Global Fiber Optic Connector In Telecom Market

Market Size in USD Million

CAGR :

%

USD

7,700.00 Million

USD

15,478.38 Million

2022

2030

USD

7,700.00 Million

USD

15,478.38 Million

2022

2030

| 2023 –2030 | |

| USD 7,700.00 Million | |

| USD 15,478.38 Million | |

|

|

|

|

Fiber Optic Connector in Telecom Market Analysis and Size

Fiber optic connectors are devices used to join or terminate fiber optic cables. They provide a means for the optical signal to be transmitted from one fiber optic cable to another or to connect a fiber optic cable to an active device such as a switch, router, or optical transceiver. These connectors ensure precise alignment of the fiber cores, allowing efficient and reliable transmission of data or light signals. .

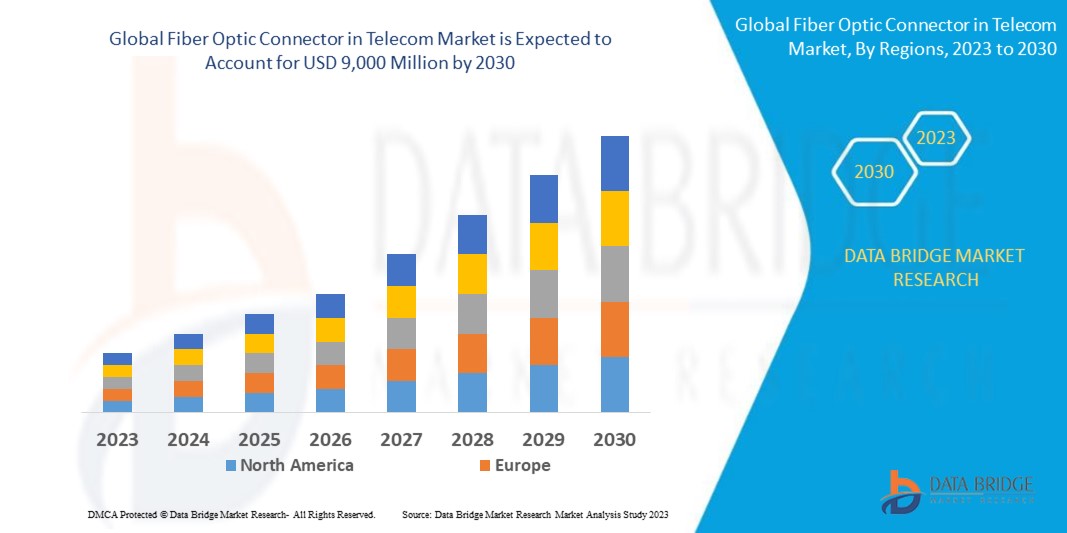

Data Bridge Market Research analyses that the global fiber optic connector in telecom market, which was USD 7,700 million in 2022, would rocket up to USD 9,000 million by 2030, and is expected to undergo a CAGR of 9.12% during the forecast period. A fiber optic connector is a device used in telecommunications to join or terminate fiber optic cables. It provides a secure and reliable connection between two optical fibers, allowing the transmission of data over long distances at high speeds. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Fiber Optic Connector in Telecom Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product Type (Subscriber Connector (SC), Ferrule Connector (FC), Lucent Connector (LC), Multi-Fiber Push On (MPO), E2000 Connector, Straight Tip (ST) Connector, and Others), Cable Type (Simplex, Duplex, Multi Fiber) |

|

Countries Covered |

U.S., Canada, and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Alcatel-Lucent SA (France), Arris Group Inc. (U.S.), TE Connectivity Ltd. (Switzerland), Hitachi Ltd. (Japan), Corning Cable Systems LLC (U.S.), The 3M Company (U.S.), Optical Cable Corporation (U.S.), Amphenol Aerospace (U.S.), Sumitomo Electric Industries, Ltd. (Japan), Hirose Electric Co. Ltd. (Japan), among others |

|

Market Opportunities |

|

Market Definition

In the telecom market, a fiber optic connector joins or terminates fiber optic cables. It provides a means for precise alignment of the fiber cores, allowing for efficient and reliable data transmission and signals over long distances. Fiber optic connectors are crucial components in telecommunications networks, enabling the seamless transfer of information between devices, such as routers, switches, and optical transceivers. These connectors ensure low signal loss, high bandwidth capabilities, and low insertion and return losses.

Global Fiber Optic Connector in Telecom Market Dynamics

Drivers

- Increasing focus on 5G deployment

The roll-out of 5G technology drives the need for faster and more robust communication networks. Fiber optic connectors are vital in connecting 5G base stations to the core network infrastructure, ensuring low latency and high-speed data transmission.

- Internet of Things (IoT)

The proliferation of IoT devices, which require reliable and high-bandwidth connections, creates opportunities for fiber optic connectors. These connectors enable efficient data transfer and support the increasing number of devices connecting to the network.

- Growing cloud computing

With the rise of cloud computing services, fiber optic connectors are crucial for establishing high-speed connections between data centres and end-users. These connectors ensure low latency and reliable data transfer, enabling efficient cloud-based services.

Opportunities

- High-speed connectivity

As broadband internet becomes a necessity for businesses and households, telecom providers are expanding their fiber optic networks to deliver high-speed connectivity. Fiber optic connectors are integral to deploying and maintaining these networks, allowing fast and stable internet connections.

Restraints/Challenges

- Expensive compared to traditional copper connectors

Fiber optic connectors, especially those designed for high-performance applications, can be relatively expensive compared to traditional copper connectors. The cost of connectors and the associated tools and equipment required for installation and maintenance can pose a challenge for budget-conscious projects or organizations.

- Installing fiber optic connectors requires specialized skills and expertise

Installing fiber optic connectors requires specialized skills and expertise. The process involves precise alignment, cleaning, and polishing of fiber ends, which can be time-consuming and labor-intensive. The complexity of installation may increase the overall project cost and potentially delay deployment.

Recent Development

- In December 2021, Same, a US-based electronic interconnect company, acquired Ultra Communications, Inc. for an undisclosed sum. Samtec's fiber optic product offering for mil/aero and harsh environment applications will be strengthened and expanded due to the acquisition

- • In April 2020, Prysmian Group announced the world's first 180m fiber cable for FT and 5G networks. It combines two technologies to launch its sirocco extreme micro duct cable with 288 fibers in a 6.5mm diameter, providing diameter and fiber density for a 288-fiber blown micro duct cable

Global Fiber Optic Connector in Telecom Market Scope

The global fiber optic connector in the telecom market is segmented on the basis of product, cable, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and insights to help them make strategic decisions for identifying core market applications.

By Product

- Subscriber Connectors

- Lucent Connectors

- Ferrule Connectors

- Straight Tip

- E2000 Connector

- Multiple-Fiber Push-On/Pull-Off

- Others

Cable

- Simplex

- Duplex

- Multi-Fiber

Application

- Datacom

- Dense Wavelength Division Multiplexing (DWDM) Systems

- High-Density Interconnection

- Inter/Intra Building

- Security Systems

- Community Antenna Television

- Others

Global Fiber optic connector in telecom market Regional Analysis/Insights

The global fiber optic connector in the telecom market is analyzed, and market size insights and trends are provided by country, type, price range, application, and end-user as referenced above.

The countries covered in the global fiber optic connector in telecom market report are the U.S., Canada, and Mexico in North America, Germany, France, the U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of the Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to dominate the global fiber optic connector in telecom market because of its advanced technological infrastructure, high adoption of smart city initiatives, strong presence of major players in the market, and rising number of research activities in this region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2023 to 2030 due to of rapid urbanization, increasing infrastructure development, and the adoption of advanced technologies in countries like China, Japan, and India. The region's expanding automotive and consumer electronics industries also contribute to the growing demand for infrared fiber optic connector in telecom solutions. Furthermore, favorable government initiatives and investments in smart city projects further drive market growth in the Asia-Pacific region.

The country section of the report also provides individual market impacting factors and domestic regulation changes that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Global Fiber Optic Connector in Telecom Infrastructure Growth Installed Base and New Technology Penetration

The global fiber optic connector in telecom market also provides you with a detailed market analysis for every country growth in technology expenditure for capital equipment, installed base of different kind of products for fiber optic connector in telecom market, the impact of technology using life line curves and changes in fiber optic connector in telecom regulatory scenarios and their impact on the fiber optic connector in telecom market. The data is available for the historic period 2015-2020.

Competitive Landscape and Fiber Optic Connector in Telecom Market Share Analysis

The global fiber optic connector in telecom market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on market.

Some of the major players operating in the global fiber optic connector in telecom market are:

- Alcatel-Lucent SA (France)

- Arris Group Inc. (U.S.)

- TE Connectivity Ltd. (Switzerland)

- Hitachi Ltd. (Japan)

- Corning Cable Systems LLC (U.S.)

- The 3M Company (U.S.)

- Optical Cable Corporation (U.S.)

- Amphenol Aerospace (U.S.)

- Sumitomo Electric Industries, Ltd. (Japan)

- Hirose Electric Co. Ltd. (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fiber Optic Connector In Telecom Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fiber Optic Connector In Telecom Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fiber Optic Connector In Telecom Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.