Global Fixed Asset Management Software Market

Market Size in USD Billion

CAGR :

%

USD

8.14 Billion

USD

18.85 Billion

2024

2032

USD

8.14 Billion

USD

18.85 Billion

2024

2032

| 2025 –2032 | |

| USD 8.14 Billion | |

| USD 18.85 Billion | |

|

|

|

|

Fixed Asset Management Software Market Size

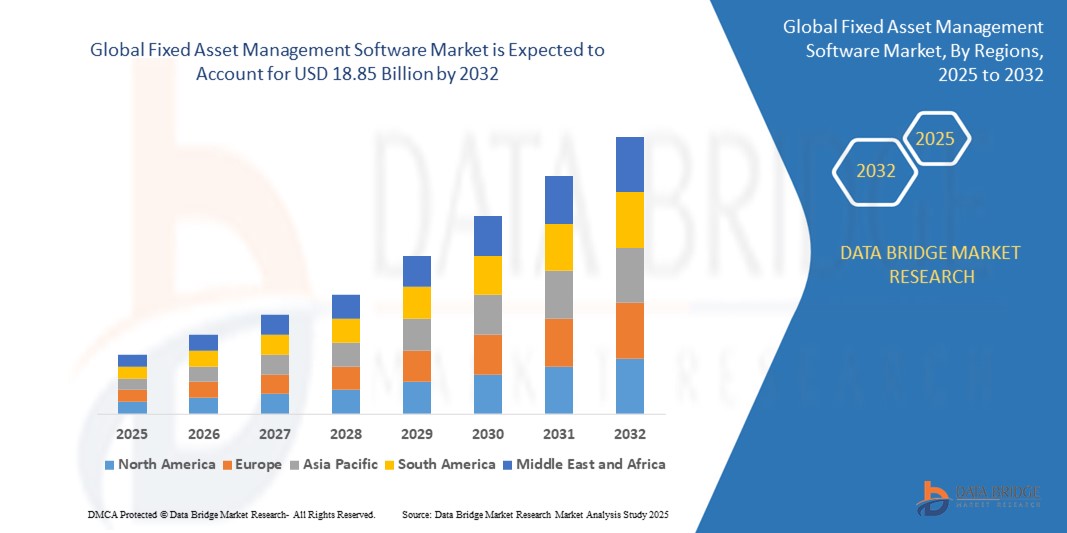

- The global fixed asset management software market size was valued at USD 8.14 billion in 2024 and is expected to reach USD 18.85 billion by 2032, at a CAGR of 11.07% during the forecast period

- The market growth is largely fuelled by the increasing need for efficient asset tracking and management, rising adoption of cloud-based solutions, and growing emphasis on regulatory compliance and operational efficiency across industries

- In addition, advancements in IoT and AI technologies are enhancing asset management capabilities, driving further adoption of fixed asset management software globally

Fixed Asset Management Software Market Analysis

- The fixed asset management software market is expanding due to increasing demand for streamlined asset tracking and improved operational visibility across various industries. Businesses are adopting advanced software solutions to enhance asset lifecycle management and reduce manual errors, improving overall productivity

- The integration of emerging technologies such as artificial intelligence and Internet of Things is transforming asset management by enabling real-time monitoring and predictive maintenance. This shift is helping organizations optimize asset utilization and lower maintenance costs, making the software increasingly valuable

- North America dominates the fixed asset management software market with the largest revenue share of 38.7% in 2024, driven by the widespread digitalization of enterprise operations, stringent compliance regulations, and high adoption of automation in asset tracking and accounting processes

- Asia-Pacific region is expected to witness the highest growth rate in the global fixed asset management software market, driven by rapid industrialization, increasing digital transformation initiatives, and rising adoption of cloud-based solutions across developing economies such as China, India, and Southeast Asia

- The software segment dominates the market with a revenue share of 65.4% in 2024, driven by the increasing adoption of automated asset management tools that enhance tracking accuracy and reporting efficiency

Report Scope and Fixed Asset Management Software Market Segmentation

|

Attributes |

Fixed Asset Management Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Fixed Asset Management Software Market Trends

“Growing Adoption of Cloud-Based Fixed Asset Management Solutions”

- There is a significant shift towards cloud-based fixed asset management software, as businesses seek scalable and flexible solutions that can be accessed remotely

- Cloud platforms enable real-time data updates and centralized management, which is particularly beneficial for organizations with multiple locations or global operations

- For instance, a multinational manufacturing company uses cloud-based software to monitor assets across different plants, improving coordination and reducing downtime

- In addition, cloud solutions often come with automated updates and enhanced security features, reducing IT overhead and ensuring compliance with data regulations

- Small and medium enterprises also benefit from cloud adoption, as it lowers upfront costs and offers subscription-based pricing models, making sophisticated asset management accessible without large capital investments

Fixed Asset Management Software Market Dynamics

Driver

“Increasing Need for Asset Lifecycle Optimization”

- Companies are focusing more on optimizing the entire lifecycle of their fixed assets, from acquisition to disposal, to reduce costs and improve asset utilization

- Fixed asset management software provides real-time visibility and analytics, helping businesses schedule timely maintenance and avoid unexpected downtime

- For instance, manufacturing firms use such software to track machinery performance and plan preventive maintenance, reducing costly breakdowns

- Similarly, healthcare institutions monitor medical equipment status to ensure compliance and operational efficiency

- This growing emphasis on asset lifecycle management is a key factor driving market growth

Restraint/Challenge

“High Implementation and Maintenance Costs”

- The initial investment required for deploying fixed asset management software can be significant, especially for small and medium-sized enterprises

- Ongoing maintenance expenses and the need for regular updates add to the total cost of ownership, making adoption challenging for budget-conscious organizations

- For instance, a small manufacturing company may hesitate to invest in comprehensive software due to limited financial resources

- In addition, organizations with complex asset portfolios face difficulties in integrating legacy systems with new software solutions, leading to increased costs and implementation delays

- These financial and technical barriers act as major challenges, limiting the widespread adoption of fixed asset management software

Fixed Asset Management Software Market Scope

The fixed asset management software market is segmented on the basis of component, deployment model, organization size, application, and end user.

By Component

On the basis of component, the fixed asset management software market is segmented into software and services. The software segment dominates the market with a revenue share of 65.4% in 2024, driven by the increasing adoption of automated asset management tools that enhance tracking accuracy and reporting efficiency.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for implementation, consulting, and technical support to optimize asset utilization and integration.

By Deployment Model

On the basis of deployment model, the fixed asset management software market is segmented into on-premises and cloud. The cloud segment holds a market share of 42.7% in 2024 and is projected to witness the fastest growth rate through 2032 due to its scalability, cost-effectiveness, and ease of remote access.

The on-premises deployment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing demand for data control, security, and compliance across highly regulated industries such as government and finance.

By Organization Size

On the basis of organization size, the fixed asset management software market is segmented into small and medium-sized enterprises and large enterprises. Large enterprises account for the largest share of 58.3% in 2024, driven by their extensive asset portfolios and regulatory compliance requirements.

The small and medium-sized enterprises is expected to witness the fastest growth rate from 2025 to 2032, due to rising awareness of asset optimization and growing adoption of affordable, scalable asset management solutions.

By Application

On the basis of application, the fixed asset management software market is segmented into accounting, tax management, asset tracking, asset management, document management, and others. Asset tracking dominates with a revenue share of 34.5% in 2024, fueled by the need for real-time monitoring and minimizing asset loss.

The accounting segment is expected to witness the fastest growth rate from 2025 to 2032, due to the rising need for accurate asset valuation, depreciation tracking, and compliance with evolving financial reporting standards.

By End User

On the basis of end user, the fixed asset management software market is segmented into manufacturing, energy and utilities, IT, telecom and media, transportation and logistics, healthcare and life sciences, and others. Manufacturing holds the largest market share of 29.8% in 2024, attributed to the critical need for managing heavy machinery and equipment.

The healthcare and life sciences segment is expected to witness the fastest growth rate from 2025 to 2032, due to growing investments in medical equipment tracking and stringent regulatory requirements for asset traceability and lifecycle management.

Fixed Asset Management Software Market Regional Analysis

- North America dominates the fixed asset management software market with the largest revenue share of 38.7% in 2024, driven by the widespread digitalization of enterprise operations, stringent compliance regulations, and high adoption of automation in asset tracking and accounting processes

- The region benefits from the presence of leading software providers, robust IT infrastructure, and growing demand for cloud-based solutions across industries such as manufacturing, IT, and healthcare

- Organizations in North America are increasingly leveraging fixed asset management software to improve asset lifecycle visibility, reduce operational costs, and ensure compliance with financial reporting standards

U.S. Fixed Asset Management Software Market Insight

The U.S. fixed asset management software market captured the largest revenue share of 82% in 2024 within North America, fueled by the early adoption of digital enterprise solutions and stringent audit and tax regulations. U.S. enterprises prioritize accurate asset tracking and depreciation management, especially amid growing investment in digital infrastructure. The demand for integrated solutions with ERP, tax, and accounting systems also contributes to the market’s expansion, particularly in industries with high-value equipment and compliance requirements.

Europe Fixed Asset Management Software Market Insight

The Europe fixed asset management software market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict regulatory frameworks, rising automation in asset-intensive sectors, and increased focus on asset optimization. European countries are increasingly adopting software tools to streamline depreciation calculation, audit readiness, and fixed asset planning. The push for sustainability and energy-efficient infrastructure also accelerates digital asset monitoring across public and private sectors.

U.K. Fixed Asset Management Software Market Insight

The U.K. fixed asset management software market is expected to witness the fastest growth rate from 2025 to 2032, driven by heightened demand for digital tools that improve financial accuracy and audit compliance. Businesses are increasingly adopting cloud-based asset management solutions to enhance operational efficiency and reduce manual errors. In addition, the UK's dynamic business environment, coupled with an expanding services sector, fuels software adoption across SMEs and large enterprises alike.

Germany Fixed Asset Management Software Market Insight

The Germany fixed asset management software market is expected to witness the fastest growth rate from 2025 to 2032, owing to the country’s strong manufacturing base and emphasis on industry 4.0 integration. German enterprises are investing in advanced asset management systems to track machinery, manage depreciation, and comply with stringent tax norms. The focus on sustainable operations and efficient capital asset planning is also driving software adoption in both public and private sectors.

Asia-Pacific Fixed Asset Management Software Market Insight

The Asia-Pacific fixed asset management software market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, infrastructure development, and growing awareness of digital asset management tools. Emerging economies such as India and Southeast Asia are seeing significant growth due to increasing IT investments, regulatory standardization, and rising adoption among SMEs. In addition, the shift toward cloud-based platforms and mobile access is accelerating software uptake across various industries.

Japan Fixed Asset Management Software Market Insight

The Japan fixed asset management software market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s advanced technology infrastructure and growing need for efficient asset tracking in sectors such as manufacturing, healthcare, and government. The emphasis on digital transformation, paired with an aging workforce, encourages the use of automated systems to maintain asset accuracy and ensure compliance with accounting standards. Integration with enterprise systems is becoming increasingly common to support real-time reporting and audit trails.

China Fixed Asset Management Software Market Insight

The China fixed asset management software market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, increasing investment in enterprise IT, and rising regulatory compliance. As China’s industrial and commercial sectors expand, businesses are adopting digital solutions to enhance visibility, reduce fraud, and manage capital assets efficiently. Local software vendors, government incentives, and the country’s position as a manufacturing hub are key drivers fueling robust market growth.

Fixed Asset Management Software Market Share

The Fixed Asset Management Software industry is primarily led by well-established companies, including:

- Infor (U.S.)

- SAP SE (Germany)

- Microsoft (U.S.)

- Oracle (U.S.)

- Sage Group plc (U.K.)

- Aptean (U.S.)

- Acumatica, Inc. (U.S.)

- Fluke Corporation (U.S.)

- AVEVA Group Limited (U.K.)

- Ramco Systems (India)

- ABB (Switzerland)

- Zoho Corporation Pvt. Ltd. (India)

- RCS Technologies (U.S.)

- Xero Limited (New Zealand)

- Spine Technologies (U.S.)

- Sensys Technologies Pvt Ltd. (India)

- VIRMATI SOFTWARE & TELECOMMUNICATIONS LTD (India)

- Real Asset Management Plc (U.K.)

Latest Developments in Global Fixed Asset Management Software Market

- In June 2022, the central government of Papua New Guinea launched a web-based fixed asset management system to improve financial management and reporting across the PNG Province. This system is designed to prevent asset theft, misuse, and abuse by providing enhanced transparency and accountability through detailed asset tracking, positively impacting governance and audit processes

- In March 2021, Sage, a prominent cloud-based business solutions provider, acquired Task Sheriff, an AI-powered software-as-a-service company. This acquisition aims to strengthen Sage’s artificial intelligence capabilities, with the Task Sheriff team joining Sage AI Labs—an international network of engineers and data scientists. This move is expected to accelerate innovation and drive advanced AI integration within the fixed asset management market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.