Global Forestry and Logging Market, By Type (Logging, Timber Tract Operations, Forest Nurseries, and Gathering of Forest Products), Application (Construction, Industrial Goods, and Others) – Industry Trends and Forecast to 2031.

Forestry and Logging Market Analysis and Size

The forestry and logging market encompasses a diverse range of activities vital to the sustainable management and utilization of forest resources worldwide. This market is driven by the global demand for timber and wood products, which are essential in construction, paper manufacturing, and various industrial applications. As urbanization and population growth continue, particularly in developing regions, the need for residential and infrastructure development fuels demand for timber, driving growth in the forestry sector. Moreover, advancements in logging technologies, such as mechanized harvesting systems and sustainable forestry practices, play a critical role in enhancing productivity and minimizing environmental impact.

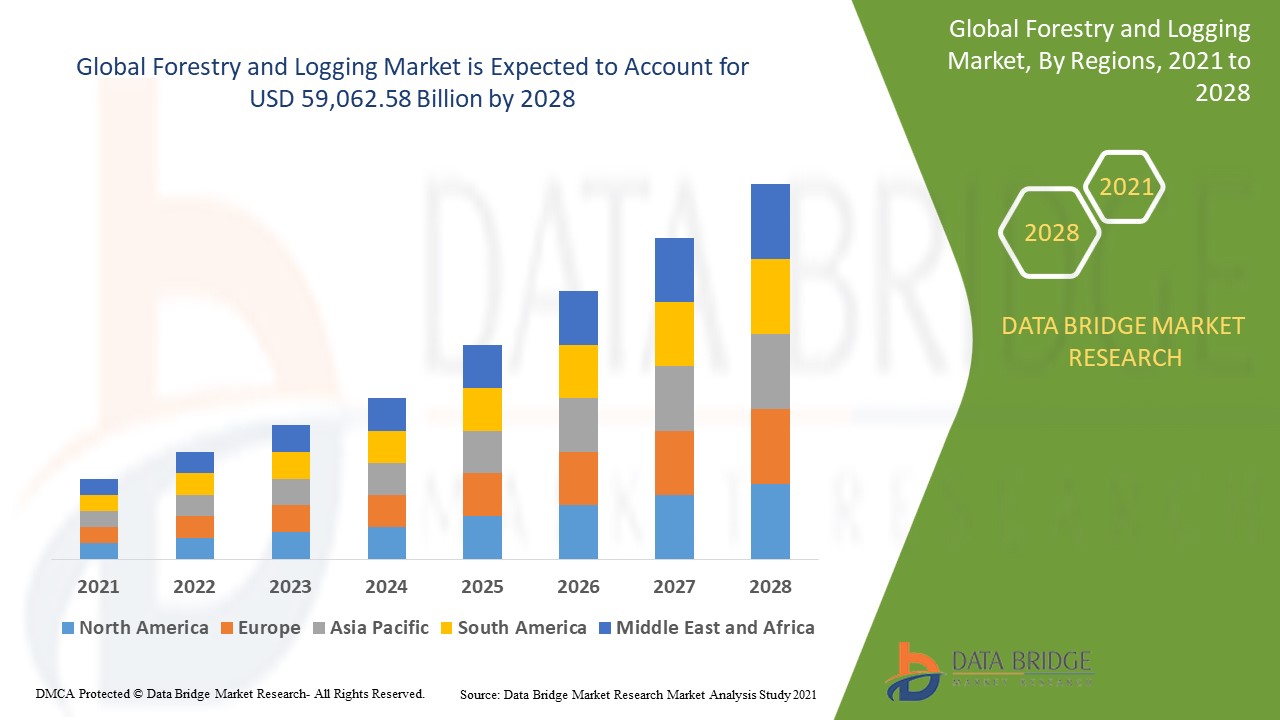

Global forestry and logging market size was valued at USD 317.17 billion in 2023 and is projected to reach USD 587.07 billion by 2031, with a CAGR of 8% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016 - 2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Logging, Timber Tract Operations, Forest Nurseries, and Gathering of Forest Products), Application (Construction, Industrial Goods, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America

|

|

Market Players Covered

|

Weyerhaeuser Company (U.S.), Rayonier Inc. (U.S.), Forestry Corporation (Australia), China Jilin Forest Industry Group Co., Ltd. (China), Tilhill Forestry (U.K.), XINHUANET (China), Oji Holdings Corporation (Japan), EGGER (Austria), James Jones & Sons Limited (U.K.), Metsähallitus’s Metsa (Finland)

|

|

Market Opportunities

|

|

Market Definition

Forestry and logging refer to the industry involved in the management, cultivation, harvesting, and processing of forests and timber resources. Forestry encompasses activities such as planting, maintaining, and managing forested areas to sustainably produce timber and other forest products while preserving biodiversity and ecosystem health. Logging specifically involves the extraction or harvesting of trees for commercial purposes, including the production of lumber, pulpwood, and other wood products.

Global Forestry and Logging Market Dynamics

Drivers

- Growing Demand for Wood Products

The increasing global population and rapid urbanization are pivotal drivers behind the growing demand for wood products. Timber is essential in construction for building homes, offices, and infrastructure, while the furniture industry relies heavily on wood for manufacturing diverse furnishings. In addition, the paper industry consumes vast quantities of wood fiber for producing paper, packaging, and other paper products. As urban centers expand and infrastructure projects escalate worldwide, the demand for timber continues to rise, creating substantial opportunities for growth in the forestry and logging market.

- Advancements in Logging Technology

Innovations in logging technology, such as mechanized harvesting systems and precision forestry techniques, are revolutionizing the industry by enhancing operational efficiency and minimizing environmental impact. Mechanized harvesting systems integrate advanced machinery for felling, processing, and transporting trees, reducing labor costs and operational time while increasing productivity. Precision forestry techniques utilize remote sensing, GPS technology, and data analytics to optimize forest management practices, ensuring selective harvesting, minimizing ecological disturbance, and driving market growth.

- Focus on Sustainable Forest Management

There is a growing focus on sustainable forest management driven by rising environmental awareness and stringent regulatory initiatives worldwide. Sustainable forestry practices emphasize responsible stewardship of forest resources, including biodiversity conservation, ecosystem health, and community engagement. Regulatory frameworks, such as forest certification programs such as Forest Stewardship Council (FSC) and Sustainable Forestry Initiative (SFI), validate adherence to sustainable practices and enhance market credibility.

Opportunities

- Forest Carbon and Ecosystem Services Revenue

Forests play a crucial role in sequestering carbon dioxide from the atmosphere and mitigating climate change impacts. Carbon offset programs enable forest owners to earn credits by maintaining or enhancing carbon stocks in their forests, which can be sold to companies seeking to offset their carbon emissions. Payments for ecosystem services, such as watershed protection and biodiversity conservation, provide additional financial incentives for sustainable forest management practices. The carbon sequestration market offers new revenue opportunities for forest owners and managers through forest carbon offsets and payments for ecosystem services.

- Technological Integration in Forestry Operations

The adoption of digital tools, remote sensing technologies, and artificial intelligence (AI) is transforming forestry operations by enhancing productivity, efficiency, and sustainability. Digital tools enable real-time monitoring of forest resources, improving decision-making processes for forest management and planning. Remote sensing technologies, including satellite imagery and drones, provide valuable insights into forest health, biodiversity mapping, and illegal logging detection. By integrating these technologies, forestry companies can achieve operational excellence, reduce environmental impacts, and maintain competitive advantages in the global market.

Restraints/Challenges

- Environmental Concerns

Environmental concerns in the forestry and logging industry encompass critical issues such as deforestation, habitat fragmentation, and biodiversity loss. Deforestation, driven by agricultural expansion, urbanization, and illegal logging, threatens global forest ecosystems and biodiversity. Habitat fragmentation disrupts wildlife habitats and migration patterns, impacting biodiversity and ecological balance. In addition, biodiversity loss reduces ecosystem resilience and diminishes forest ecosystem services, such as carbon sequestration and water regulation.

- Regulatory Constraints on Forestry and Logging

Stringent regulatory constraints in the forestry and logging sector impose significant challenges on industry stakeholders, particularly regarding land use, environmental impact mitigation, and forest certification. Regulatory frameworks vary globally but often include requirements for sustainable forest management practices, adherence to environmental standards, and certification from recognized bodies such as the Forest Stewardship Council (FSC). Compliance with these regulations can increase operational costs through investments in sustainable practices, forest inventory assessments, and monitoring systems. Moreover, regulatory constraints may restrict market access for timber products that do not meet environmental or social criteria, affecting profitability and market competitiveness.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In July 2023, Trimble introduced LIMS PRO, a new cloud-hosted iteration of its Log Inventory and Management System (LIMS), tailored for managing raw material procurement in sawmills. This cloud-based log settlement solution aims to enhance operational transparency for mills, enabling small- and medium-sized forest product companies to achieve productivity and growth benefits previously accessible only to larger enterprises

- In February 2021, West Fraser Timber Co. Ltd. and Norbord Inc. announced the successful completion of their merger. West Fraser acquired all outstanding common shares of Norbord as per the agreed terms, where Norbord shareholders received 0.675 shares of West Fraser for each Norbord share held

Global Forestry and Logging Market Scope

The market is segmented on the basis of type and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Logging

- Timber Tract Operations

- Forest Nurseries

- Gathering Of Forest Products

Application

- Construction

- Industrial Goods

- Others

Global Forestry and Logging Market Regional Analysis/Insights

The market is analyzed and market size insights and trends are provided by country, type, and application as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

Asia-Pacific is expected to dominate the market due to urbanization, and economic development. This dominance is further supported by an expanding population and a surge in construction projects across various countries in the region.

North America is expected to be the fastest growing due to advancements in logging procedures, cable harvesting systems, and helicopter logging, technologies that enhance efficiency and minimize environmental impact.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Forestry and Logging Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- Weyerhaeuser Company (U.S.)

- Rayonier Inc. (U.S.)

- Forestry Corporation (Australia)

- China Jilin Forest Industry Group Co., Ltd. (China)

- Tilhill Forestry (U.K.)

- XINHUANET (China)

- Oji Holdings Corporation (Japan)

- EGGER (Austria)

- James Jones & Sons Limited (U.K.)

- Metsähallitus’s Metsa (Finland)

SKU-