are:

- ABB (Switzerland)

- AUBO Robotics (U.S.)

- Fanuc (Japan)

- F&P Robotics (Switzerland)

- Universal Robots (Denmark)

- Kawasaki Heavy Industries, Ltd. (U.S)

- Robert Bosch GmbH (Germany)

- Precise Automation & Control Pvt Ltd. (U.S.)

- Rethink Robotics GmbH (Germany)

- Stäubli International AG. (Switzerland)

- MABI AG (Switzerland)

- YASKAWA ELECTRIC CORPORATION. (Japan)

- KUKA AG (Germany)

- TECHMAN ROBOT INC. (Taiwan)

- Doosan Robotics Inc. (South Korea)

SKU-