Global Flexible Ac Transmission System Market

Market Size in USD Million

CAGR :

%

USD

964.29 Million

USD

1,852.02 Million

2024

2032

USD

964.29 Million

USD

1,852.02 Million

2024

2032

| 2025 –2032 | |

| USD 964.29 Million | |

| USD 1,852.02 Million | |

|

|

|

|

Flexible Alternating Current (AC) Transmission System Market Analysis

The global efforts to minimize carbon emissions by generating energy from renewable sources such as the wind, water, and solar are growing. To fulfil the rising demand for electricity in industrialized regions including the Americas and Europe, there is an increasing need for improved power transfer capability on current transmission lines. Therefore, to assure the generation of clean, environmentally friendly, as well as the sustainable electricity, the electrical system needs to be upgraded. To ensure system stability, power supply quality, and dependability, flexible alternating current (AC) transmission system are utilized to integrate renewable energy sources into transmission networks.

Flexible Alternating Current (AC) Transmission System Market Size

Global flexible alternating current (AC) transmission system market size was valued at USD 964.29 million in 2024 and is projected to reach USD 1852.02 million by 2032, with a CAGR of 8.50% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Flexible Alternating Current (AC) Transmission System Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Key Market Players |

ABB (Switzerland), Cisco Systems, Inc., (U.S.), Eaton (U.S.), SIEMENS (Germany), LARSEN & TOUBRO LIMITED (India), Hyundai Motors (South Korea), Mitsubishi Electric Corporation (Japan), Toshiba Corporation (Japan), C&S Electric Limited (India), Hitachi Ltd., (Japan), Schneider Electric (France), Tavrida Electric (Russia), Fuji Electric Co. Ltd., (Japan), Powell Industries (U.S.), Sensata Technologies Inc., (U.S.) and ENTEC Electric and Electronic (South Korea) |

|

Market Opportunities |

|

Flexible Alternating Current (AC) Transmission System Market Definition

Flexible alternating current (AC) transmission system basically consists of static equipment. The alternating current (AC) transmission of electrical energy is carried out by this mechanism. The system is made to make the network more controllable and to increase its capacity for power transfer. Typically, this system is powered electronically. The reliability of the alternating current (AC) grids is improved by the use of flexible alternating current (AC) transmission systems. It aids in lowering delivery costs as well. By supplying reactive or inductive power to the grid, these devices can help to increase the efficiency of power transmission overall and the quality of the transmission

Flexible Alternating Current (AC) Transmission System Market Dynamics

Drivers

- Expansion of Transmission Lines

Governments have been concentrating on boosting power capacity and developing grid infrastructure during the last few years. As a result, a vast network of transmission lines has been built to transport power generated at stations to consumers. The electricity transmission market will grow due to ongoing utility-based transmission network growth and increased grid infrastructure renovation spending. Power transmission industry growth will be positively impacted by favorable regulatory improvements relating to the combination of a sustainable electric network and ongoing cross-border connectivity expansion. Transmission line lengths are growing in nations like China, the US, and India. As a result, the market is estimated to expand largely due to the expansion of transmission lines.

Furthermore, the increase in disposable income along with the increase in the purchasing power among the consumers which further increases the demand for organic and premium products fuels the market growth. A tendency toward integrating renewable energy infrastructure along with quick industrial growth by industry players to support volume manufacturing would further boost product demand.

Opportunities

- Increased Investments and Favorable Reforms

The rising investments toward the renovation of the existing grid infrastructure is estimated to generate lucrative opportunities for the market, which will further expand the future flexible alternating current (AC) transmission system market's growth rate. Additionally, the favorable regulatory reforms pertaining to a sustainable electric network combination will also offer numerous growth opportunities within the market.

Restraints/Challenges

- High Cost

The high cost of flexible alternating current (AC) transmission system's availability is serving as a major market restraint, as the majority of industries and utility players are hesitant to use this technology because of the relatively high initial cost associated with its installation. The financial benefits and return on investment, such as greater yearly sales due to flexible alternating current (AC) transmission system's improved power transfer capability, outweigh the original investment cost, nevertheless, when the cost is compared to the projected benefits.

- Limitations associated with Size and Communication

For the large-scale deployment of flexible alternating current (AC) transmission system devices to be successful, several problems must be solved. As the size of flexible alternating current (AC) transmission system is directly linked to the overall system's cost and desired performance characteristics, proper size and setting of the system devices play a significant role in determining the device's overall cost. This factor is projected to be challenge for the flexible alternating current (AC) transmission system market over the forecast period.

This flexible alternating current (AC) transmission system market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the flexible alternating current (AC) transmission system market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Flexible Alternating Current (AC) Transmission System Market Scope

The flexible alternating current (AC) transmission system market is segmented on the basis of compensation type, generation type, functions, components, application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Compensation Type

- Shunt Compensation

- Series Compensation

- Combined Compensation

Generation Type

- First Generation

- Second Generation

Functions

- Voltage Control

- Network Stabilization

- Transmission Capacity

- Harmonic Suppression

Components

- Power Electronics Devices

- Phase Shifting Transformers

- Protection and Control Systems

Application

- Voltage Control

- Power Control

End User

- Utilities

- Renewables

- Industrial

- Railways

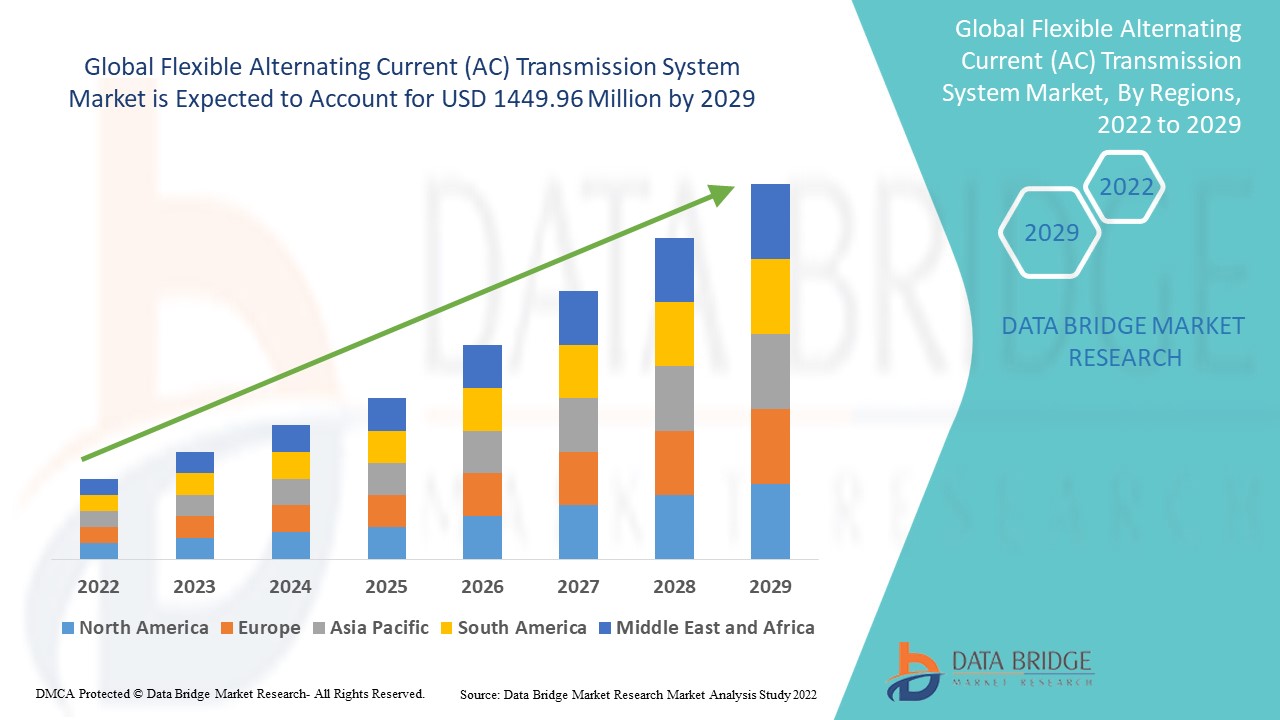

Flexible Alternating Current (AC) Transmission System Market Regional Analysis

The flexible alternating current (AC) transmission system market is analyzed and market size insights and trends are provided by country, compensation type, generation type, functions, components, application and end user as referenced above.

The countries covered in the flexible alternating current (AC) transmission system market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the flexible alternating current (AC) transmission system market from 2025 to 2032. The market is dominant within this region because of the increasing amount of railway line extension projects across the economies such as U.S. and Canada within the region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2025 to 2032 due to the region's developing amount of substations and broadcast channels.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Flexible Alternating Current (AC) Transmission System Market Share

The flexible alternating current (AC) transmission system market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to flexible alternating current (AC) transmission system market.

Flexible Alternating Current (AC) Transmission System Market Leaders Operating in the Market Are:

- ABB (Switzerland)

- Cisco Systems, Inc., (U.S.)

- Eaton (U.S.)

- SIEMENS (Germany)

- LARSEN & TOUBRO LIMITED (India)

- Hyundai Motors (South Korea)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- C&S Electric Limited (India)

- Hitachi Ltd., (Japan)

- Schneider Electric (France)

- Tavrida Electric (Russia)

- Fuji Electric Co. Ltd., (Japan)

- Powell Industries (U.S.)

- Sensata Technologies Inc., (U.S.)

- ENTEC Electric and Electronic (South Korea)

Latest Developments in Flexible Alternating Current (AC) Transmission System Market

- In May 2020, The Dynamic Reactive Compensator (DRC) project for National Grid in the UK has been successfully powered by GE Renewable Energy's Grid Solutions company [NYSE:GE]. With a 975 Mvar power range, this project is the largest utility-grade Static Synchronous Compensator (STATCOM) scheme in Europe. The transmission network in southeast UK has three different substations where it is distributed and coordinated

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flexible Ac Transmission System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flexible Ac Transmission System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flexible Ac Transmission System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.