Global Fog Computing Market

Market Size in USD Million

CAGR :

%

USD

581.91 Million

USD

20,462.80 Million

2024

2032

USD

581.91 Million

USD

20,462.80 Million

2024

2032

| 2025 –2032 | |

| USD 581.91 Million | |

| USD 20,462.80 Million | |

|

|

|

|

Fog Computing Market Size

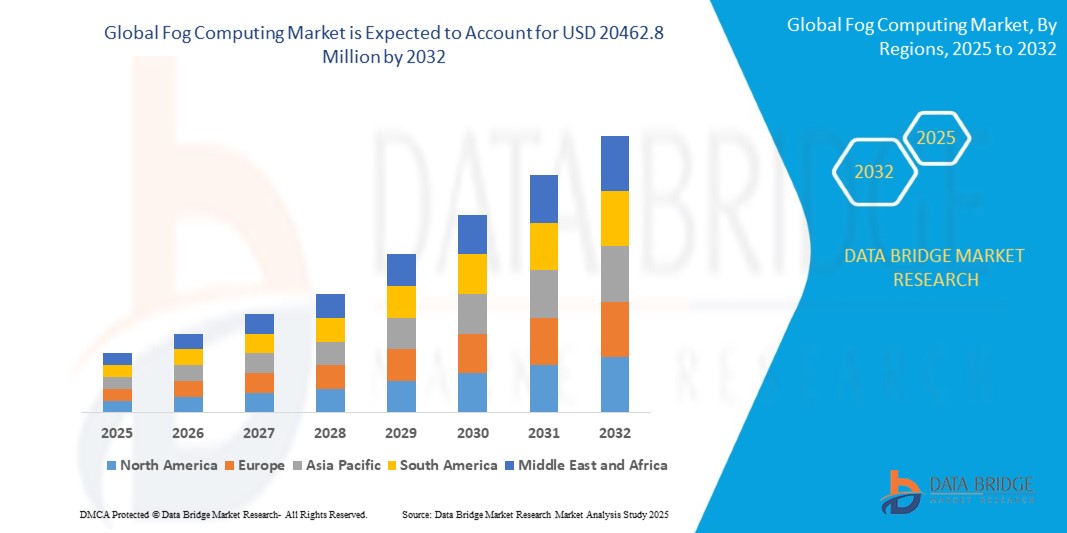

- The Global Fog Computing Market size was valued at USD 581.91 Million in 2024 and is expected to reach USD 20,462.80 Million by 2032, at a CAGR of 56.05 % during the forecast period

- This growth is fueled by factors such as the rapid expansion of IoT ecosystems, the rise in smart city initiatives, and the growing need for efficient data management closer to the data source. In addition, rising concerns over data security and bandwidth limitations in cloud computing are encouraging the adoption of fog computing solutions across industries such as manufacturing, healthcare, transportation, and energy

Fog Computing Market Analysis

- Fog computing is a decentralized computing infrastructure in which data, computing, storage, and applications are distributed in the most logical, efficient place between the data source and the cloud

- It is a critical enabler for applications that require real-time processing and low-latency decision-making, especially in industrial IoT, autonomous vehicles, and smart city projects

- The demand for fog computing is significantly driven by the exponential growth of connected devices and the need to process massive amounts of data closer to the source. With increasing concerns around bandwidth limitations, latency issues, and data security, fog computing offers a practical solution by bringing intelligence to the network edge

- The North America region stands out as one of the dominant markets for fog computing, supported by a strong presence of tech giants, robust R&D activity, and early adoption of edge and IoT solutions. The region continues to lead innovations in real-time data processing across sectors such as healthcare, automotive, and manufacturing

- For instance, companies like Cisco, IBM, and Dell Technologies have made significant investments in edge and fog architectures, offering platforms that integrate seamlessly with IoT devices and AI-driven applications

- Globally, fog computing ranks as a key technological pillar supporting edge intelligence, especially in mission-critical systems where milliseconds of delay can impact safety or performance. It plays a pivotal role in advancing autonomous systems, industrial automation, and next-generation communication networks like 5G

Report Scope and Fog Computing Market Segmentation

|

Attributes |

Fog Computing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fog Computing Market Trends

“Increased Adoption of 3D Imaging and Digital Integration”

- One prominent trend in the global fog computing market is the growing integration of artificial intelligence (AI) and machine learning at the edge, particularly within Industrial IoT (IIoT) and real-time data ecosystems

- These advancements enhance the performance of edge networks by enabling instant, localized decision-making, reducing dependency on centralized cloud systems, and improving response times for mission-critical operations

For instance,

- In May 2023, Pegasystems Inc. launched an AI-powered Pega Process Mining system, integrated into its platform to streamline enterprise operations using edge and fog computing concepts. The system allows real-time analysis and optimization of workflows, highlighting a shift toward embedded intelligence at the edge

- Similarly, Cisco has made continuous investments in fog computing infrastructure through its Cisco IOx platform, which enables hosting of applications directly on network edge devices—blending fog computing and edge AI to support faster analytics in sectors such as energy, transportation, and manufacturing

- This trend is driving the development of intelligent fog nodes capable of running complex algorithms locally, reducing latency, enhancing privacy, and enabling scalability

Fog Computing Market Dynamics

Driver

“Proliferation of Connected Devices and the Rise of 5G Networks”

- The exponential growth in the number of connected devices—including sensors, smartphones, autonomous vehicles, and industrial machinery—is fueling the demand for faster, more efficient data processing frameworks

- Traditional cloud infrastructure often struggles with the sheer volume and velocity of data generated by these devices, leading to latency issues, bandwidth constraints, and increased operational costs

- Fog computing provides a distributed computing layer that brings processing power closer to data sources, thereby alleviating congestion and enabling real-time analytics and decision-making

- The global rollout of 5G networks is further amplifying this demand, offering ultra-low latency, high bandwidth, and greater reliability, which complement fog computing capabilities

- With 5G-enabled devices expected to generate even more granular and time-sensitive data, fog computing serves as a critical infrastructure component to support edge computing environments

- Industries such as healthcare, autonomous vehicles, smart cities, and industrial automation are increasingly relying on fog computing to handle high-speed data transmissions while maintaining low latency and improved user experiences

For instance,

- In February 2023, Huawei introduced its next-generation fog computing solutions optimized for 5G infrastructure. The solution supports real-time video analytics and remote diagnostics for smart city surveillance and healthcare use cases

- As the world becomes increasingly interconnected and reliant on real-time data, the combination of 5G and fog computing is emerging as a backbone for next-generation digital ecosystems, driving sustained market growth

Opportunity

“Enhancing Edge Ecosystems with Artificial Intelligence Integration”

- The integration of artificial intelligence (AI) into fog computing environments offers transformative opportunities across various sectors by enabling real-time data processing and intelligent decision-making at the network edge

- AI-powered fog nodes can analyze data locally, automate system responses, and support complex analytics in latency-sensitive environments such as industrial automation, autonomous vehicles, and healthcare

- With the rise of AI-driven applications such as facial recognition, predictive maintenance, anomaly detection, and traffic management, deploying AI models on fog infrastructure enhances both speed and accuracy while reducing dependency on centralized cloud systems

- Fog nodes embedded with AI capabilities can support continuous learning, adapt to evolving data patterns, and provide localized insights—empowering organizations to act quickly and effectively

- In addition, fog-based AI systems help preserve data privacy and meet compliance requirements by minimizing the transmission of sensitive data to external servers

For instance,

- In March 2024, IBM unveiled a new fog computing platform with integrated AI model training and inference capabilities designed for real-time industrial monitoring. The system allows on-site equipment to predict failures and automatically trigger maintenance protocols, significantly reducing downtime and repair costs

- As industries increasingly adopt intelligent edge systems, the fusion of AI with fog computing opens up vast potential for innovation, operational efficiency, and smarter automation, creating compelling opportunities for growth and differentiation in the fog computing market

Restraint/Challenge

“High Infrastructure and Deployment Costs Hindering Market Penetration”

- The high initial cost of setting up fog computing infrastructure presents a significant challenge, especially for small and medium-sized enterprises (SMEs) and organizations operating in cost-sensitive sectors

- Deploying a fog computing network involves substantial investments in edge hardware, sensors, gateways, specialized software, and ongoing system maintenance

- Additionally, integrating fog computing with existing IT and operational technology (OT) systems can be technically complex and require skilled personnel, leading to higher implementation and training costs

- These financial and technical barriers often deter organizations from adopting fog computing solutions, particularly in regions with limited technological infrastructure or funding support

- The cost challenge is further amplified in industries with stringent regulatory or data localization requirements, where customized deployments add to the overall expense

For instance,

- In June 2023, a report by Capgemini Research Institute titled "The Edge Disconnect: Closing the Gap Between Vision and Reality" revealed that while 70% of industrial organizations planned to adopt edge or fog computing, only 30% had done so, primarily due to high infrastructure costs and the complexity of integration with legacy systems

- As a result, despite the potential to transform real-time data processing, high deployment and maintenance costs continue to restrict fog computing adoption, particularly in cost-sensitive markets and SMEs with limited IT budgets

Fog Computing Market Scope

The market is segmented on the basis of computing solution, application, and deployment models.

|

Segmentation |

Sub-Segmentation |

|

By Computing Solution |

|

|

By Application |

|

|

By Deployment Models |

|

In 2025, the Smart Manufacturing is projected to dominate the market with the largest share in application segment

The Smart Manufacturing segment is expected to dominate the Fog Computing Market with the largest share of 34.17% in 2025 due to the increasing adoption of industrial automation and real-time analytics in manufacturing processes. Fog computing enables low-latency data processing close to the source, which is critical for time-sensitive operations such as predictive maintenance, robotics, and quality control in smart factories. The rising demand for Industry 4.0 integration and edge intelligence further fuels this segment’s dominance.

The Hybrid Fog Node is expected to account for the largest share during the forecast period in deployment model segment

In 2025, the Hybrid Fog Node segment is expected to dominate the market with the largest market share of 39.59% due to its ability to combine the benefits of both private and public fog infrastructures. Hybrid nodes offer greater scalability, improved data privacy, and flexible computing options, making them suitable for sectors such as healthcare, manufacturing, and smart cities. These nodes help balance security needs with the cost advantages of public fog environments.

Fog Computing Market Regional Analysis

“North America Holds the Largest Share in the Fog Computing Market”

- North America holds a leading position in the global fog computing market, supported by robust technological infrastructure, early adoption of edge technologies, and a strong ecosystem of cloud and IoT providers

- The U.S. in particular, dominates the regional market due to a high concentration of leading players such as Cisco Systems, IBM, Dell Technologies, and Intel, who are continuously investing in fog and edge computing innovations

- The increasing demand for low-latency data processing in sectors such as autonomous vehicles, smart cities, healthcare, and industrial automation is a key factor propelling regional market growth

- Strong government and private sector initiatives promoting 5G deployment, industrial IoT expansion, and AI at the edge have further accelerated adoption across various verticals

- The presence of well-funded R&D institutions and favorable regulatory frameworks for emerging technologies supports rapid development and commercialization of fog computing solutions in the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Fog Computing Market”

- The Asia-Pacific region is expected to witness the fastest growth in the global fog computing market, driven by rapid industrialization, growing digital transformation initiatives, and surging adoption of IoT technologies across key sectors such as manufacturing, transportation, and smart cities

- Countries such as China, India, Japan, and South Korea are at the forefront of this growth due to rising investments in 5G networks, government support for digital infrastructure, and a growing number of connected devices

- Japan, known for its advanced industrial automation and smart factory ecosystem, is rapidly integrating fog computing to support real-time machine monitoring and AI-based process optimization

- China and India are seeing a surge in demand for fog-enabled solutions in urban management, healthcare, and agriculture, fueled by smart city projects and the need for low-latency processing to support AI and edge analytic

- In addition, the presence of regional tech giants and the increasing efforts of global cloud and edge solution providers to expand their footprint in Asia-Pacific are accelerating technology adoption across the region.

Fog Computing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cisco (U.S.)

- Microsoft (U.S.)

- Arm Limited (U.K.)

- Intel Corporation (U.S.)

- General Electric (U.S.)

- FUJITSU (Japan)

- Schneider Electric (France)

- TOSHIBA CORPORATION (Japan)

- ADLINK Technology (Taiwan)

- Dell (U.S.)

- Nebbiolo Technologies (U.S.)

- FogHorn Systems (U.S.)

- SAP SE (Germany)

- AT&T Intellectual Property (U.S.)

- Cradlepoint Inc. (U.S.)

- IBM Corporation (U.S.)

- VIMOC Technologies Inc. (U.S.)

- Cyxtera Technologies Inc. (U.S.)

Latest Developments in Global Fog Computing Market

- In December 2024, Cisco introduced an innovative fog computing solution designed to optimize edge devices within industrial IoT environments. This platform incorporates AI and machine learning to facilitate real-time data processing at the edge, enhancing operational efficiency and reducing latency for applications such as manufacturing and smart cities

- In November 2024, Intel partnered with a prominent cloud service provider to create fog computing solutions specifically designed for autonomous vehicles. This collaboration aims to enhance edge data processing and decision-making, ensuring the safety and efficiency of self-driving cars in real-time traffic scenarios

- In October 2024, Hewlett Packard Enterprise (HPE) completed the acquisition of a fog computing startup specializing in real-time analytics for smart grids. This strategic move aims to bolster HPE's capabilities in the energy sector by delivering scalable edge computing solutions, enabling more efficient and precise energy distribution and management

- In September 2024, Huawei introduced a fog computing platform tailored for the telecommunications industry. This platform is designed to bolster 5G network infrastructure by enabling data processing closer to the network edge. By doing so, it reduces network congestion and enhances the speed and reliability of 5G services for both consumers and businesses

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fog Computing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fog Computing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fog Computing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.