Global Full Dentures Market

Market Size in USD Billion

CAGR :

%

USD

1.61 Billion

USD

2.92 Billion

2024

2032

USD

1.61 Billion

USD

2.92 Billion

2024

2032

| 2025 –2032 | |

| USD 1.61 Billion | |

| USD 2.92 Billion | |

|

|

|

|

Full Dentures Market Size

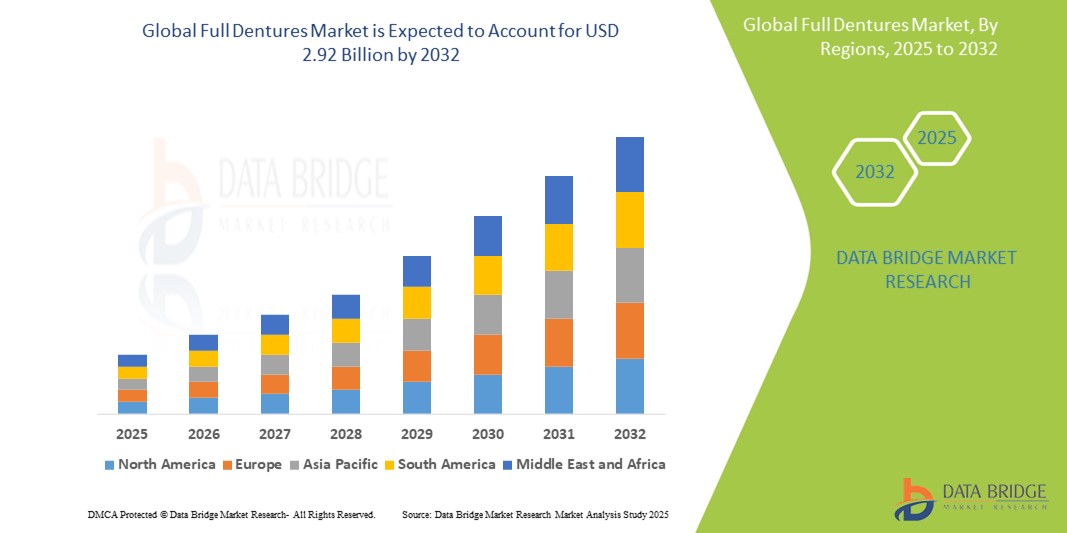

- The global full dentures market size was valued at USD 1.61 billion in 2024 and is expected to reach USD 2.92 billion by 2032, at a CAGR of 7.70% during the forecast period

- The market growth is largely fueled by the rising prevalence of edentulism, aging global population, and increasing awareness of oral healthcare, driving the demand for effective prosthetic dental solutions

- Furthermore, advancements in denture fabrication technologies—such as CAD/CAM systems and 3D printing—are enhancing the fit, comfort, and aesthetics of full dentures. These innovations, along with growing affordability and access to dental care in emerging economies, are significantly boosting the industry's growth

Full Dentures Market Analysis

- Full dentures, which replace the complete set of teeth in either the upper or lower jaw, are essential restorative dental appliances widely used to restore oral function and aesthetics, especially in aging populations and individuals suffering from complete edentulism

- The increasing demand for full dentures is primarily fueled by the growing global elderly population, a rising incidence of tooth loss due to periodontal diseases and dental caries, and heightened awareness of oral rehabilitation options

- North America dominated the full dentures market with the largest revenue share of 37% in 2024, driven by advanced dental infrastructure, favorable reimbursement policies, and a high prevalence of age-related tooth loss, particularly in the U.S. where both public and private dental services support prosthodontic treatments

- Asia-Pacific is expected to be the fastest growing region in the full dentures market during the forecast period due to increasing healthcare expenditure, growing dental tourism, and expanding access to dental care in countries such as China and India

- The conventional dentures segment dominated the full dentures market with a market share of 59.2% in 2024, attributed to their cost-effectiveness, widespread availability, and the longstanding familiarity among both dentists and patients in diverse healthcare settings

Report Scope and Full Dentures Market Segmentation

|

Attributes |

Full Dentures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Full Dentures Market Trends

“Digital Denture Fabrication and Customization Through CAD/CAM and 3D Printing”

- A significant and accelerating trend in the global full dentures market is the growing adoption of digital technologies such as CAD/CAM systems and 3D printing for the fabrication of full dentures. These innovations are streamlining production processes, enhancing fit and comfort, and reducing turnaround times, thereby improving patient outcomes and satisfaction

- For instance, companies such as Dentsply Sirona and Ivoclar are offering digital denture solutions that allow dental professionals to design and mill highly customized dentures with precise anatomical alignment. This reduces the number of patient visits and manual adjustments typically associated with conventional denture creation

- 3D printing technology is increasingly being used for the rapid prototyping and production of denture bases and teeth, enabling dental laboratories and clinics to produce accurate and durable full dentures faster than traditional methods. Some systems also allow integration of facial scanning and bite registration data for superior personalization

- The shift toward digital workflows not only increases the efficiency of dental professionals but also minimizes human error, enhances repeatability, and allows easier storage of patient records for future reference or reprints

- This trend is reshaping the expectations of both patients and dental practitioners by introducing faster service delivery, better fit, and aesthetic customization. As a result, dental laboratories and clinics are investing in digital equipment and software, fueling further innovation and expansion in the full dentures market

Full Dentures Market Dynamics

Driver

“Rising Geriatric Population and Tooth Loss Prevalence”

- The steadily growing global geriatric population, coupled with increasing rates of complete tooth loss due to aging, periodontal disease, and other chronic conditions, is a key driver behind the rising demand for full dentures

- For instance, according to the World Health Organization (WHO), nearly 30% of people aged 65–74 have lost all their natural teeth, which directly translates into a growing patient base for complete denture prosthetics

- As more elderly individuals seek to restore oral function and aesthetics, full dentures remain a cost-effective and accessible solution. Their ability to improve chewing efficiency, facial structure, and speech is leading to higher acceptance rates, especially among populations without access to high-end implant procedures

- In addition, the expanding availability of dental services, increasing healthcare expenditure, and supportive insurance policies in developed markets further facilitate denture adoption. Public health initiatives promoting oral health in aging populations are also contributing to increased awareness and demand

- These factors, combined with improvements in denture materials and design, are significantly propelling the full dentures market across both developed and emerging economies

Restraint/Challenge

“Fit-Related Issues and Limited Affordability in Low-Income Regions”

- One of the main challenges facing the full dentures market is the persistence of fit-related discomfort and reduced functionality compared to natural teeth or implant-supported options. Poorly fitting dentures can lead to sore spots, difficulty in chewing, and a decline in overall oral health, negatively impacting user satisfaction and long-term compliance

- Furthermore, while conventional full dentures are generally more affordable than implant-based alternatives, cost remains a concern for low-income populations, especially in regions where public dental health services are limited or non-existent. In many developing countries, the out-of-pocket expense of even basic dentures can be prohibitive

- In addition, patients often require multiple appointments for fittings and adjustments, which can be logistically challenging for individuals in remote areas or with mobility issues. This deters some from seeking treatment or following through with denture replacement

- Addressing these barriers through public oral health initiatives, cost-effective denture programs, and wider adoption of digital production technologies that enable faster and more precise fittings will be critical for expanding market access and patient satisfaction, particularly in underserved regions

Full Dentures Market Scope

The market is segmented on the basis of material, usage, end user, technology, and distribution channel.

- By Material

On the basis of material, the full dentures market is segmented into acrylic dentures, ceramic dentures, porcelain dentures, metal dentures, and others. The acrylic dentures segment dominated the market with the largest revenue share in 2024, attributed to its affordability, ease of fabrication, and lighter weight compared to other materials. Acrylic is widely used in conventional full dentures due to its adaptability and the comfort it offers patients, particularly among elderly populations.

The ceramic dentures segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by rising demand for superior aesthetics and biocompatibility. Ceramic materials offer enhanced appearance and durability, making them an increasingly popular choice for patients seeking lifesuch as dental prosthetics with minimal allergic reaction risks.

- By Usage

On the basis of usage, the full dentures market is segmented into removable and fixed full dentures. The removable dentures segment accounted for the highest market share in 2024 due to their lower cost, ease of maintenance, and widespread acceptance, particularly in elderly patients. These dentures are easy to fit and remove, offering convenience and affordability in both high-income and low-income populations.

The fixed dentures segment is projected to grow at the highest CAGR during the forecast period, driven by advancements in implant-supported denture technology and increasing demand for greater stability, functionality, and natural feel. The rise in dental tourism and access to implant procedures is further encouraging adoption of fixed denture options.

- By End User

On the basis of end user, the full dentures market is segmented into specialized dental hospitals, somatology departments in general hospitals, and dental clinics. Dental clinics dominated the market in 2024, capturing the largest revenue share due to the high volume of outpatient visits and the availability of both general and specialized prosthodontic services. Their widespread geographic presence and patient preference for local treatment options further strengthen this segment.

Specialized dental hospitals are expected to exhibit the fastest growth during forecast period, driven by increasing focus on advanced oral rehabilitation and growing investments in infrastructure and technology to deliver precise and customized denture solutions.

- By Technology

On the basis of technology, the full dentures market is segmented into conventional dentures, implant-supported dentures, and CAD/CAM dentures. The conventional dentures segment held the largest market share of 59.2% in 2024, supported by their long-standing usage, cost-effectiveness, and familiarity among dental practitioners. These dentures remain a primary solution in resource-limited settings where implant services are less accessible.

The CAD/CAM dentures segment is projected to witness the fastest CAGR from 2025 to 2032, as digital dentistry continues to revolutionize denture fabrication. These systems offer enhanced accuracy, faster turnaround times, and greater customization, appealing to both clinicians and tech-savvy patients.

- By Distribution Channel

On the basis of distribution channel, the full dentures market is segmented into direct sales, distributor, online, and pharmacy & drug store. The direct sales channel dominated the market in 2024, especially among dental labs and clinics that procure customized dentures directly from manufacturers or dental solution providers. This method ensures better control over product quality and customization.

The online channel is expected to grow at the fastest rate during the forecast period, driven by increasing digital adoption, expanding e-commerce platforms, and growing awareness of at-home dental impression kits. Online channels are also facilitating access to affordable denture solutions in underserved regions.

Full Dentures Market Regional Analysis

- North America dominated the full dentures market with the largest revenue share of 37% in 2024, driven by advanced dental infrastructure, favorable reimbursement policies, and a high prevalence of age-related tooth loss, particularly in the U.S. where both public and private dental services support prosthodontic treatments

- Consumers in the region prioritize advanced dental restoration options that enhance both function and aesthetics, with full dentures remaining a cost-effective and widely accepted solution for total edentulism

- This robust market presence is further supported by favorable insurance coverage, widespread availability of skilled dental professionals, and strong adoption of digital technologies such as CAD/CAM in denture fabrication, making North America a leading hub for both conventional and digitally produced full dentures

U.S. Full Dentures Market Insight

The U.S. full dentures market captured the largest revenue share of 79.6% in 2024 within North America, fueled by a rising geriatric population and the widespread availability of advanced dental care services. Increasing awareness regarding oral health, along with supportive insurance coverage for prosthodontic procedures, has enhanced access to full dentures. Moreover, the U.S. leads in the adoption of digital dentistry, with growing integration of CAD/CAM technologies improving denture customization and turnaround times, further driving market demand.

Europe Full Dentures Market Insight

The Europe full dentures market is projected to grow at a significant CAGR throughout the forecast period, driven by an aging demographic and the increasing incidence of complete edentulism. Public healthcare systems in countries such as Germany, France, and Italy provide partial reimbursement for dental prosthetics, supporting wider denture adoption. In addition, the increasing shift toward digital denture manufacturing and a strong network of dental laboratories are advancing the efficiency and accessibility of full denture solutions across the region

U.K. Full Dentures Market Insight

The U.K. full dentures market is expected to witness steady growth during the forecast period, supported by the country’s aging population and demand for cost-effective dental restorations. National Health Service (NHS) provisions make dentures accessible to a wide patient base, while private clinics are expanding their adoption of high-end materials and CAD/CAM technologies. The rising preference for aesthetic and natural-looking denture options is also contributing to the growing demand across both public and private sectors.

Germany Full Dentures Market Insight

The Germany full dentures market is poised for moderate yet consistent growth during the forecast period, driven by strong dental infrastructure, high awareness of oral rehabilitation, and a robust reimbursement framework. Germany is at the forefront of integrating digital workflows in prosthodontics, including intraoral scanning and computer-aided design for full dentures. A preference for precision-fit, biocompatible materials and sustainable dental solutions is aligning with growing consumer demand for advanced yet environmentally conscious products.

Asia-Pacific Full Dentures Market Insight

The Asia-Pacific full dentures market is projected to grow at the fastest CAGR from 2025 to 2032, driven by large aging populations, expanding healthcare access, and increasing dental tourism. Countries such as China, India, and Japan are experiencing rising demand for full dentures as awareness of oral health improves. Government-led healthcare initiatives, combined with the affordability of locally manufactured dentures, are expanding market reach. Furthermore, technological advancements and growing adoption of digital dentistry are streamlining denture production across the region.

Japan Full Dentures Market Insight

The Japan full dentures market is advancing steadily, propelled by its rapidly aging society and emphasis on oral hygiene. The country’s mature dental care system and preference for high-precision, comfortable prosthetic solutions are accelerating the adoption of CAD/CAM-based dentures. In addition, Japan’s tech-savvy population is driving innovations in materials and techniques that cater to personalized and efficient full denture fabrication.

India Full Dentures Market Insight

The India full dentures market held the largest revenue share in Asia Pacific in 2024, driven by a large edentulous population, growing dental awareness, and expanding middle-class affordability. The country’s dental tourism sector is thriving due to cost-effective prosthetic solutions and skilled professionals. Increasing private dental clinic penetration, along with the adoption of digital technologies and government-led rural dental health programs, is significantly boosting the demand for full dentures across urban and semi-urban areas.

Full Dentures Market Share

The Full Dentures industry is primarily led by well-established companies, including:

- Dentsply Sirona (U.S.)

- Ivoclar Vivadent (Liechtenstein)

- Kulzer GmbH (Germany)

- Zimmer Biomet (U.S.)

- Mitsui Chemicals, Inc. (Japan)

- GC Corporation (Japan)

- COLTENE Group (Switzerland)

- VITA Zahnfabrik (Germany)

- SHOFU INC. (Japan)

- VOCO GmbH (Germany)

- 3M (U.S.)

- Den-Mat Holdings, LLC (U.S.)

- Lang Dental Manufacturing Company, Inc. (U.S.)

- Modern Dental Group Limited (Hong Kong)

- Nissin Dental Products Inc. (Japan)

- YAMAHACHI DENTAL MFG., CO. (Japan)

- AvaDent Digital Dental Solutions (U.S.)

- National Dentex Labs (U.S.)

- Glidewell (U.S.)

- SCHEU-DENTAL GmbH (Germany)

What are the Recent Developments in Global Full Dentures Market?

- In April 2024, Dentsply Sirona Inc., a global leader in dental solutions, expanded its digital dentures offering by launching a new line of Lucitone Digital Print full dentures in collaboration with Carbon’s 3D printing platform. This innovation significantly reduces production time while improving precision and aesthetics, reinforcing the shift toward digitally-driven denture manufacturing and addressing the growing demand for efficient, patient-specific prosthetics

- In March 2024, Ivoclar Vivadent AG introduced a next-generation milling system, PrograMill PM7 Plus, tailored for full denture production using high-performance materials. The system supports CAD/CAM fabrication of removable prosthetics, enabling dental labs to produce dentures with greater consistency, durability, and patient comfort. This launch reflects Ivoclar’s commitment to advancing digital dentistry and automation in prosthodontics

- In March 2024, COLTENE Holding AG, a major player in dental consumables, partnered with multiple European dental laboratories to integrate AI-assisted denture design software into clinical workflows. This collaboration aims to enhance the customization of full dentures by streamlining digital impressions and design accuracy, ultimately improving fit and function for patients across diverse age groups

- In February 2024, Aspen Dental, one of the largest dental service providers in the U.S., opened its newest denture lab facility in Arizona. The center is focused on increasing production capacity for full and implant-supported dentures using digital scanning and 3D printing technologies. The move enhances Aspen’s ability to meet the rising demand for same-day or quick-turnaround denture solutions in underserved markets

- In January 2024, GC Corporation launched Aadva Full Denture System, a new digital platform that combines intraoral scanning, AI-based design tools, and proprietary materials for complete denture fabrication. Initially rolled out in Japan and select Asia-Pacific countries, the system is intended to meet the increasing need for precise, digitally manufactured dentures for aging populations while optimizing workflow efficiency in dental clinics and labs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.