Global Flexitank Market

Market Size in USD Billion

CAGR :

%

USD

4.10 Billion

USD

18.83 Billion

2024

2032

USD

4.10 Billion

USD

18.83 Billion

2024

2032

| 2025 –2032 | |

| USD 4.10 Billion | |

| USD 18.83 Billion | |

|

|

|

|

Flexitank Market Size

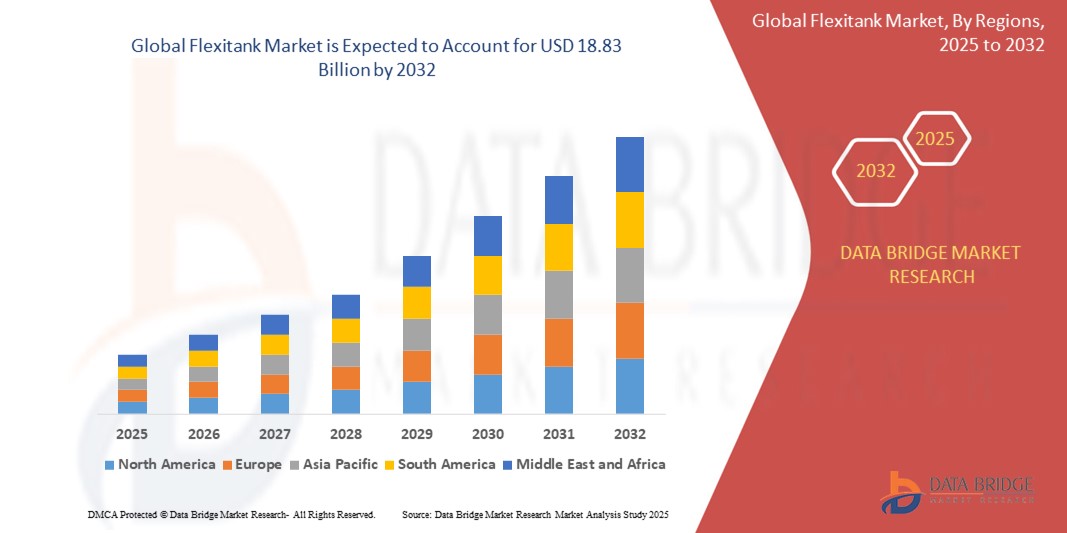

- The global flexitank market size was valued at USD 4.10 billion in 2024 and is expected to reach USD 18.83 billion by 2032, at a CAGR of 21% during the forecast period

- The market growth is largely fueled by the increasing preference for cost-effective and efficient bulk liquid transportation, as flexitanks offer higher payload capacity and reduced packaging waste compared to traditional drums and IBCs

- Furthermore, rising global trade in food-grade liquids, non-hazardous chemicals, and industrial fluids, along with expanding export activities in emerging economies, is driving demand for flexitank solutions, thereby significantly boosting the industry's growth

Flexitank Market Analysis

- Flexitanks, serving as single-use or reusable bladder systems for bulk liquid transportation, are increasingly vital in global logistics due to their high efficiency, lower transportation costs, and ability to maximize container payload compared to traditional alternatives such as drums and IBCs

- The escalating demand for flexitanks is primarily fueled by the surge in global trade of food-grade liquids, non-hazardous chemicals, and agricultural products, coupled with rising cost pressures and growing emphasis on sustainable, space-efficient packaging solutions

- Asia-Pacific dominated the flexitank market with a share of 47.43% in 2024, due to rising export of food-grade liquids, edible oils, and industrial chemicals

- North America is expected to be the fastest growing region in the flexitank market during the forecast period due to rising demand for cost-efficient bulk liquid transport in the food, beverage, and industrial sectors

- Multilayer segment dominated the market with a market share of 55.32% in 2024, due to its enhanced strength, durability, and superior protection against contamination and leakage during long-haul transportation. Multilayer flexitanks are particularly favored for transporting high-value and sensitive liquids, such as food-grade oils and pharmaceutical ingredients, owing to their ability to prevent oxidation and preserve product integrity

Report Scope and Flexitank Market Segmentation

|

Attributes |

Flexitank Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flexitank Market Trends

“Increasing Global Trade”

- A significant and accelerating trend in the global flexitank market is the surge in international trade of bulk liquids such as edible oils, wine, non-hazardous chemicals, and industrial fluids, which is driving the widespread adoption of flexitank-based transportation solutions

- For instance, companies such as Qingdao BLT Packing Industrial Co., Ltd. and Environmental Packaging Technologies, Inc. have expanded their global operations to support rising exports from Asia, Europe, and the U.S., offering high-capacity, cost-efficient flexitank systems for long-distance liquid logistics

- Flexitanks enable exporters to significantly reduce per-unit transport costs and packaging waste, while increasing container payloads—benefits that are particularly appealing in competitive global trade environments. For instance, SIA FLEXITANKS supports exporters across over 60 countries with flexible and customized solutions that align with global shipping needs

- The growing preference for containerized transport over ISO tanks or drums, due to faster loading times and lower repositioning costs, is further reinforcing the adoption of flexitanks among exporters of agricultural and industrial liquids. MY FLEXITANK and Rishi FIBC Solutions Pvt Ltd. are also investing in innovations to cater to high-volume global clients with specialized requirements

- This trend is fundamentally reshaping bulk liquid logistics by enabling faster, safer, and more sustainable international shipping. Consequently, key players such as HOYER GmbH are expanding their global supply chain capabilities, integrating advanced flexitank systems that meet evolving trade and environmental standards

- The demand for efficient, scalable, and eco-friendly bulk liquid transport is growing rapidly across sectors and geographies, as businesses respond to increased global trade flows and look for innovative packaging solutions that reduce costs and environmental impact

Flexitank Market Dynamics

Driver

“Growing Demand for Non-Hazardous Liquid Transportation”

- The increasing demand for safe and cost-effective transportation of non-hazardous liquids such as edible oils, beverages, liquid fertilizers, and non-toxic industrial fluids is a significant driver for the growth of the flexitank market

- For instance, in November 2022, FESCO Transportation Group launched FESCO Flexi, a specialized service for transporting bulk liquids using sealed flexitank liners, enhancing the company’s capacity to meet rising regional and international demand for non-hazardous liquid logistics

- As industries expand their global trade footprint, flexitanks offer a highly efficient alternative to traditional methods by maximizing payload capacity, reducing contamination risk, and eliminating the need for costly cleaning or return logistics

- Furthermore, companies such as Environmental Packaging Technologies, Inc. and Rishi FIBC Solutions Pvt Ltd. are actively expanding their product lines to meet the safety and hygiene standards required for transporting food-grade and pharmaceutical liquids, supporting widespread market adoption

- The rise in global exports of safe-to-ship liquids across food, agriculture, and industrial sectors is accelerating the uptake of flexitanks in both developed and developing markets, positioning them as an ideal solution for non-hazardous liquid logistics

Restraint/Challenge

“Limited Awareness and Infrastructure”

- Limited awareness regarding the benefits of flexitanks and the lack of supporting infrastructure in several regions pose a significant challenge to broader market penetration. Many logistics providers and end-users in emerging markets remain unfamiliar with flexitank technology and its advantages over traditional bulk liquid transport methods

- For instance, despite being one of the major flexitank manufacturers, Qingdao BLT Packing Industrial Co., Ltd. faces hurdles in market expansion across remote regions where port facilities lack the necessary handling equipment or trained personnel for flexitank deployment

- Addressing these limitations through targeted awareness campaigns, training programs, and investment in logistics infrastructure is essential for unlocking new market opportunities. Companies such as SIA FLEXITANKS and MY FLEXITANK have initiated educational outreach and customer support services to guide clients on safe usage, filling protocols, and container compatibility

- While established logistics hubs are steadily incorporating flexitank-compatible facilities, bridging the infrastructure gap across underserved areas remains critical. Collaborations between flexitank providers and regional logistics companies to co-develop solutions are key to accelerating adoption

- Overcoming these challenges through greater industry collaboration, infrastructure investments, and ongoing client education will be vital for achieving broader adoption and maximizing the flexitank market’s global potential

Flexitank Market Scope

The market is segmented on the basis of product, type, loading type, material, and application.

• By Product

On the basis of product, the flexitank market is segmented into monolayer, bi-layer, and multilayer. The multilayer segment dominated the largest market revenue share of 55.32% in 2024, primarily due to its enhanced strength, durability, and superior protection against contamination and leakage during long-haul transportation. Multilayer flexitanks are particularly favored for transporting high-value and sensitive liquids, such as food-grade oils and pharmaceutical ingredients, owing to their ability to prevent oxidation and preserve product integrity.

The monolayer segment is projected to witness the fastest growth rate from 2025 to 2032, driven by rising demand in cost-sensitive regions and for short-distance transport. These flexitanks offer a more economical solution for non-hazardous liquids where extensive protection is not critical, attracting small-scale exporters and SMEs involved in bulk liquid trade.

• By Type

On the basis of type, the market is segmented into single use and reusable. The single-use segment held the largest market revenue share in 2024, owing to its convenience, lower risk of cross-contamination, and widespread adoption in food and chemical industries. Single-use flexitanks eliminate the need for cleaning and sterilization, making them suitable for one-time exports and reducing turnaround time for shipping containers.

The reusable segment is anticipated to record the fastest CAGR from 2025 to 2032, supported by growing environmental concerns and sustainability initiatives across logistics operations. Reusable flexitanks, though requiring careful handling and maintenance, are gaining popularity among companies aiming to reduce packaging waste and operational costs in repeat trade cycles.

• By Loading Type

On the basis of loading type, the flexitank market is segmented into top loading and bottom loading. The top loading segment led the market revenue in 2024, attributed to its simple design and compatibility with various liquid types, particularly in small to mid-sized cargoes. It remains a preferred choice for transporting industrial oils and lubricants that don’t require rapid loading or unloading.

The bottom loading segment is projected to register the highest growth rate from 2025 to 2032, propelled by the increasing preference for faster filling and discharge processes. Bottom loading designs help minimize air entrapment and spillage, improving operational efficiency and ensuring higher safety compliance, especially in the food and beverage industry.

• By Material

On the basis of material, the flexitank market is segmented into polyethylene, polypropylene, and others. The polyethylene segment captured the largest market revenue share in 2024, driven by its widespread use in food-grade and chemical-grade flexitanks. Its high chemical resistance, flexibility, and compliance with international food safety standards make it the material of choice for transporting edible oils, syrups, and non-hazardous chemicals.

The polypropylene segment is expected to witness the fastest CAGR from 2025 to 2032, due to its rising adoption in industrial-grade flexitanks where higher mechanical strength and thermal resistance are needed. Polypropylene-based tanks are becoming increasingly popular in regions with higher ambient temperatures or in applications requiring enhanced durability.

• By Application

On the basis of application, the flexitank market is segmented into food grade liquids, non-hazardous chemicals, industrial liquids, agricultural liquids, and others. The food grade liquids segment accounted for the largest market revenue share in 2024, driven by the growing global trade of edible oils, wine, juices, and sweeteners. Flexitanks are extensively used in this segment due to their hygienic properties, cost-efficiency, and the ability to load larger volumes compared to drums or IBCs.

The industrial liquids segment is projected to grow at the fastest rate from 2025 to 2032, fueled by increasing demand for bulk transportation of lubricants, paints, and cleaning agents. The shift from conventional packaging to flexitanks in industrial sectors is influenced by reduced logistics costs, minimal handling requirements, and improved safety measures in chemical transportation.

Flexitank Market Regional Analysis

- Asia-Pacific dominated the flexitank market with the largest revenue share of 47.43% in 2024, driven by rising export of food-grade liquids, edible oils, and industrial chemicals

- The region's expanding trade infrastructure, cost-effective labor, and growing preference for bulk liquid transport over drums and IBCs are major contributors to market growth

- Trade liberalization policies, increasing agricultural exports, and the rising adoption of flexitanks among small and mid-size exporters are accelerating market penetration across the region

China Flexitank Market Insight

China market led the Asia-Pacific region in revenue share in 2024, supported by its position as a major global exporter of food-grade oils, wine, and industrial liquids. The rapid scale-up of trade volumes and local production of cost-effective flexitanks have enhanced its domestic adoption. Moreover, government initiatives encouraging export efficiency and packaging sustainability are further boosting market growth.

India Flexitank Market Insight

India's flexitank market is expanding rapidly, driven by the country's large edible oil imports and rising exports of agricultural and industrial liquids. Indian logistics providers are increasingly favoring flexitanks due to their ability to maximize container payload and reduce per-unit shipping costs. The presence of multiple domestic manufacturers is also making flexitanks a cost-efficient option for regional trade.

Europe Flexitank Market Insight

The Europe flexitank market is expected to grow steadily over the forecast period, driven by increasing wine exports, stringent environmental regulations, and a growing emphasis on sustainable packaging alternatives. Flexitanks are being adopted by European exporters seeking to reduce carbon footprints and logistic costs, especially for bulk transportation of non-hazardous chemicals and food-grade liquids.

Germany Flexitank Market Insight

Germany’s flexitank market is growing due to rising chemical and beverage exports, supported by the country’s strong industrial base and logistics infrastructure. Companies are adopting flexitanks to comply with EU packaging directives and reduce plastic waste. Technological innovation in flexitank materials and increasing focus on reusable solutions are shaping the market’s direction.

North America Flexitank Market Insight

North America is projected to register the fastest CAGR from 2025 to 2032, fueled by rising demand for cost-efficient bulk liquid transport in the food, beverage, and industrial sectors. Flexitanks are gaining traction for transporting plant-based oils, liquid sweeteners, and specialty chemicals, driven by the need to optimize cargo space and reduce packaging waste.

U.S. Flexitank Market Insight

The U.S. market held the largest share in North America in 2024, supported by robust exports of agricultural products and high demand for flexitanks in the chemical and food processing industries. Logistics companies in the U.S. are increasingly turning to flexitanks for their ability to reduce turnaround times and lower freight costs, with strong support from advancements in intermodal transportation and regulatory emphasis on sustainable logistics.

Flexitank Market Share

The flexitank industry is primarily led by well-established companies, including:

- Qingdao BLT Packing Industrial Co., Ltd. (BLT) (China)

- Braid Logistics UK Ltd. (U.K.)

- Bulk Liquid Solutions (India)

- Büscherhoff Packaging Solutions GmbH (Germany)

- Environmental Packaging Technologies, Inc. (U.S.)

- HOYER GmbH (Germany)

- K Tank Supply Ltd. (U.K.)

- Mak & Williams Flexitank Supply Ltd. (U.K.)

- MY FLEXITANK (Malaysia)

- KriCon Group BV (Netherlands)

- Qingdao LAF Packaging Co., Ltd. (China)

- SIA FLEXITANKS (Latvia)

- Yunjet Plastics Packaging (China)

- Trans Ocean Bulk Logistics Ltd. (U.K.)

- TRUST Flexitanks (Singapore)

- FLUIDTAINER FLEXITANK Sdn Bhd (Malaysia)

- Hinrich Industries (U.S.)

- ONE Flexitank (Malaysia)

- ORCAFLEXI SDN BHD (Malaysia)

- INFINITY BULK LOGISTICS SDN. BHD (Malaysia)

- Rishi FIBC Solutions Pvt Ltd. (India)

Latest Developments in Global Flexitank Market

- In November 2023, ASF, Inc., a logistics service provider, revealed its plans to broaden its flexitank portfolio, offering highly efficient and environmentally friendly shipping solutions for non-hazardous bulk liquid cargo

- In November 2022, FESCO Transportation Group expanded its service portfolio under FESCO Supply Chain with the introduction of FESCO Flexi, aimed at transporting bulk liquids in containers using sealed flexitank liners. This strategic move has enhanced market accessibility to flexitank-based logistics solutions, particularly in Russia and neighboring trade regions, supporting the overall growth of bulk liquid transport infrastructure

- In October 2020, Hillebrand, based in Mainz, Germany, launched the Pulse flexitank, specifically engineered for high-density and solidifying bulk liquids. This innovation contributed to expanding flexitank applications in more complex liquid logistics, thereby boosting adoption in industrial and chemical transport segments and strengthening the flexitank market’s technological advancement.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flexitank Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flexitank Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flexitank Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.