Global Fixed Satellite Services Fss Market

Market Size in USD Billion

CAGR :

%

USD

22.30 Billion

USD

33.96 Billion

2021

2029

USD

22.30 Billion

USD

33.96 Billion

2021

2029

| 2022 –2029 | |

| USD 22.30 Billion | |

| USD 33.96 Billion | |

|

|

|

|

Market Analysis and Size

The prevalence of DTH TV platforms, an increase in the number of HDTV channels, and an increase in the number of broadband subscribers globally present growth opportunities for the Fixed Satellite Services Market. This has resulted in fierce competition with new satellite launches from existing FSS operators, whereas many new satellite operators expect to launch their first satellite within the next few years.

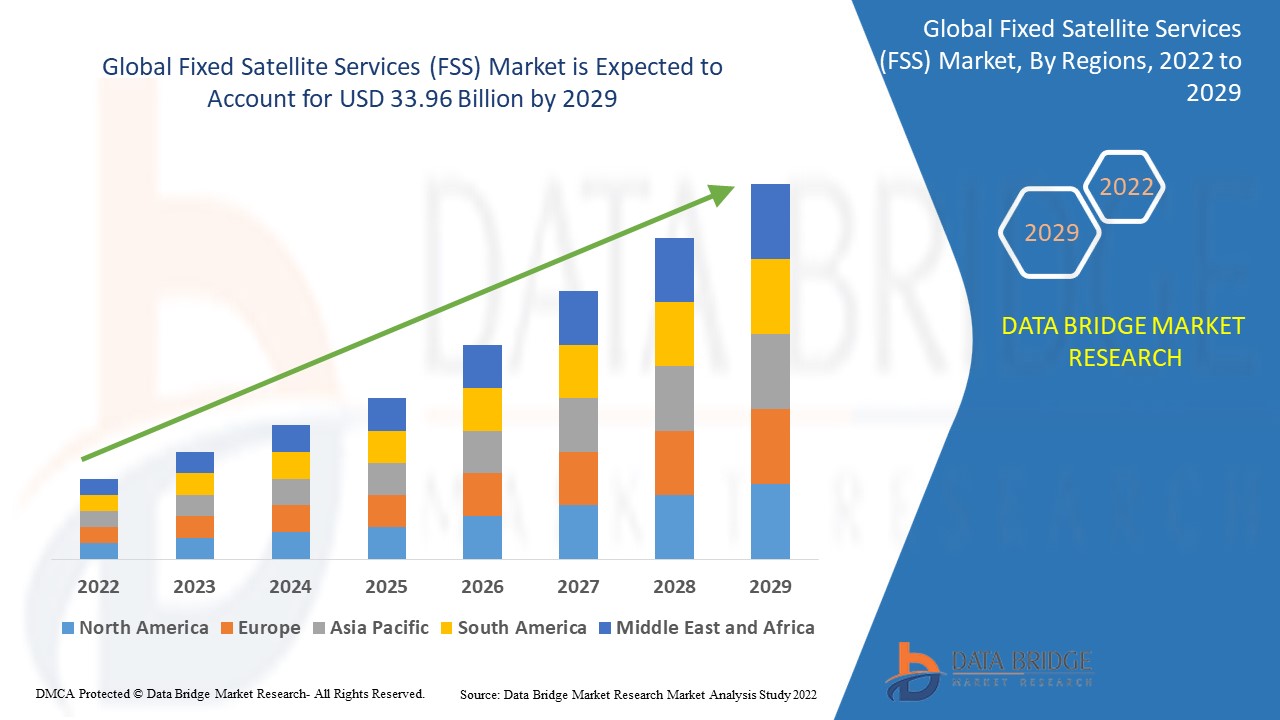

Data Bridge Market Research analyses that the fixed satellite services (FSS) market was valued at USD 22.3 billion in 2021 and is expected to reach the value of USD 33.96 billion by 2029, at a CAGR of 5.40% during the forecast period of 2022-2029.

Market Definition

Fixed satellite services, or FSS, are radio communication services that connect different earth stations. These satellite services make use of VSAT technology to send and receive phone calls as well as television signals for broadcasting. They have low power output and large dish-style antennas for improved service reception. Because FSS systems provide services to multiple users at the same time, they are strategically placed to cover a large area and allow users to communicate while travelling without losing signals.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Service Type (Wholesale FSS, TV Channel Broadcast, Broadband and Enterprise Network, Video Contribution and Distribution, Trunking and Backhaul, Managed FSS, Others), Organization Size (Small Office Home Office, Small and Medium Business, Large Enterprises), Vertical (Government, Education, Aerospace and Defence, Media and Entertainment, Oil and Gas, Retail, Telecom and IT, Healthcare and Logistics, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Global, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

SES S.A. (Luxembourg), SKY Perfect JSAT Corporation (Japan), Thaicom public company limited (Thailand), Hispasat (Spain), Arabsat (Saudi Arabia), Eutelsat communications SA (France), Star One credit union (India), Singtel (Singapore), Intelsat (Luxembourg), Telesat (Canada), Nigerian communications satellite ltd (Nigeria) |

|

Opportunities |

|

Fixed Satellite Services (FSS) Market Dynamics

Drivers

- Surge in adoption of DTH TV platforms and rising smartphone sales

High-speed internet has become a necessity for communication due to rising income levels and smartphone sales. As a result, the global fixed satellite services market has grown significantly in recent years. Due to the increased adoption of HDTV channels and emerging DTH TV platforms, global demand for fixed satellite services has increased.

- Increasing penetration of 5G networks around the world

Increased 5G penetration is expected to boost market growth over the forecast period. This is because, as users increase their use of 5G connections, the market is expected to expand even further, as 5G connections rely on fixed satellites to establish connections. There has been research into sharing the 28 GHz band between 5G new radio cellular systems and fixed satellite services (FSS). This method focuses on simulating a sharing scenario between the FSS system's uplink and the 5G NR enhanced mobile broadband (eMBB) cellular system's uplink. It can aid in the development of interference from FSS terminals to the 5G base station, also known as next-generation Node-B.

Opportunity

Increasing spending on military satellite communication, telecom backhaul, content and broadcast delivery, and enterprise and broadband connectivity are expected to drive demand for fixed satellite services over the forecast period. There has been an increase in demand for high-throughput connectivity and corporate enterprise networks in the oil and gas industry. This has provided several opportunities for growth for the major players in the global FSS market.

Restraints

The high costs of capital and the increasing use of fibre optic transmission cables are two major obstacles to the widespread deployment of fixed satellite services. Furthermore, the market's strict government regulation and restricted orbital positions may make it difficult for new companies to enter the analysed market. A new market trend is synergies and collaboration among satellite operators to improve transponder usage rates. Rising FSS demand has fuelled fierce competition, with established providers launching new satellites and new satellite operators entering the market.

This fixed satellite services (FSS) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the fixed satellite services (FSS) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Fixed Satellite Services (FSS) Market

The COVID-19 has negatively affected the satellite launch services market. Lockdowns and isolation during pandemics has not only complicate the supply chain management, but slowed the rate of testing, development and launching of pre-determined satellite launches. This has led to delay of many mission offered by the launch service providers. But with the betterment of the situation across the globe the testing and development has catch the required phase, yet there is no denial that the satellite launch services market has suffered heavily due to COVID-19.

Global Fixed Satellite Services (FSS) Market Scope

The fixed satellite services (FSS) market is segmented on the basis of service type, organization size and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service type

- Wholesale FSS

- TV Channel Broadcast

- Broadband and Enterprise Network

- Video Contribution and Distribution

- Trunking and Backhaul

- Managed FSS

- Others

Organisation size

- Small Office Home Office

- Small and Medium Business

- Large Enterprises

Application

- Government

- Education

- Aerospace and Defence

- Media and Entertainment

- Oil and Gas

- Retail

- Telecom and IT

- Healthcare and Logistics

- Others

Fixed Satellite Services (FSS) Market Regional Analysis/Insights

The fixed satellite services (FSS) market is analysed and market size insights and trends are provided by country, service type, organization size and vertical as referenced above.

The countries covered in the fixed satellite services (FSS) market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Global, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa.

North America is expected to have the largest share of the FSS market. The primary drivers of this growth are an increase in demand for bandwidth driven by high-speed internet services, an increase in the use of satellite connectivity applications for last-mile connections, and an increase in the need for real-time monitoring and control systems that can be exploited using satellites. Asia-Pacific is expected to have a massive share of the FSS market. The primary driver of this growth is an increase in demand for bandwidth driven by high-speed internet services, an increase in the use of satellite connectivity applications for last-mile connections, and an increase in the need for real-time monitoring and control systems that can be exploited using satellites.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Fixed Satellite Services (FSS) Market Share Analysis

The fixed satellite services (FSS) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to fixed satellite services (FSS) market.

Some of the major players operating in the fixed satellite services (FSS) market are:

- SES S.A. (Luxembourg)

- SKY Perfect JSAT Corporation (Japan)

- Thaicom public company limited (Thailand)

- Hispasat (Spain)

- Arabsat (Saudi Arabia)

- Eutelsat communications SA (France)

- Star One credit union (India)

- Singtel (Singapore)

- Intelsat (Luxembourg)

- Telesat (Canada)

- Nigerian communications satellite ltd (Nigeria)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.