Global Filament Tapes Market, By Filament Type (Single Sided Tapes, Double Sided Tapes), Backing Adhesive Type (Plastic Film, Paper, Fabric, Foam), Adhesive Type (Rubber Based, Acrylic Based, Hot Melt Adhesive), Width (12 mm, 18 mm, 24 mm, 36 mm, 48 mm, 72 mm, 96 mm), Application (Bundling, Strapping, Insulation, Carton Sealing, Sealing, Others), End Use (Shipping and Logistics, Building and Construction, Food and Beverages, Electrical and Electronics, Automotive, Healthcare and Hygiene, Printing, Metalworking, Oil and Gas, General Industrial, Consumer Goods, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

Over the forecast period, the market for filament tapes is expected to accelerate due to its popularity due to its ability to provide lightweight packaging solutions for various end-user industries. Additionally, an increase in the introduction of improved filament tapes is also anticipated to fuel market expansion. For instance, Tesa SE introduced a new line of premium filament tapes with fiberglass reinforcements in October 2018. When conventional strapping tapes are unable to endure extremely large loads, severe degrees of abrasion, or high shear forces, the new filament tapes offer durability.

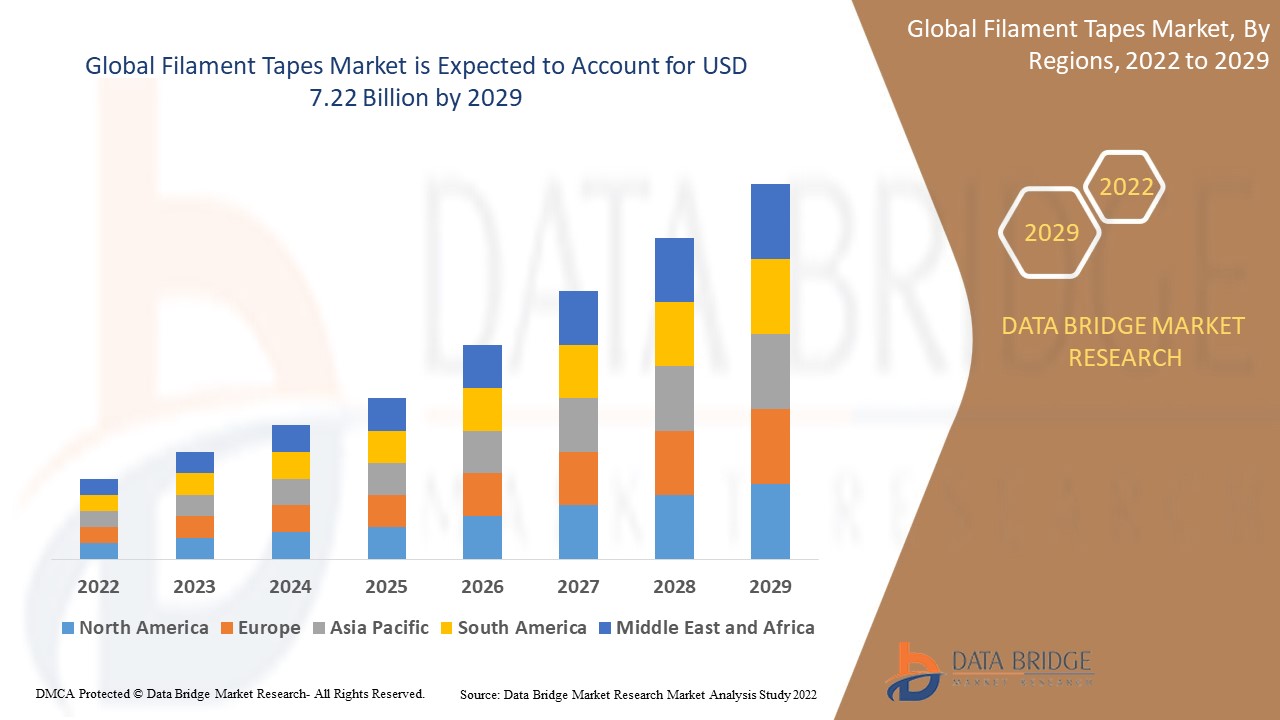

Global filament tapes market was valued at USD 3.87 billion in 2021 and is expected to reach USD 7.22 billion by 2029, registering a CAGR of 8.10% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Filament Type (Single Sided Tapes, Double Sided Tapes), Backing Adhesive Type (Plastic Film, Paper, Fabric, Foam), Adhesive Type (Rubber Based, Acrylic Based, Hot Melt Adhesive), Width (12 mm, 18 mm, 24 mm, 36 mm, 48 mm, 72 mm, 96 mm), Application (Bundling, Strapping, Insulation, Carton Sealing, Sealing, Others), End Use (Shipping and Logistics, Building and Construction, Food and Beverages, Electrical and Electronics, Automotive, Healthcare and Hygiene, Printing, Metalworking, Oil and Gas, General Industrial, Consumer Goods, Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia- Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, UAE, Egypt, Israel, Rest of Middle East and Africa

|

|

Market Players Covered

|

3M (U.S), Nippon Industries (Japan), Gripking Tapes India Pvt. Ltd., (India), PPM Industries SpA (Italy), PIONEER CORPORATION (Japan), Szxinst (China), Ajit Industries Pvt. Ltd. (India), Nitto Denko Corporation (Japan), Tesa Tapes (Germany), AVERY DENNISON CORPORATION (U.S.), Scapa (U.K.), Lohmann GmbH & Co. Kg (Germany), Mactac, LLC (U.S.), JTAPE LTD. (U.K.), Decofix Papers & Tapes (India), LINTEC Corporation (Japan), Shurtape Technologies, LLC (U.S.), Tape India (India) and VITS TECHNOLOGY GMBH (Germany)

|

|

Market Opportunities

|

|

Market Definition

Filament tapes are typically utilized as packing adhesive to seal the heavy-duty boxes or other materials. The watertight and chemical-resistance of the filament tapes make them perfect for sealing hazardous items, wrapping pipeline and cable, securing weak plastics, and moving heavy things and reinforcing plastic components. There are three grades of products: low, medium, and high.

Filament Tapes Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Growth In Usage due to Beneficial Features

The filament tapes are employed for indoor and outdoor applications due to their superior stress strength over glue or twine. The customer base anticipated that the market expansion of filament tapes with multiple uses, easy removal, and convenient application would be supported. Additionally, the filament tapes are used in heavy packaging due to their strength and tear resistance, and are thus appropriate for use in the automobile, FMCG, building, and construction industries. The marine and logistics industries use filaments as a result of the rise of the filament industry because brand owners and service providers opt to bundle and consolidate the filament tape to enable bulk transit.

- Surging Usage across Automotive

The developing automotive industry increases the demand for filament tape. Since manufacturers are paying more attention to brake and engine noise reduction and are using contemporary thermoplastics and vinyl as vibratory damping materials, it is predicted that these factors will cause the growth of the gasoline market. These motors employ this dampening substance and high-power filament tapes. It is anticipated that the use of filament tape will encourage its commercial development.

Furthermore, the rising usages of tapes in heavy packaging and easy availability of raw material will further propel the growth rate of filament tapes market. The growth of the e-commerce and industrial growth for FMCG will drive market value growth. The rising number of infrastructure development projects and rapid urbanization are other market growth determinants.

Opportunities

- Advancement in Technology and Adoption of Eco-Friendly Process

The increasing adoption of advanced technology such as acrylic adhesive by the market players extends profitable opportunities to the market players in the forecast period of 2022 to 2029. Additionally, the growing adoption of eco-friendly production processes for developing these tapes will further expand the future growth of the filament tapes market.

Restraints/Challenges

- Volatility In The Prices Of Raw Material

The raw materials used for manufacturing these tapes have fluctuations associated with their cost. This will create hindrances for the growth of the filament tapes market.

- Stringent Regulations

The various stringent government laws and regulations on filament tape will prove to be a demerit for the filament tapes market. Therefore, this will challenge the filament tapes market growth rate.

This filament tapes market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the filament tapes market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Filament Tapes Market

The recent outbreak of coronavirus had a positive influence on the filament tapes market. The market for filament tapes has benefited from the arrival of the COVID-19 global pandemic. The market for filament tapes is anticipated to increase because to the rapid development of e-commerce. The primary application of filament tapes was for carton screening, then for isolation and bundling.

However, pandemic has disrupted the supply and distribution system, causing countries to enact lock-down. The change in commercial and sales activity affected the final product. There is a gap between supply and demand as a result of the closure of hypermarkets and convenience stores. As the FMCG and e-commerce sectors expand, strong packaging is needed for cartons being transported to prevent damage. The emergence of COVID-19 has had significant effects on other industries, including the automotive and consumer goods industries, thus the market CAGR would be quite low as compared to its prior year.

Recent Development

- In September 2021, The launch of a new line of tapes produced from recyclable and biodegradable materials was announced by Ajit Industries Private Limited (AIPL). The product line consists of kraft paper tapes that are water activated and self-adhesive.

Global Filament Tapes Market Scope

The filament tapes market is segmented on the basis of filament type, backing adhesive type, adhesive type, width, end-use, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Filament Type

- Single Sided Tapes

- Double Sided Tapes

Backing Adhesive Type

- Plastic Film

- Paper

- Fabric

- Foam

Adhesive Type

- Rubber Based

- Acrylic Based

- Hot Melt Adhesive

Width

- 12 mm

- 18 mm

- 24 mm

- 36 mm

- 48 mm

- 72 mm

- 96 mm

Application

- Bundling

- Strapping

- Insulation

- Carton Sealing

- Sealing

- Others

End Use

- Shipping and Logistics

- Building and Construction

- Food and Beverages

- Electrical and Electronics

- Automotive

- Healthcare and Hygiene

- Printing

- Metalworking

- Oil and Gas

- General Industrial

- Consumer Goods

- Others

Filament Tapes Market Regional Analysis/Insights

The filament tapes market is analyzed and market size insights and trends are provided by country, filament type, backing adhesive type, adhesive type, width, end-use, and application as referenced above.

The countries covered in the filament tapes market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the filament tapes market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2022-2029. The market growth over this region is attributed to the rising demand for biodegradable pressure sensitive adhesive due to its eco-friendly qualities within the region.

Asia-Pacific on the other hand, is estimated to show lucrative growth over the forecast period of 2022-2029, due to the simple accessibility of labor and raw materials at reasonable prices, as well as the rising levels of investment in the form of foreign direct investment by the leading manufacturers across the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Filament Tapes Market Share Analysis

The filament tapes market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to filament tapes market.

Some of the major players operating in the filament tapes market are

- 3M (U.S.)

- Nippon Industries (Japan)

- Gripking Tapes India Pvt. Ltd., (India)

- PPM Industries SpA (Italy)

- PIONEER CORPORATION (Japan)

- Szxinst (China)

- Ajit Industries Pvt. Ltd. (India)

- Nitto Denko Corporation (Japan)

- Tesa Tapes (Germany)

- AVERY DENNISON CORPORATION (U.S.)

- Scapa (U.K.)

- Lohmann GmbH & Co. Kg (Germany)

- Mactac, LLC (U.S.)

- JTAPE LTD. (U.K.)

- Decofix Papers & Tapes (India)

- LINTEC Corporation (Japan)

- Shurtape Technologies, LLC (U.S.)

- Tape India (India)

- VITS TECHNOLOGY GMBH (Germany)

SKU-