Global Fiberglass Pipes Market

Market Size in USD Billion

CAGR :

%

USD

4.65 Billion

USD

6.81 Billion

2024

2032

USD

4.65 Billion

USD

6.81 Billion

2024

2032

| 2025 –2032 | |

| USD 4.65 Billion | |

| USD 6.81 Billion | |

|

|

|

|

Fiberglass Pipes Market Size

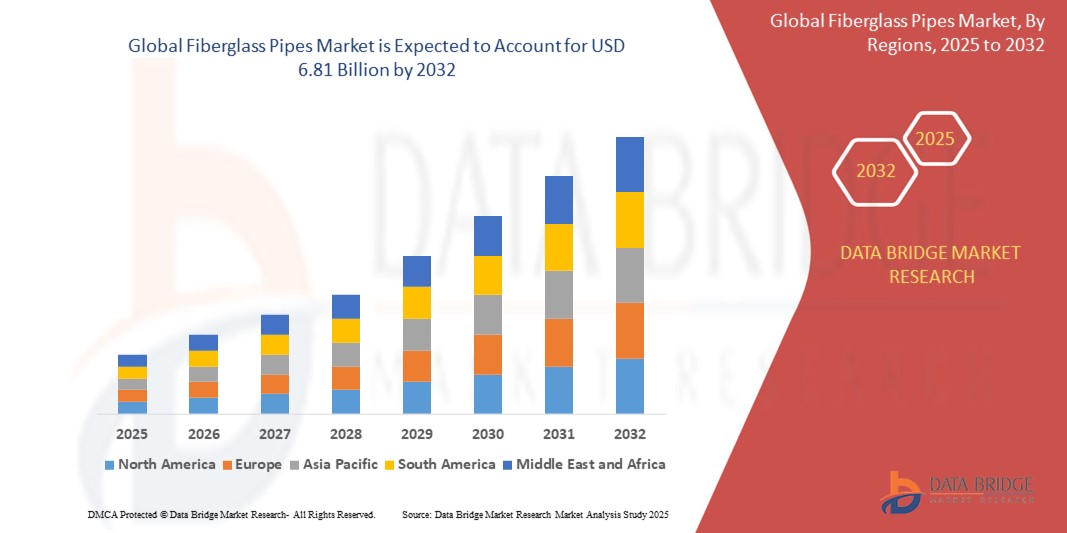

- The global fiberglass pipes market was valued at USD 4.65 billion in 2024 and is expected to reach USD 6.81 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.9%, primarily driven by the growing demand from the oil & gas industry

- This growth is driven as Fiberglass pipes offer superior resistance to corrosion compared to traditional metal pipes, making them ideal for transporting oil, gas, and corrosive fluids in upstream and downstream operations.

Fiberglass Pipes Market Analysis

- Fiberglass pipes are increasingly used in oil & gas for their corrosion resistance, light weight, and long service life, especially in offshore and high-pressure environments.

- Developing countries are boosting demand through infrastructure upgrades and irrigation projects, where fiberglass pipes offer low maintenance and cost-effective solutions.

- Glass Reinforced Epoxy (GRE) pipes and E-glass fibers dominate the market due to their durability and efficiency in aggressive chemical and thermal conditions.

- Rising environmental regulations and the need for sustainable piping solutions are pushing industries to replace conventional metal pipes with fiberglass alternatives.

Report Scope and Fiberglass Pipes Market Segmentation

|

Attributes |

Fiberglass Pipes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fiberglass Pipes Market Trends

Growing Adoption of Corrosion-Resistant Fiberglass Pipes in Harsh Industrial Environments

- Fiberglass pipes offer excellent chemical and thermal resistance, making them suitable for environments with extreme temperatures and exposure to aggressive chemicals.

- This makes them ideal for applications in chemical processing, desalination, and wastewater treatment.

- While the initial investment in fiberglass pipes may be higher, their long-term benefits include reduced maintenance costs and extended service life.

- Their resistance to corrosion minimizes the need for frequent inspections and repairs, leading to significant cost savings over time.

- For instance, Chevron has implemented fiberglass pipes in certain chemical injection and wastewater systems to reduce corrosion-related failures in offshore facilities, cutting maintenance downtime.

- The increasing adoption of corrosion-resistant fiberglass pipes across various industries is driven by their durability, cost-effectiveness, and alignment with environmental sustainability goals. As industries continue to seek reliable and long-lasting piping solutions, the demand for fiberglass pipes is expected to grow.

Fiberglass Pipes Market Dynamics

Driver

Growing Demand from the Oil & Gas Industry

- Fiberglass pipes offer superior resistance to corrosion compared to traditional metal pipes, making them ideal for transporting oil, gas, and corrosive fluids in upstream and downstream operations.

- Their lightweight nature reduces transportation and installation costs, especially in remote or offshore oilfields where logistics are complex and costly.

- Fiberglass pipes can withstand extreme temperatures and pressures, which is critical for oil & gas exploration and production in challenging environments.

- Although initial costs may be higher, the lower maintenance requirements and longer service life result in significant cost savings over time, making fiberglass pipes economically attractive.

For instance,

- Saudi Aramco has increasingly adopted fiberglass reinforced plastic (FRP) pipes for water injection and oil field pipelines due to their excellent corrosion resistance in saline environments.

- The oil & gas sector's need for durable, low-maintenance, and corrosion-resistant piping solutions is a key driver fueling the growth of the global fiberglass pipes market.

Opportunity

Offshore Oil & Gas Infrastructure Modernization

- The many offshore oil & gas facilities are operating beyond their intended lifespans, prompting demand for durable, corrosion-resistant materials like fiberglass pipes for refurbishment and replacement projects.

- Unlike metal pipes, fiberglass pipes are not susceptible to seawater corrosion, making them ideal for use in offshore platforms, risers, and subsea pipelines.

- Fiberglass pipes are significantly lighter than steel, reducing transportation and installation costs, especially in offshore environments where logistics are complex and costly.

- Growing safety and environmental regulations in the offshore sector encourage the adoption of reliable, leak-proof piping systems—where fiberglass offers a long-term, low-risk solution.

- As offshore oil & gas operators modernize aging infrastructure and seek materials with better performance and lower maintenance needs, fiberglass pipes emerge as a strategic, cost-effective alternative poised for expanded adoption.

Restraint/Challenge

High Installation and Maintenance Costs

- Fiberglass pipes often require significant initial investment compared to traditional materials like steel or PVC, making them less attractive for cost-sensitive projects.

- Their lightweight yet brittle nature demands careful transportation and installation, often requiring trained personnel and specific tools, adding to labor and logistics costs.

- Maintenance and repair of fiberglass pipes are more complex, as field repairs demand specialized materials and expertise to ensure integrity and durability.

- In many regions, a shortage of technicians trained in fiberglass installation and repair leads to higher labor charges and project delays.

- While fiberglass pipes offer advantages like corrosion resistance and low weight, their high installation and maintenance costs remain a barrier to widespread adoption, especially in cost-sensitive or remote infrastructure projects.

Fiberglass Pipes Market Scope

The market is segmented on the basis of type, fibre type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Fibre Type |

|

|

By Application |

|

Fiberglass Pipes Market Regional Analysis

Asia-Pacific is the Dominant Region in the Fiberglass Pipes Market

- Asia-Pacific dominates the fiberglass pipes market with shares 42.14%, due to growth and expansion of various end user verticals in this region.

- Rising economic development, increasing urbanization and rising infrastructural development such as installation of sewage lines, increasing water distribution channels, and much more and some other growth inducing factors for this region

- China holds a significant share of 45.3% in the region as it is the major contributor from this region being the largest exporter of oil and gas from this region.

Middle East & Africa is Projected to Register the Highest Growth Rate

- Middle East & Africa region is expected to witness the highest growth rate in the fiberglass pipes market, driven by expanding oil & gas infrastructure, increasing water desalination projects, and rising construction activity

- Saudi Arabia is the country projected to register the highest growth rate due to its large-scale investments in oil & gas, water infrastructure (including desalination), and mega construction projects under Vision 2030, all which demand durable, corrosion-resistant piping solutions like fiberglass.

Fiberglass Pipes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- PPG Industries, Inc. (U.S.)

- Future Pipe Industries (U.A.E.)

- Chemical Process Piping Pvt. Ltd. (India)

- Saudi Arabian Amiantit Co. (Saudi Arabia)

- NOV Inc. (U.S.)

- Russel Metals Inc. (Canada)

- Amiblu Holding GmbH (Austria)

- ANDRONACO INDUSTRIES (U.S.)

- Enduro (U.S.)

- Gruppo Sarplast (Italy)

- FIBREX (U.S.)

- FCX Performance (U.S.)

- Hengrun Group Co., Ltd (China)

- Graphite India Limited (India)

- ADPF (U.A.E.)

- Balaji Fiber Reinforce Pvt. Ltd. (India)

- Zhongfu Lianzhong Group (China)

- Shawcor Ltd. (Canada)

- FIBREX - Fiberglass Pipe Manufacturer, FRP Pipes, GRP Pipes (U.S.)

Latest Developments in Global fiberglass pipes market

- In March 2023, NOV secured a contract from Cadeler to produce and deliver Bondstrand glass-reinforced epoxy (GRE) piping systems for wind turbine installations. This order includes approximately 1,300 meters of Bondstrand 2000M and 2440 series pipes, with diameters ranging from 2 to 36 inches, intended for applications such as water generators, cooling systems, and ballast operations.

- In January 2025, Future Pipe Industries (FPI) advanced its sustainability goals by adopting rail transportation in Egypt, aligning with the Egyptian Government’s green logistics initiatives. The company now transports GRP pipes between the Dry Port and Alexandria Sea Port. Recent eco-conscious shipments to Algeria have highlighted FPI’s commitment to reducing emissions, easing road traffic, and improving delivery efficiency.

- Amiblu expanded its footprint in the Asia-Pacific market in January 2024 through the acquisition of RPC Pipe Systems in Australia. This move enables Amiblu to capitalize on RPC’s long-standing experience with Flowtite GRP pipe systems and to reinforce its efforts in addressing water scarcity with high-performance GRP solutions.

- In December 2023, Wietersdorfer Group, through its subsidiary Amiblu Australia Ltd., acquired a 75.1% stake in RPC Pipe Systems, further establishing a stronghold in the Australian market. RPC operates two advanced manufacturing plants in Adelaide and employs around 100 professionals. This acquisition opens significant expansion opportunities across Australia and New Zealand.

- Pipelife International AG, a leading producer of fiberglass piping, announced in March 2023 its acquisition of Tuboplast S.A., a fiberglass pipe manufacturer based in Poland. The deal aims to bolster Pipelife’s presence in the European market.

- In November 2023, Creative Composites Group (CCG) of Pennsylvania, USA, acquired the assets of United Fiberglass of America, Inc., based in Ohio. United Fiberglass specialized in fiberglass piping, conduit, and bridge drainage systems, and this acquisition strengthens CCG’s position in the FRP composites sector.

- In September 2023, Iraq inaugurated its first facility dedicated to manufacturing glass fibre-reinforced plastic (GRP) pipes for infrastructure projects. Developed by Iraq's Narjes Group in collaboration with Italy’s TOPFIBRA, the plant has a production capacity of seven tonnes per hour.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fiberglass Pipes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fiberglass Pipes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fiberglass Pipes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.