Global Fleet Management Market

Market Size in USD Billion

CAGR :

%

USD

38.98 Billion

USD

112.75 Billion

2024

2032

USD

38.98 Billion

USD

112.75 Billion

2024

2032

| 2025 –2032 | |

| USD 38.98 Billion | |

| USD 112.75 Billion | |

|

|

|

|

Fleet Management Market Size

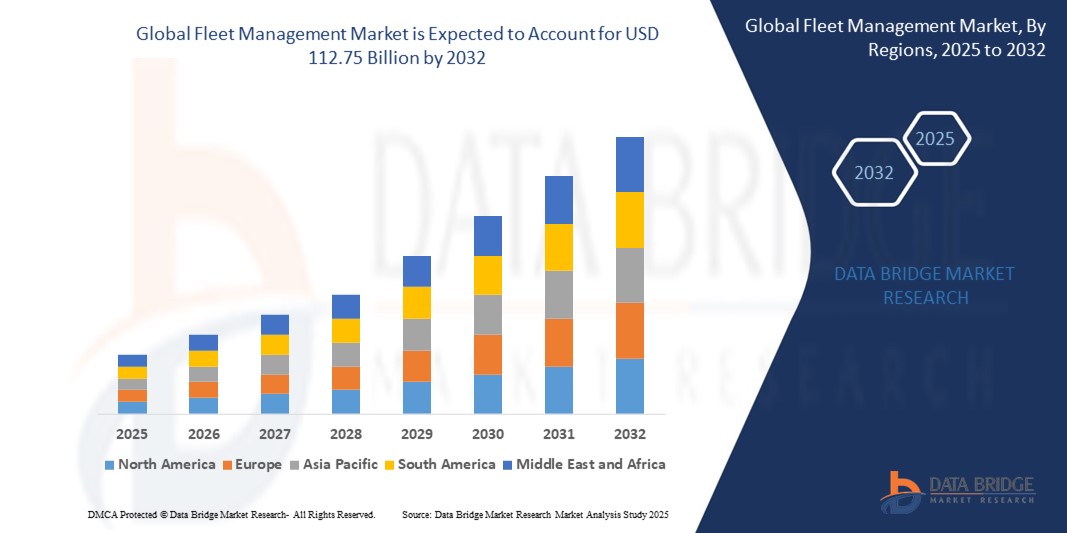

- The global fleet management market size was valued at USD 38.98 billion in 2024 and is expected to reach USD 112.75 billion by 2032, at a CAGR of 14.20% during the forecast period

- The market growth is primarily driven by the increasing adoption of advanced telematics, IoT integration, and real-time tracking technologies, which enhance operational efficiency and reduce costs in fleet operations

- Rising demand for sustainable transportation solutions, stricter regulatory compliance, and the growing need for optimized logistics in commercial and private sectors are further propelling the market's expansion

Fleet Management Market Analysis

- Fleet management systems, encompassing solutions and services for vehicle tracking, diagnostics, and operational optimization, are becoming critical for businesses aiming to improve efficiency, safety, and compliance in transportation and logistics

- The surge in demand for fleet management is fueled by the need for real-time data analytics, fuel efficiency, and driver safety, coupled with the rapid adoption of electric vehicles and smart mobility solutions

- North America dominated the fleet management market with the largest revenue share of 38.5% in 2024, driven by advanced infrastructure, widespread adoption of telematics, and the presence of major industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, expanding e-commerce, and increasing investments in smart transportation infrastructure

- The heavy commercial vehicle segment dominated the largest market revenue share of 45.2% in 2024, driven by the extensive use of fleet management solutions in logistics and transportation industries for optimizing long-haul operations, fuel efficiency, and compliance with regulations

Report Scope and Fleet Management Market Segmentation

|

Attributes |

Fleet Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Fleet Management Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global fleet management market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies facilitate advanced data processing, offering deeper insights into fleet performance, driver behavior, fuel efficiency, and predictive maintenance requirements

- AI-driven fleet management solutions enable proactive decision-making, identifying potential vehicle issues before they result in costly repairs or operational downtime

- For instances, companies are leveraging AI platforms to analyze driver behavior data, such as speeding, harsh braking, or inefficient routing, to optimize fuel consumption, enhance safety, and provide tailored fleet management strategies

- This trend enhances the efficiency and value of fleet management systems, making them increasingly appealing to both small businesses and large enterprises

- AI algorithms can process extensive datasets, including real-time vehicle location, fuel consumption patterns, and driver performance metrics, to optimize routes and ensure compliance with regulations

Fleet Management Market Dynamics

Driver

“Rising Demand for Connected Fleets and Advanced Safety Features”

- Growing demand for connected fleet services, such as real-time GPS tracking, route optimization, and remote diagnostics, is a key driver for the global fleet management market

- Fleet management systems enhance safety through features such as accident prevention, real-time driver behavior monitoring, electronic logging device (ELD) compliance, and stolen vehicle recovery

- Government regulations, particularly in North America, which dominates the market, are driving adoption by mandating safety and compliance features such as ELD for commercial vehicles

- The proliferation of IoT and advancements in 5G technology are enabling faster data transmission and lower latency, supporting sophisticated fleet management applications across passenger cars, light commercial vehicles, and heavy commercial vehicles

- Fleet operators are increasingly adopting factory-installed or aftermarket fleet management solutions to meet operational demands and enhance vehicle efficiency

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The significant upfront costs for hardware and software integration pose a barrier to adoption, particularly for small businesses and small fleets in cost-sensitive regions such as Asia-Pacific, the fastest-growing market

- Retrofitting existing vehicles with fleet management systems can be complex and expensive, especially for internal combustion engine and electric vehicle fleets

- Data security and privacy concerns are major challenges, as fleet management systems collect sensitive data on vehicle locations, driver behavior, and operational metrics, raising risks of data breaches or misuse

- The fragmented regulatory landscape across regions, with varying data protection and compliance requirements, complicates operations for global fleet management providers

- These challenges may deter adoption, particularly in regions with high data privacy awareness or budget constraints, potentially slowing market growth

Fleet Management market Scope

The market is segmented on the basis of mode of transport, offering, lease type, vehicle type, hardware, fleet size, deployment model, technology, functions, communication range, operations, and business type.

- By Mode of Transport

On the basis of mode of transport, the global fleet management market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. The heavy commercial vehicle segment dominated the largest market revenue share of 45.2% in 2024, driven by the extensive use of fleet management solutions in logistics and transportation industries for optimizing long-haul operations, fuel efficiency, and compliance with regulations.

The passenger car segment is expected to witness the fastest growth rate from 2025 to 2032, with a CAGR of 15.8%, fueled by rising consumer demand for connected car technologies, real-time tracking, and enhanced safety features in personal and shared mobility services.

- By Offering

On the basis of offering, the global fleet management market is segmented into solutions and services. In 2024, the solutions segment dominated with a 66.27% market revenue share, attributed to the widespread adoption of fleet management software for asset tracking, route optimization, and real-time analytics.

The services segment is anticipated to grow at the fastest rate from 2025 to 2032, with a CAGR of 16.5%, driven by increasing demand for managed services, predictive maintenance, and consulting to enhance operational efficiency and reduce downtime.

- By Lease Type

On the basis of lease type, the global fleet management market is segmented into on-lease and without lease. The on-lease segment held the largest market share of 64.98% in 2024, driven by the growing trend of full-service leasing among businesses seeking cost-effective fleet management without ownership burdens.

The without lease segment is expected to grow at a robust CAGR of 14.9% from 2025 to 2032, as businesses, particularly small and medium enterprises, opt for outright vehicle ownership paired with advanced fleet management systems for flexibility and control.

- By Vehicle Type

On the basis of vehicle type, the global fleet management market is segmented into internal combustion engine (ICE) and electric vehicles (EVs). The ICE segment dominated with an 83.37% market share in 2024, owing to its established infrastructure and widespread use in commercial fleets.

The EV segment is projected to experience the fastest growth from 2025 to 2032, with a CAGR of 18.3%, driven by global sustainability initiatives, government incentives, and the integration of telematics for EV-specific monitoring, such as battery health and charging optimization.

- By Hardware

On the basis of hardware, the global fleet management market is segmented into GPS tracking devices, dash cameras, Bluetooth tracking tags, data loggers, and others. The GPS tracking devices segment held the largest market share of 38.7% in 2024, due to their critical role in real-time vehicle location tracking, theft prevention, and route optimization.

The dash cameras segment is expected to witness the fastest growth from 2025 to 2032, with a CAGR of 17.2%, driven by increasing demand for driver behavior monitoring, accident prevention, and compliance with safety regulations.

- By Fleet Size

On the basis of fleet size, the global fleet management market is segmented into small fleets (less than 100 vehicles), medium fleets (100-500 vehicles), and large and enterprise fleets (500+ vehicles). The large and enterprise fleets segment dominated with a 52.4% market share in 2024, driven by the need for comprehensive fleet management solutions in logistics, transportation, and e-commerce industries.

The small fleets segment is projected to grow at the fastest CAGR of 16.1% from 2025 to 2032, as small businesses increasingly adopt affordable cloud-based solutions to enhance operational efficiency.

- By Deployment Model

On the basis of deployment model, the global fleet management market is segmented into on-premise, cloud, and hybrid models. The cloud segment held the largest market share of 59.8% in 2024, driven by its scalability, cost-efficiency, and ability to integrate with IoT and analytics for real-time insights.

The hybrid segment is expected to grow at the fastest CAGR of 15.4% from 2025 to 2032, as businesses seek a balance between the security of on-premise systems and the flexibility of cloud-based solutions.

- By Technology

On the basis of technology, the global fleet management market is segmented into GNSS, cellular systems, electronic data interchange (EDI), remote sensing, computational method & decision making, RFID, and others. The cellular systems segment dominated with a 62.3% market share in 2024, owing to its reliable coverage and seamless integration with IoT ecosystems for real-time data transmission.

The GNSS segment is anticipated to witness the fastest growth from 2025 to 2032, with a CAGR of 16.7%, driven by advancements in satellite-based navigation and demand for precise location tracking in remote areas.

- By Functions

On the basis of functions, the global fleet management market is segmented into asset management, route management, fuel consumption, real-time vehicle location, delivery schedule, accident prevention, mobile apps, monitoring driver behavior, vehicle maintenance updates, ELD compliance, and others. The real-time vehicle location segment held the largest market share of 34.6% in 2024, driven by its critical role in fleet optimization, theft prevention, and delivery efficiency.

The monitoring driver behavior segment is expected to witness the fastest growth from 2025 to 2032, with a CAGR of 17.5%, fueled by increasing emphasis on safety, regulatory compliance, and the adoption of AI-driven analytics to improve driver performance and reduce accidents.

- By Communication Range

On the basis of communication range, the global fleet management market is segmented into short-range communication and long-range communication. The long-range communication segment dominated with a 68.2% market share in 2024, driven by its ability to provide seamless connectivity for fleet operations across large geographic areas, particularly in logistics and transportation.

The short-range communication segment is projected to grow at the fastest CAGR of 15.9% from 2025 to 2032, supported by the rising use of Bluetooth and Wi-Fi-based solutions for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication in urban environments.

- By Operations

On the basis of operations, the global fleet management market is segmented into commercial and private operations. The commercial operations segment held the largest market share of 78.4% in 2024, driven by the extensive adoption of fleet management solutions in industries such as logistics, e-commerce, and construction to enhance efficiency and reduce costs.

The private operations segment is expected to grow at a CAGR of 14.8% from 2025 to 2032, as individual vehicle owners and small businesses increasingly adopt telematics for personal vehicle tracking and maintenance.

- By Business Type

On the basis of business type, the global fleet management market is segmented into large business and small business. The large business segment dominated with a 65.7% market share in 2024, attributed to the high demand for comprehensive fleet management systems among enterprises with extensive fleets.

The small business segment is anticipated to witness the fastest growth from 2025 to 2032, with a CAGR of 16.3%, driven by the affordability of cloud-based solutions and the growing need for operational efficiency among small and medium enterprises.

Fleet Management Market Regional Analysis

- North America dominated the fleet management market with the largest revenue share of 38.5% in 2024, driven by advanced infrastructure, widespread adoption of telematics, and the presence of major industry players

- Consumers and businesses prioritize fleet management solutions for optimizing vehicle efficiency, reducing operational costs, and ensuring regulatory compliance, particularly in regions with extensive supply chain networks

- Growth is supported by advancements in telematics, IoT, and cloud-based solutions, alongside increasing adoption in both commercial and private fleet operations

U.S. Fleet Management Market Insight

The U.S. fleet management market captured the largest revenue share of 77.9% in 2024 within North America, fueled by strong demand from transportation and logistics industries and growing awareness of fuel efficiency and safety benefits. The trend towards real-time tracking and predictive maintenance, coupled with stringent regulations such as ELD compliance, boosts market expansion. Major companies such as UPS and FedEx leverage fleet management systems to optimize delivery operations, enhancing market growth.

Europe Fleet Management Market Insight

The Europe fleet management market is expected to witness significant growth, supported by regulatory emphasis on vehicle safety, emissions reduction, and operational efficiency. Consumers and businesses seek solutions that enhance route optimization and driver behavior monitoring. The growth is prominent in both commercial and private fleets, with countries such as Germany and France showing significant uptake due to environmental regulations and urban logistics demands.

U.K. Fleet Management Market Insight

The U.K. market for fleet management is expected to witness rapid growth, driven by demand for improved operational efficiency and safety in urban and suburban logistics. Increased interest in real-time vehicle tracking and fuel management encourages adoption. Evolving regulations, such as those mandating electronic logging devices, influence fleet operators to balance compliance with cost efficiency.

Germany Fleet Management Market Insight

Germany is expected to witness rapid growth in the fleet management market, attributed to its advanced logistics sector and high focus on fuel efficiency and sustainability. German businesses prefer technologically advanced solutions such as GNSS and cellular systems that optimize fleet operations and reduce emissions. The integration of these solutions in both large and small fleets supports sustained market growth.

Asia-Pacific Fleet Management Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding logistics and e-commerce sectors in countries such as China, India, and Japan. Increasing awareness of route optimization, fuel efficiency, and driver safety boosts demand. Government initiatives promoting smart transportation and sustainability further encourage the adoption of advanced fleet management solutions.

Japan Fleet Management Market Insight

Japan’s fleet management market is expected to witness rapid growth due to strong consumer and business preference for high-quality, technologically advanced solutions that enhance operational efficiency and safety. The presence of major automotive and logistics companies, along with the integration of fleet management systems in commercial vehicles, accelerates market penetration. Rising interest in aftermarket solutions also contributes to growth.

China Fleet Management Market Insight

China holds the largest share of the Asia-Pacific fleet management market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for efficient logistics solutions. The country’s growing e-commerce sector and focus on smart mobility support the adoption of advanced fleet management technologies. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Fleet Management Market Share

The fleet management industry is primarily led by well-established companies, including:

- Geotab (Canada)

- Verizon Connect (U.S.)

- Samsara (U.S.)

- Trimble (U.S.)

- Omnitracs (U.S.)

- Teletrac Navman (U.S.)

- TomTom Telematics (Netherlands)

- Mix Telematics (South Africa)

- Fleetmatics (U.S.)

- Masternaut (U.K.)

- KeepTruckin (U.S.)

- ORBCOMM (U.S.)

- Zonar Systems (U.S.)

- Wialon (Belarus)

- Fleet Complete (Canada)

- NexTraq (U.S.)

- Azuga (U.S.)

- Spireon (U.S.)

What are the Recent Developments in Global Fleet Management Market?

- In October 2024, Beans.ai partnered with Nauto to revolutionize last-mile delivery for commercial fleets. This strategic collaboration integrates Beans.ai’s precision routing and geospatial data solutions with Nauto’s AI-powered Video Event Data Recorder (VEDR) technology. The combined platform enhances delivery accuracy, streamlines operations, and improves driver safety while supporting VEDR compliance for package delivery contractors. By optimizing pick-up and drop-off locations and reducing delivery windows by up to 50%, the partnership reflects a broader industry shift toward intelligent, data-driven logistics solutions that elevate performance in fleet operations

- In April 2024, Penske Truck Leasing launched Catalyst AI, a groundbreaking digital platform designed to transform fleet management. This AI-powered solution provides real-time insights into fleet performance, enabling managers to benchmark their operations against similar fleets using dynamic comparative data. By analyzing over 57 billion data points, Catalyst AI identifies a fleet’s unique “DNA” and delivers tailored key performance indicators to optimize fuel efficiency, utilization, and cost reduction. The platform marks a shift from traditional benchmarking methods, empowering fleet leaders with actionable intelligence to drive smarter, faster decisions

- In March 2024, Waymo partnered with Uber Freight to deploy autonomous trucks for cargo transportation across select U.S. states, marking a pivotal advancement in logistics automation. This strategic collaboration integrates Waymo’s self-driving technology with Uber Freight’s digital brokerage platform, enabling carriers to operate trucks equipped with the Waymo Driver within a hybrid network. The initiative aims to optimize long-haul freight operations, reduce delivery times, and address labor shortages by allowing autonomous trucks to handle extended routes while human drivers focus on short-haul tasks. This partnership signals a transformative shift toward scalable, intelligent logistics solution

- In January 2024, MoveEV, an AI-powered platform focused on electric vehicle transition, partnered with Geotab to integrate its flagship product, ReimburseEV, into the Geotab Marketplace. This collaboration enables seamless reimbursement for home EV charging by combining vehicle telematics data with utility information to generate IRS-compliant receipts. Designed for fleets with electric and plug-in hybrid vehicles, the solution simplifies employee reimbursements, supports off-peak charging, and reduces the need for on-site infrastructure. The partnership marks a significant step in promoting sustainable fleet management and accelerating EV adoption across commercial and government sectors

- In September 2023, Trimble partnered with transportation solution provider Next Generation Logistics to integrate its Engage Lane procurement platform into the Dynamics TMS® system via the Trimble Transportation Cloud. This first-of-its-kind collaboration enables a dynamic, lane-level freight procurement process—from order tendering and bidding to awarding and fulfillment—through a seamless digital workflow. By connecting shipper and carrier TMS systems, the partnership enhances supply chain visibility, accelerates contracting, and improves capacity utilization. It reflects a broader industry push toward connected, data-driven logistics solutions that streamline operations and foster resilient transportation networks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.