Global Food Robotics In Processed Food Application Market

Market Size in USD Billion

CAGR :

%

USD

6.40 Billion

USD

16.42 Billion

2024

2032

USD

6.40 Billion

USD

16.42 Billion

2024

2032

| 2025 –2032 | |

| USD 6.40 Billion | |

| USD 16.42 Billion | |

|

|

|

|

Food Robotics in Processed Food Application Market Size

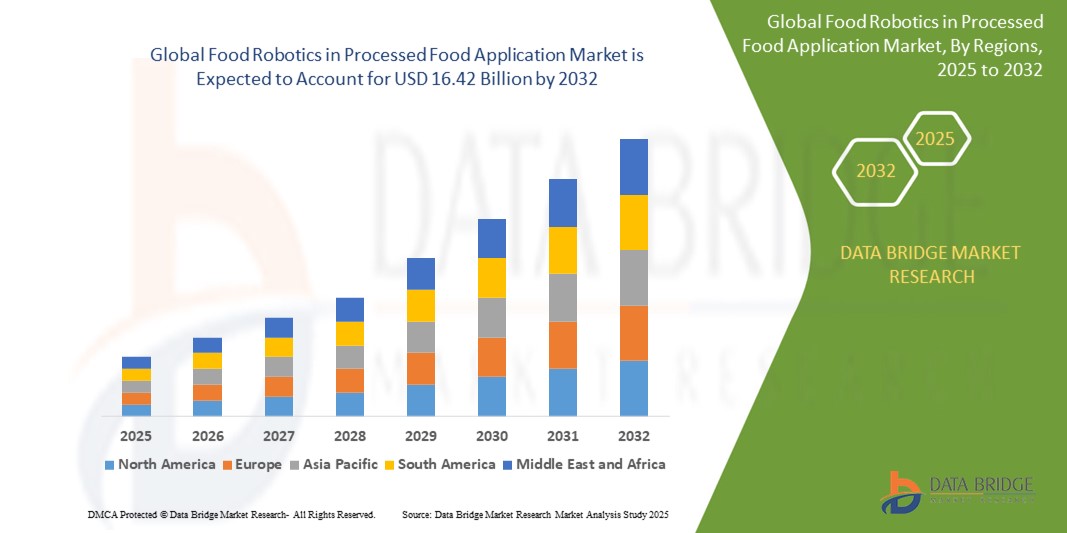

- The global food robotics in processed food application market size was valued at USD 6.40 billion in 2024 and is expected to reach USD 16.42 billion by 2032, at a CAGR of 12.50% during the forecast period

- The market growth is Market growth is primarily driven by the increasing adoption of automation in food processing to enhance efficiency, reduce labor costs, and improve product consistency, fueled by advancements in robotic technologies and the rising demand for processed and packaged foods

- In addition, growing consumer demand for high-quality, safe, and hygienic food products, coupled with stringent regulatory standards, is positioning food robotics as a critical solution for modern food processing operations, significantly boosting industry growth

Food Robotics in Processed Food Application Market Analysis

- Food robotics, encompassing automated systems for tasks such as packaging, palletizing, and processing, are increasingly integral to the food and beverage industry due to their precision, speed, and ability to meet stringent hygiene standards in processed food applications

- The surge in demand for food robotics is driven by the need for operational efficiency, rising labor costs, and the growing trend of automation in food manufacturing, particularly in high-volume production environments

- Europe dominated the food robotics in processed food application market with the largest revenue share of 38.5% in 2024, driven by advanced manufacturing infrastructure, high adoption of automation technologies, and strong regulatory frameworks ensuring food safety. Germany and the U.K. are key contributors, with significant investments in robotic solutions by major food processing companies

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid industrialization, increasing demand for processed foods, and rising investments in automation in countries such as China, Japan, and India

- The articulated segment dominated the largest market revenue share of 42.3%, driven by its flexibility and ability to mimic human arm movements, making it ideal for complex tasks such as cutting, deboning, packaging, and palletizing in food processing. Its precision and versatility in confined spaces further bolster its dominance

Report Scope and Food Robotics in Processed Food Application Market Segmentation

|

Attributes |

Food Robotics in Processed Food Application Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Robotics in Processed Food Application Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global food robotics market in processed food applications is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies facilitate advanced data processing, enabling detailed insights into production efficiency, equipment performance, and quality control metrics

- AI-driven robotics solutions support proactive maintenance by predicting equipment failures before they disrupt operations, reducing downtime and maintenance costs

- For instances, companies are leveraging AI platforms to optimize robotic operations, such as adjusting packaging speeds based on real-time demand or analyzing sorting patterns to minimize food waste

- This trend enhances the appeal of food robotics systems for manufacturers, improving operational efficiency and compliance with stringent food safety standards

- AI algorithms can process data from robotic tasks, such as picking precision, packaging consistency, and processing accuracy, to optimize performance and ensure high-quality output

Food Robotics in Processed Food Application Market Dynamics

Driver

“Rising Demand for Automation and Food Safety Compliance”

- Growing consumer demand for processed and packaged foods, including ready-to-eat meals and convenience products, is a key driver for the food robotics market

- Robotics systems enhance food safety by automating tasks such as packaging, picking, and processing, reducing human contact and contamination risks

- Stringent government regulations, particularly in Europe with standards such as HACCP and ISO 22000, are accelerating the adoption of robotics to ensure compliance with food safety and hygiene requirements

- Advancements in IoT and 5G connectivity enable faster data transfer and real-time monitoring, supporting sophisticated robotic applications in food processing

- Food manufacturers are increasingly integrating robotics as standard solutions to meet rising production demands and maintain consistent product quality

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The high initial costs of robotic hardware, software, and system integration pose a significant barrier, particularly for small and medium-sized enterprises in emerging markets

- Retrofitting existing production lines with robotic systems can be complex and expensive, requiring specialized expertise and infrastructure upgrades

- Data security and privacy issues are a major challenge, as robotics systems collect sensitive operational data, raising concerns about cyberattacks, data misuse, and compliance with regulations such as GDPR in Europe

- The lack of standardized global regulations for data handling in food robotics complicates operations for manufacturers operating across multiple regions

- These factors may slow market growth in cost-sensitive regions or areas with heightened awareness of data privacy

Food Robotics in Processed Food Application market Scope

The market is segmented on the basis of type, payload, and application.

- By Type

On the basis of type, the global food robotics in processed food application market is segmented into articulated, cartesian, scara, parallel, cylindrical, collaborative, and other types. The articulated segment dominated the largest market revenue share of 42.3%, driven by its flexibility and ability to mimic human arm movements, making it ideal for complex tasks such as cutting, deboning, packaging, and palletizing in food processing. Its precision and versatility in confined spaces further bolster its dominance

The collaborative robots (cobots) segment is expected to witness the fastest growth rate from 2025 to 2032. This growth is fueled by increasing focus on worker safety, ease of programming and deployment, and the rising demand for flexible automation solutions in food processing facilities where human-robot collaboration is beneficial.

- By Payload

On the basis of payload, the global food robotics in processed food application market is segmented into low, medium, and heavy. The medium payload segment is expected to hold the largest market revenue share, primarily due to its balanced capacity and flexibility, making it highly versatile for various applications across the food industry.

The heavy payload segment is anticipated to witness significant growth, driven by technological advancements and improved R&D in handling larger volumes and heavier food products efficiently in processed food applications.

- By Application

On the basis of application, the global food robotics in processed food application market is segmented into packaging, repackaging, palletizing, picking, processing, and other. The packaging segment holds the largest market revenue share, driven by the increasing demand for packaged foods and the need for high-speed, consistent, and hygienic packaging processes that robots can efficiently manage, reducing waste and increasing production capacity.

The processing segment is anticipated to experience robust growth from 2025 to 2032. This is fueled by the critical need for precision, consistency, and hygiene in various food processing tasks such as cutting, mixing, and sorting, where robotic solutions offer superior performance and help maintain strict food safety standards.

Food Robotics in Processed Food Application Market Regional Analysis

- Europe dominated the food robotics in processed food application market with the largest revenue share of 38.5% in 2024, driven by advanced manufacturing infrastructure, high adoption of automation technologies, and strong regulatory frameworks ensuring food safety. Germany and the U.K. are key contributors, with significant investments in robotic solutions by major food processing companies

- Consumers and manufacturers prioritize robotic solutions for improving production precision, reducing labor costs, and ensuring compliance with stringent food safety standards, particularly in regions with advanced industrial ecosystems

- Growth is supported by advancements in robotic technologies, including articulated, SCARA, and collaborative robots, alongside rising adoption in both large-scale food processing plants and smaller facilities

U.K. Food Robotics in Processed Food Application Market Insight

The U.K. market for food robotics is expected to witness significant growth, driven by demand for automation to improve operational efficiency and product consistency in urban and suburban food processing facilities. Increased interest in smart manufacturing and rising awareness of robotics’ role in reducing labor costs encourage adoption. Evolving food safety regulations also influence market trends, balancing automation needs with compliance.

Germany Food Robotics in Processed Food Application Market Insight

Germany is expected to witness robust growth in the food robotics market, attributed to its advanced food processing and manufacturing sector and high focus on operational efficiency and sustainability. German manufacturers prefer technologically advanced robots, such as articulated and collaborative types, that enhance productivity and contribute to energy efficiency. The integration of these systems in premium food processing facilities and aftermarket upgrades supports sustained market growth.

North America Food Robotics in Processed Food Application Market Insight

North America holds a significant share of the global food robotics market, driven by a robust food processing industry and increasing adoption of automation to improve operational efficiency and meet stringent safety standards. The demand for robotics in applications such as packaging, palletizing, and processing is fueled by the need for precision, scalability, and hygiene in food production. The U.S. leads the region, with growing investments in smart manufacturing and technological advancements in robotics supporting market expansion.

U.S. Food Robotics in Processed Food Application Market Insight

The U.S. food robotics in processed food application market is expected to witness significant growth, fueled by strong demand for automation in food processing and packaging. Growing awareness of robotics’ benefits in improving throughput and maintaining hygiene standards drives market expansion. The trend towards smart factories and increasing regulations promoting food safety further boost adoption. Integration of robotics in both new installations and retrofitting of existing facilities creates a robust market ecosystem.

Asia-Pacific Food Robotics in Processed Food Application Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding food processing industries and rising investments in automation in countries such as China, India, and Japan. Increasing awareness of robotics’ benefits in improving production efficiency, ensuring food safety, and enhancing product quality boosts demand. Government initiatives promoting smart manufacturing and food safety standards further encourage the adoption of advanced robotic systems.

Japan Food Robotics in Processed Food Application Market Insight

Japan’s food robotics market is expected to witness rapid growth due to strong consumer and manufacturer preference for high-quality, technologically advanced robotic systems that enhance production efficiency and safety. The presence of major food processing equipment manufacturers and the integration of robotics in large-scale facilities accelerate market penetration. Rising interest in customized automation solutions also contributes to growth.

China Food Robotics in Processed Food Application Market Insight

China holds the largest share of the Asia-Pacific food robotics market, propelled by rapid urbanization, increasing food consumption, and growing demand for automation in food processing. The country’s expanding middle class and focus on smart manufacturing support the adoption of advanced robotic systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Food Robotics in Processed Food Application Market Share

The food robotics in processed food application industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Kawasaki Heavy Industries, Ltd. (Japan)

- YASKAWA ELECTRIC CORPORATION (Japan)

- Rockwell Automation, Inc. (U.S.)

- FANUC CORPORATION (Japan)

- Mitsubishi Electric Corporation (Japan)

- Universal Robots A/S (Denmark)

- KUKA AG (Germany)

- Seiko Epson Corporation (Japan)

- Stäubli International AG (Switzerland)

- MAYEKAWA MFG. CO., LTD. (Japan)

- Bastian Solutions, Inc. (U.S.)

- MYCOM OSI (U.S.)

- DENSO CORPORATION (Japan)

- Toshiba Corporation (Japan)

- Stryker (U.S.)

- Adept Technologies Inc. (U.S.)

- Panasonic Corporation (Japan)

- Comau (Italy)

- Nachi Robotic Systems, Inc. (U.S.)

What are the Recent Developments in Global Food Robotics in Processed Food Application Market?

- In February 2025, LBX Food Robotics announced the expansion of its Bake Xpress hot food vending kiosks into Canada, following the achievement of Canadian Standards Association (CSA) certification. This milestone allows for rapid deployment across diverse venues—such as hospitality, retail, healthcare, and education—without the need for individual site inspections. While not a traditional processed food application, Bake Xpress represents a significant advancement in automated food preparation and dispensing, offering freshly baked meals and pastries on demand through a compact robotic kiosk. The move underscores the growing relevance of food robotics in delivering convenient, high-quality meals in unattended settings

- In July 2024, Chef Robotics unveiled a first-of-its-kind AI-powered flexible food robot aimed at tackling labor shortages and boosting production in the food manufacturing sector. Powered by ChefOS, the company’s proprietary food manipulation software, the robot adapts to high-mix production environments—handling diverse ingredients and portion sizes with precision. Unsuch as traditional automation, Chef’s system offers partial automation that integrates seamlessly into existing workflows. Notable customers such as Amy’s Kitchen, Sunbasket, and Chef Bombay have already adopted the technology, reporting improvements in consistency, labor productivity, and throughput

- In August 2023, UK-based robotics innovator Wootzano officially launched its operations in the United States, introducing its flagship Avarai robot to the market. Designed for post-harvest applications, Avarai uses embedded electronic skin and AI-powered computer vision to gently handle delicate fresh produce—such as grapes and tomatoes—without bruising or damage. This precision reduces food loss and boosts packing efficiency, addressing labor shortages in produce packing sheds. The expansion, supported by partners such as the Fresno County Economic Development Corporation and the British Consulate General – San Francisco, marks a major milestone in Wootzano’s global growth strategy

- In April 2023, Doosan Robotics introduced its E-SERIES, a groundbreaking line of NSF-certified collaborative robots tailored for the food and beverage industry. Designed with sealed gaps between connecting axes and a slim, hygienic build, these cobots meet stringent safety standards while offering exceptional flexibility in food preparation tasks. With a 5 kg payload and nearly 3 ft reach, the E-SERIES can handle diverse applications—from frying chicken to brewing coffee—already deployed in concepts such as Robert Chicken and Dr. Presso. This launch marks a significant step in automating food production with efficient, sanitary, and adaptable robotic solutions

- In April 2023, ABB Robotics entered a collaboration with Pulmuone, a leading Korean food processing company, to develop AI-powered robotic solutions for cultivating laboratory-grown seafood. The partnership focuses on automating cell culture handling and testing, aiming to boost production efficiency, reduce contamination risks, and relieve skilled lab workers from repetitive tasks. ABB’s portfolio of collaborative robots (cobots) will play a key role in safely supporting human operators, while Pulmuone plans to leverage this technology to establish mass production by 2026—potentially becoming the first to apply AI robotics to cell-cultured food

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Robotics In Processed Food Application Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Robotics In Processed Food Application Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Robotics In Processed Food Application Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.