Global Fertigation And Chemigation Market

Market Size in USD Billion

CAGR :

%

USD

36.60 Billion

USD

60.57 Billion

2024

2032

USD

36.60 Billion

USD

60.57 Billion

2024

2032

| 2025 –2032 | |

| USD 36.60 Billion | |

| USD 60.57 Billion | |

|

|

|

|

Fertigation and Chemigation Market Size

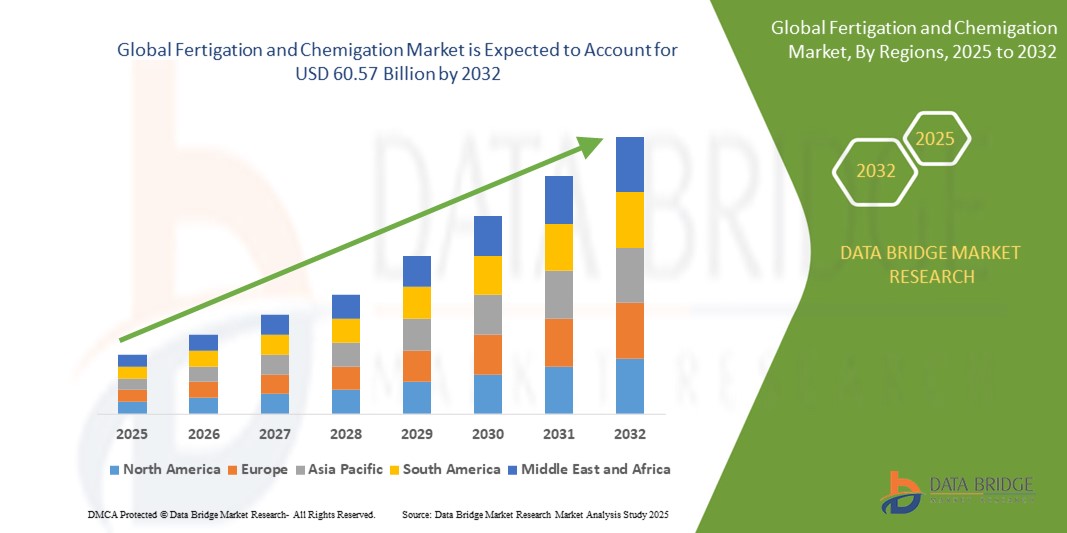

- The global fertigation and chemigation market size was valued at USD 36.60 billion in 2024 and is expected to reach USD 60.57 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fuelled by the increasing adoption of precision agriculture practices, the growing need for efficient water usage, and the rising demand for higher crop yields with minimal environmental impact

- In addition, the rising emphasis on sustainable farming and the reduction of fertilizer and pesticide runoff is encouraging farmers to shift toward integrated fertigation and chemigation systems that enable controlled application of agrochemicals with minimal waste

Fertigation and Chemigation Market Analysis

- The market is experiencing robust growth due to technological advancements in irrigation systems, especially in developing regions where efficient resource management is becoming a critical necessity

- Growing concerns over water scarcity and nutrient wastage are driving the integration of automated fertigation and chemigation systems that optimize nutrient delivery and crop productivity

- North America dominated the fertigation and chemigation market with the largest revenue share in 2024, fuelled by advanced agricultural infrastructure, widespread adoption of precision farming techniques, and strong government support for sustainable irrigation practices

- Asia-Pacific region is expected to witness the highest growth rate in the global fertigation and chemigation market, driven by increasing food demand, water scarcity concerns, and growing adoption of modern irrigation techniques across developing economies such as China, India, and Southeast Asia

- The fertilizers segment held the largest market revenue share in 2024, primarily driven by the widespread adoption of nutrient delivery systems across large-scale farms. Fertilizers remain a critical input in fertigation systems as they enable targeted nutrient supply, promoting higher crop yields and minimizing wastage. The growing emphasis on soil health and precision agriculture continues to reinforce the demand for fertilizer-based fertigation solutions.

Report Scope and Fertigation and Chemigation Market Segmentation

|

Attributes |

Fertigation and Chemigation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fertigation and Chemigation Market Trends

“Growing Integration of Automation and Smart Irrigation Systems”

- Increased adoption of IoT-enabled fertigation controllers is streamlining operations on farms

- Smart irrigation platforms help deliver precise dosages of nutrients and chemicals, reducing input waste

- Automation improves efficiency by minimizing human intervention and enabling remote monitoring

- Real-time data from sensors ensures crops receive optimal amounts of water and nutrients

- Companies such as Netafim offer smart fertigation solutions, helping farmers cut costs while improving yield

Fertigation and Chemigation Market Dynamics

Driver

“Rising Global Focus on Sustainable and Precision Agriculture”

- Growing environmental concerns are pushing the need for targeted nutrient and chemical delivery

- Fertigation and chemigation reduce runoff and nutrient leaching, preserving soil health and water quality

- These systems increase input efficiency, especially in regions with water scarcity and poor soil fertility

- Government-backed programs and incentives are accelerating adoption across multiple regions

- For instance, India’s micro-irrigation subsidies have significantly boosted fertigation usage among smallholder farmers

Restraint/Challenge

“High Initial Setup Cost and Technical Complexity”

- Advanced fertigation systems require expensive components such as pumps, filters, and dosing units

- Small-scale farmers face difficulty affording the infrastructure without external financial support

- System operation demands skilled labor, which may be scarce in rural and underdeveloped regions

- Poor system maintenance or calibration errors can lead to inefficient or uneven nutrient distribution

- In regions such as Sub-Saharan Africa, many farmers struggle to implement such systems due to cost and lack of access to technical training

Fertigation and Chemigation Market Scope

The market is segmented on the basis of input type, crop type, application, and irrigation type.

• By Input Type

On the basis of input type, the fertigation and chemigation market is segmented into fertilizers, insecticides, fungicides, herbicides, and other input types. The fertilizers segment held the largest market revenue share in 2024, primarily driven by the widespread adoption of nutrient delivery systems across large-scale farms. Fertilizers remain a critical input in fertigation systems as they enable targeted nutrient supply, promoting higher crop yields and minimizing wastage. The growing emphasis on soil health and precision agriculture continues to reinforce the demand for fertilizer-based fertigation solutions.

The insecticides segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising concerns over pest-related crop losses and increasing adoption of integrated pest management practices. Insecticides in chemigation allow precise application, reducing human exposure and ensuring better coverage. This method proves especially effective in managing infestations in fruit orchards and greenhouse settings.

• By Crop Type

On the basis of crop type, the market is segmented into grains and cereals, pulses and oilseeds, fruits and vegetables, and turfs and ornamentals. The fruits and vegetables segment dominated the market in 2024 owing to the high value and perishability of these crops, which demand efficient irrigation and nutrient management. Fertigation and chemigation systems enable consistent growth, improved quality, and extended shelf life for horticultural crops.

The pulses and oilseeds segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing global demand and the suitability of micro-irrigation systems in dryland farming. Technological advancements in drip and sprinkler systems have further facilitated the use of fertigation in cultivating these crops.

• By Application

On the basis of application, the market is segmented into agricultural irrigation, landscape irrigation, greenhouse irrigation, and other applications. The agricultural irrigation segment accounted for the largest market share in 2024, driven by the increasing need for efficient water and input usage in farming practices. The scalability and adaptability of fertigation systems make them a preferred choice for diverse agricultural lands.

Greenhouse irrigation is expected to witness the fastest growth rate from 2025 to 2032, owing to the rapid expansion of protected cultivation worldwide. Fertigation and chemigation in greenhouses allow optimal control of the microclimate and nutrient levels, significantly enhancing productivity and resource efficiency.

• By Irrigation Type

On the basis of irrigation type, the fertigation and chemigation market is segmented into sprinkler irrigation, drip irrigation, and other irrigation types. The drip irrigation segment dominated the market in 2024, supported by its high efficiency in delivering inputs directly to plant roots, reducing runoff, and conserving water. It is particularly suited for row crops and horticultural applications, where precision is vital.

The sprinkler irrigation segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its suitability for larger field crops and increasing adoption in both developed and developing regions. The flexibility of sprinkler systems in applying various inputs through chemigation enhances their appeal for mechanized farming operations.

Fertigation and Chemigation Market Regional Analysis

• North America dominated the fertigation and chemigation market with the largest revenue share in 2024, fuelled by advanced agricultural infrastructure, widespread adoption of precision farming techniques, and strong government support for sustainable irrigation practices

• Farmers across the region increasingly utilize fertigation and chemigation systems to enhance crop yields, optimize nutrient delivery, and reduce water wastage

• The presence of major agricultural technology companies and favorable regulatory frameworks further accelerate the adoption of these systems, especially across high-value crops and large-scale farming operations

U.S. Fertigation and Chemigation Market Insight

The U.S. fertigation and chemigation market accounted for the highest revenue share in North America in 2024, driven by the country’s large-scale commercial farming sector and rising demand for efficient resource management. The emphasis on improving crop productivity while minimizing environmental impact encourages farmers to shift towards automated irrigation systems. Government-led initiatives promoting water conservation and the increasing use of precision agriculture technologies continue to bolster market expansion. The adoption of fertigation is especially prominent in specialty crop production regions such as California and Florida.

Europe Fertigation and Chemigation Market Insight

The Europe fertigation and chemigation market is expected to witness the fastest growth rate from 2025 to 2032, propelled by stringent environmental policies and the push for sustainable farming practices. European farmers are embracing fertigation to comply with nutrient management regulations and to reduce fertilizer runoff. Countries such as Spain, France, and Italy are witnessing increased use of these systems in vineyards, orchards, and greenhouse cultivation. In addition, rising awareness regarding efficient irrigation in response to water scarcity supports market penetration across Southern Europe.

U.K. Fertigation and Chemigation Market Insight

The U.K. fertigation and chemigation market is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing emphasis on sustainable agriculture and climate-smart irrigation techniques. Farmers in the U.K. are leveraging precision irrigation systems to maintain consistent crop quality and reduce input costs. The market is particularly gaining traction in horticulture and greenhouse operations. Ongoing investments in agricultural innovation and the adoption of integrated nutrient and water management systems contribute to the market’s development.

Germany Fertigation and Chemigation Market Insight

The Germany’s fertigation and chemigation market is expected to witness the fastest growth rate from 2025 to 2032, due to its strong focus on technological innovation in agriculture. German farmers increasingly employ smart irrigation systems in response to rising concerns over water efficiency and environmental impact. The country’s advanced research capabilities and support for agri-tech startups are encouraging the integration of automation and data analytics in fertigation practices. High-value crop cultivation, particularly in greenhouses, is a key driver of this trend.

Asia-Pacific Fertigation and Chemigation Market Insight

The Asia-Pacific fertigation and chemigation market is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing demand for food, expanding population, and water scarcity challenges. Countries such as China, India, and Australia are actively investing in modern irrigation techniques to boost agricultural output and improve resource utilization. Government subsidies, digital farming initiatives, and the presence of key market players contribute to rapid adoption. The widespread implementation of drip and sprinkler irrigation systems enhances fertigation and chemigation efficiency in the region.

Japan Fertigation and Chemigation Market Insight

The Japan fertigation and chemigation market is expected to witness the fastest growth rate from 2025 to 2032, underpinned by the country’s precision agriculture approach and limited arable land. Japanese farmers focus on maximizing productivity from smaller plots, making automated and efficient irrigation systems essential. The integration of IoT-based sensors and remote monitoring in irrigation systems is gaining momentum, improving the precision of nutrient and pesticide application. Greenhouse farming and specialty crops such as fruits and vegetables are major adopters of these systems in Japan.

China Fertigation and Chemigation Market Insight

The China holds the largest market share in the Asia-Pacific fertigation and chemigation market in 2024, driven by government-backed initiatives to modernize agriculture and address environmental concerns. Rapid urbanization and the need to improve agricultural productivity have led to increased adoption of drip irrigation and nutrient delivery systems. The government’s focus on water conservation, combined with the growing popularity of greenhouse farming and protected cultivation, is accelerating market growth. Local manufacturers also play a pivotal role in supplying cost-effective fertigation and chemigation systems.

Fertigation and Chemigation Market Share

The Fertigation and Chemigation industry is primarily led by well-established companies, including:

- Valmont Industries, Inc. (U.S.)

- The Toro Company (U.S.)

- Jain Irrigation Systems Ltd. (India)

- Lindsay Corporation (U.S.)

- Rivulis (Israel)

- NETAFIM (Israel)

- Rain Bird Corporation (U.S.)

- T-L Irrigation (U.S.)

- Nelson Irrigation (U.S.)

Latest Developments in Global Fertigation and Chemigation Market

- In February 2022, Netafim USA, a subsidiary of Netafim Ltd, launched its AlphaDisc filter as a product development initiative. This advanced filtration system is designed to protect irrigation setups from clogging caused by organic contaminants, thereby improving water distribution efficiency and system longevity. The launch strengthens Netafim’s position in the fertigation and chemigation market by addressing key operational challenges and enhancing irrigation reliability

- In May 2021, Valmont Industries completed the acquisition of Prospera Technologies, an Israeli crop analytics start-up, in a strategic investment move valued at USD 300 billion. This acquisition aims to accelerate the digital transformation of center pivot irrigation systems by integrating AI-based crop analytics. The development enhances precision agriculture capabilities, promoting more efficient resource use and increasing productivity, thereby positively impacting the fertigation and chemigation market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.