Global Food Microencapsulation Market

Market Size in USD Billion

CAGR :

%

USD

10.90 Billion

USD

19.73 Billion

2021

2029

USD

10.90 Billion

USD

19.73 Billion

2021

2029

| 2022 –2029 | |

| USD 10.90 Billion | |

| USD 19.73 Billion | |

|

|

|

|

Food Microencapsulation Market Analysis and Size

Encapsulation technology is becoming increasingly important in a variety of industries, including biomedical diagnostics, food, cosmetics, and drug therapy. The Microencapsulation industry has the potential to deliver nutrients to the body that are difficult to obtain by including them in fortified or functional food products. The technology is also being used to improve the bioavailability and delivery of nutraceuticals, which have been shown to have therapeutic and disease-prevention properties.

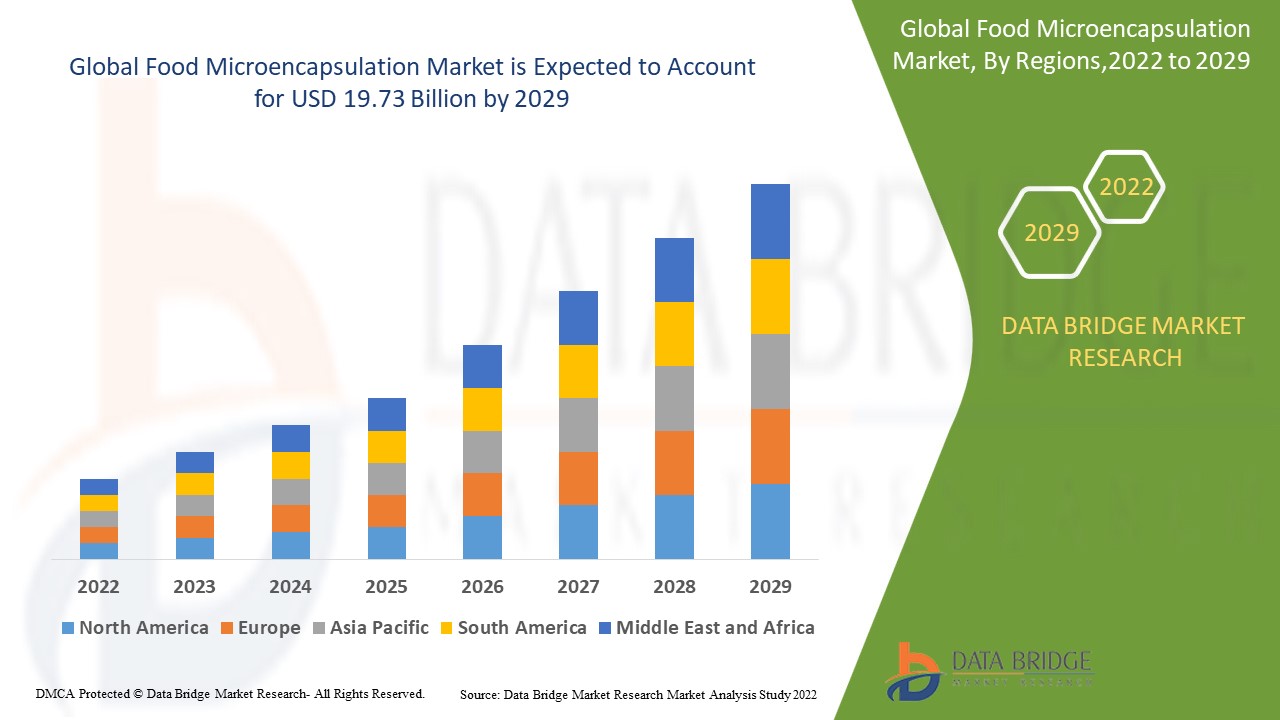

Data Bridge Market Research analyses that the food microencapsulation market was valued at a USD 10.9 billion in 2021 is expected to reach the value of USD 19.73 billion by 2029, at a CAGR of 7.70% during the forecast period of 2022-2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Food Microencapsulation Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Technology (Spray, Emulsion and Dripping), Core Material (Pharmaceutical & Healthcare Drugs and Others), Shell Material (Polymers, Gums & Resins and Others), Application (Pharmaceutical & Health Care Products, Home & Personal Care, Food & Beverages, Agrochemicals, Construction, Textile) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Cargill, Incorporated (U.S.), BASF SE (Germany), DuPont (U.S.), DSM (Netherlands), FrieslandCampina (Netherlands), Kerry Group plc (Ireland), Ingredion (Switzerland), International Flavors & Fragrances Inc. IFF (U.S.), Symrise (Germany), Sensient Technologies Corporation (U.S.), Blachem Inc. (U.S.), Firmenich S.A. (Switzerland), Vitablend (Netherlands), Advanced Bionutrition Corp (U.S.), Encpasys LLC (U.S.), Clextral (France), Sphera Encapsulation (Italy), Aveka (U.S.), Lycored (Israel), and Tastetech (U.K.) |

|

Opportunities |

|

Market Definition

Microencapsulation is a technique in which liquid, solid, or gaseous active ingredients are packaged within another material to protect or shield the active ingredient from its surroundings. This method is useful for increasing the stability of thermochromic mixtures.

Food Microencapsulation Market Dynamics

Drivers

- growing application of microencapsulation techniques in a variety of fields

Encapsulation technology is becoming increasingly important in a variety of fields, including drug therapy, biomedical diagnostics, cosmetics, and food. Due to their outstanding features and benefits, nano-encapsulation and microencapsulation techniques are increasingly being developed and used in a wide range of industries. These benefits typically include superior bioavailability of compounds in drug delivery systems given that approximately half of all drugs produced have issues with poor bioavailability. Innovative microencapsulation techniques promote such advantages and have modulated particle densities to meet specifications for lightweight and porous materials.

- The high dependence of microencapsulation technology in food and beverage industry

Microencapsulation is a nanotechnology application that is well-known in the pharmaceutical industry but has significant potential in the food industry. Despite being a relatively new technology, Microencapsulation has quickly established a strong reputation and is now one of the most widely used in the food industry. Microencapsulation has been used in a variety of food applications over the last few years, including food transportation, food storage, food production, food packaging, and food processing.

Opportunity

The growing economies and technological advancements are attributed to the high growth opportunities for the food encapsulation market in emerging regions. Introducing new encapsulation technologies, such as microencapsulation and bio-encapsulation, is driving the demand for encapsulation in various food applications. Many food products benefit from encapsulation in terms of taste. Manufacturers in the food industry are focusing on innovative developments in encapsulation processes that will aid in product differentiation, value addition, and ensuring the safety of food products while retaining their taste. The advancement of microencapsulation results in smaller bioactive agents with increased bioavailability. Cost savings result from the innovation of these processes, providing an incentive for the adoption of food encapsulation.

Restraints

The rising cost of the microencapsulation process and the availability of substitutes, among other factors, are major restraints that will further challenge the food microencapsulation market during the forecast period.

This microencapsulation market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the microencapsulation market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Food Microencapsulation Market

The COVID-19 pandemic is expected to significantly impact the microencapsulation market due to supply chain disruptions. Polysaccharides, proteins, lipids, and emulsifiers are important raw materials and formulations in the food microencapsulation market. Europe imports a large amount of raw materials from Asia Pacific. International border closures and trade barriers have halted all imports and exports, disrupting the manufacturing process. Asia Pacific countries, including India and China, are home to a slew of small-scale emerging microencapsulation companies. These businesses source raw materials locally and export finished goods to domestic and international markets. Government regulations concerning transportation bans have resulted in short-term disruptions in the transportation of finished goods to market.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- BASF SE and Sandoz GmbH, a Novartis subsidiary, have agreed to invest at the Kundl/Schaftenau Campus in Austria in April 2021. This agreement allows BASF SE to expand its enzymes and biotechnology products manufacturing footprint.

- Kerry announced in May 2021 that it will build a purpose-built food technology and innovation centre of excellence in Queensland, Australia.

- Cargill Incorporated will invest USD 100 million in its Indonesian sweetener plant in October 2019 to construct a corn wet mill with a starch dryer to increase starch and sweetener production.

- In November 2018, the company invested Euro 50 million in a new natural food ingredient manufacturing site in Georgia, US, to improve production facilities in the U.S.

Global Food Microencapsulation Market Scope

The food microencapsulation market is segmented on the basis of technology, core material, shell material & application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Spray

- Emulsion

- Dripping

Core material

- Pharmaceutical

- Healthcare Drugs

- Others

Shell material

- Polymers

- Gums & Resins

- Others

Application

- Pharmaceutical

- Health Care Products

- Home

- Personal Care

- Food & Beverages

- Agrochemicals

- Construction

- Textile

Food Microencapsulation Market Regional Analysis/Insights

The food microencapsulation market is analysed and market size insights and trends are provided by country, shell material, method, application and core phase as referenced above.

The countries covered in the food microencapsulation market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America has the world's largest share of the food microencapsulation market. The region's growth is being aided by the high availability of shell materials such as hydrocolloid and emulsions, as well as the presence of a large number of manufacturers. The Asia Pacific region has seen significant growth in recent years, owing to rising demand for processed foods and a thriving food and beverage industry. Rapid urbanisation, rising disposable income, and rising living standards, particularly in emerging countries such as China and India, are also driving the region's growth. The increasing advancements in technology used in the processed food sector can be attributed to Europe's growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Food Microencapsulation Market Share Analysis

The food microencapsulation market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to food microencapsulation market.

Some of the major players operating in the food microencapsulation market are:

- Cargill, Incorporated (U.S.)

- BASF SE (Germany)

- DuPont (U.S.)

- DSM (Netherlands)

- FrieslandCampina (Netherlands)

- Kerry Group plc (Ireland)

- Ingredion (Switzerland)

- International Flavors & Fragrances Inc. IFF (U.S.)

- Symrise (Germany)

- Sensient Technologies Corporation (U.S.)

- Blachem Inc. (U.S.)

- Firmenich SA (Switzerland)

- Vitablend (Netherlands)

- Advanced Bionutrition Corp (U.S.)

- Encpasys LLC (U.S.)

- Clextral (France)

- Sphera Encapsulation (Italy)

- Aveka (U.S.)

- Lycored (Israel)

- Tastetech (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FOOD MICROENCAPSULATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FOOD MICROENCAPSULATION MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL FOOD MICROENCAPSULATION MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 GLOBAL FOOD MICROENCAPSULATION MARKET, BY TECHNOLOGY, 2022-2031 (USD MILLION)

9.1 OVERVIEW

9.2 SPRAY DRYING

9.3 COACERVATION

9.4 EXTRUSION

9.5 SPRAY COOLING

9.6 WET BLENDING

9.7 ENCAPSULATION

9.8 OTHERS

10 GLOBAL FOOD MICROENCAPSULATION MARKET, BY CORE MATERIAL, 2022-2031 (USD MILLION)

10.1 OVERVIEW

10.2 VITAMINS

10.3 MINERALS

10.4 ENZYMES

10.5 ORGANIC ACIDS

10.6 ADDITIVES

10.7 FLAVORS & ESSENCES

10.8 PROBIOTICS

10.9 OTHERS

11 GLOBAL FOOD MICROENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 PROTEINS

11.3 CARBOHYDRATES

11.4 LIPIDS

11.5 POLYMERS

11.6 GUMS & RESINS

11.7 OTHERS

12 GLOBAL FOOD MICROENCAPSULATION MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 DIETARY SUPPLEMENTS

12.3 FUNCTIONAL FOOD

12.4 BAKERY & CONFECTIONERY

12.5 BEVERAGES

12.6 DAIRY PRODUCTS

12.7 MEAT

12.8 OTHERS

13 GLOBAL FOOD MICROENCAPSULATION MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

GLOBAL FOOD MICROENCAPSULATION MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 U.K.

13.2.3 ITALY

13.2.4 FRANCE

13.2.5 SPAIN

13.2.6 SWITZERLAND

13.2.7 RUSSIA

13.2.8 TURKEY

13.2.9 BELGIUM

13.2.10 NETHERLANDS

13.2.11 SWITZERLAND

13.2.12 DENMARK

13.2.13 NORWAY

13.2.14 FINLAND

13.2.15 SWEDEN

13.2.16 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 SINGAPORE

13.3.6 THAILAND

13.3.7 INDONESIA

13.3.8 MALAYSIA

13.3.9 PHILIPPINES

13.3.10 AUSTRALIA

13.3.11 NEW ZEALAND

13.3.12 HONG KONG

13.3.13 TAIWAN

13.3.14 REST OF ASIA-PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 UNITED ARAB EMIRATES

13.5.5 ISRAEL

13.5.6 BAHRAIN

13.5.7 KUWAIT

13.5.8 OMAN

13.5.9 QATAR

13.5.10 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL FOOD MICROENCAPSULATION MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL FOOD MICROENCAPSULATION MARKET – COMPANY PROFILE

15.1 BALCHEM CORP

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 PRODUCTION CAPACITY OVERVIEW

15.1.4 REVENUE ANALYSIS

15.1.5 RECENT UPDATES

15.2 VOBIS, LLC

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 PRODUCTION CAPACITY OVERVIEW

15.2.4 REVENUE ANALYSIS

15.2.5 RECENT UPDATES

15.3 SPHERA ENCAPSULATION

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 PRODUCTION CAPACITY OVERVIEW

15.3.4 REVENUE ANALYSIS

15.3.5 RECENT UPDATES

15.4 MILLIKEN & COMPANY

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 PRODUCTION CAPACITY OVERVIEW

15.4.4 REVENUE ANALYSIS

15.4.5 RECENT UPDATES

15.5 BARENTZ

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 PRODUCTION CAPACITY OVERVIEW

15.5.4 REVENUE ANALYSIS

15.5.5 RECENT UPDATES

15.6 ROYAL FRIESLAND CAMPINA

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 PRODUCTION CAPACITY OVERVIEW

15.6.4 REVENUE ANALYSIS

15.6.5 RECENT UPDATES

15.7 BASF SE

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 PRODUCTION CAPACITY OVERVIEW

15.7.4 REVENUE ANALYSIS

15.7.5 RECENT UPDATES

15.8 GIVAUDAN

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 PRODUCTION CAPACITY OVERVIEW

15.8.4 REVENUE ANALYSIS

15.8.5 RECENT UPDATES

15.9 FIRMENICH SA

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 PRODUCTION CAPACITY OVERVIEW

15.9.4 REVENUE ANALYSIS

15.9.5 RECENT UPDATES

15.1 SYMRISE

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 PRODUCTION CAPACITY OVERVIEW

15.10.4 REVENUE ANALYSIS

15.10.5 RECENT UPDATES

15.11 LYCORED

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 PRODUCTION CAPACITY OVERVIEW

15.11.4 REVENUE ANALYSIS

15.11.5 RECENT UPDATES

15.12 TASTETECH

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 PRODUCTION CAPACITY OVERVIEW

15.12.4 REVENUE ANALYSIS

15.12.5 RECENT UPDATES

15.13 AVEKA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 PRODUCTION CAPACITY OVERVIEW

15.13.4 REVENUE ANALYSIS

15.13.5 RECENT UPDATES

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Food Microencapsulation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Microencapsulation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Microencapsulation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.