Global Financial Statement Fraud Market

Market Size in USD Billion

CAGR :

%

USD

20.80 Billion

USD

82.53 Billion

2021

2029

USD

20.80 Billion

USD

82.53 Billion

2021

2029

| 2022 –2029 | |

| USD 20.80 Billion | |

| USD 82.53 Billion | |

|

|

|

|

Market Analysis and Size

The spread of machine learning (ML) in various fields benefits both consumers and companies in the anti-money laundering software market. Stakeholders in the value chain are increasing their profits with the help of ML, because the novel technique aids in the detection of previously undetected patterns. As a result, companies in the financial statement fraud market are developing solutions that integrate with MI and cloud computing.

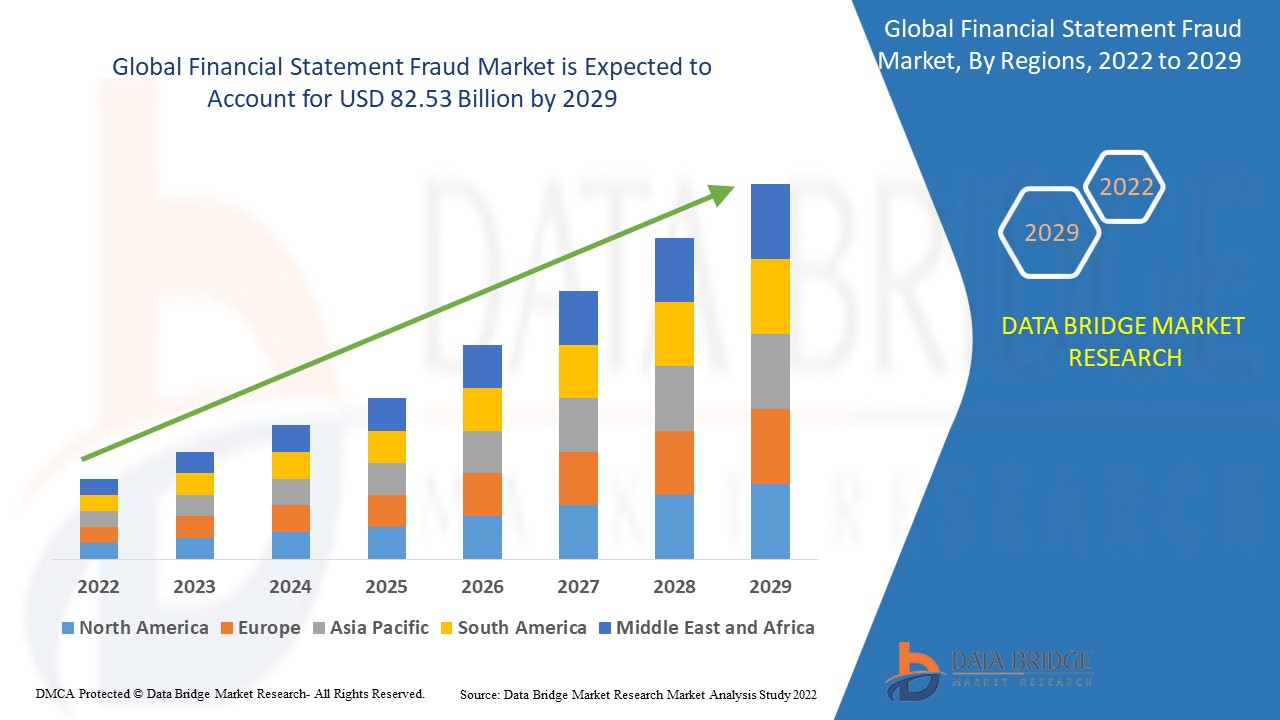

Data Bridge Market Research analyses that the financial statement fraud market was valued at USD 20.8 billion in 2021 and is expected to reach the value of USD 82.53 billion by 2029, at a CAGR of 18.80% during the forecast period of 2022 to 2029.

Market Definition

Overstating assets, revenues, and profits while understating liabilities, expenses, and losses is the essence of financial statement fraud. It is essentially the incorrect presentation of an enterprise's financial condition accomplished through intentional misstatement or disclosures in financial statements to defraud financial statement users. Accounting fraud is defined by the Association of Certified Fraud Examiners (ACFE) as "deception or misrepresentation that an individual or entity makes knowing that the misrepresentation may result in some unauthorised benefit to the individual, the entity, or some other party.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Form (Overstating Revenues, Inflating an Asset's Net Worth, Hiding Obligations/Liabilities, Incorrectly Disclosing Related-Party Transactions), Warning Sign (Accounting Anomalies, Consistent Sales Growth, Depreciation Methods, Weak Internal Corporate Governance, Outsized Frequency of Complex Third-Party Transactions, Missing Paperwork, Incentivizes Fraud), Detection Method (Horizontal Financial Statement Analysis, Vertical Financial Statement Analysis), Application (Defence, Government, Banks & Financial Institutions, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Global, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Altergy. (US), SAP SE (Germany), Coupa Software Inc. (US), Procurify (Canada), IBM (US), TRADOGRAM. (Canada), Fraxion. (US), SutiSoft, Inc. (India), Sievo (Finland), GEP (US), Empronc Solutions Pvt. Ltd. (India), Sage Intacct, Inc. (US), Touchstone Group Plc (UK) |

|

Opportunities |

|

Financial Statement Fraud Market Dynamics

Drivers

- Surge in adoption of advanced fraud-prevention techniques in the military and banking sectors

Rising demand for advanced fraud-prevention techniques, increased application of security in the military and banking sectors and the growing need to protect financial losses due to increasing threats are some of the factors that will likely boost the growth of the financial statement fraud market during the forecast period of 2022-2029. Rising use of artificial intelligence and machine learning will create numerous opportunities, leading to the growth of the financial statement fraud market during the forecast period.

- Rising popularity of digital transactions around the world

The rising popularity of transaction monitoring among consumers and the growing need to obtain a comprehensive view of data to combat financial crimes threatening the financial landscape are both influencing the financial statement fraud market. Furthermore, increased IT spending, financial institutions' focus on digital payment-related issues, rapid digitization, and increased enterprise investment benefit the financial statement fraud market. Furthermore, the integration of AI, ML, and big data technologies, as well as the widespread use of advanced analytics in financial statement, creates profitable opportunities for financial statement fraud market participants during the forecast period.

Opportunity

Rising adoption of cloud-based security solutions to improve productivity and efficiency, rising instances of security breaches and data breaches, and an increase in the number of research and development capabilities by major players are some of the other factors driving market growth.

Restraints

The market's growth will be limited by a lack of technological competence in developing and undeveloped nations, as well as the difficulty of software installation and configuration. Furthermore, the market's growth pace will be slowed still again by a drop in awareness and in backward economies, as well as the high expenses of adopting software. Market growth rates would also be hampered by the lack of solid infrastructure in backward economies.

This financial statement fraud market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the financial statement fraud market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Financial Statement Fraud Market

In this COVID-19 scenario, each country's national lockdown has increased the market span of digital technologies. This has simplified people's daily lives, but it has also opened the door for fraudsters and money launderers, as they can now access critical information from digital platforms by hacking them. The worst-affected healthcare industry is fighting multiple battles, as the urgency of hospitals and healthcare institutions to resurrect the IT systems under attack and avoid a negative impact on treatments due to stalled systems makes them attractive targets for cybercriminals. These developments demonstrate to the rest of the world that the healthcare industry is committed to overcoming the current crisis and moving forward toward its long-term objectives.

Recent Development

- NICE Actimize will improve SURVEIL-X, a comprehensive trade surveillance solution, in July 2020. SURVEIL-X has been enhanced with self-service analytics for custom risk detection. Financial Services Organizations (FSOs) can use SURVEIL-X Studio to quickly create, test, and deploy custom analytics risk detection models to close regulatory and operational risk gaps.

- NICE Actimize launched CDD-X in April 2019 to modernise KYC/CDD programmes with advanced analytics and the power of AI. The powerful combination of AI technology and NICE Actimize's expertise in KYC/CDD reduces customer review time by up to 70% and improves high-risk customer management accuracy.

Global Financial Statement Fraud Market Scope

The financial statement fraud market is segmented on the basis of form, warning sign, detection method, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Form

- Overstating Revenues

- Inflating an Asset's Net Worth

- Hiding Obligations/Liabilities

- Incorrectly Disclosing Related-Party Transactions

Warning Sign

- Accounting Anomalies

- Consistent Sales Growth

- Depreciation Methods

- Weak Internal Corporate Governance

- Outsized Frequency of Complex Third-Party Transactions

- Missing Paperwork

- Incentivizes Fraud

Detection method

- Horizontal Financial Statement Analysis

- Vertical Financial Statement Analysis

Application

- Defence

- Government

- Banks & Financial Institutions

- Others

Financial Statement Fraud Market Regional Analysis/Insights

The financial statement fraud market is analysed and market size insights and trends are provided by country, form, warning sign, detection method, and application as referenced above.

The countries covered in the financial statement fraud market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Global, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa.

Europe dominates the financial statement fraud market and will maintain its dominance throughout the forecast period due to the rise of cybersecurity threats, rapid adoption of financial statement fraud by various banks and finance industries to manage various types of risk, and the presence of prominent key players.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Financial Statement Fraud Market Share Analysis

The financial statement fraud market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to financial statement fraud market.

Some of the major players operating in the financial statement fraud market are:

- Altergy. (US)

- SAP SE (Germany)

- Coupa Software Inc. (US)

- Procurify (Canada)

- IBM (US)

- TRADOGRAM (Canada)

- Fraxion (US)

- SutiSoft, Inc. (India)

- Sievo (Finland)

- GEP (US)

- Empronc Solutions Pvt. Ltd. (India)

- Sage Intacct, Inc. (US)

- Touchstone Group Plc (UK)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FINANCIAL STATEMENT FRAUD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FINANCIAL STATEMENT FRAUD MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL FINANCIAL STATEMENT FRAUD MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 GLOBAL FINANCIAL STATEMENT FRAUD MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1. STRATEGY CONSULTING

6.3.2.2. TRAINING AND EDUCATION

6.3.2.3. DEPLOYMENT AND INTEGRATION

6.3.2.4. SUPPORT AND MAINTENANCE

7 GLOBAL FINANCIAL STATEMENT FRAUD MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 CLOUD

7.3 ON-PREMISES

8 GLOBAL FINANCIAL STATEMENT FRAUD MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISES

8.3 SMALL AND MEDIUM ENTERPRISE (SMES)

9 GLOBAL FINANCIAL STATEMENT FRAUD MARKET, BY METHOD

9.1 OVERVIEW

9.2 OVERSTATEMENT OF THE ASSETS

9.3 MISAPPLICATION OF THE GAAP RULES

9.4 MISREPRESENTATION OF INFORMATION

9.5 UNDERSTATEMENT OF EXPENSES

9.6 UNDERSTATEMENT OF LIABILITIES

9.7 OTHERS

10 GLOBAL FINANCIAL STATEMENT FRAUD MARKET, BY DETECTION TYPE

10.1 OVERVIEW

10.2 HORIZONTAL FINANCIAL STATEMENT ANALYSIS

10.3 VERTICAL FINANCIAL STATEMENT ANALYSIS.

11 GLOBAL FINANCIAL STATEMENT FRAUD MARKET, BY END USER

11.1 OVERVIEW

11.2 BANKS

11.2.1 BY TYPE

11.2.1.1. CORPORATE AND TAXATION BANKING

11.2.1.2. RETAIL BANK

11.2.2 BY OFFERING

11.2.2.1. SOFTWARE

11.2.2.2. SERVICES

11.3 CREDIT UNIONS

11.3.1 BY OFFERING

11.3.1.1. SOFTWARE

11.3.1.2. SERVICES

11.4 SPECIALTY FINANCE

11.4.1 BY OFFERING

11.4.1.1. SOFTWARE

11.4.1.2. SERVICES

11.5 THRIFTS

11.5.1 BY OFFERING

11.5.1.1. SOFTWARE

11.5.1.2. SERVICES

11.6 CAPITAL MARKET

11.6.1 BY OFFERING

11.6.1.1. SOFTWARE

11.6.1.2. SERVICES

12 GLOBAL FINANCIAL STATEMENT FRAUD MARKET, BY GEOGRAPHY

12.1 GLOBAL FINANCIAL STATEMENT FRAUD MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1.1 NORTH AMERICA

12.1.1.1. U.S.

12.1.1.2. CANADA

12.1.1.3. MEXICO

12.1.2 EUROPE

12.1.2.1. GERMANY

12.1.2.2. FRANCE

12.1.2.3. U.K.

12.1.2.4. ITALY

12.1.2.5. SPAIN

12.1.2.6. RUSSIA

12.1.2.7. TURKEY

12.1.2.8. BELGIUM

12.1.2.9. NETHERLANDS

12.1.2.10. SWITZERLAND

12.1.2.11. REST OF EUROPE

12.1.3 ASIA PACIFIC

12.1.3.1. JAPAN

12.1.3.2. CHINA

12.1.3.3. SOUTH KOREA

12.1.3.4. INDIA

12.1.3.5. AUSTRALIA

12.1.3.6. SINGAPORE

12.1.3.7. THAILAND

12.1.3.8. MALAYSIA

12.1.3.9. INDONESIA

12.1.3.10. PHILIPPINES

12.1.3.11. REST OF ASIA PACIFIC

12.1.4 SOUTH AMERICA

12.1.4.1. BRAZIL

12.1.4.2. ARGENTINA

12.1.4.3. REST OF SOUTH AMERICA

12.1.5 MIDDLE EAST AND AFRICA

12.1.5.1. SOUTH AFRICA

12.1.5.2. EGYPT

12.1.5.3. SAUDI ARABIA

12.1.5.4. U.A.E

12.1.5.5. ISRAEL

12.1.5.6. REST OF MIDDLE EAST AND AFRICA

12.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIESS

13 GLOBAL FINANCIAL STATEMENT FRAUD MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL FINANCIAL STATEMENT FRAUD MARKET, SWOT & DBMR ANALYSIS

15 GLOBAL FINANCIAL STATEMENT FRAUD MARKET, COMPANY PROFILE

15.1 DIGITAL RESOLVE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 KOUNT INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 SIGNIFY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 ACTICO GMBH

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 GLOBALVISION SYSTEMS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ORACLE

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 PROTIVITI INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 BOTTOMLINE TECHNOLOGIES (DE), INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 WNS (HOLDINGS) LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 CAPGEMINI SE

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 IBM

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 SAS INSTITUTE, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 CONCLUSION

17 RELATED REPORTS

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.