Global Fitness and Recreational Sports Centre Market Segmentation, By Type (Gymnasiums, Yoga, Aerobic Dance, Handball Sports, Racquet Sports, Skating, Swimming, and Others), Age Group (35 and Younger, 35-54, and 55 and Older), End-user (Men and Women) – Industry Trends and Forecast to 2031

Fitness and Recreational Sports Centre Market Analysis

The fitness and recreational sports centre market is witnessing significant growth driven by advancements in technology and innovative methods. One notable trend is the integration of wearable fitness technology, such as smartwatches and fitness trackers, which provides real-time data on health metrics. These devices enhance user engagement by allowing clients to monitor their progress and set personalized goals.

Moreover, the use of virtual reality (VR) in fitness training is emerging, offering immersive workout experiences that cater to various fitness levels. This technology not only makes workouts more engaging but also helps in reducing the dropout rates in fitness programs. Additionally, the rise of mobile fitness apps facilitates personalized training plans, nutrition tracking, and community support, further encouraging participation.

Furthermore, advancements in gym equipment, such as smart machines that adjust resistance based on user performance, are enhancing workout efficiency. The shift towards hybrid models, combining in-person and virtual classes, has also opened new revenue streams for fitness centres. Overall, these technological advancements and methods are pivotal in driving growth, attracting a diverse clientele, and ensuring long-term sustainability in the fitness and recreational sports centre market.

Fitness and Recreational Sports Centre Market Size

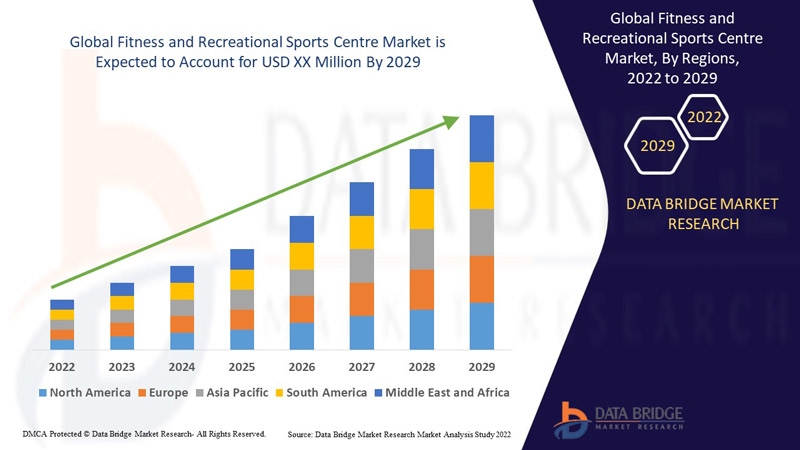

The global fitness and recreational sports centre market size was valued at USD 242.79 billion in 2023 and is projected to reach USD 350.59 billion by 2031, with a CAGR of 4.70% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Fitness and Recreational Sports Centre Market Trends

“Growing Popularity of Group Fitness Classes”

The fitness and recreational sports center market is experiencing significant growth driven by the rising popularity of group fitness classes. These classes, including spin, yoga, and high-intensity interval training (HIIT), foster community engagement and motivation among participants. For instance, In September 2020, Gold's Gym launched a new mobile app designed for tracking fitness goals and enhancing member engagement. This app featured personalized workout plans, progress tracking, and motivational tools, making it easier for users to stay on track with their fitness journeys. By embracing technology, Gold's Gym aimed to strengthen its connection with members, providing them with valuable resources to support their health and fitness aspirations.

Report Scope and Fitness and Recreational Sports Centre Market Segmentation

|

Attributes

|

Fitness and Recreational Sports Centre Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

24 Hour Fitness USA, LLC (U.S.), GOLD'S GYM (U.S.), Planet Fitness Franchising, LLC (U.S.), Life Time, Inc. (U.S.), RSG Group (Germany), CrossFit, LLC (U.S.), Fitness First India Pvt Ltd (India), KONAMI (Japan), David Lloyd Leisure Ltd (U.K.), Town Sports International (U.S.), Fitness First (U.K.), and Virgin Active (U.K.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Fitness and Recreational Sports Centre Market Definition

A fitness and recreational sports center is a facility designed to promote health, wellness, and physical activity through a variety of programs and amenities. These centers typically offer gymnasiums, weight training areas, swimming pools, and group exercise classes, catering to individuals of all fitness levels. They also provide recreational activities such as basketball, volleyball, and racquet sports. Many centers host community events, workshops, and fitness assessments to encourage participation and engagement. Additionally, they may offer personal training services, nutritional counseling, and youth sports programs, fostering a supportive environment for individuals and families to improve their physical fitness and overall well-being.

Fitness and Recreational Sports Centre Market Dynamics

Drivers

- Rising Obesity Rates

The increasing prevalence of obesity, which affects over 42% of adults in the U.S., has intensified the search for effective fitness solutions. This alarming trend has led to a growing number of individuals seeking out recreational centers as vital resources for weight management and overall health improvement. Facilities offering specialized programs, such as weight loss boot camps, personal training sessions, and nutrition counseling, cater to those looking to shed pounds and adopt healthier lifestyles. For instance, organizations such as Planet Fitness and Anytime Fitness have seen significant membership growth, driven by their focus on affordable access to exercise and supportive environments for those tackling obesity-related challenges.

- Growing Youth Sports Participation

The increasing emphasis on youth sports participation is significantly driving the fitness and recreational sports center market. Families are recognizing the importance of physical activity for children’s development, leading to higher enrollment in various sports programs. For instance, In July 2020, Life Time Fitness debuted a new line of fitness apparel tailored for active lifestyles. This collection was designed to provide comfort, style, and performance, catering to a wide range of fitness enthusiasts. The launch not only showcased the brand's commitment to quality but also aimed to strengthen its market presence by expanding beyond fitness facilities into the apparel industry, promoting a holistic approach to health and wellness.

Opportunities

- Flexibility in Membership Plans

The introduction of flexible membership options, such as pay-per-visit, short-term memberships, and no-commitment trial periods, creates significant opportunities in the fitness market. These plans cater to diverse consumer needs, attracting those who may be hesitant to commit long-term due to financial concerns or uncertain workout habits. For instance, In June 2020, 24 Hour Fitness launched an exciting new line of fitness equipment designed to meet the diverse needs of its members. This launch aimed to enhance workout experiences, offering innovative and high-quality options for strength training and cardio exercises. The introduction of this equipment reflects the company’s commitment to providing effective fitness solutions and keeping pace with industry trends, ultimately enhancing member satisfaction and engagement.

- Increasing Health Awareness

The rising emphasis on health and wellness among consumers is creating significant opportunities in the fitness and recreational sports center market. As individuals become more conscious of the benefits of regular physical activity, many seek memberships in fitness centers to enhance their overall well-being. For instance, In August 2020, Planet Fitness unveiled a new virtual fitness platform, adapting to the changing landscape of fitness amid the pandemic. This innovative platform offered members a variety of online workouts, live classes, and training sessions accessible from the comfort of their homes. The introduction of the virtual platform was a strategic move to maintain engagement and provide value to members during unprecedented times, emphasizing convenience and community.

Restraints/Challenges

- High Operational Costs

High operational costs significantly hinder the fitness and recreational sports center market. Maintaining facilities incurs substantial expenses, including rent, utilities, equipment maintenance, and staff salaries. These costs create a barrier for new entrants, making it difficult for them to establish competitive pricing or comprehensive services. Existing centers also face profitability challenges, as rising operational expenses can squeeze margins, leading to potential service reductions or facility neglect. This financial strain may force centers to limit offerings, impacting customer satisfaction and retention. Consequently, high operational costs can stifle innovation and growth within the market, hindering overall development and competitiveness.

- Changing Consumer Preferences

Changing consumer preferences significantly hinder the fitness and recreational sports center market. As health and fitness trends evolve, there is a noticeable shift towards specialized offerings such as high-intensity interval training (HIIT), yoga, and wellness programs. Consumers increasingly seek personalized and varied workout experiences that cater to specific goals, such as weight loss, strength training, or mental wellness. Fitness centers that fail to adapt to these shifting demands risk alienating their existing clientele and losing potential members. This inability to innovate or diversify services can lead to decreased membership retention and overall market share, ultimately impacting revenue and long-term sustainability for these facilities.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Fitness and Recreational Sports Centre Market Scope

The market is segmented on the basis of type, age group and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Gymnasiums

- Yoga

- Aerobic Dance

- Handball Sports

- Racquet Sports

- Skating

- Swimming

- Others

Age Group

- 35 and Younger

- 35-54

- 55 and Older

End-user

- Men

- Women

Fitness and Recreational Sports Centre Market Regional Analysis

The market is analyzed and market size insights and trends are provided by type, age group and end-user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to be the fitness and recreational sports centre market leader, driven by the highest number of gym members and gyms in the U.S. The region's growing health consciousness, coupled with a rising emphasis on wellness and physical fitness, fuels demand for fitness facilities. Additionally, innovative offerings and advanced training programs further enhance the attractiveness of these centres, solidifying North America's dominant position in the market.

Asia-Pacific is expected to score the highest CAGR in the fitness and recreational sports center market, driven by increasing health concerns among consumers. The growing middle-class population, coupled with rising female participation in health clubs, contributes significantly to this trend. Additionally, greater awareness of fitness benefits and an expanding range of fitness facilities are further fueling market growth in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Fitness and Recreational Sports Centre Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Fitness and Recreational Sports Centre Market Leaders Operating in the Market Are:

- 24 Hour Fitness USA, LLC (U.S.)

- GOLD'S GYM (U.S.)

- Planet Fitness Franchising, LLC (U.S.)

- Life Time, Inc. (U.S.)

- RSG Group (Germany)

- CrossFit, LLC (U.S.)

- Fitness First India Pvt Ltd (India)

- KONAMI (Japan)

- David Lloyd Leisure Ltd (U.K.)

- Town Sports International (U.S.)

- Fitness First (U.K.)

- Virgin Active (U.K.)

Latest Developments in Fitness and Recreational Sports Centre Market

- In April 2023, the LeisureLink Partnership announced an exciting extension to ANGUSalive, enhancing accessibility for fitness enthusiasts. This collaboration allows members of the Shetland Recreational Trust's MORE4life program to enjoy a range of activities, including gym access, public swimming, and fitness classes. Members can take advantage of these offerings at various leisure centers located throughout Aberdeen, Argyll and Bute, the Borders, Highland, Moray, Orkney, and the Western Isles all at no additional cost

- In December 2022, Lincoln University forged a partnership with the Linc Wellness and Recreation Center and Studio, aimed at promoting health and fitness among students and staff. This collaboration will enhance the wellness programs available on campus, offering a wide range of recreational activities, fitness classes, and wellness resources. The initiative underscores the university's commitment to fostering a healthy lifestyle within its community

- In August 2020, 24 Hour Fitness underwent a significant transformation when it was acquired by the private equity firm AEA Investors. This acquisition marked a pivotal moment for the company as it sought to revitalize its brand and improve its offerings. Under new management, 24 Hour Fitness aimed to enhance its services and expand its reach in the competitive fitness industry, focusing on member experience and facility upgrades

- In September 2020, Life Time Fitness was similarly acquired by the private equity firm Leonard Green & Partners, signaling a strategic shift for the brand. This acquisition aimed to leverage financial resources for growth and innovation, allowing Life Time Fitness to enhance its facilities and expand its wellness programs. The partnership positioned the company to better compete in the evolving fitness landscape by focusing on member engagement and premium services

SKU-