Global Footwear Market

Market Size in USD Billion

CAGR :

%

USD

700.90 Billion

USD

1,100.38 Billion

2024

2032

USD

700.90 Billion

USD

1,100.38 Billion

2024

2032

| 2025 –2032 | |

| USD 700.90 Billion | |

| USD 1,100.38 Billion | |

|

|

|

|

Footwear Market Size

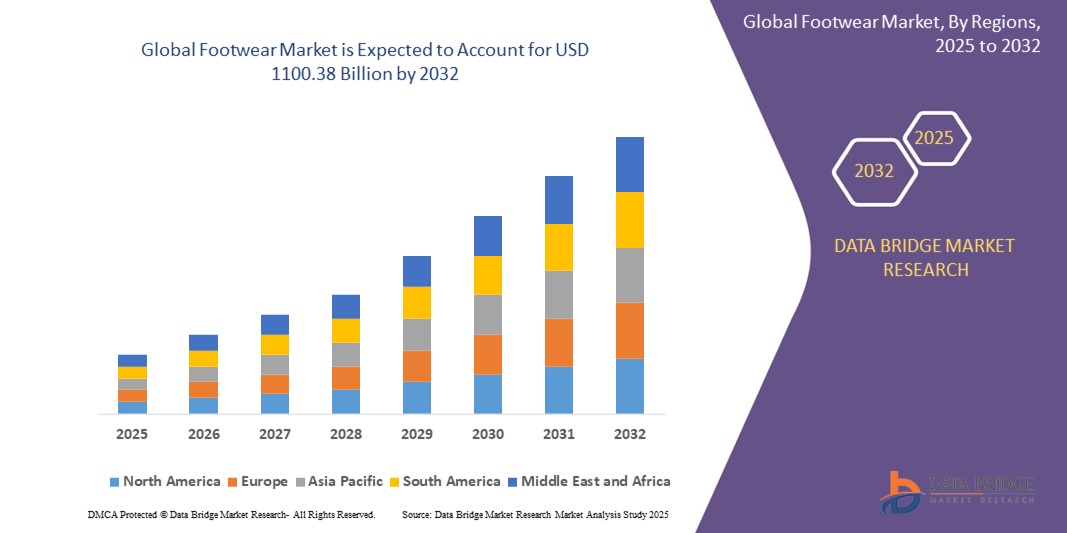

- The global footwear market size was valued at USD 700.90 billion in 2024 and is expected to reach USD 1100.38 billion by 2032, at a CAGR of 5.80% during the forecast period

- This market growth is largely driven by increasing fashion consciousness, evolving lifestyle preferences, and the growing global population, particularly in urban areas with rising disposable incomes

- In addition, the surge in e-commerce penetration, expanding athleisure trends, and consumer preference for customized and sustainable footwear options are acting as major catalysts for industry expansion

Footwear Market Analysis

- Footwear, encompassing casual, athletic, formal, and specialty shoes, has become a key element of self-expression, functionality, and lifestyle alignment across global demographics, with innovations in materials, comfort, and design playing pivotal roles

- The rising demand for eco-friendly materials, orthopedic support, and performance-driven sports footwear is pushing brands to adopt advanced manufacturing techniques and digital customization tools

- The market is witnessing robust demand across men’s, women’s, and children’s segments, with growth further fueled by increasing brand awareness, celebrity endorsements, and collaborative limited-edition launches, especially in urban and digitally connected regions

- North America dominated the global footwear market with a revenue share of 27.12% in 2024, fueled by strong brand presence, innovation in athletic and casual footwear, and a rising focus on health, fitness, and fashion trends

- Asia-Pacific is the fastest-growing footwear market globally, expected to grow at a CAGR of 5.11% from 2025 to 2032. Key markets such as China, India, and Japan are experiencing rising demand fueled by urbanization, increasing disposable incomes, and expanding digital retail

- The athletics segment dominated the market with the largest revenue share of 28.9% in 2024, driven by growing health consciousness, increased participation in sports and fitness activities, and the expanding athleisure trend

Report Scope and Footwear Market Segmentation

|

Attributes |

Footwear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Footwear Market Trends

“Sustainability and Eco-Innovation Driving Product Development”

- A growing and transformative trend in the global footwear market is the focus on sustainable materials and eco-conscious production processes. Consumers, especially millennials and Gen Z, are demanding ethical and environmentally friendly products, pushing brands toward greener innovation

- Leading footwear companies are launching products made from recycled plastics, plant-based materials, and biodegradable components. For instance, Adidas launched its "Futurecraft Loop" a 100% recyclable performance running shoe while Allbirds uses natural materials such as merino wool and sugarcane in its collections

- Companies are also adopting circular economy models, encouraging consumers to return used shoes for recycling or resale. Nike’s “Move to Zero” initiative is a notable instance, aiming to reduce carbon emissions and waste across its product line

- Advanced production technologies, such as 3D knitting and additive manufacturing, are reducing material waste during production while enabling customized, on-demand manufacturing with minimal environmental impact

- As environmental concerns become a core purchasing factor, sustainability is no longer a niche value but a mainstream demand shaping product design, marketing, and supply chain practices

- The surge in eco-conscious consumer behavior and governmental regulations around sustainability is expected to accelerate innovation in material science and waste reduction across the footwear industry

Footwear Market Dynamics

Driver

“Growing Demand for Athleisure and Functional Fashion”

- The global rise of the athleisure trend where athletic wear crosses over into casual and everyday fashion is a significant driver in the footwear market, particularly in the sports and lifestyle categories

- Consumers increasingly prefer comfortable, stylish, and versatile footwear that can transition from gyms to streets, fueling demand for sneakers, trainers, and slip-ons. This trend is especially prominent among urban youth and working professionals

- In March 2024, Puma reported a double-digit increase in lifestyle footwear sales, driven by new collections targeting the athleisure segment. Likewise, Lululemon and Under Armour continue to expand their footwear offerings to complement their athletic apparel lines

- The pandemic accelerated this shift, with remote work and casual dress codes boosting demand for performance-infused casual shoes. Consumers now seek footwear that balances functionality, style, and comfort in one product

- The proliferation of collaborations between athletic brands and fashion influencers (e.g., Nike x Travis Scott or Adidas x Gucci) is further amplifying the appeal of athleisure footwear and expanding its reach across demographics and regions

Restraint/Challenge

“Supply Chain Disruptions and Raw Material Volatility”

- The footwear industry continues to face challenges related to global supply chain disruptions, particularly with sourcing materials and managing international logistics efficiently

- Raw material shortages (e.g., rubber, leather, synthetic fabrics), shipping delays, and rising transportation costs have significantly impacted production timelines and cost structures for footwear brands worldwide

- In late 2023, VF Corporation (parent of Vans and Timberland) reported lower-than-expected earnings due to extended lead times and shipping backlogs from Southeast Asian manufacturing hubs

- Geopolitical tensions, stricter environmental regulations, and unexpected events such as pandemics or climate-induced disasters can exacerbate these challenges, disrupting the consistent supply of essential components

- Brands are attempting to mitigate this by diversifying their supplier base, reshoring parts of their manufacturing, and investing in smart logistics and inventory management systems. However, such transitions involve high capital costs and time

- For small to mid-sized companies especially, managing cost inflation and maintaining timely product delivery amid ongoing supply chain instability remains a significant obstacle to scaling and profitability

Footwear Market Scope

The market is segmented on the basis of type, shoe material/soling material, distribution channel, and end-user.

- By Type

On the basis of type, the Footwear market is segmented into Loafers, Shoes, Sandal/Flip-Flops, Ballerinas, Boots, Wedges, Athletics, Healthcare Shoes, and Others. The Athletics segment dominated the market with the largest revenue share of 28.9% in 2024, driven by growing health consciousness, increased participation in sports and fitness activities, and the expanding athleisure trend. Athletic footwear continues to see widespread adoption across demographics due to its versatility, comfort, and evolving designs suitable for casual as well as performance wear.

The Boots segment is projected to witness the fastest CAGR from 2025 to 2032, propelled by growing demand in colder regions, their rising use in occupational settings, and evolving fashion trends across both men's and women's categories.

- By Shoe Material / Soling Material

On the basis of Shoe Material / Soling Material, the market is segmented into Plastic, Leather, Rubber, Textile, and Others. The Rubber segment held the largest market share of 32.4% in 2024, owing to its durability, water resistance, flexibility, and cost-effectiveness, making it the preferred material for sports, work, and casual footwear. Rubber soles are particularly favored for their shock-absorbing properties and suitability for various terrains.

The Textile segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by innovations in sustainable fabrics, lightweight designs, and increasing consumer preference for breathable and eco-friendly materials.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into E-Commerce, Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, and Others. E-Commerce dominated the market with the highest revenue share of 38.7% in 2024, driven by growing online shopping behavior, competitive pricing, broader product variety, and ease of product comparison. The growth of direct-to-consumer (DTC) brands and online-exclusive launches further boosts this segment.

The Specialty Store segment is expected to register the fastest CAGR from 2025 to 2032, owing to personalized service, exclusive brand experiences, and physical trial before purchase—particularly important in the footwear industry.

- By End-User

On the basis of end-user, the market is categorized into Women, Men, and Children. The Women segment held the dominant revenue share of 42.5% in 2024, attributed to higher footwear ownership per individual, greater emphasis on fashion variety, and increasing purchasing power among female consumers. Brands continue to introduce diverse product ranges and seasonal collections targeting the women’s segment, further driving growth.

The Children segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the increasing birth rate in developing economies, rising awareness of proper foot care, and frequent replacement needs due to growth spurts.

Footwear Market Regional Analysis

- North America dominated the global footwear market with a revenue share of 27.12% in 2024, fueled by strong brand presence, innovation in athletic and casual footwear, and a rising focus on health, fitness, and fashion trends

- Consumers in the region are increasingly drawn to eco-friendly materials, customization features, and digitally enabled shopping experiences (e.g., virtual try-ons and AI-driven sizing)

- High disposable incomes, sports participation, and the popularity of athleisure wear continue to drive demand for premium and performance footwear

U.S. Footwear Market Insight

The U.S. dominated the North American footwear market in 2024, driven by evolving fashion trends, health awareness, and a strong digital retail ecosystem. The market is witnessing a surge in demand for performance footwear and limited-edition sneakers, spurred by the rise of sneaker culture and collaborations with athletes and influencers. Eco-conscious consumers are also pushing brands to adopt sustainable materials and ethical production practices. Innovations from companies such as Nike, New Balance, and Crocs are enhancing consumer engagement, while omnichannel strategies and mobile shopping apps are reshaping how consumers browse and buy footwear.

Europe Footwear Market Insight

Europe's footwear market is expanding steadily, supported by a discerning consumer base that values quality, style, and sustainability. The region has long been home to global fashion houses and heritage brands, particularly in Italy, France, and Germany, which continue to influence global trends. Consumers are increasingly favoring eco-friendly and ethically sourced footwear, while luxury and designer categories are thriving due to high brand loyalty. E-commerce adoption is rising, but physical retail remains important for high-end purchases. Renovation in retail concepts and consumer demand for versatile, comfortable footwear is reshaping offerings across both premium and mass-market segments.

U.K. Footwear Market Insight

The U.K. footwear market is projected to grow at a healthy rate, supported by a strong demand for trendy, comfortable, and sustainable options. As consumers become more fashion-forward and digitally savvy, online retail channels are gaining prominence, especially among Gen Z and Millennials. Ethical and vegan footwear is growing in popularity, reflecting the population’s shifting values toward sustainability. The U.K.’s robust logistics and e-commerce infrastructure allow local and global brands to efficiently reach diverse consumer bases. In addition, the influence of streetwear, sports fashion, and sneaker resale culture is contributing to vibrant growth across various price points.

Germany Footwear Market Insight

Germany’s footwear market is flourishing, anchored by global giants such as Adidas and PUMA, which continue to invest in innovation, sustainability, and performance-driven products. German consumers prioritize comfort, durability, and environmental responsibility, making eco-friendly materials and functional designs increasingly important. The market is also benefiting from rising demand for orthopedic and ergonomic footwear, particularly among older demographics. Germany’s advanced manufacturing ecosystem and strong retail presence support a broad product range across sports, casual, and business categories. Online and in-store experiences are being refined to reflect consumer preferences for hybrid shopping and detailed product transparency.

Asia-Pacific Footwear Market Insight

Asia-Pacific is the fastest-growing footwear market globally, expected to grow at a CAGR of 5.11% from 2025 to 2032. Key markets such as China, India, and Japan are experiencing rising demand fueled by urbanization, increasing disposable incomes, and expanding digital retail. Consumers across APAC are embracing a mix of global trends and local fashion influences, creating diverse and fast-evolving preferences. E-commerce platforms, social media marketing, and direct-to-consumer (DTC) brands are reshaping the competitive landscape. Local production capabilities, cost-effective supply chains, and growing interest in smart and sustainable footwear continue to accelerate market momentum.

Japan Footwear Market Insight

Japan’s footwear market is experiencing steady growth, driven by the country’s blend of technological innovation, minimalist fashion sensibilities, and aging population. Consumers value comfort, craftsmanship, and functionality, leading to a strong market for slip-resistant, orthopedic, and durable shoes. Japan’s affinity for high-tech solutions extends to the retail space, with virtual try-ons and mobile shopping gaining traction. Local and international brands compete to meet the demand for fashionable yet practical footwear, particularly in urban centers. Furthermore, Japan’s growing number of smart homes and connected lifestyles are indirectly influencing footwear design through an emphasis on convenience and performance.

China Footwear Market Insight

China led the Asia-Pacific footwear market in 2024 in terms of revenue, driven by rapid urbanization, high smartphone penetration, and a digitally engaged middle class. Chinese consumers are highly responsive to fashion trends, with sneakers, luxury footwear, and athleisure styles in particularly high demand. E-commerce giants and social platforms such as Tmall, JD.com, and Douyin (TikTok) play a crucial role in product discovery and sales. Domestic manufacturing capabilities allow for rapid product turnaround, and local brands are increasingly competing with global players on quality and innovation. The government’s smart city initiatives and investment in retail tech further support growth.

Footwear Market Share

The Footwear industry is primarily led by well-established companies, including:

- Crocs Retail, LLC (U.S.)

- Adidas (Germany)

- SKECHERS USA, Inc. (U.S.)

- Nike, Inc. (U.S.)

- Okabashi (U.S.)

- BATA BRAND (Switzerland)

- GEOX S.p.A (Italy)

- PUMA (Germany)

- Under Armour, Inc. (U.S.)

- Wolverine World Wide, Inc. (U.S.)

- ASICS Corporation (Japan)

- THE ALDO GROUP INC. (Canada)

- Relaxo Footwears Limited (India)

- KERING (France)

- VF Corporation (U.S.)

- Deichmann SE (Germany)

- FILA Holdings Corp. (South Korea)

- New Balance (U.S.)

- ECCO Sko A/S (Denmark)

- Burberry (U.K.)

Latest Developments in Global Footwear Market

- In November 2024, Salomon, a France-based sports lifestyle brand, inaugurated two new retail outlets in London and across the U.K., offering a broad selection of high-performance footgear tailored for hiking and running enthusiasts. This strategic expansion highlights the brand’s ongoing commitment to strengthening its footprint in the premium outdoor footwear segment

- In November 2024, Crocs, a U.S.-headquartered footwear company, opened a new 1,600 sq. ft. store in Lulu Mall, Kerala, India, featuring its iconic and seasonal collections. The launch underscores Crocs’ growing focus on the Indian retail landscape and consumer base

- In July 2024, Nike Inc, a leading U.S. footwear manufacturer, introduced its latest innovation, the Air Max Dn shoe, designed to deliver exceptional comfort and modern aesthetics. This product release marks Nike’s continuous push for performance-driven and stylish designs to appeal to a wider demographic

- In March 2024, Yoho, a direct-to-consumer footwear brand based in India, rolled out its latest sneaker line named Blinc, available in multiple color variants for both men and women via its website and leading e-commerce platforms. This launch reflects Yoho’s efforts to capture young, style-conscious consumers with versatile product offerings

- In November 2023, FitFlop, a U.K.-based footwear company, launched a new promotional campaign titled “For People Who Move” aimed at boosting awareness of its ergonomic and fashion-forward product line. This initiative emphasizes FitFlop’s positioning as a brand that supports active lifestyles with stylish comfort

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.