Global Feed Protein Market, By Source (Animal Feeds, Plant Feeds), Livestock (Poultry, Ruminants, Aqua, Swine, Others), Product (Oilseed Meals, Fishmeal, Animal By-Product Meals) – Industry Trends and Forecast to 2029.

Feed Protein Market Analysis and Size

Changing economic patterns, affordability, and improving the financial situations of farmers in developing countries are expected to drive the growth of the feed protein market further. Rapid economic development and rising meat demand have resulted in the widespread use of feed protein.

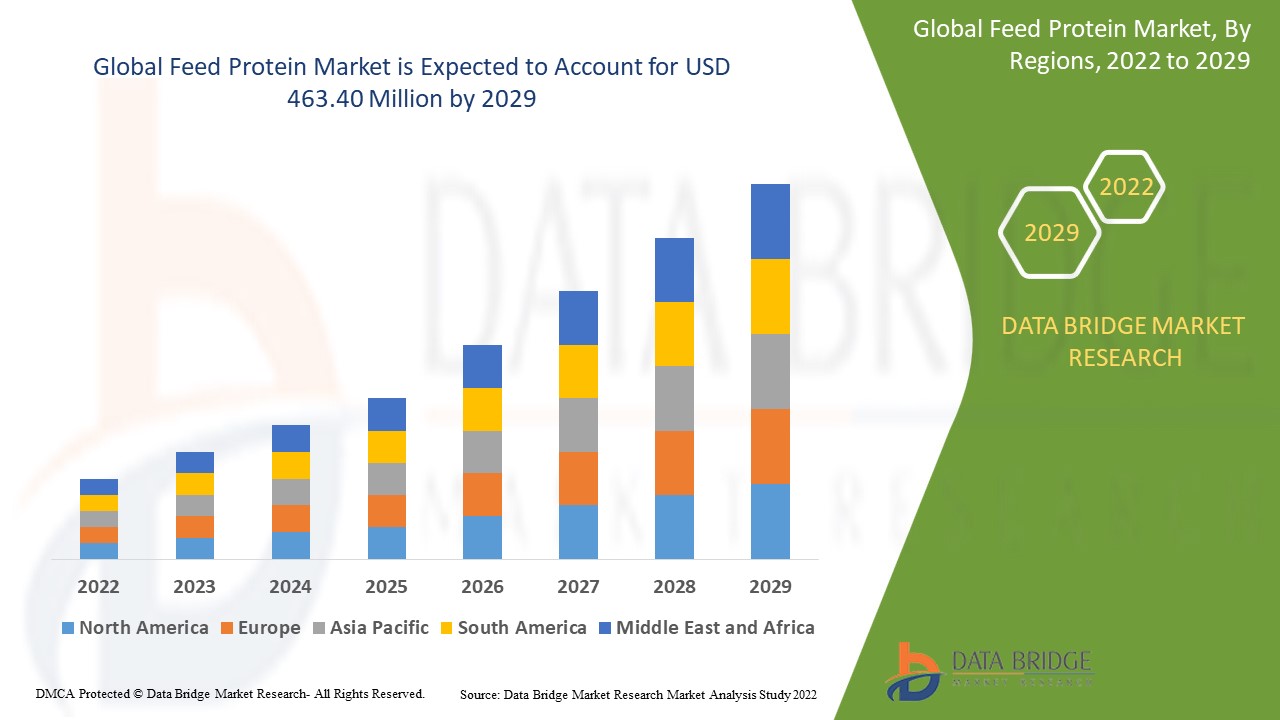

Data Bridge Market Research analyses that the feed protein market was growing at a value of USD 280 million in 2021 and is expected to reach the value of USD 463.40 million by 2029, at a CAGR of 6.50% during the forecast period. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Feed Protein Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Source (Animal Feeds, Plant Feeds), Livestock (Poultry, Ruminants, Aqua, Swine, Others), Product (Oilseed Meals, Fishmeal, Animal By-Product Meals),

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

DuPont (U.S.), Hamlet Protein (U.S.), ADM (U.S.), CHS Inc. (U.S.), Burcon (Canada), CropEnergies AG (Germany), Evershining Ingredient Co., Ltd. (Thailand), Imcopa Food Ingredients B.V. (Netherlands), Victoria Group (Serbia), Calysta, Inc. (U.S.), Titan Biotech (India), Janatha Fish Meal & Oil Products (India), Alltech (Nicholasville), Prinova Group LLC, (U.S.) SOPROPECHE (France), Bio-marine Ingredients Ireland Ltd. (Ireland), Haarslev and BRF (Brazil)

|

|

Opportunities

|

|

Market Definition

Proteins are essential nutrients for the human body because they are the building blocks of body tissue and also serve as a fuel source. From a nutritional standpoint, the amino acid composition of the protein is the most essential aspect and distinguishing feature. Due to the importance of protein as a major constituent in biologically active compounds in the body, protein-rich products are highly commendable for poultry production and nutrition. Feed protein is an important nutrient for the proper nutrition of all animals and is becoming an important component of the overall integrated food chain.

Global Feed Protein Market Dynamics

Drivers

- Growing demand for the animal based products

The growing demand for animal products such as meat and dairy has put significant pressure on livestock farmers to improve livestock competence. On the other hand, rising feed prices are forcing farmers to choose between optimizing efficiency and keeping expenses to a minimum. As they aid in the effective supplementation of required nutrients to livestock, protein feed supplements are the best option for reducing dairy farm feed expenses by improving feed digestion and feed conversion ratio.

- Growing investments and innovations

Other factors expected to drive the growth of the protein feed market include increased research and development activities related to animal feed, rising preference for food with high nutrition content, and increased focus on investments and innovation.

Opportunities

One of the main factors contributing to the growth of the feed protein is the increasing utilization of the product in the aquaculture feed industry. This is due to the fact that fish farming currently provides more than half of the world's fish food supply, a figure that is expected to rise further in the coming years. As a result, feed proteins are expected to play an essential role in supplying high-quality amino acids and overall nutritive value to the aquaculture sector.

Restraints

However, rising disease outbreaks among livestock populations due to numerous diseases found in animals, rising environmental concerns, and stringent government regulations imposed on food safety are the major factors acting as restraints and will further challenge the growth of the feed protein market during the forecast period mentioned above.

This feed protein market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the feed protein market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In 2020, Archer Daniels Midland (ADM) Company announced plans to phase out dry lysine production in the first half of 2021. ADM Animal Nutrition instead focuses on l-lysine liquid 50% and encapsulated lysine products. ADM worked closely with swine and poultry feed producers to transition to liquid lysine throughout 2020.

- In 2019, Cargill Incorporated invested USD 20 million in the plan to establish a premix plant in Kota, India, thereby assisting farmers in improving animal health and productivity through its diverse portfolio of liquid feed supplements.

- In 2019, BASF launched a new line of phytase products for the feed industry in Indonesia, expanding the company's product portfolio in the region.

Global Feed Protein Market Scope

The feed protein market is segmented on the basis of source, product and livestock. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Source

- Animal feeds

- Plant feeds

Livestock

- Poultry

- Swine

- Cattle

- Calves

- Aquaculture

- Others

Product

- Oilseed Meals

- Soymeal

- Rapeseed/canola meal

- Sunflower meal

- Copra palm meal

- Cottonseed meal

- Other oils

- Fishmeal

- Animal By-Product Meals

- Meat and bone meal

- Feather meal

- Blood meal

- Poultry meal and meat meal

Feed Protein Market Regional Analysis/Insights

The feed protein market is analysed and market size insights and trends are provided by country, source, product and livestock as referenced above.

The countries covered in the feed protein market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the feed protein market due to rising meat product demand in various Asian countries, rising livestock productivity and quality, increased use of technologies, ongoing research and development to innovate various animal husbandry methods, and rising disposable income. North America is the second largest region in terms of feed protein market growth, owing to rising meat consumption in Brazil and Argentina and the region's increasing industrialization of animal husbandry. Europe is the third largest market for feed protein, owing to rising meat consumption, food safety concerns, and lower meat prices in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Feed Protein Market Share Analysis

The feed protein market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to feed protein market.

Some of the major players operating in the feed protein market are:

- DuPont (U.S.)

- Hamlet Protein (U.S.)

- ADM (U.S.)

- CHS Inc. (U.S.)

- Burcon (Canada)

- CropEnergies AG (Germany)

- Evershining Ingredient Co., Ltd. (Thailand)

- Imcopa Food Ingredients B.V. (Netherlands)

- Victoria Group (Serbia)

- Calysta, Inc. (U.S.)

- Titan Biotech (India)

- Janatha Fish Meal & Oil Products (India)

- Alltech (Nicholasville)

- Prinova Group LLC, (U.S.)

- SOPROPECHE (France)

- Bio-marine Ingredients Ireland Ltd. (Ireland)

- Haarslev and BRF (Brazil)

SKU-