Global Fermenters Market

Market Size in USD Billion

CAGR :

%

USD

2.10 Billion

USD

3.30 Billion

2024

2032

USD

2.10 Billion

USD

3.30 Billion

2024

2032

| 2025 –2032 | |

| USD 2.10 Billion | |

| USD 3.30 Billion | |

|

|

|

|

Fermenters Market Size

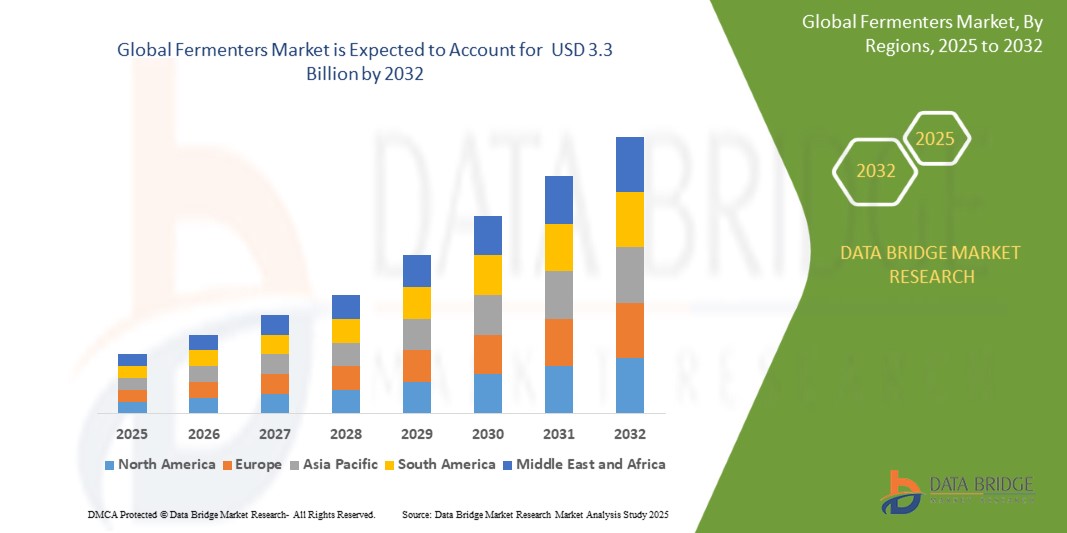

- The Global Fermenters Market size was valued at USD 2.1 Billion in 2024 and is expected to reach USD 3.3 Billion by 2032, at a CAGR of 6.47% during the forecast period

- The Fermenters Market is experiencing consistent growth, fueled by rising demand across industries such as pharmaceuticals, food and beverage, and biotechnology for efficient microbial processing solutions. Fermenters play a critical role in the large-scale production of antibiotics, enzymes, biofuels, and other bioproducts, offering controlled and optimized environments for microbial growth

- Additionally, the global shift toward sustainable and bio-based production methods, coupled with increased R&D investments in biopharmaceuticals and synthetic biology, is accelerating fermenter adoption. Emerging economies are expanding their industrial biotechnology capabilities, further boosting market prospects. Technological advancements in automated and single-use fermenters are expected to drive innovation and operational efficiency, supporting long-term market growth

Fermenters Market Analysis

- Fermenters, essential bioprocessing equipment, are increasingly used across industries such as pharmaceuticals, food & beverage, and biotechnology due to their ability to support controlled microbial growth and optimize large-scale production of bio-based products like antibiotics, enzymes, and vaccines

- The growing demand for sustainable, bio-based solutions—particularly in pharmaceuticals, nutraceuticals, and alternative protein sectors—is driving the adoption of advanced fermenters that offer precision control, scalability, and enhanced yield efficiencies

- North America dominates the Fermenters Market with the largest revenue share of 38.01% in 2024, driven by strong biopharmaceutical R&D, robust healthcare infrastructure, and growing interest in synthetic biology. The U.S. leads the region with high capital investment and technological innovation in fermentation-based production

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, expanding biotechnology and pharmaceutical sectors, and supportive government policies in countries like China, India, South Korea, and Japan

- Among product types, stainless steel fermenters hold a significant market share of 44.6% in 2024 due to their durability, reusability, and suitability for industrial-scale operations. However, demand for single-use fermenters is rapidly increasing, especially in R&D and pilot-scale production, due to their cost-efficiency, flexibility, and reduced contamination risk

Report Scope and Fermenters Market Segmentation

|

Attributes |

Fermenters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fermenters Market Trends

“Technological Advancements and Sustainable Innovation in Fermentation Processes”

- A prominent and growing trend in the Global Fermenters Market is the integration of advanced bioprocessing technologies and sustainable innovations to enhance yield, reduce contamination risk, and support the production of high-value bioproducts across industries such as pharmaceuticals, food & beverage, and biofuels

- Leading companies like Sartorius, Thermo Fisher Scientific, and Merck are investing in next-generation fermenters equipped with automated control systems, real-time monitoring, and data analytics to optimize process efficiency and ensure consistent product quality

- The industry is witnessing a shift toward eco-friendly, single-use fermenters that reduce cleaning requirements, lower water and energy usage, and minimize cross-contamination—supporting sustainability goals and operational flexibility, especially in biopharmaceutical R&D

- Digitalization, including the adoption of AI and IoT-enabled fermentation systems, is revolutionizing process control, enabling predictive maintenance, enhanced scalability, and adaptive process optimization in both pilot and large-scale production settings.

- There is rising demand for modular and scalable fermenter systems tailored to specialized applications such as personalized medicine, alternative proteins, and microbial fermentation in synthetic biology

- This trend toward innovation-driven, sustainable, and intelligent fermentation solutions is redefining market dynamics. Companies prioritizing R&D, digital integration, and environmental compliance are best positioned to lead in this evolving and competitive landscape

Fermenters Market Dynamics

Driver

“Rising Demand by Bioprocessing Efficiency, Sustainable Production, and Technological Innovation”

- The increasing global focus on efficient, scalable, and sustainable bioproduction across industries such as pharmaceuticals, food & beverage, and industrial biotechnology is a key driver propelling the Fermenters Market. Fermenters provide a controlled environment for microbial and cell culture processes, enhancing yield, purity, and production speed—critical in modern biomanufacturing

- For instance, in January 2025, Sartorius AG introduced a new line of modular single-use fermenters specifically designed for vaccine and biologics production, offering seamless scalability and reduced contamination risk while aligning with global demand for rapid, flexible bioprocessing solutions

- Growing regulatory emphasis on environmentally responsible manufacturing and the push toward bio-based alternatives are prompting industries to shift from traditional chemical synthesis to microbial fermentation methods—particularly in North America and Europe, where ESG mandates are increasingly stringent

- Advancements in fermentation technologies, such as integration of real-time analytics, automated feeding systems, and AI-driven process optimization, are enabling manufacturers to achieve higher process efficiency, minimize batch failures, and reduce operational costs

- The increasing need for decentralized and agile production capabilities in emerging sectors like personalized medicine, alternative proteins, and synthetic biology is fueling the demand for compact, smart, and adaptable fermenter systems

- This convergence of process efficiency, sustainability imperatives, and digital biomanufacturing innovation is accelerating the global expansion of the Fermenters Market, with Asia-Pacific and Latin America poised for rapid adoption due to industrial growth, government incentives, and expanding biotech infrastructure

Restraint/Challenge

“High Capital Investment and Regulatory Complexity Limiting Market Scalability”

- The high capital expenditure associated with the design, manufacturing, and operation of advanced fermenters—particularly stainless steel and pilot-scale models—remains a significant restraint on market expansion. These systems require precise engineering, sterile environments, and sophisticated control systems, driving up initial setup and maintenance costs, especially for startups and small-scale biotech firms

- For example, the installation of large-scale fermenters for industrial bioprocessing often involves cleanroom facilities, advanced automation, and compliance with GMP standards, making the entry barrier steep for emerging companies in developing markets

- In highly regulated regions such as the U.S. and EU, fermenter-based production processes—especially for biopharmaceuticals and food-grade products—must comply with stringent safety and quality standards including FDA, EMA, and HACCP protocols. This necessitates costly validation procedures, extended approval timelines, and ongoing compliance monitoring, slowing market responsiveness and product innovation.

- Additionally, variability in regional regulatory frameworks and a lack of harmonized global standards create complexity for multinational manufacturers, complicating global supply chain integration and increasing administrative burdens

- Volatility in raw material and component prices—such as stainless steel, sensors, and bioreactor control systems—further challenges cost management, particularly amid global supply chain disruptions and inflationary pressures

- In certain emerging markets, limited technical expertise in fermentation science and a shortage of trained bioprocessing professionals hinder the adoption of advanced fermenter technologies, constraining market development despite rising demand

- Addressing these restraints will require increased investment in modular and single-use systems, collaborative regulatory harmonization efforts, and workforce development programs to build technical capacity and reduce adoption barriers in both mature and emerging economies

Fermenters Market Scope

- By Type

On the basis of type, the Fermenters Market is segmented into Continuous Stirred Fermenter, Tower Fermenter, Deep Jet Fermenter, Batch Fermenter, Cyclone Column Fermenter, Gas Lift Fermenter, Photo Fermenter, Rotary Drum Fermenter, and Others

The Continuous Stirred Fermenter segment dominates the market with the largest revenue share of 28.4% in 2024, owing to its widespread use in industrial-scale bioprocessing, particularly in the production of antibiotics, organic acids, and biofuels. This fermenter type is highly favored in pharmaceutical and biotech industries due to its ability to maintain consistent environmental conditions, achieve high cell densities, and support continuous production, thereby improving overall process efficiency and yield

- By Process

On the basis of process, the Fermenters Market is segmented into Batch, Fed-Batch, and Continuous

The Batch segment dominates the market with the largest revenue share of 37.2% in 2024, driven by its widespread application in the production of pharmaceuticals, enzymes, and specialty chemicals. Batch fermentation is preferred for its operational simplicity, flexibility, and ease of control, making it ideal for small-to-medium scale operations and research-based applications

- By Mode of Operation

On the basis of mode of operation, the Fermenters Market is segmented into Automatic and Semi-Automatic.

The Automatic segment dominates the market with the largest revenue share of 61.3% in 2024, attributed to the increasing demand for precision, process standardization, and scalability in biomanufacturing. Automatic fermenters are extensively adopted in pharmaceutical, food & beverage, and industrial biotechnology sectors due to their ability to perform real-time monitoring, automated control of critical parameters, and data-driven process optimization.

- By Material Type

On the basis of material type, the Fermenters Market is segmented into Stainless-Steel and Glass

The Stainless-Steel segment dominates the market with the largest revenue share of 64.5% in 2024, driven by its extensive use in large-scale industrial fermentation processes across pharmaceuticals, food & beverage, and biofuel production. Stainless-steel fermenters are preferred for their superior durability, corrosion resistance, and ability to withstand high pressure and temperature conditions

- By Microorganism

On the basis of microorganism, the Fermenters Market is segmented into Bacteria and Fungi.

The Bacteria segment dominates the market with the largest revenue share of 54.7% in 2024, owing to its critical role in the production of antibiotics, amino acids, enzymes, and organic acids. Bacterial fermentation processes are widely used in pharmaceutical, food, and industrial biotechnology sectors due to their rapid growth rates, high productivity, and ability to be genetically engineered for enhanced yield

- By End User

On the basis of end user, the Fermenters Market is segmented into Food, Beverage, Healthcare Products, and Cosmetics.

The Food segment dominates the market with the largest revenue share of 33.9% in 2024, driven by the rising demand for fermented food products such as yogurt, cheese, pickles, soy products, and probiotic-rich items. Fermenters play a vital role in the large-scale production of food-grade microorganisms, enzymes, and organic acids essential for flavor, texture, and preservation in food processing

Fermenters Market Regional Analysis

- North America dominates the Fermenters Market with the largest revenue share of 39.01% in 2024, driven by strong demand across food, pharmaceuticals, and biotechnology sectors. The region benefits from advanced bioprocessing technologies, a robust industrial base, and high R&D investments aimed at enhancing fermentation efficiency, yield, and sustainability in various applications

- Leading manufacturers are focusing on automation and precision control technologies in fermentation, especially for large-scale antibiotic, vaccine, and enzyme production. The growing interest in plant-based and functional foods also contributes to the market’s upward momentum

U.S. Fermenters Market Insight

The U.S. Fermenters Market captured the largest revenue share of 81% in North America in 2024, fueled by the country’s leadership in pharmaceutical R&D, contract manufacturing, and food biotechnology. Strong investments in biologics, synthetic biology, and microbial production platforms are driving high demand for advanced fermenters. Additionally, the increasing adoption of single-use systems and continuous fermentation processes supports long-term market expansion

Europe Fermenters Market Insight

The Europe Fermenters Market is projected to grow steadily over the forecast period, supported by a mature pharmaceutical industry, stringent environmental regulations, and the rise of clean-label and organic food trends. The region's emphasis on circular bioeconomy and sustainable bioprocessing is encouraging the use of high-efficiency fermenters in industrial and academic research settings

U.K. Fermenters Market Insight

The U.K. Fermenters Market is expected to grow at a notable CAGR, driven by the rapid expansion of biotechnology startups, advancements in precision fermentation, and increased government funding for biomanufacturing. The country's strong presence in the healthcare and specialty food sectors further enhances market potential

Germany Fermenters Market Insight

The Germany Fermenters Market is set to expand at a considerable CAGR, supported by the country’s engineering expertise and leadership in pharmaceutical production. Rising demand for sterile, automated fermenter systems in the manufacturing of biologics, vaccines, and diagnostic enzymes is a key growth factor

Asia-Pacific Fermenters Market Insight

The Asia-Pacific Fermenters Market is poised to register the fastest CAGR of 24% from 2025 to 2032, driven by rapid industrialization, expanding food and beverage industries, and growing investment in pharmaceutical manufacturing. Countries such as China, India, Japan, and South Korea are adopting advanced fermentation technologies to meet local and export demands for health supplements, antibiotics, and processed food products

Japan Fermenters Market Insight

The Japan Fermenters Market is gaining momentum due to the country's focus on functional foods, fermentation-based cosmetic ingredients, and precision medicine. Technological innovations in automated and compact fermenters for lab-scale and industrial use are attracting biotech firms and research institutions

China Fermenters Market Insight

The China Fermenters Market accounted for the largest revenue share in Asia-Pacific in 2024, supported by government-backed biopharma expansion, food fortification programs, and increased consumer demand for probiotics. Investments in fermentation infrastructure and partnerships with global biotech firms are further accelerating market adoption

Fermenters Market Share

The smart lock industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Eppendorf AG (Germany)

- Sartorius AG (Germany)

- GEA Group AG (Germany)

- Pierre Guérin Technologies (France)

- Applikon Biotechnology B.V. (Netherlands)

- Biotek Instruments, Inc. (U.S.)

- ABEC, Inc. (U.S.)

- Belach Bioteknik AB (Sweden)

- DSM Nutritional Products AG (Switzerland)

- Bionet Engineering (Spain)

- Solaris Biotech (Italy)

- Minerva Biolabs GmbH (Germany)

- Biostat Finesse GmbH (Germany)

- ZETA GmbH (Austria)

Latest Developments in Global Fermenters Market

- In April 2025, Sartorius AG launched a next-generation line of automated single-use fermenters designed to streamline biopharmaceutical manufacturing. These systems feature enhanced scalability, integrated monitoring, and AI-driven process controls to optimize cell culture conditions and improve batch-to-batch consistency in vaccine and biologic production

- In March 2025, Eppendorf AG introduced a new series of benchtop fermenters tailored for research and small-scale production. The BioBLU® c-series fermenters offer modular flexibility, advanced aeration control, and compatibility with a wide range of microorganisms, supporting innovation in academic, industrial, and synthetic biology labs

- In February 2025, Thermo Fisher Scientific Inc. announced the expansion of its fermenter production facility in Massachusetts, aiming to meet surging demand from pharmaceutical and food industries. The expansion includes increased capacity for stainless-steel and hybrid fermenters with integrated data analytics to support GMP-compliant manufacturing

- In January 2025, Bioengineering AG unveiled a new continuous stirred tank fermenter (CSTR) optimized for the production of industrial enzymes and probiotics. Featuring real-time pH and DO control, this fermenter enhances yield efficiency and supports sustainable production practices for functional food and feed applications

- In January 2025, GEA Group AG partnered with a leading Asian biotechnology firm to co-develop large-scale photo fermenters for use in the production of algae-based nutritional and cosmetic ingredients. The collaboration aims to leverage solar bio-reactor technology for energy-efficient, high-yield biomass cultivation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fermenters Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fermenters Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fermenters Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.