Global Flue Gas Desulphurization System Market

Market Size in USD Billion

CAGR :

%

USD

41.16 Billion

USD

56.66 Billion

2024

2032

USD

41.16 Billion

USD

56.66 Billion

2024

2032

| 2025 –2032 | |

| USD 41.16 Billion | |

| USD 56.66 Billion | |

|

|

|

|

Flue Gas Desulphurization System Market Size

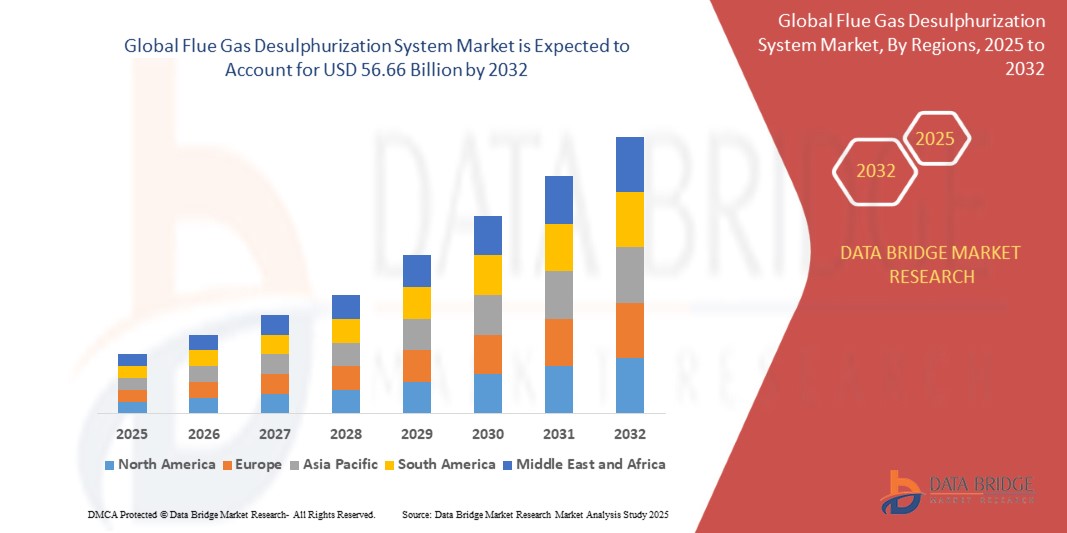

- The global flue gas desulphurization system market size was valued at USD 41.16 billion in 2024 and is expected to reach USD 56.66 billion by 2032, at a CAGR of 4.6% during the forecast period

- Growth is primarily driven by stringent environmental regulations aimed at reducing SO₂ emissions from power plants and industrial sources, combined with the expansion of coal-based power capacity in emerging economies.

- Rapid industrialization in Asia-Pacific, alongside upgrades and retrofits of existing plants in mature markets such as North America and Europe, further accelerates market demand.

Flue Gas Desulphurization System Market Analysis

- Flue gas desulphurization systems remove sulfur dioxide from exhaust gases of fossil fuel–based industrial facilities, helping plants comply with strict air quality standards.

- Among the technologies, wet FGD systems lead the market in 2024 due to their high efficiency (up to 90% SO₂ removal) and adaptability to large-scale operations in power generation and cement manufacturing.

- Dry/semi-dry FGD systems are increasingly used in water-scarce regions and for cost-sensitive retrofit projects, while spray dry systems remain popular in mid-scale applications.

- The power generation sector dominates FGD demand, with coal-based plants integrating systems either at commissioning or retrofitting stage. Cement, metals, and chemical industries are also investing in FGD adoption to meet evolving environmental laws.

- Asia-Pacific accounted for the largest share in 2024, driven by aggressive pollution control policies in China and India, large-scale coal-fired capacity, and industrial growth.

Report Scope and Flue Gas Desulphurization System Market Segmentation

|

Attributes |

Flue Gas Desulphurization System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flue Gas Desulphurization System Market Trends

Adoption of Hybrid and Modular FGD Systems

- The industry is witnessing significant interest in hybrid and modular FGD solutions that integrate multiple emission-control technologies (e.g., NOx and PM removal) into a single unit, reducing footprint and cost.

- Improved scrubbing materials, energy-efficient absorbers, and low-maintenance designs are shaping new system deployments.

- Digital monitoring and predictive maintenance are enhancing operational efficiency while ensuring regulatory compliance.

- Wastewater recycling and gypsum byproduct utilization are emerging as priorities to improve sustainability.

Flue Gas Desulphurization System Market Dynamics

Driver

Strict Environmental Regulations and Emission Reduction Requirements

- The global increase in stringent regulations targeting sulfur dioxide (SO₂) emissions primarily from coal-fired power plants and heavy industries is the main driver propelling the growth of the flue gas desulfurization system market. Governments worldwide have enacted policies such as the U.S. EPA Clean Air Act, the EU Industrial Emissions Directive, and aggressive standards in China and India, requiring installation or upgrading of FGD systems to meet compliance.

- The expansion of coal-based power generation capacity in emerging economies like China, India, and Southeast Asian countries, combined with growing industrialization, further accelerates demand for FGD technologies integrated at new plant construction or through retrofitting existing facilities.

- Increasing awareness of public health impacts due to acid rain, respiratory diseases, and environmental pollution caused by SO₂ emissions encourages operators to adopt advanced scrubbing solutions.

- International climate commitments and raising global air quality standards continue to generate regulatory pressure, making FGD systems critical for maintaining operational licenses and avoiding penalties.

Restraint/Challenge

High Capital Expenditure and Operational Costs

- A key challenge limiting wider adoption of FGD systems is the significant upfront capital investment required for equipment, civil works, and integration with existing plant infrastructure, which can be prohibitive for small and medium-sized enterprises or in developing regions.

- Operational costs are also high due to ongoing energy consumption, chemical reagent usage, maintenance needs, and the complex handling of wastewater and solid byproducts such as gypsum slurry.

- Managing wastewater treatment and complying with stringent discharge regulations adds technical and financial burdens, particularly in jurisdictions with strict environmental policies.

- Retrofitting aging plants poses additional challenges with potentially long installation times and integration complexities that can disrupt plant operations and increase expenses.

- In water-scarce regions, wet FGD systems face constraints, pushing the need for alternative dry or semi-dry technologies, which may have other trade-offs in efficiency or costs.

Flue Gas Desulphurization System Market Scope

The market is segmented on the basis of technology, end-use industry, and installation type.

- By Technology

On the basis of technology, the flue gas desulphurization system market is segmented into wet FGD systems, spray dry FGD systems, and dry/semi-dry FGD systems. The wet FGD systems segment dominates the largest market revenue share in 2024, primarily due to its high SO₂ removal efficiency (up to 90%), proven reliability, and widespread adoption across large-scale power generation and heavy industry facilities. Spray dry FGD systems are widely preferred in regions with limited water availability, offering lower water consumption while maintaining moderate efficiency. Dry/semi-dry systems are gaining traction for their lower capital requirements and ease of retrofit into older plants, making them suitable for cost-conscious operators in emerging markets.

- By Installation Type

On the basis of installation type, the market is divided into greenfield and brownfield projects. Greenfield installations involve integrating FGD systems into new facilities during the design and construction phase, which is prevalent in developing regions experiencing rapid energy infrastructure expansion. Brownfield projects involve retrofitting or upgrading existing plants with modern FGD technologies to comply with updated emission norms. Brownfield adoption is notably high in mature markets like North America and Europe due to stricter regulatory enforcement and the aging fleet of coal-fired power stations.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into power generation, cement, metal processing & mining, chemical & petrochemical, and others. Power generation is the largest end-use segment in 2024, driven by the ongoing need for SO₂ control in coal-fired plants to meet emission norms. The cement industry represents a growing demand segment as environmental standards tighten in construction materials production. Metal processing & mining facilities utilize FGD systems to reduce emissions from smelting and refining operations, while the chemical & petrochemical segment is adopting these systems to comply with industrial air quality mandates. The “Others” category includes smaller but relevant sectors like pulp & paper and waste-to-energy plants.

Flue Gas Desulphurization System Market Regional Analysis

- Asia-Pacific dominates the flue gas desulfurization system market with the largest revenue share of approximately 40–45% in 2024, supported by rapid industrialization, significant expansion of coal-fired power generation capacity, and stringent environmental regulations implemented in key countries such as China, India, Japan, and South Korea.

- In this region, growing urbanization and increasing awareness of environmental and public health safety are driving widespread adoption of FGD technologies in power plants and heavy industries. National mandates and enforcement for emission reductions propel investment in new installations and retrofit projects alike.

- The Asia-Pacific market growth is further fueled by the availability of cost-effective manufacturing infrastructure, favorable government policies promoting cleaner technologies, and the presence of a vast export-oriented industrial base. These factors collectively establish Asia-Pacific as the leading region in the global flue gas desulfurization system market.

U.S. Flue Gas Desulphurization System Market Insight

The U.S. dominates the North American FGD system market in 2024, driven by stringent EPA regulations enforcing sulfur dioxide emission reductions in coal-fired power plants and heavy industries. Extensive retrofitting of aging coal plants with advanced wet and dry FGD technologies supports high market penetration. Robust technological innovation and adoption of digital monitoring and automation systems further provide operational efficiencies. The growing focus on environmental compliance and air quality standards, alongside government incentives for pollution control, sustains demand across power generation, cement, and industrial sectors.

Europe Flue Gas Desulphurization System Market Insight

Europe’s FGD market is positioned for steady growth, fueled by strict policies such as the EU Industrial Emissions Directive that mandate SO₂ emission reductions across power plants and industrial facilities. Countries including Germany, France, and the U.K. lead regional adoption through investments in both retrofitting older coal plants and integrating FGD systems into new builds. European markets emphasize sustainability, driving innovation in wastewater management and byproduct valorization within FGD systems. The region’s environmental advocacy and technological leadership underpin continued expansion.

U.K. Flue Gas Desulphurization System Market Insight

The U.K. FGD market shows strong momentum, driven by increasing regulatory measures aimed at reducing industrial emissions and national net-zero carbon commitments. The modernization of power and industrial plants with high-efficiency wet and hybrid FGD systems is accelerating. Emphasis on multipollutant control and process automation enhances system performance, while government grants and environmental programs incentivize upgrades, especially in sectors like power generation, cement, and heavy manufacturing.

Germany Flue Gas Desulphurization System Market Insight

Germany’s FGD system market is advancing steadily, supported by the country’s expertise in environmental technology and strict emission norms. Demand arises from the need to retrofit aging coal power plants and comply with national and EU regulations on sulfur emissions. The industrial base in chemicals and metals also drives FGD adoption. Germany prioritizes sustainable solutions, favoring innovative scrubbing materials, digital process controls, and waste reuse techniques in emissions control.

Asia-Pacific Flue Gas Desulphurization System Market Insight

Asia-Pacific holds the largest revenue share in 2024, propelled by rapid industrialization, urbanization, and energy demand growth in major economies like China, India, Japan, and South Korea. Strict environmental policies aimed at curbing SO₂ emissions from coal-fired power plants and industries have led to widespread adoption and expansion of FGD technologies, especially wet FGD systems. The region benefits from affordable manufacturing infrastructure, government pollution control initiatives, and collaborative industrial efforts that boost technology deployment and export capabilities.

India Flue Gas Desulphurization System Market Insight

India’s FGD system market is expected to register the substantial CAGR over the forecast period, driven by ambitious government mandates requiring sulfur emission reduction from coal-fired power stations. Significant investments in new power capacity and stringent retrofit requirements for existing plants are pushing market growth. Increased focus on pollution control, combined with rising healthcare and environmental awareness, accelerates demand across various end-use industries.

China Flue Gas Desulphurization System Market Insight

China leads the Asia-Pacific and global FGD market in revenue share, fueled by its enormous coal-fired power capacity and national commitments to reduce air pollution. The government’s strict enforcement of emission standards and large-scale projects refurbishing and upgrading thermal plants boost demand for advanced FGD solutions. China is also a hub for technological innovation and manufacturing of FGD components, serving both domestic and international markets. Rapid urbanization and growing industrial output further drive system adoption.

Flue Gas Desulphurization System Market Share

The Flue Gas Desulphurization System industry is primarily led by well-established companies, including:

- Mitsubishi Heavy Industries Ltd. (Japan)

- General Electric Company (U.S.)

- Andritz AG (Austria)

- Doosan Lentjes GmbH (Germany)

- Babcock & Wilcox Enterprises Inc. (U.S.)

- Siemens AG (Germany)

- Thermax Ltd. (India)

- Hamon Group (Belgium)

- FLSmidth & Co. A/S (Denmark)

- Ducon Infratechnologies Limited (India)

- Rafako S.A. (Poland)

- Marsulex Environmental Technologies (U.S.)

- Chiyoda Corporation (Japan)

- China Boqi Environmental (Holding) Co. Ltd. (China)

- Valmet Corporation (Finland)

Latest Developments in Global Flue Gas Desulphurization System Market

- In March 2024, Mitsubishi Heavy Industries Ltd. upgraded its large-scale wet FGD plant designs by incorporating advanced slurry handling technology, resulting in a 12% improvement in operational efficiency and reduced maintenance costs.

- In September 2023, General Electric (GE) Vernova expanded its FGD services portfolio in the Asia-Pacific region by introducing modular hybrid emission control systems that combine SO₂ removal with NOx and particulate matter controls, catering to diverse industrial needs.

- In June 2023, Thermax Ltd., an India-based environmental solutions provider, commissioned a 3x600 MW wet FGD project in India, fully compliant with Bharat Stage VI emission norms, marking a significant step in emission control modernization for the country’s coal-fired power plants.

- In November 2022, Andritz AG introduced a pioneering waterless dry/semi-dry scrubber technology designed for arid regions, minimizing water consumption while maintaining effective SO₂ reduction, attracting interest from Middle Eastern and African markets.

- In August 2022, Siemens AG launched an AI-powered process optimization platform for its wet FGD units, enabling predictive maintenance and real-time operational adjustments to optimize performance and ensure continuous regulatory compliance.

- In April 2021, Hamon Group signed a long-term service agreement with a major Southeast Asian utility to provide FGD system maintenance, upgrades, and technology support for multiple coal power plants, strengthening its regional market presence.

- In January 2020, Doosan Lentjes GmbH successfully executed an extensive retrofit of a large brownfield coal-fired power station in Europe, replacing outdated FGD units with state-of-the-art modular systems that reduce installation time and enhance removal efficiency.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flue Gas Desulphurization System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flue Gas Desulphurization System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flue Gas Desulphurization System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.