Global Food Certification Market

Market Size in USD Billion

CAGR :

%

USD

7.12 Billion

USD

14.51 Billion

2024

2032

USD

7.12 Billion

USD

14.51 Billion

2024

2032

| 2025 –2032 | |

| USD 7.12 Billion | |

| USD 14.51 Billion | |

|

|

|

|

Food Certification Market Size

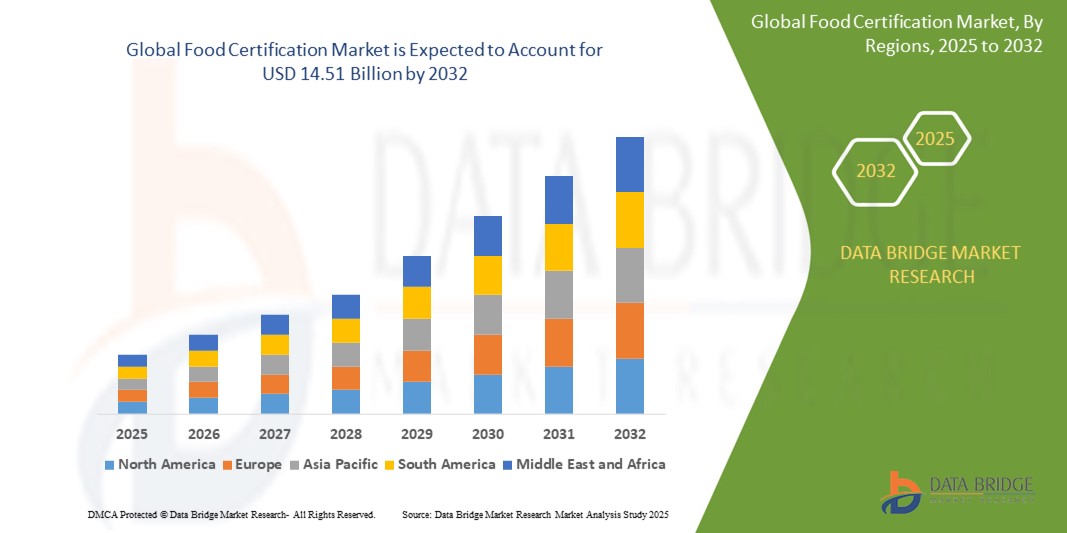

- The global food certification market size was valued at USD 7.12 billion in 2024 and is expected to reach USD 14.51 billion by 2032, at a CAGR of 9.31% during the forecast period

- The market growth is largely fueled by increasing consumer awareness regarding food safety, quality, and traceability, alongside rising incidences of foodborne illnesses and contamination that are pushing demand for certified products across global supply chains

- Furthermore, stringent regulatory frameworks and export compliance requirements are compelling food producers and processors to adopt recognized certification standards, driving widespread certification uptake and significantly boosting the industry's growth

Food Certification Market Analysis

- Food certification is a process where a third-party organization assesses and verifies that food products adhere to specific standards and regulations. It ensures that food items meet criteria related to safety, quality, and compliance with legal requirements, providing consumers and businesses with confidence in the safety and quality of the certified food products

- The escalating demand for food certification is primarily fueled by increasing concerns over food safety, rising consumer preference for clean-label and ethically sourced products, and the need for global market access through recognized certification systems

- Europe dominated the food certification market with a share of 38.5% in 2024, due to strict food safety regulations, high consumer demand for quality assurance, and the presence of well-established certification bodies

- Asia-Pacific is expected to be the fastest growing region in the food certification market during the forecast period due to rapid urbanization, rising food exports, and growing middle-class consumer awareness across China, India, and Southeast Asia

- Organic food certification segment dominated the market with a market share of 67.4% due to increasing consumer demand for chemical-free, non-GMO, and environmentally responsible food products. Governments and NGOs are promoting organic labeling to encourage healthier diets and eco-friendly agricultural practices, particularly in Europe and North America

Report Scope and Food Certification Market Segmentation

|

Attributes |

Food Certification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Certification Market Trends

“Rising Demand for Clean-Label and Ethical Certifications”

- A prominent trend in the global food certification market is the increasing demand for clean-label and ethical food certifications, reflecting consumer preference for transparency, safety, and sustainability

- For instance, certifications such as Organic, Non-GMO, and Fair Trade are gaining traction as food producers align with evolving consumer values and stricter sourcing standards

- Major retailers and brands are expanding their certified product lines to meet rising demand for ethically sourced and health-conscious food items, especially in North America and Europe

- This shift is compelling manufacturers to seek third-party verification for quality and ethical claims, reshaping product development and marketing strategies

- Food service providers are also responding by incorporating certified ingredients into menus to appeal to informed and environmentally aware consumers

- As this trend accelerates, certification bodies are expanding service portfolios, including region-specific and dietary-specific certifications such as vegan and allergen-free

Food Certification Market Dynamics

Driver

“Stringent Global Food Safety Regulations”

- The growing implementation of strict food safety regulations by governments and international agencies is a key driver of the food certification market

- For instance, regulatory frameworks such as the FDA’s FSMA in the U.S. and the EU’s General Food Law demand rigorous safety standards, pushing companies to adopt certifications for compliance and credibility. Certifications such as ISO 22000, HACCP, and BRC provide structured frameworks for managing food safety hazards and meeting cross-border regulatory requirements

- This is particularly vital in global trade, where certified suppliers gain competitive advantages and smoother entry into international markets

- Large retailers and food manufacturers often require certified suppliers to reduce liability risks and ensure traceability, encouraging certification adoption throughout the value chain

- In response, certification providers are partnering with digital platforms to streamline auditing, documentation, and renewal processes for global compliance

Restraint/Challenge

“High Certification Costs and Resource Burden on SMEs”

- One of the significant challenges in the food certification market is the high cost and complexity of certification for small and medium enterprises (SMEs)

- For instance, many small food producers in Asia and Africa struggle to obtain global certifications such as BRC or ISO due to financial and logistical constraints

- Certification involves expenses such as audits, infrastructure upgrades, consultant fees, and ongoing compliance management, often straining SME budgets

- Lack of access to training, qualified personnel, and digital tracking systems further complicates their ability to meet documentation and traceability requirements. This inhibits equitable participation in certified global food supply chains, despite growing demand for diverse and local food products

- To address this, governments and NGOs are initiating funding and capacity-building programs, while certifiers are exploring modular and region-specific schemes for affordability and accessibility

Food Certification Market Scope

The market is segmented on the basis of risk, type, application, category, and end user.

• By Risk

On the basis of risk, the food certification market is segmented into high-risk foods and low-risk foods. The high-risk foods segment accounts for the largest market revenue share in 2024, driven by stringent safety regulations and the elevated potential for contamination in products such as meat, poultry, seafood, and dairy. These food categories are highly susceptible to microbial growth and require rigorous certification to comply with food safety standards, boost consumer confidence, and reduce liability for producers and retailers. The growing consumer demand for transparency in labeling and the need for traceability in global food supply chains further intensify the demand for certifications in high-risk categories.

The low-risk foods segment is projected to witness the fastest CAGR from 2025 to 2032, as awareness of food safety expands beyond traditionally regulated categories. Products such as grains, dried fruits, and packaged snacks are increasingly seeking certifications to meet export requirements and appeal to health-conscious consumers. The adoption of certifications in low-risk segments is also fueled by retailers and e-commerce platforms emphasizing verified and clean-label products.

• By Type

On the basis of type, the food certification market is segmented into ISO 22000, BRC, SQF, IFS, HALAL, KOSHER, Free-From Certifications, HACCP, Vegan, and Others. The ISO 22000 segment holds the largest market revenue share in 2024, supported by its global recognition and applicability across the entire food supply chain. Its structured framework for food safety management makes it a preferred standard among multinational food manufacturers aiming for international compliance and operational consistency.

The HALAL segment is expected to witness the fastest growth from 2025 to 2032, driven by rising demand from Muslim-majority countries and growing halal food preferences in non-Islamic regions. Increasing consumer awareness about halal standards, ethical sourcing, and religious compliance is prompting food producers worldwide to pursue halal certification to expand their market reach and gain competitive advantage.

• By Application

On the basis of application, the food certification market is segmented into bakery products, confectionary products, baby foods, meat and poultry products, convenience food, nuts and dried fruits, milk and dairy products, tobacco, honey, tea and coffee, cereals, grains and pulses, herbs and spices, and others. The meat and poultry products segment dominated the market revenue share in 2024, driven by the high-risk nature of these products and the critical need for traceability, hygiene compliance, and pathogen control throughout the processing and distribution stages. Certifications in this segment are vital for export approval and consumer assurance, especially in regulated markets such as the U.S. and EU.

The baby foods segment is projected to grow at the fastest CAGR from 2025 to 2032, spurred by heightened parental concerns regarding ingredient purity and the rising demand for premium, certified-safe infant nutrition. Certification for baby foods is also bolstered by government regulations and growing demand for organic and allergen-free variants.

• By Category

On the basis of category, the food certification market is segmented into organic food certification and sustainable food certification. The organic food certification segment captured the largest market share of 67.4% in 2024, driven by increasing consumer demand for chemical-free, non-GMO, and environmentally responsible food products. Governments and NGOs are promoting organic labeling to encourage healthier diets and eco-friendly agricultural practices, particularly in Europe and North America.

The sustainable food certification segment is projected to experience the fastest growth from 2025 to 2032, fueled by corporate ESG commitments and growing interest in climate-smart and socially responsible sourcing. Certifications focused on biodiversity preservation, ethical labor, and resource efficiency are gaining prominence among both producers and retailers aiming to meet sustainability targets.

• By End User

On the basis of end user, the food certification market is segmented into growers, manufacturers, retailers, food service organizations, and others. The manufacturers segment led the market revenue share in 2024, as food processors and packaged goods companies pursue certifications to gain market access, enhance brand credibility, and align with regulatory and quality assurance requirements. Certifications help manufacturers reduce recalls, build consumer trust, and secure partnerships with global distributors and retailers.

The food service organizations segment is expected to grow at the highest CAGR from 2025 to 2032, owing to increased scrutiny from diners and authorities regarding hygiene and sourcing practices. Restaurants, catering services, and institutional kitchens are increasingly adopting food certifications to differentiate their offerings, assure quality, and comply with food safety mandates in high-traffic public environments.

Food Certification Market Regional Analysis

- Europe dominated the food certification market with the largest revenue share of 38.5% in 2024, driven by strict food safety regulations, high consumer demand for quality assurance, and the presence of well-established certification bodies

- The region places strong emphasis on sustainability, organic labeling, and traceability, making food certifications essential for market access and consumer trust.

- Supportive regulatory frameworks such as the EU Food Law and widespread retail enforcement of certification standards further boost adoption across the supply chain, from producers to retailers

Germany Food Certification Market Insight

The Germany food certification market held the largest revenue share in 2024 within Europe, supported by the country’s structured food regulation system and a consumer base that prioritizes sustainability, transparency, and quality. German producers and exporters increasingly adopt certifications such as EU Organic, IFS, and HACCP to meet stringent domestic and international standards. Rising demand for vegan and allergen-free certified products and the strong presence of food processing industries further contribute to market expansion.

U.K. Food Certification Market Insight

The U.K. food certification market is projected to grow at a notable CAGR during the forecast period, driven by heightened consumer awareness regarding food provenance and safety. Post-Brexit regulatory transitions are encouraging food businesses to adopt internationally recognized certifications to maintain trade continuity. Demand for Halal, BRC, and sustainable food certifications is rising across supermarkets, food service providers, and exporters aiming for wider global reach.

Asia-Pacific Food Certification Market Insight

The Asia-Pacific food certification market is projected to grow at the fastest CAGR from 2025 to 2032, fueled by rapid urbanization, rising food exports, and growing middle-class consumer awareness across China, India, and Southeast Asia. Increasing government efforts to enhance food safety standards and support for international trade agreements are accelerating certification adoption. The expanding packaged food sector, coupled with demand for certified organic and Halal products, is reshaping the regional food industry.

China Food Certification Market Insight

The China food certification market held the largest revenue share in 2024 within Asia-Pacific, driven by strong government enforcement of food safety laws and a surge in demand for premium, certified food products. China’s major role in global food exports and the rise of health-conscious consumers are prompting widespread adoption of certifications such as ISO 22000, HACCP, and organic labels. The domestic market’s push for higher standards is further supported by the emergence of national certification programs.

India Food Certification Market Insight

The India food certification market is expected to grow at the highest CAGR in Asia-Pacific during the forecast period, driven by increasing regulatory scrutiny, rising health awareness, and export-oriented production. The implementation of FSSAI regulations and consumer demand for transparency are encouraging food manufacturers, processors, and retailers to seek third-party certifications. Growth in certified organic, vegan, and clean-label products is especially notable across urban markets and e-commerce platforms.

Food Certification Market Share

The food certification industry is primarily led by well-established companies, including:

- GFSI (France)

- UL LLC (U.S.)

- SCS Global Services (U.S.)

- Lloyd's Register Group Services Limited (U.K.)

- Eagle Certification Group (Canada)

- GROUPE ECOCERT (France)

- NSF International (U.S.)

- BRCGS (U.K.)

- Bureau Veritas (France)

- SGS SA (Switzerland)

- Intertek Group Plc (U.K.)

- TÜV NORD GROUP (Germany)

- DNV GL (Norway)

- DEKRA (Germany)

- Mérieux NutriSciences (France)

- Eurofins Scientific (Luxembourg)

- ALS Limited (Australia)

- AsureQuality (New Zealand)

- Control Union Certifications Germany gmbh (Germany)

- FoodChain ID Group Inc (U.S.)

- Kiwa (Netherlands)

Latest Developments in Global Food Certification Market

- In June 2025, SGS announced the launch of "The PLEDGE on Food Waste Certification", a globally recognized certification program aimed at helping food service providers reduce food waste, enhance operational efficiency, and strengthen sustainability efforts. This move highlights the growing emphasis on food waste management as part of comprehensive food certification strategies and is expected to gain traction among hospitality and food service chains committed to ESG goals

- In May 2025, Revant Himatsingka, popularly known as Food Pharmer, introduced Food Pharmer 2.0, launching his own brand alongside a proprietary food certification rollout. The initiative aims to bring greater transparency to packaged food ingredients, offering consumers easy-to-understand certifications focused on health, safety, and nutrition labeling. This consumer-centric approach is likely to influence younger, health-aware demographics and push brands toward cleaner formulations

- In November 2022, SCS Global Services introduced its plant-based certification program, SCS-109 Standard. This initiative supports plant-based alternatives and acknowledges innovation in various consumer products such as food, beverages, CBD, and body care items. Certification guarantees the absence of animal-derived ingredients, with a minimum requirement of 95% plant-based ingredients for human and animal consumption products and 50% for body care products

- In November 2022, SGS SA launched the SGS Food Contact Product Certification Mark, aiding manufacturers in demonstrating product compliance, safety, and performance. Addressing both mandatory and voluntary safety requirements, the mark enhances traceability and consumer trust, streamlining market access. Recognized in markets such as the U.S. U.K., Switzerland, European Union, and China, it provides a competitive edge

- In September 2022, Intertek Group PLC launched the Intertek Vegan Certification, a new vegan food certification mark designed to instill confidence in product claims. Going beyond standard label reviews, this program assesses the suitability of food products for vegan and plant-based consumers. It employs Intertek's ATIC approach for comprehensive third-party verification through auditing, testing, inspection, and training, providing a robust framework for authenticating vegan claims

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Certification Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Certification Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Certification Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.